Regulation : Danish Financial Supervisory Authority, Banco de España, FSA, Monetary Authority of Singapore, Swiss Federal Banking Commission, Japanese Financial Services Agency

Accepts US Clients: No

Min. Deposit : $5000

Leverage : 1:200

Platforms : Saxo Trader, Saxo Web Trader, Saxo MT4, Saxo Mobile Trader, Saxo Trader Apps for iPhone, iPad and Androids

We Like

- Over 160 currency pairs and other instruments to trade

- Tight variable spreads

- Wide range of trading platforms

We Don’t Like

- Min. deposit of $5000 which is pretty high for many forex traders

- No mini account

- Do not accept online payment

SaxoBank requires higher initial deposit and provides low leverage ratio. Their spread is pretty low and remains fixed most of the times. However, small traders and investors might not be interested in this broker due to higher minimum deposit requirement.

Saxo Bank is an international online investment bank headquartered in Copenhagen, Denmark. They have their offices in more than 25 countries. Saxo Bank was founded in 1992 and online since 1996. Saxo Bank is one of the original ECN broker with broadest list of trading instruments. They allow trading in 30,000 different trading instruments from over 33 global exchanges. They have won many awards such as e-FX Awards 2012, two awards at World Finance 2012 Foreign Exchange Awards, Best World Finance 2011 White Label Solution in the World award, Shares Award 2011, six Euromoney Awards and many more. They are regulated by the Danish Financial Supervisory Authority, Banco de España, FSA, Monetary Authority of Singapore, Swiss Federal Banking Commission, Japanese Financial Services Agency.

Trading Platform:

Saxo Bank provides 5 different types of trading platforms including their in-house built trading platform. These platforms are as follows,

• Saxo Trader

• Saxo Web Trader

• Saxo MT4

• Saxo Mobile Trader

• Saxo Trader Apps for iPhone, iPad and Androids.

Saxo Trader is an in-house built platform of Saxo Bank. This platform is a reliable and stable platform where you can trade in 30,000 trading instruments. This platform is enriched with charting tools, trading options and account summary.

