The term “managed forex accounts” refers to investment setups whereby a client hands over their currencies to a professional financial firm to trade on their behalf. A seasoned broker can help you trade them online or even guide you over the phone.

These days, having a professionally managed foreign exchange trading account is rather commonplace. As a result of this high demand, many of the best managed accounts have been lumped together with the worst. Despite the availability of thousands of forex managed accounts, only a small fraction would be rated among the best.

List of the best managed Forex accounts

There are several thousands of traders who offer forex managed funds services. Managers on the list below have been chosen based on their demonstrated track record, long-term credibility, and, most significantly, their ability to generate revenue for their clients.

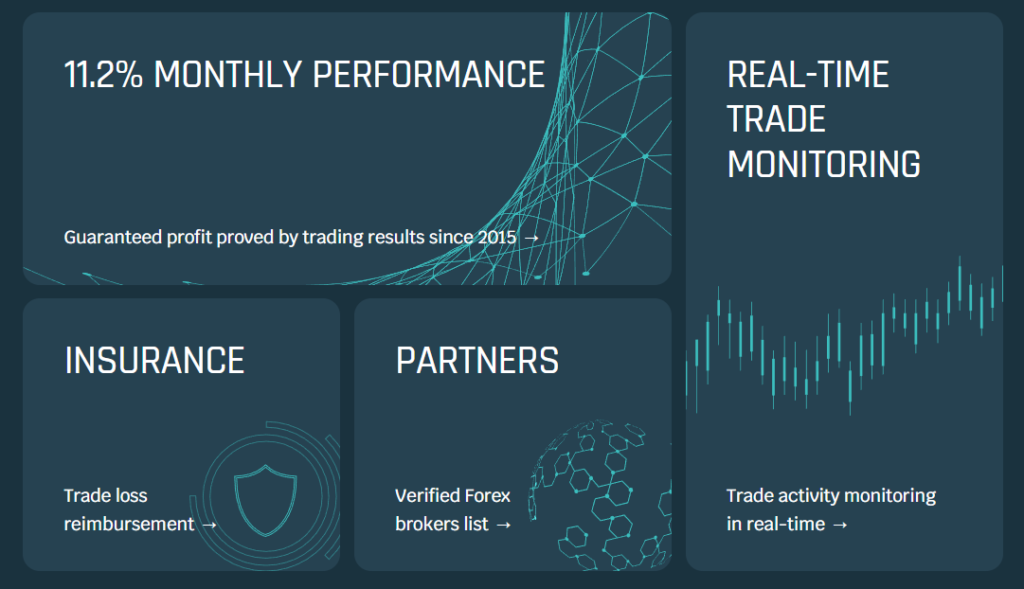

1. TechBerry

TechBerry trading platform started operations in 2015, allowing individuals to subscribe to the best social trading broker overall. It has been providing consecutive monthly profits with the help of a special inbuilt neural algorithm. There is no need to worry about the losses as the service provides coverage facility starting from 50% for the green plan up to 100% for the infinity plan.

The platform has 7 different membership plans. The Green offer requires $19 annual fees and a $5000 minimum deposit. Users have to pay $499/yearly for the infinite plane that comes with 100% funds coverage, access to real-time trade performance, and a personal manager. The platform offers access to trial accounts for 14 days without any subscription charges.

Pros

- Accessible from all around the world

- Multiple membership plan options

- Free trial account accessibility

- Trading loss reimbursement

Cons

- Little information on trading strategy

- High amount of minimum deposit requirement

2. Pepperstone MAM

Pepperstone provides its services through both its own and third-party internet trading platforms, such as cTrader and MetaTrader 4, as well as a variety of mobile applications.

Beginners can open an Electronic Communication Network (ECN) account with the company for as little as $200. In contrast, advanced ECN brokers often require a designated account financed with at least $1,000.

Pros

- Pocket-friendly initial minimum deposit of $200 for ECN accounts.

- They have integrated their MT4 platform with both live and demo accounts.

- Fast execution of trades.

- They offer trades on 107 currency pairs.

- Low spreads.

- Copy trading available.

Cons

- They charge high fees for international wire transfers.

- 30-day limit on the demo account is a disincentive.

- $7 commission on trade is on the higher side.

Learn2Trade

Learn2Trade is a trading corporation with its headquarters in London. If you are getting started with them, they will walk you through the process of opening a Multi Account Manager (MAM) account with AvaTrade, a registered brokerage firm.

Pros

- Free demo account on which you can test their strategy.

- Integrated with the globally-regulated AvaTrade.

- Transparent on their trading strategies.

Cons

- $5,000 minimum deposit is too high.

3. eToro

Trading forex with eToro is considered low-risk because the company is licensed in two tier-1 and one tier-2 jurisdictions. The biggest attraction of eToro is its social copy trading feature. If you’re not interested in the complicated analysis that comes with trading, you can just mimic the trades of successful traders.

Pros

- You get to learn from seasoned and skilled traders.

- Commission-free trading.

