Heyyyyyyyyyya!

So, if you followed the instructions in the last lesson, the guys at eToro (or any other platform you signed up to) will probably be calling soon.

Here’s some great tips & tricks they might not talk to you about, but you really should know before you start to invest.

1. Choose The Right Traders to Copy

A social trading platform that is fully legitimate and regulated won’t tell you what traders to copy. They’re simply not allowed to. And since I’m just now starting to seriously trade with eToro, I also can’t recommend traders until I know for 100% that they’re amazing.

But, I can tell you what I’m doing to make sure I pick the right ones.

a. Make sure this trader is marked as a Popular Investor.

This means that eToro have given him a “stamp of approval”, therefore allowing him to be followed by more than a certain number of investors, in exchange for them agreeing to put certain restrictions on taking risks, and the way they manage their own investment.

The logic is simple: eToro doesn’t want to recommend anyone who can make 1,000 of their customers lose their money in a heartbeat. So, this is their way of protecting investors.

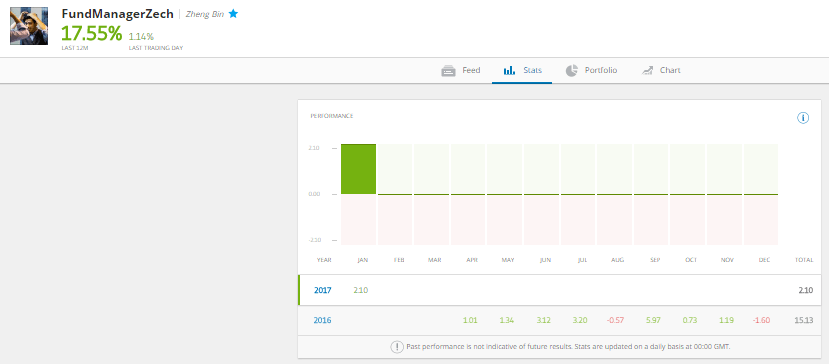

This is what a Popular Investor profile looks like. The star next to them name signifies that this trader is indeed a Popular Investor.

The Red Star Symbols a Champion Popular Investor Status

The Red Star Symbols a Champion Popular Investor Status

Now, usually eToro lets people follow traders before they become “Popular Investors”, but doing that is a risk. I wouldn’t do it myself, and therefore wouldn’t recommend that to you.

So, only Popular Investors for us, folks. Now on to the next tip.

b. Look for consistent positive performance.

This is an important one.

A lot of traders can have a great few months, or even a year. But if you’re looking for the least amount of hassle possible, you need to find traders who have been killing it for a while.

Let’s take a look at these two examples.

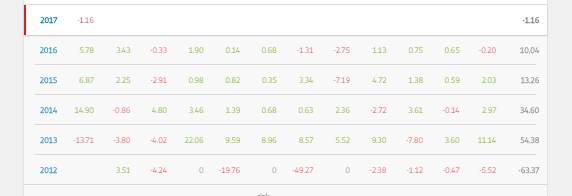

Investor A:

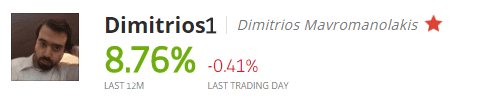

Investor B:

As you can see, investor B had a better 2016. He generated a return of 15.13%, while investor A only did 10.04.

However, Investor B only been doing this for a year. Investor A has shown consistent great returns for 4 years straight. So, if it were my money, I’d either split it 70%-30% (70% of my money on Investor A, 30% on Investor B), or put it all on Investor A if I really wanted to lower the risk and maintenance.

Look for more than a positive bottom line. Look for a legacy.

2. Spread Your Investment Across Various Traders

A lot of new investors will find a few good traders, decide on a random split of their investment between them, start copying them, and call it a day.

Don’t be like them.

Damn Straight.

Damn Straight.

Before you invest a single cent, consult your account manager, and make sure you divide your risk.

One way of doing that is choosing to follow traders who trade on different assets. Bonds & indices are less risky than stocks, and stocks are less risky than commodities, and commodities are less risky than trading on currency pairs (Forex) – So a good strategy would be to split the money between a trader who focuses on indices, a trader who focuses on stocks, and a trader who focuses on Forex (my personal favorite, yet riskiest, form of trading).

3. Think Long-Term

Great investing is a marathon, not a sprint.

Once you’ve chosen the right traders to go with, give them the opportunity to perform well, long-term. Don’t stress out if they have a couple of bad months, or if they’re playing it a little riskier than you’d like.

Let’s take Popular Investor FundManagerZech for example.

As you can see, he’s had a great 2016. But if you started following him in August, you might have been really disappointed at the first month’s results. That’s why it’s important to remain calm, and trust your initial decisions.

4. Keep it Real

Don’t get greedy. It’s tempting to see a trader with shiny numbers, and throw away your strategy to bet on him even if you’re living up to your return expectations. We all want bigger and better, all the time.

But if you take anything from this lesson, it’s this – Build a strategy with a realistic yearly goal, and stick to it. No zig-zagging, no gold-digging. That’s where most investors fall, and others turn to binary options. Yuck, can’t believe you made me say that word again.

In Conclusion

Investing smart is all about three things:

- Building a plan, and sticking to it with minor tweaks and adjustments along the way.

- Choosing the right investors to follow is a combination of diversification and long-term performance.

- Keeping it cool, and thinking long-term.

Now go out there and kill it.

– Tim Baudin

P.S Homework time:

Send me an E-Mail to info@forexezy.com, with three investors you think could be great to follow. Tell me why.

The Red Star Symbols a Champion Popular Investor Status

The Red Star Symbols a Champion Popular Investor Status

Damn Straight.

Damn Straight.