We Like:

- About 1250 trading instruments available to customers

- Solid regulatory background from reputable regulatory agencies

- Competitive spreads starting from 0.3 pips

- An array of trading platforms integrated with smart trading tools

- No deposit and withdrawal fees

- Only $100 as minimum deposit

- Offers several payment options

- 24 hr multilingual customer support

- Negative balance protection

- Trade assets such as crypto 24/7

- Hedging — allowed

- Scalping — allowed

- Copy-trading — available

- No hidden fees and commissions

- Segregation of funds

- Go long and short on CFDs

We Don’t Like:

- Charges brokerage fees

- The minimum spread is capped a bit high on some instruments

- Charges an inactivity fee of $50 every quarter during account dormancy

- Only clients with a deposit of $1000 and more get a personal account manager

- Does not serve clients from the USA

The Verdict:

AvaTrade Group Limited is an online forex and CFDs trading platform operating as a stream of brokers based in different sections of the globe. Its head office, AvaTrade EU Ltd, is headquartered in Dublin, Ireland, and leads its subsidiaries in serving over 300,000 clients across the world.

The brokerage platform launched in 2006 to offer clients access to the Forex and CFDs market with fast executions and competitive spreads. It diversified its assets and services amid receiving regulation from the central bank of Ireland and now claims to offer 1250+ trading instruments and executes two million trades a month.

Nonetheless, the broker says to operate under legitimate regulation hovered by reputable agencies such as the ASIC and the CySEC. In addition, AvaTrade notes it has achieved over 30 industrial awards, giving it traction to more clients’ attention.

Company details

Online forex and CFDs trading company AvaTrade rolled out its services in Dublin, Ireland, in 2006. The broker envisioned extending roots around the globe serving clients with competitive spreads and fast executions. It now claims to offer 1250+ trading instruments to a wide range of clients and runs offices in different locations worldwide. Some of its branches operate from China, Chile, Australia, South Africa, and other nations.

Amid its expansion, AvaTrade witnessed several milestones and currently confirms the holding of more than 30 industrial awards in its trophy cabinet. The broker also claims to have won the hearts of 300,000+ clients. They trade their assets with spreads as low as 0.3 pips and maximum leverage of up to 400:1. However, the minimum spread depends on the type of instrument or FX pair, as some products trade with spreads capped at 1.5 pips. Some markets such as cryptocurrencies, trade around the clock giving clients the opportunity to speculate on its instruments 24/7.

AvaTrades’ tradable assets include:

- Forex pairs

- Indices

- Bonds

- Commodities

- Stocks

- Cryptocurrencies

- EFTs

The broker’s spectrum of customers from around the globe trade these assets with STP executions through AvaTrades’ state-of-the-art trading platforms. It provides an array of trading platforms furnished with smart and sophisticated trading tools making the process a fun experience.

Some of the available trading platforms include its proprietary trading platform [the AvaTrade Go] and the world’s popular trading platforms, the MT4 and the MT5. It couples these platforms with social trading platforms such as Duplitrade and ZuluTrade available to investors and signal providers.

That said, some of the available tools include:

- Trading calculators

- VPS

- Expert advisors

- Economic calendar

- Analytical tools

- Economic indicators

Despite the clients having access to these tools, AvaTrade avails itself to them 24/7 solving any arising problems and answering queries. In fact, it claims to have won an award for the best multilingual customer support. The help support also aids new clients in opening an account with AvaTrade with a minimum deposit of $100.

After opening and funding the account, the client has the opportunity to transform it into a professional account and enjoy leverages of up to 400:1, among other features. Retail account clients only trade leverage of up to 30:1. However, opening a professional account requires the trader to meet objectives like having a financial instrument portfolio of over 500,000 euros.

Some of the available funding methods include:

- Credit/ debit cards like Visa, MasterCard

- E-wallets such as Skrill and Neteller

- WebMoney

- Bank wire transfers

Regulations

- The Central Bank of Ireland regulates AvaTrade EU Ltd under registration number C53877.

- AvaTrade Markets Ltd. abides by the laws imposed by the British Virgin Islands (BVI) Financial Services Commission.

- AvaTrade Capital Markets Australia Pty Ltd holds license No.406684 from the ASIC.