- Unlimited free demo account.

- Simple and user-friendly interface.

Cons

- You may copy a trader who has simply been on a lucky streak and not necessarily skilled.

- Indirect fees such as the $5 withdrawal fee can be expensive.

- There have been instances of delays in processing withdrawals.

4. AvaSocial

AvaSocial is a brand-new service from AvaTrade, and it’s already proving popular. It was introduced in the second half of 2020. Developed in collaboration with the help of FCA-regulated Pelican Trading, AvaSocial is an advanced social trading platform that also allows users to copy trade.

Pros

- It allows new traders to learn from the best and more experienced traders.

- $100 minimum deposit is pocket-friendly.

- The user interface is friendly and easy to use.

Cons

- There’s always a risk of copying a lucky trader who is not necessarily skilled in trading.

- It does not explicitly define the roles of novice traders and experts.

5. CentreForex

CentreForex was established in 2000 and is comprised of a group of experienced and professional traders who operate in conjunction with registered brokers to provide comprehensive trading services. The provider also offers intraday signals and manages PAMM accounts.

Pros

- Long experience in the market, spanning more than 2 decades.

- They transmit daily real-time live feeds.

- The user interface is friendly and easy to use.

Cons

- $250 monthly subscription fee is far above industry average.

- $3,000 initial investment for their PAMM account is quite high.

6. ActivTrades

Following its inception in 2001 in Switzerland, ActivTrades PLC has had a presence in the United Kingdom since 2005. Its trades are executed through the MetaTrader 4, MetaTrader 5, and ActivTrader platforms. You can try out all three platforms on their demo account.

Pros

- You get a demo account for 72 hours without having to register and a 30-day demo period after registering.

- 50 currency pairs available for trading.

- Insurance coverage for your funds up to $1,000,000.

Cons

- Demo account is only valid for 30 days.

- Minimum deposit of $1000 is on the higher side.

- The service lacks social trading.

- Spread betting is only available for UK residents.

7. VantageFX PAMM

Vantage FX is a subsidiary of the Vantage Group and has been in the forex market for about 12 years. The support trading on MT4 and MT5, with leverage capped at 1:500 and minimum deposit set at $200.

Vantage FX offers fast execution and ultra-low spreads, especially for traders using Raw and Pro EXN accounts. With these accounts, you will trade EURUSD on pips as low as zero and 0.4 pips on GBPUSD.

Pros

- Up to 1:500 in leverage.

- They support trading on MetaTrader 5 and MetaTrader 4 platforms.

- They support social trading.

- STP and ECN execution available.

Cons

- They do not accept US-based clients.

- Their UK clients are limited to accessing 1:30 leverage.

Understanding managed forex accounts

Currency managers manage transactions and investments on behalf of their clients on managed Forex accounts. Even though the basic principle of managed accounts involves entrusting an external party to determine how to do business with your money, the bottom line is that the account owner always has unrestricted access to and total control over their accounts. Therefore, the currency manager wouldn’t be able to trade with your money in a manner that you do not approve.

How do forex managed accounts work?

Account managers’ main duty is to hunt for good trading opportunities while also defining risk parameters, putting strategies into action, and soliciting their customers’ opinions. In many ways, using a managed account takes the burden of critical decision-making from clients, allowing them to avoid the emotional struggles associated with the investment.

In exchange for successfully executing transactions with the broker, traders will receive a small fee from the manager or bank, which will allow them to keep part of the profits.

Safety of managed forex accounts

When using a Forex managed account, both the money manager and investor benefit from the transparency, safety, and security offered by the setup. But beware of managed account scams, as there are several reported instances.

Victims of managed account scams are often pressured into investing large sums of money, often their whole life savings. You must first understand how to distinguish between a typical managed FX account and a pooled account if you want to avoid falling for such frauds. Scammers have a far greater chance of exploiting pooled accounts.

What are the types of forex managed trading accounts?

- Individually Managed Accounts: As you may infer from the name, these are accounts that are managed on behalf of an investor by a manager who takes instructions from the investor and implements them fully. It is your particular risk tolerance as well as the trading style you develop for the manager that influence his or her trading decisions.

- Pooled Managed Accounts: These are accounts that operate using money sourced from different investors. These investors’ contributions are therefore “pooled” together to and directed towards various forex investments.

Pros & cons of using managed forex accounts

Pros

- Expertise and experience: Managed accounts are overseen by competent and experienced financial professionals or well-thought-out and backtested algorithms. Profitability is increased, while risk exposure is reduced as a result.

- Spend less time in front of a computer screen: Trading requires relatively long working hours, which can lead to exhaustion. By hiring someone to trade for you, you may free up your time to pursue other interests.

- Offers peace of mind: Employing a third party to handle a client’s forex account relieves the account owner of the emotional and psychological weight that comes with trading every day.

- It is a good fit for all kinds of traders: Managed accounts are a good way to invest, regardless of one’s skill level. This is because the heavy burden of decision making in trading often lies with the account manager.

