Japan is home to the third-largest economy with a gross domestic product per capita of about $45,000. The standard of living in the country is slightly lower than in the US or Germany but higher than that of China.

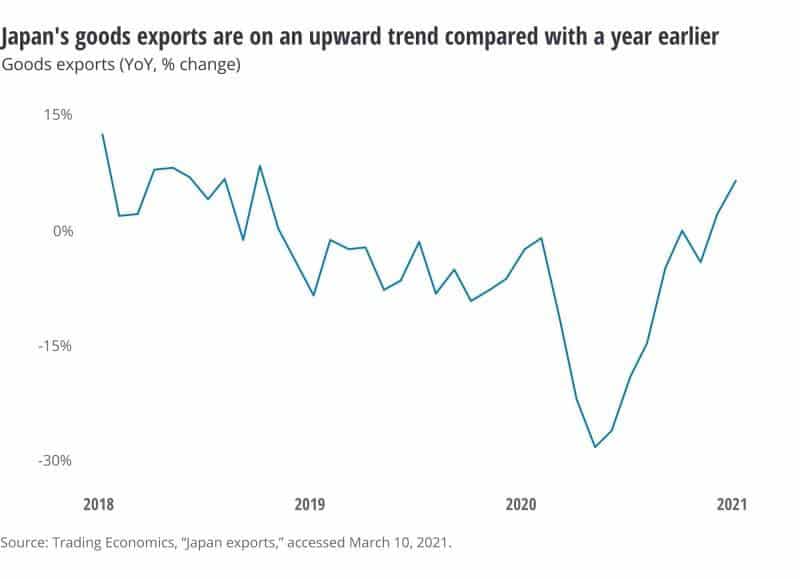

The country’s mixed economy is export-dependent. Some of its largest exports include cars, machine parts, and electrical components. Similarly, electric vehicles’ transition is likely to significantly impact Japan as EVs use one-third fewer parts than gas-powered vehicles.

Crude oil, coal, and petroleum products are some of the island nation’s biggest imports. In recent years, Japan has started reducing its reliance on these imports amid increased focus and investments in renewable energy.

The currency fluctuations affect international trade, thus influencing Japan’s economy. Similarly, the Bank of Japan is often called to action to salvage the situation. The policies that the central bank passes go a long way in influencing yen strength against the majors.

Interest rate factor

To spur growth and stabilize the economy, the BOJ tries to keep interest rates low as possible. With low interest rates, the borrowing costs often edge lower, making it easy for people and companies to borrow, thus fueling economic activities.

The BOJ keeps interest rates low by simply buying government debt as part of quantitative easing measures. The central bank currently owns close to $4 trillion in government bonds as part of the easing program, which has helped sustain interest rates at record lows.

The benchmark rate is currently at 0.10% and expected to remain low for the foreseeable future as Japan’s economy struggles with one of the biggest contractions in recent history owing to COVID-19 shocks. Low rates and falling prices should continue to offer support to the nation’s deflationary environment.

Strengthened currency

Similarly, low interest rates continue to pile pressure on the yen, which has weakened significantly against the majors. At times currency weakness is good. A depreciated Japanese currency makes exports cheaper and more competitive. While the same causes the prices of imports to increase, the net effect is usually a trade deficit.

A strengthened legal tender is the last thing that the Japanese economy needs to remain competitive in the export business. In the 1980s, the yen traded somewhere at about 200 and 270 against the dollar. During this period, the country’s manufacturing industry experienced tremendous growth as the country’s exports remained cheap and elicited strong demand.

Strengthened currency impact

In recent years, things have changed significantly. The yen has strengthened considerably against the greenback, with the exchange rate fluctuating to less than 110 for the dollar. The strengthening against the dollar has had a significant impact on the country’s manufacturing industry.

Instead of the country focusing on domestic manufacturing for exports, overseas production has taken over. A strengthened yen made it difficult for manufacturers to compete against similar products produced overseas, which turned out to be relatively cheap.

Japanese exporters had felt the full brunt of the strengthening as they can no longer sell their goods abroad as they used to when the currency was weaker.