- AvaTrade Capital Markets Pty holds license number 45984 from the South African Financial Sector Authority (FSCA).

- AvaTrade Japan holds license No. 1662 from the Financial Services Agency (FSA) and its license No. 1574 from the Financial Futures Association of Japan.

- In the Middle East, the broker is regulated by the Abu Dhabi Global Markets (ADGM) and holds license number 190018 from the Financial Regulatory Services Authority (FRSA).

- The broker also holds a two-tier regulatory license (No. 347/17) from the CySEC.

- In Israel, AvaTrade is regulated by the Israel Securities Authority under license number 514666577.

AvaTrade prides itself on having seven different jurisdictions from legitimate regulatory bodies across the globe.

Its licenses booklet holds registrations from bodies such as the Central Bank of Ireland, the ASIC, the CySEC, the FSCA, among a portfolio of other reputable licenses.

Trading platforms

AvaTrade provides diverse trading platforms to clients looking to exploit its markets. The broker operates as a market maker, offering competitive spreads averaging around 0.9 pips and STP executions. To meet its quality of services, the broker brings on board multiple trading platforms integrated with smart plugins for clients to choose from.

Traders select either its braced trading platform, the AvaTrade Go, or the world’s renowned MetaTrader Platforms, the MT4 and the MT5. Moreover, it provides copy trading platforms tailored to serve investors and expert traders. In addition, customers have the privilege to access platforms tailored for a set of assets, such as AvaOptions. That best works when trading options.

AvaTrade Go

- Voted as the best FX trading platform by the Global Forex Awards

- Sophisticated dashboard

- Clear charts

- Integrated with management tools

- Access to all markets

- All strategies — allowed

- Full integration with EAs

- Automated trading — yes

- Integrates with social platforms like ZuluTrade

MetaTrader 4

- One-click trading

- EA functionality

- Nine timeframes

- Three charts with direct trading

- 30 built-in indicators

- 24 graphical objects

- One single login across all platforms

- Micro lots — available

- Internal mailing system

- News streaming

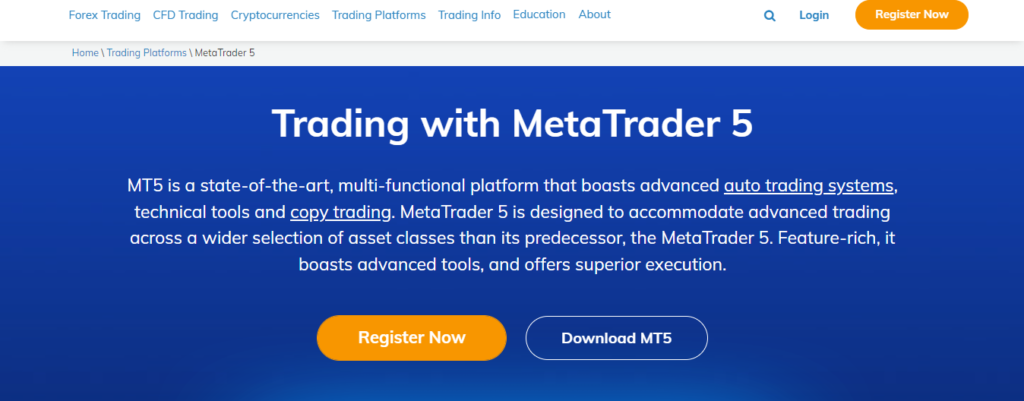

MetaTrader 5

- Multi-asset trading

- Integration with copy trading platforms

- Inter-account funds transfer

- One-click trading

- EA functionality

- 12-time frames

- Three charts with direct trading

- 38 built-in indicators

- 37 graphical objects

- One single login across all your trading platforms

- Six pending orders

- Trading history information

- Micro lots available

- Internal mailing system

- News streaming

- Multi-threaded strategy tester

Range of markets

AvaTrade offers a wide range of markets that clients speculate on as CFDs and forex trading. Some of the assets tradable as CFDs include indices, bonds, stocks, cryptocurrencies, and ETFs. The foreign exchange market supports a spectrum of FX pairs encompassing significant, major, and exotic pairs. Collectively, the markets trade with leverages of up to 400:1 and typical spreads of 0.9 pips.

