Heyyyyyya!

In the last lesson, I told you that I believe 99.9% of people don’t really care about how investing works. The just want their money to earn them more money. And as much as possible, if possible, porfavor.

Chances are, you feel exactly the same.

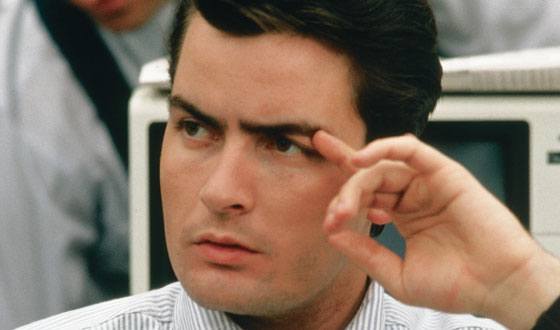

However, just because you don’t want to become Charlie Sheen on Wall Street, that doesn’t mean you don’t want the best possible return for your money, right?

Gordon WIll Never Forgive You Charlie

Gordon WIll Never Forgive You Charlie

In comes Copy-Trading, AKA Social Investing.

Copy-Trading is a relatively new investment method, which basically means copying other, more knowledgeable investors.

I would never use this method, because I am sorta like Charlie Sheen.

But for someone who doesn’t care too much about becoming a financial expert, it’s a great way to get the knowledge (and the results), without having to understand too much about investing.

How Does Copy Trading Work?

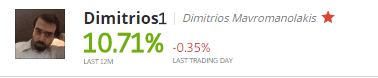

Let’s look at this guy for example.

This is an investor on the copy-trading platform eToro. He made 10.71% in the last 12 months, which is a lot more than the 1.2% the S&P 500 made.

This guy didn’t just beat the market. He annihilated it.

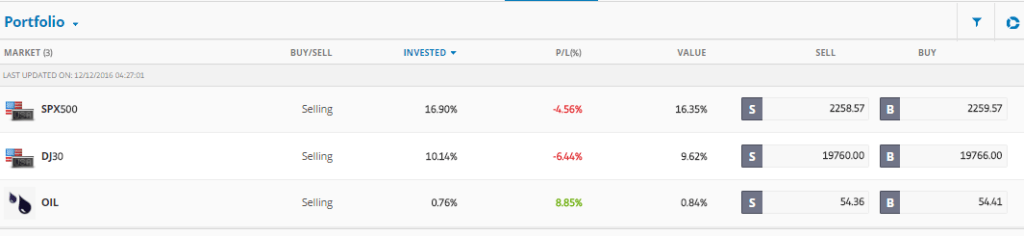

This is what Dimitrios1’s portfolio looks like:

This is a relatively simple portfolio. To me.

For you, this is straight Chinese, right?

That’s the beauty of Copy-Trading – It doesn’t matter. You can copy EXACTLY what Dimitrios1 is doing, and get the exact same return he’s getting. Obviously, you can learn more about how he does it, BUT YOU NEVER HAVE TO DO IT YOURSELF.

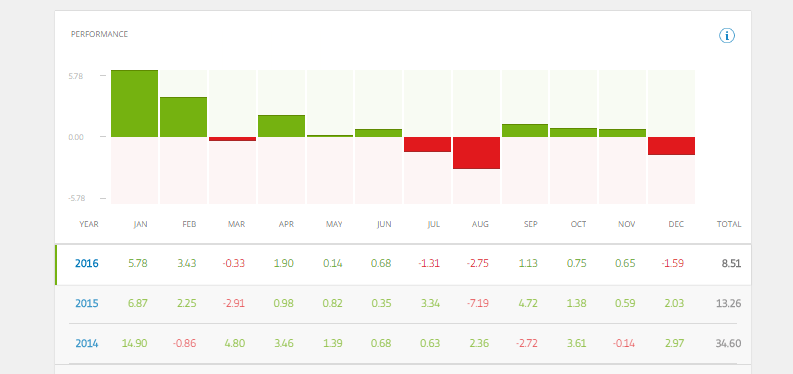

Dimitrios1 Has Been With eToro Since 2014. Let’s Assume You’ve Been Copying Him Since Day 1.

These are Dimitrios1’s stats since 2014:

Now, let’s compare leaving $5,000 in the bank, putting it in the S&P500, and investing it with Dimitrios1:

| Date | Bank | S&P500 | Dimitrios1 |

| 1.1.2014 | $5,000 | $5,000 | $5,000 |

| 1.1.2015 | $5,000 | $5,684.5 | $6,730 |

| 1.1.2016 | $5,000 | $5752.7 | $7,622.3 |

| 12.12.2016 | $5,000 | $6315.9 | $8,271 |

The prosecution rests.

Is Copy-Trading the Answer to All of The World’s Problems?

Nope. it can’t take away people who don’t silence their phones in movie theaters.

Also, there are a few risks you HAVE to be aware of:

- Bigtime investors have more money than you

If an investor takes a $5,000 risk as part of his strategy, and loses it, he can usually just inject more money into his account and take the momentary loss. For you, $5,000 may be all you’ve got. That’s why it’s important to spread the risk (I’ll teach you how later), and only risk what you can afford to lose.

- Fees

Dimitrios1 is a great investor. Others aren’t necessarily. If you copy the wrong one, you’d might end up earning less than the market after fees.

- Gamblers

Investors are human. Even a really good investor can have a momentary lapse in judgement, and when he makes a bad decision it will naturally affect you as well. eToro have done a good job at monitoring this, but it can still happen – particularly in other, less regulated platforms. Again, the solution for this is to make sure you choose the right investor to follow.

—

Ok, so lesson 2 is over! Here’s some homework until next time.

Action Items of the day:

Tell me in the comments about one thing that scares you, or doesn’t quite sit right with you, about copy trading.

Look at your checking account balance, and calculate how much money you would have made if you started investing with Dimitrios1 in January 2014. Write the number down in your course notes document.

Until next time,

Tim Baudin

Gordon WIll Never Forgive You Charlie

Gordon WIll Never Forgive You Charlie