A shift to overseas production has taken a significant toll on the Japanese economy in recent years. With most jobs moving abroad, the unemployment rate has increased significantly. Additionally, companies have had to resort to new measures to shield themselves from the downsides of fluctuating exchange rates. In contrast, a strengthened yen has been a boon for Japanese tourists and Japanese companies participating in mergers and acquisitions abroad.

A strengthened currency taking a toll on exports explains the burst of Japan’s bubble economy in the late 1980s. In the end, the island nation struggled with over two decades of stagnation and deflation. The yen hit a record low of 80 against the dollar in 2011, spelling more trouble as exports became relatively expensive.

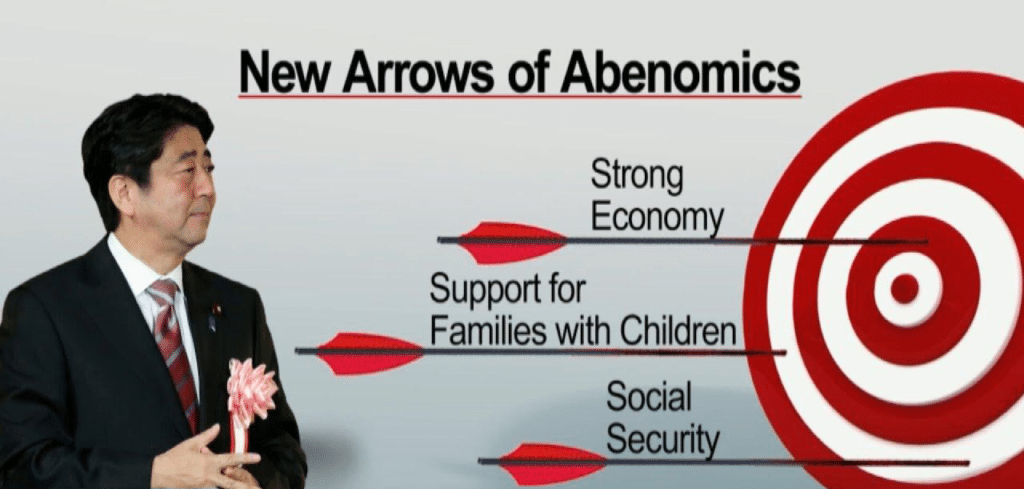

The trend only started to reverse following the election of Shinzo Abe as Prime Minister. The appointment of Kuroda as the central bank governor triggered a period of quantitative easing that curtailed further strengthening.

Abenomics to the rescue

During Abe’s tenure as Prime Minister, Japan’s central bank embarked on expansive monetary policies that triggered the native currency weakness. It ended up weakening from 80 against dollar level as of 2011, touching highs of 125 yen/dollar level in 2015. By fuelling the weakness, Abe succeeded in making Japan’s exports more affordable and competitive once again.

However, the devaluation might have come too late as some companies had already moved their manufacturing capacity abroad. Toyota is one of the companies that has started manufacturing its cars in Japan.

The devaluation of the yen as part of Abenomics also took a toll on Japanese businesses. The businesses had to pay more for the imports, which hurt consumers given the increased prices of some items.

During Abe’s tenure, there was also a significant increase in infrastructure spending. The prime minister promised to tame the country’s rising debt that had increased to 235% on the debt-to-GDP ratio. However, raising the consumer tax to 10% backfired as the nation plunged into recession in 2014.

As part of the monetary policies designed to stimulate the Japanese economy, the prime minister also resorted to modernizing the agricultural industry and reduced tariffs as part of new structural reforms.

Bottom line

Japan’s economy is highly influenced by exports and the prices of some of the country’s biggest imports. Similarly, the central bank strives to balance monetary policies to ensure exports remain competitive while ensuring imports don’t drain the coffers.

Whenever the central bank believes a weaker currency is needed to boost the export business, cutting interest rates often comes into play. Similarly, if a weakened yen is not boosting growth levels in the country, the central bank often lets it strengthen to tame inflation levels.