Cons:

- The potential to learn in the markets is lost when money is given to a third party to trade. By giving your money to a third party to trade, you forfeit the opportunity to learn about the markets via practice and research.

- Profits are not assured: Be aware that the individual trading on your FX account is not responsible for any losses incurred on your behalf.

- Inadequate data: In many circumstances, it is impossible to evaluate managers’ past performance because of a lack of appropriate background knowledge.

- Fees charged: Unlike trading on your own, you have to pay your account manager agreed fees, regardless of whether they make a profit or lose your money.

Forex managed accounts: things to consider

If you’re going to use a managed trading account, you’ll need to engage a forex account manager to help you execute trades. Do your homework and look at the account manager’s past performance before hiring them. When selecting an account manager, the following are the most important factors to take into account:

The broker itself

When hiring an account manager, it is important to ensure that you have completed all necessary due diligence and have thoroughly reviewed the previous performance of the candidate. Secondly, make sure you have enough money to cover the required deposit as well as any additional operational expenses. Thirdly, the broker should have exceptional customer service and offer it in a language you understand. They should also be licensed to conduct business in your jurisdiction.

Diversify your investments

Investing in a variety of assets boosts your return on investment while reducing your overall risk. Investing in stocks or real estate, for example, may only generate profits if the prices of your assets appreciate.

The ability to make money when currency prices are both up and down is one of the benefits of using a managed forex account. As a result, even in a bad economy, you’ll be able to make money.

Choose fund managers wisely

To defraud investors, scammers use a wide range of tactics, including managed FX accounts. The most common scams involve fabricating testimonials and reviews, manipulating data, and working with unlicensed brokers to split the profits.

Indicators such as the amount of the funds under management might give investors insight into the manager’s success and approach. It’s also a way to gauge how much other investors believe in a given manager based on their performance.

Methods of allocation

Plan your investment so that it will help you achieve your long-term financial objectives. Preparation is key, regardless of how much money you have in the bank or how much passive income you want to bring in each month.

The time horizon component determines how long an investor intends to keep their money in the market. By defining your risk tolerance, you will understand how much you’re willing to lose in the hopes of making more money in the future. People who are risk-averse tend to hang onto their portfolios rather than investing in riskier assets.

How to find the right forex managed account?

Calmar Ratio calculates the average annual compound rate of return and weighs it against the maximum drawdown throughout the period. It is therefore an excellent performance metric to use. Higher Calmar Ratio equals greater risk adjusted returns, while a lower Calmer Ratio equals lower returns.

- Step 1: Register with your selected account manager and submit all relevant documentation, such as a copy of your national identification card or driver’s license.

- Step 2: To authorize the manager to conduct business using funds drawn from the investor’s account, the investor signs a power of attorney, giving the manager some control over the account.

- Step 3: The investor then has to fund their trading account, which is then integrated with the manager’s master account.

If you’ve completed Step 3, you’ll be able to see when money is coming into or going out of your account.

- Step 4: The manager begins trading using the funds deposited in your account and does their best to return a profit.

- Step 5: This is the final step in which the agreed-upon fee will be sent by the investor into the broker’s bank account.

How much can you make on a managed forex account?

If you’re looking to allocate money without putting in any of your own time or effort, a managed FX account is a great option. Success in this field however is primarily dependent on the competency and experience of the broker you have selected.

Are managed forex accounts legit?

Despite the fact that the majority of money managers are honest, there have been a few high-profile frauds over the years. It’s therefore critical that you run the appropriate background checks on every account manager you intend to hire. Ensure that the people you choose to manage your money are properly licensed and certified by checking with the appropriate authorities.

When are forex managed forex accounts required?

Managed Forex Accounts can be a good choice for you under the following circumstances:

- If you are overburdened and unable to monitor the market: This sort of account is an excellent alternative if you lack the necessary time and/or knowledge to trade in the forex market.

- If you lack the psychological capacity needed to succeed as a trader: Trading can be psychologically and emotionally draining. Therefore, if you know that you can’t handle this kind of pressure on a frequent basis, then handing over the responsibility to an account manager would be a great idea.

- If you are a new trader and would rather leave it to an expert to guide you through the Forex markets’ extreme volatility.

Are the managed forex accounts world leading?

The global forex market is the largest market, transacting about $6 trillion every day. However, only a tiny number of managed forex accounts services providers would be rated among the best. For a service provider to be considered a world-leader, they must have a verifiable proof outside what they advertise on their websites.

Managed forex accounts verdict

A Forex managed account can help you increase your profit margins. Unfortunately, there are a lot of bad forex managed funds mixed in with the good. However, you should assess whether you really need a managed account in the first place.

Keep in mind that, in addition to significantly higher minimum deposit requirements, you can be charged anywhere from 15% to 40% (or more) of your profits. You may also have to pay brokerage and additional manager fees, depending on the account specifics. Also remember that there are no assurances of profit making in trading, even when you are dealing with the most accomplished and experienced traders.