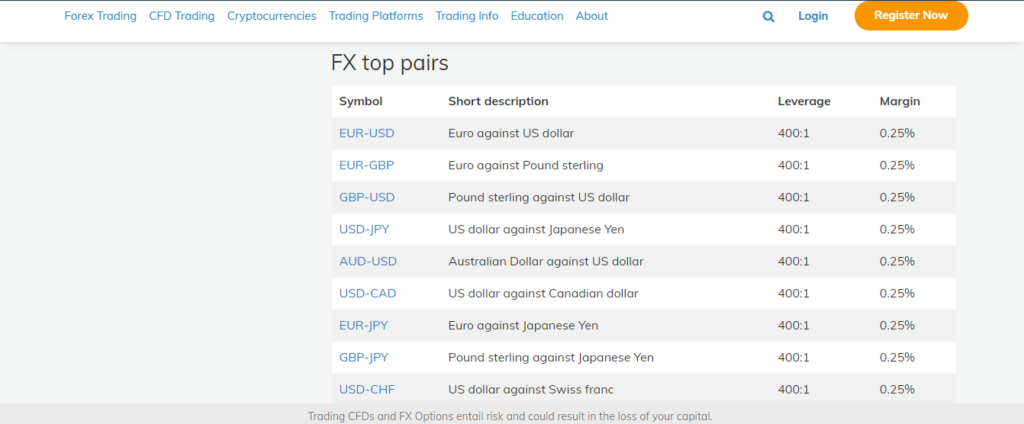

Forex

AvaTrades’ foreign exchange market trades with 24/7 expert customer support and holds over 50 currency pairs from Monday through Friday. The FX pairs consist of significant, major, and exotic currencies and all trade against eight base currencies and BTC.

The minimum spread depends on the currency pair as EUR/GBP trades with a min spread of 1.5 pips while EUR/USD spread is capped at 0.9 pips. The maximum leverage differs as retail account traders only trade leverage of up to 30:1 while professional account traders’ leverage goes up to 400:1.

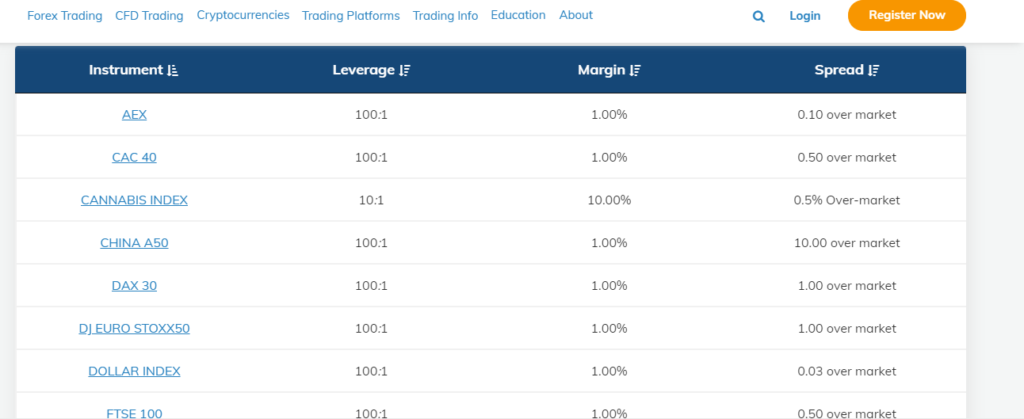

Indices

Customers at AvaTrade access the indices market 24/5 holding assets such as CHINA A50, FTSE 100, among others, trading with fast executions, leverages of up to 100:1, and an over-market spread starting from 0.03 pips. The broker offers about 30 indices that clients speculate on by either going short or long on their value movement.

Bonds

AvaTrade also helps its clients tap into the Bonds & Treasuries marketplace with instruments such as European and Asian bonds trading on the MT5 and MT4 platforms. These asset traders have the ability to open the positions to buy and sell with competitive spreads and leverages of up to 20:1.

ETFs

The ETF market holds top tradable products such as the Market Vectors, TR Gold Miners, Energy Select Sector, among others that clients speculate on as CFDs with spreads as low as 0.0013 pips and leverages of up to 20:1. Traders also yield good results even when the market goes down.