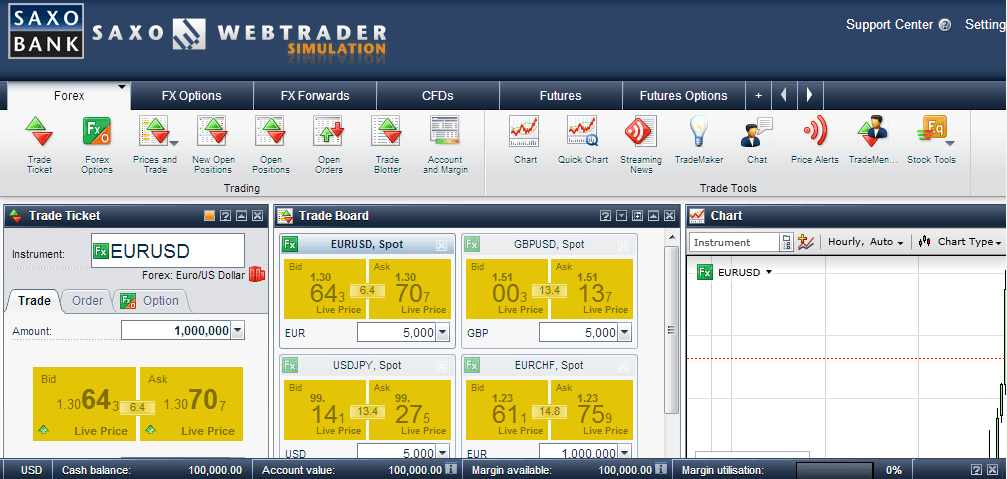

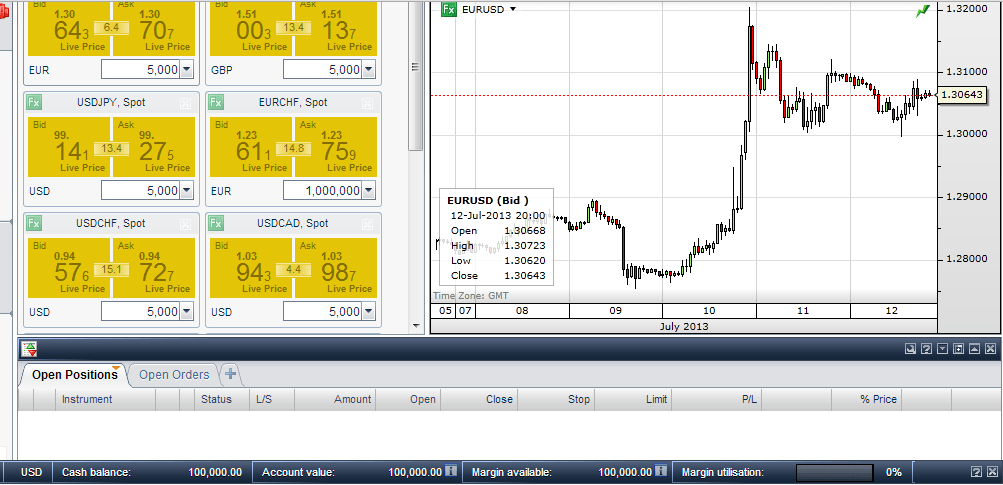

Saxo Bank has developed an outstanding web based trading platform for their traders. Traders can access and trade in this platform without downloading any trading platform. This web based platform has charting tools, trading options, trading summary, account summary, trade marker, chat, price alerts, trade mentor, stock tools etc. Here are some snapshots of this trading platform

Main Features:

Saxo Bank is fully licensed, regulated and well reputed international online investment bank which enables trading in 30,000 trading instruments. This broker has the broadest list of trading instruments including Forex, CFDs, ETFs, Stocks, futures, Options and other derivatives.

They have multi-lingual and award winning trading platforms for their traders. They offer tight variable spreads for their clients. Their spread remains fixed under normal market condition. Saxo Bank is dedicated to providing 100% execution without any slippage. Saxo Bank has their office in 25 different countries besides their headquarters in Denmark. This allows local traders to reach global markets easily. They provide leverage ratio up to 1:200.

Types of Trading Accounts:

Saxo Bank offers 4 different types of trading accounts. These are as follows,

• Classic Account (Minimum Deposit is $5000)

• Premium Account (Minimum Deposit is $100,000)

• Platinum Account (Minimum Deposit is $500,000)

• Saxo MT4 Account (No Minimum Deposit and Delivered by Saxo Capital Markets Cyprus Ltd.)

Commissions and Spreads:

Saxo bank offers tight variable spreads for Spot FX trading. Their spread remains fixed under normal market conditions. The spread remains fixed 99% of the time in case of EUR/USD. Typical spread for the major pair EUR/USD is 2 pips. They charge ticket fee of $10 on small trades to cover their administration related costs.

Customer Service:

Saxo Bank provides Monday to Friday from 00:00 – 21: 00 CEST customer service via live chat, telephone and fax. They have FAQ section where traders will find answers/solutions of various questions and issues. They also provide customer support via instant messenger and built in chat function in the trading platform.

What We Liked:

Regulation: This broker has very strong and reliable regulation as they are regulated in various countries. Regulation is the prime criteria for a reliable forex broker and this broker meets the criteria very well. Saxo Bank is regulated by Danish Financial Supervisory Authority, Banco de España, FSA, Monetary Authority of Singapore, Swiss Federal Banking Commission, Japanese Financial Services Agency.

Broadest List of Trading Instruments: Saxo Bank allows traders to trade in 30,000 different trading instruments. This includes Forex, CFDs, ETFs, Stocks, futures, Options and other derivatives. This is a great opportunity for traders to diversify their investment into various types of markets and trading instruments.

