Despite challenges and the ongoing reforms, 15 insurance companies listed on the Nigerian Exchange Limited (NGX), declared N142.2 billion profit before tax in 2024, analysis of their unaudited result and accounts for period in ended December 31, 2024 has revealed.

This is about 75.5 per cent increase over N81.03 billion reported in the 2023 financial year.

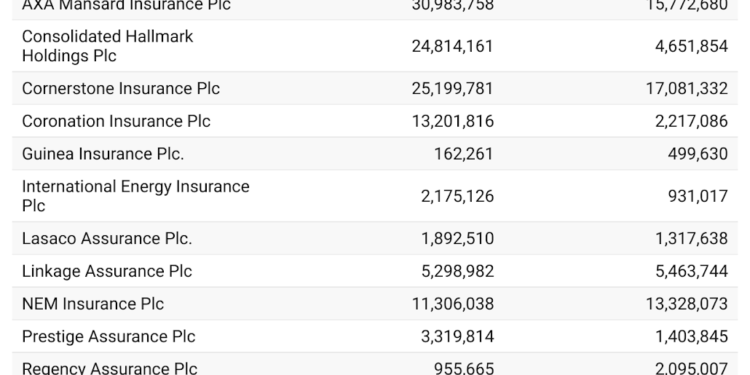

THISDAY analysis showed that out of the 15 companies, Guinea Insurance Plc, Linkage Assurance Plc, NEM Insurance Plc, Regency Assurance Plc and Veritas Kapital Assurance Plc declared decline in profit before tax while AXA Mansard Insurance Plc led others as the most profitable listed insurance company on NGX.

While Guinea Insurance reported N162.26 million PBT, about 67.5 per cent decline from N499.63 million in 2023, Linkage Assurance posted N5.3 billion PBT in 2024, a 3 per cent drop from N5.46 billion reported in 2023.

NEM Insurance announced N11.31 billion PBT, a decline of 15.17 per cent from N13.33 billion in 2023. On its part, Regency Assurance posted N955.7 million PBT in 2024, a decline of 54 per cent from N2.1 billion reported in 2023.

In addition, Veritas Kapital Assurance closed the 2024 unaudited financial at N213.7 million, a drop of 92.8 per cent from N2.98 billion declared in 2023.

In the period under review, AXA Mansard Insurance announced to investing public N30.98 billion PBT, an increase of 96.4 per cent from N15.77 billion in 2023.

Coronation Insurance Plc, and Consolidated Hallmark Holdings Plc announced significant increase in PBT last year. Coronation Insurance declared N13.2 billion PBT in 2024, about 495.5 per cent growth from N2.2 billion in 2023, Consolidated Hallmark Holdings closed 2024 with N24.8 billion PBT, a significant increase of 433.4 per cent from N4.65 billion reported in 2023.

Nigeria’s insurance sector is undergoing significant reforms to modernize and enhance its operations. Part of these reforms include: the Nigeria Insurance Industry Reform Bill, 2024 aimed to consolidate outdated laws to provide a more robust regulatory environment, increased capital requirements, focus on deepening penetration, and claims management and consumer protection.

These reforms represent a significant shift, aiming to modernize the industry and increase its contribution to Nigeria’s economic growth. However, the proposed changes require careful implementation to balance industry development with inclusivity and fairness.

The sector continues to struggle with limited market size, double-digit inflation, and currency devaluation, which affect the ability of companies to meet higher capital requirements, among other challenges.

In the period under review, 14 out of the 15 companies reported N710.36 billion insurance revenue, about 64 per cent growth from N433.5billion declared in the corresponding period of 2023.

However, these 14 insurance companies generated revenue from life and Non-Life businesses (Oil & gas, Agriculture, Investment management, Property development and Health Maintenance).

In the unaudited 2024 result and accounts to the Exchange, Axamansard Insurance again

generated the highest insurance revenue, followed by AIICO Insurance, and NEM Insurance.

In 2024, Axamansard Insurance generated N131.34 billion insurance revenue, about 59 per cent increase from N82.8 billion reported in 2023, while AIICO Insurance posted N107.06 billion insurance revenue in 2024, representing a growth of 49.5 per cent from N71.63 billion reported in n2023.

In addition, NEM Insurance posted N97.11 billion insurance revenue in 2024, up by 86.77 per cent from N51.99 billion reported in 2023. The impressive performance of listed insurance companies has contributed to the NGX Insurance Index, gaining 0.49 per cent in its Year-till-Date performance as of February 07, 2025.

The sector has also faced the fluctuation of the naira impacted foreign exchange availability in the economy, causing the exchange rate to rise both in the official and parallel markets.

The Central Bank of Nigeria (CBN) raised the interest rate from 18.75 per cent to 27.5 per cent between January and September 2024 to rein in inflation and stabilise the naira.

Commenting, the Chief Executive Officer, Highcap Securities Limited, Mr. David Adnori stated that these insurance companies should take pride in their achievements and resilience displayed in 2024 unaudited financial year amidst the rapidly changing macro environment in the period under review.

“Last year Nigeria recorded a prevailing economic landscape, market and inflationary trends influence customer spending leading to shifts in consumer demand. Despite challenges posed by the macroeconomic environment and supply constraints, these listed insurance companies delivered strong performance, maintaining a disciplined approach to strategic investments for the future hence upholding the strength of our balance sheet,” he said.

He added that insurance sector over the years in Nigeria remained a hard sell in Nigeria despite significant changes and advancements.

“However, embedded insurance holds the potential to address these challenges by integrating insurance products with existing services and increasing awareness, accessibility, and trust in the insurance sector,” Adnori said.

Also, the Chief operating officer of InvestData Consulting Limited, Mr. Ambrose Omordion had noted that the insurance sector performance on the NGX is purely market dynamics, stressing that, though penetration may be weak, a little off these companies are introducing products and services to drive top-line.

The number of insurance companies licensed to operate in Nigeria hit 67 from 54, according to latest figures obtained from the NAICOM, declared in 2023.

According to Nigeria’s Gross Domestic Product (GDP) third quarter of (Q3) 2024 report, the insurance sector grew by 19.8 per cent in the Q3 2024, enhancing the financial services sector growth that outperformed other sectors by 32 per cent.

The service sector in Nigeria dominated sectoral growth performance for most part of 2024.

The Nigerian economy, however, exhibited resilience on account of GDP performance which grew at 2.98 per cent in the first quarter (Q1 2024), 3.19 percent in the second quarter (Q2 2024), and 3.46 per cent in the third quarter (Q3 2024), despite the intense macroeconomic headwinds in 2024.

It is predicted to close the year at about 3.6 per cent, which is at par with International Monetary Fund (IMF) forecasts for GDP growth for the sub-Sahara Africa which is 3.6 per cent and better than the global GDP forecast of 3.2 per cent.

In an analysis, the Director and Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf, acknowledged that in Q3 2024, the financial services sector outperformed other sectors with a growth performance of 32 per cent.

In a report tagged: “Nigeria 2024 Economic Review and 2025 Outlook Gross Domestic Product (GDP) Performance,” he stated that the Insurance sector grew by 19.8 per cent; road transport grew by 17.9 per cent, and rail transportation by 19.7 per cent.