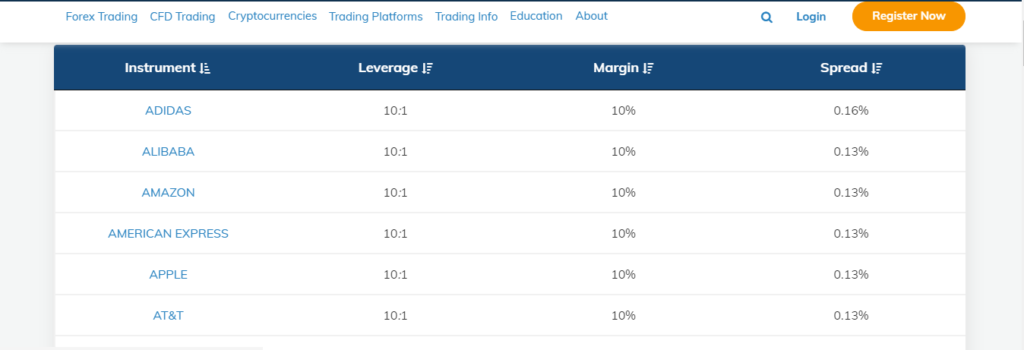

Stocks

The stock market at AvaTrade also lies under the umbrella of CFDs. Clients speculate on the value movement of stocks from major companies such as Adidas, Alibaba, Amazon, among others, from Monday through Friday. The instruments trade with fast executions, a margin of 10%, and a leverage of up to 10:1.

Commodities

The commodities marketplace at AvaTrade opens five days a week except for Saturday and Sunday. It trades with 24/5 expert support available in multiple languages. It holds both soft and hard commodities that clients trade as CFDs. Soft commodities include products such as coffee, wheat, etc., while hard commodities only involve assets that are mined from the ground.

Some of the hard commodities include valuable instruments such as precious metals and energy products. All commodity assets trade with leverages of up to 200:1 but the min. Spread depends on the instrument traded. Gold trades with spreads as low as 0.03 pips.

Cryptocurrencies

The cryptocurrency market is considered one of the volatile markets in the financial world with plenty of instruments for investors to speculate. At AvaTrade, the market holds a portfolio of cryptocurrencies such as BTC, Ethereum, Litecoin, among others.

Due to its fluctuation, the broker allows clients access to this market 24/7 with real-time customer support. The products trade with no hidden fees and leverage of up to 2:1 for EU clients and 25:1 for non-EU customers. The digital assets also trade against each other or against fiat currencies such as the USD, EUR, JPY, and more.

Main features

Wrapping up AvaTrades’ features based on our research, we allude that the broker provides decent features that create a good trading environment. It provides several trading platforms integrated with smart tools tailored to serve all sorts of traders. Nonetheless, it lightens the platforms-feature with copy trading platforms like DupliTrade and ZuluTrade that come in handy to investors and signal providers.

Besides, it allows access to a wide range of markets trading 24/5 with real-time customer support, competitive spreads, and STP executions. Moreso, the crypto market trades around the clock with competitive leverages of as low as 2:1. In addition, the broker offers several payment channels with zero deposit and withdrawal fees to clients.

Tools fueling trading include:

- Trading guides and videos

- eBooks

- Indicators

- Blogs

- AvaProtect — curbs traders from major losses

- Trading Central — Feeds traders with daily market trends

Types of trading accounts

AvaTrade provides a demo account and two real accounts that clients open. After creating a real account, the client owns a retail account but is later allowed to upgrade to a professional account.

For traders to qualify for the real professional account, they should meet the following objectives:

- The financial instrument portfolio must be 500,000 euros or above.

- They must show sufficient trading activity in the last 12 months.

- Have relevant experience in the financial services sector.

N/B AvaTrade also offers an Islamic account.