What We Disliked:

Online Payment Methods are not Accepted: Saxo Bank does not allow transaction by online payment methods such as Moneybookers, Neteller, Paypal etc. These payment methods are very popular to forex traders for deposit and withdrawal. Unfortunately, Saxo Bank does not allow any of these online payment methods.

Low Leverage Ratio: Maximum allowed leverage ratio in Saxo Bank is 1:200. This is not adequate in compare to other forex brokers in the market.

Requires Higher Initial Deposit: Saxo Bank requires higher initial deposit. They require a minimum deposit of $5000 which is pretty high as there are some brokers with a minimum deposit of $5 only.

The Bottom Line:

Though Saxo Bank requires higher initial deposit and provides low leverage ratio, they are one of the best broker according to their regulation. They are not just a broker but an international investment with broadest list of trading instrument in the world. Their spread is pretty low and remains fixed most of the times which can be considered as a key feature of this broker. However, small traders and investors might not be interested in this broker due to higher minimum deposit requirement.

I’m experiencing a live account with SAXO. I was catched by a very good offer for new customers: deposit $2000 and get a Mini Ipad for free. Well, infact you need to do a more than reasonable amount of trades every month for almost six months, but it’s fair enough.

Portion of actual user comment on Forexpeacearmy.com

The only con I give them is their platform still not being able to accept custom indicators, and formulas… other than that… very good.

I trade with 500K + and no way I’d deposit this kind of money in brokers like Alpari or Fxpro or anything..

Portion of actual user comment on Forexbrokerz.com

| Platform: | |

| Trading Platforms | Saxo Trader, Saxo Web Trader, Saxo MT4, Saxo Mobile Trader, Saxo Trader Apps for iPhone, iPad and Androids |

| OS Compatibility | Microsoft Windows, Mobile, Web, iPhone |

| Mobile Trading | Yes |

| Web Based Trading | Yes |

| Platform Languages | 20 Languages |

| Addition Services | Trade Marker, FX Options Board, FX Options Report, Workspace, Instrument Explorer, Economic Calendar, News, Stock Screener, Equity Research, Chat. |

| Other Tradable Instruments | CFDs, ETFs, Stocks, futures, Options and other derivatives |

| Hedging | Yes |

| Scalping | Yes |

| Trailing Stop | Yes |

| One Click Trading | Yes |

| Automated Trading | Yes |

| OCO Orders | No |

| Account Details : | |

| Max Leverage | 1:200 |

| Min. Initial Deposit | Classic Account – $5000 Premium Account – $100,000 Platinum Account – $500,000 Saxo MT4 Account – No Minimum Deposit |

| Commissions | No |

| Typical Spread (Majors) | EUR/USD – 2 |

| Deposit Options | Bank Wire |

| Withdrawal Options | Bank Wire |

| Demo Account | Yes |

| Account Types | Micro, Mini and Standard |

| Number of pairs offered | Over 160 |

| Dealing Desk | Market Maker |

| Additional Features | Trade Mentor, Platform Guides, Tutorials, Webinars, Tradingfloor.com, Trademaker, FX Tools, Widgets. |

| Bonus and Promotion: | |

| No Deposit Bonus | No |

| First Deposit Bonus | No |

| Other Promotional Offers | No |

| Company Information : | |

| Headquarter In | Denmark |

| Established Year | 1992 |

| Regulating Authority | Danish Financial Supervisory Authority, Banco de España, FSA, Monetary Authority of Singapore, Swiss Federal Banking Commission, Japanese Financial Services Agency |

| Website | www.saxobank.com |

| US Clients Accepted | No |

| Customer Support Languages | Live chat, Telephone, Fax, Instant Messenger, Chat function in trading platform |

| Support by | Live chat, Email, Telephone, Facsimile |