The retail account

- Leverage up to 1:30

- Negative balance protection — yes

- Commissions — no

- Several funding methods — yes

- Minimum deposit — $100

- Base currencies — USD, EUR, GBP, BTC

- Hedging — yes

- Scalping and swing trading — yes

- Few assets

- Min. deposit via bank wire — $500

- Deposit/withdrawal fees — no

- Fewer tools compared with the professional account

The professional account

- Leverage up to 400:1

- Negative balance protection — yes

- Commissions — no

- Several funding methods — yes

- Minimum deposit — $100

- Base currencies — USD, EUR, GBP, BTC

- Hedging — yes

- Scalping and swing trading — yes

- Multi-assets — yes

- Min. deposit via bank wire — $500

- Deposit/withdrawal fees — no

- Lots of trading tools

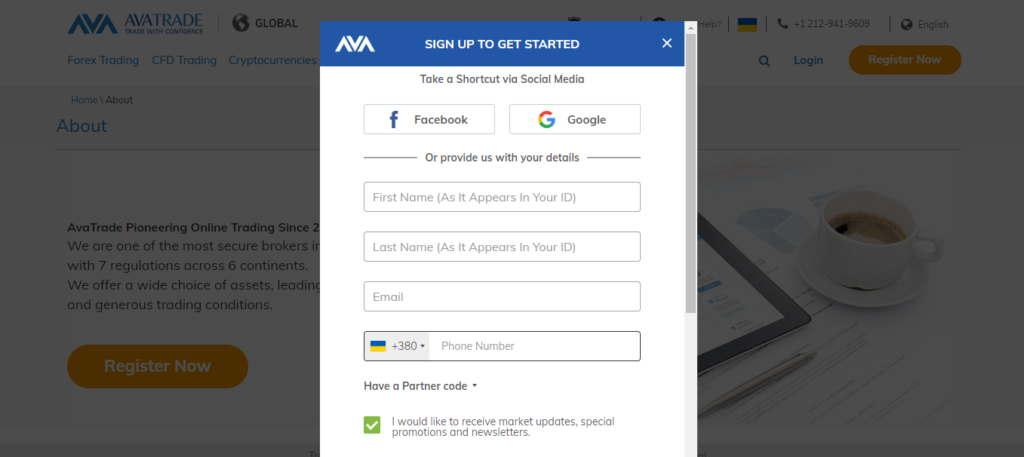

Opening an account at AvaTrade

Step 1: Log into their website and click the Register button.

Step 2: Fill the registration form they provide or use your Facebook details.

Step 3: Verify your email.

Step 4: Log into your trading account.

Step 5: Fund the account.

Step 6: Select your trading platform.

Step 7: Start trading.

Commissions and spreads

AvaTrade operates as a market maker serving clients with STP execution of orders. The broker waives all trading commissions on its instruments but gains from fees on the markup spread. It offers fixed high spreads compared to other brokers, with some instruments trading with spreads capped at 2% (over-market typical spread).

The broker also charges brokerage fees and an inactivity fee of $50 quarterly (after three months of dormancy) every month. However, it claims to provide some financial benefits such as negative balance protection and segregation of funds.

Customer service

AvaTrade offers 24/5 multilingual customer support that helps all sorts of traders meet their trading goals. The customer support team is divided into serving clients from different places. Depending on their region, clients get in touch with customer support through an email and a phone number.

In addition, the clients have access to a trading info section that holds important trading details and answers to the most obvious queries raised by clients. Besides, the education section serves clients with rich, informative resources like trading guides and videos boosting their trading skills. It also offers a live chat portal that links clients directly with the customer support team.

AvaTrade Review

What we liked

- Top-class customer service

- No deposit fees

- Multiple payment platforms

- Segregation of funds and negative balance protection

- Easy to open an account

- Well regulated broker

- Copy-trading available

What we disliked

- High spreads compared to other brokers

- Inactivity fees

- Brokerage fees

- Delay when contacting support

The bottom line

AvaTrade is an online FX and CFDs trading platform existing as a stream of brokers scattered in different sections of the globe. It holds tight regulation from seven jurisdictions co-led by the ASIC and CySEC and claims to have attained 30+ industrial awards in the last ten years. The broker links traders to the financial markets through its well-furnished platforms to speculate on a wide range of assets.

But, although it claims to provide competitive spreads on its instruments, the broker’s spreads are capped a bit higher when compared to other liquidity providers. Also, it fails to provide sufficient information about its account types which can affect some clients, especially newbies.