Breaking Equity is an online platform that offers a wide range of tools and resources to help investors stay up-to-date on financial markets and events. With real-time news alerts, personalized watchlists, customizable dashboards, expert analysis and commentary, financial data and research reports, and portfolio tracking and analysis tools, Breaking Equity is a valuable resource for both novice and experienced investors. In this review, we will explore the features offered by Breaking Equity and discuss how they can benefit investors in making informed investment decisions.

Features

- News Alerts: Breaking Equity provides real-time news updates from a variety of sources, including traditional media outlets and independent financial research firms. This enables investors to stay on top of the latest market developments and make decisions quickly.

- Watchlists: Breaking Equity allows users to create personalized watchlists with stocks, ETFs, mutual funds, and other investments. Investors can customize their lists to track specific securities, industries, or sectors.

- Dashboards: Breaking Equity’s customizable dashboards provide an organized view of all your watchlists and portfolios. With these dashboards, investors can easily identify trends and take advantage of market opportunities quickly.

- Expert Analysis & Commentary: Breaking Equity provides expert analysis and commentary from experienced financial professionals, helping investors make informed decisions and stay ahead of the market.

- Financial Data & Research Reports: Breaking Equity offers access to a wide range of financial data and research reports that can help investors gain insight into companies and industries they are considering for their portfolios.

- Portfolio Tracking & Analysis Tools: Breaking Equity offers several portfolio tracking and analysis tools that can help investors monitor their investments and make decisions accordingly.

What is Equity Review and why is it important for stock market investors

Equity review refers to the process of analyzing and evaluating a company’s financial performance, including its revenue, expenses, profit margins, cash flow, and other relevant factors. Equity review is important for stock market investors because it provides them with valuable insights into a company’s financial health and helps them make informed investment decisions.

By conducting an equity review, investors can determine whether a company is profitable and well-managed, assess its growth potential, and identify any potential risks or challenges that could impact its future performance. This information can help investors decide whether to buy, hold, or sell a particular stock.

Equity reviews can be conducted using a variety of tools and methods, such as financial statements, valuation models, ratio analysis, and other financial metrics. Investors need to conduct thorough equity reviews regularly to stay informed about their investments and make informed decisions based on the latest information available.

A step-by-step guide to researching companies and evaluating their potential

Sure, here’s a step-by-step guide to researching companies and evaluating their potential:

- Define Your Investment Goals: Determine the type of stocks you would like to invest in and define your investment goals in terms of risk tolerance, return expectations, and time horizon.

- Identify Companies to Research: Once you’ve defined your investment goals, identify companies that match your investment criteria. You can use online tools and resources to find companies based on industry, market capitalization, financial metrics, and other factors.

- Conduct Preliminary Research: Once you have identified potential companies, conduct preliminary research to gather basic information about the company, such as its business model, products and services, target market, competitive landscape, and financial performance. You can use financial news websites, investment forums, and company websites to gather this information.

- Analyze Financial Statements: Review the company’s financial statements, including its balance sheet, income statement, and cash flow statement. This will give you an idea of the company’s profitability, liquidity, debt levels, and cash flow. You can use financial analysis tools such as ratio analysis, trend analysis, and benchmarking to assess the financial health of the company.

- Evaluate Management: Assess the quality and experience of the company’s management team. Look for a track record of success, strong leadership, and a commitment to delivering shareholder value.

- Assess Competitive Landscape: Evaluate the competitive landscape and assess the company’s competitive advantage. Look for companies with a unique product or service offering, a strong brand, or other competitive advantages that can help them succeed in the market.

- Consider Valuation: Finally, consider the company’s valuation of its peers and the broader market. Look for companies that are undervalued relative to their earnings potential and growth prospects. You can use valuation metrics such as price-to-earnings ratio, price-to-book ratio, and enterprise value-to-EBITDA to assess the company’s valuation.

By following these steps, you can conduct a thorough analysis of a company’s potential and make informed investment decisions based on objective criteria.

How to identify undervalued stocks and determine the best time for entry/exit

Identifying undervalued stocks and determining the best time for entry/exit can be a challenging task, but here are some steps to help:

- Conduct Fundamental Analysis: The first step to identifying undervalued stocks is to conduct a fundamental analysis to determine the company’s financial health and performance. Look for companies with strong fundamentals such as stable earnings, low debt levels, and strong growth prospects.

- Assess Valuation Metrics: Next, assess valuation metrics such as price-to-earnings ratio, price-to-book ratio, and enterprise value-to-EBITDA to determine if the stock is trading at a discount relative to its peers and the broader market. Look for a low valuation relative to its earnings potential and growth prospects.

- Identify Industry Trends: Consider the industry trends and the company’s competitive position within the industry. Look for companies that have a unique and sustainable competitive advantage that can help them grow and outperform their peers.

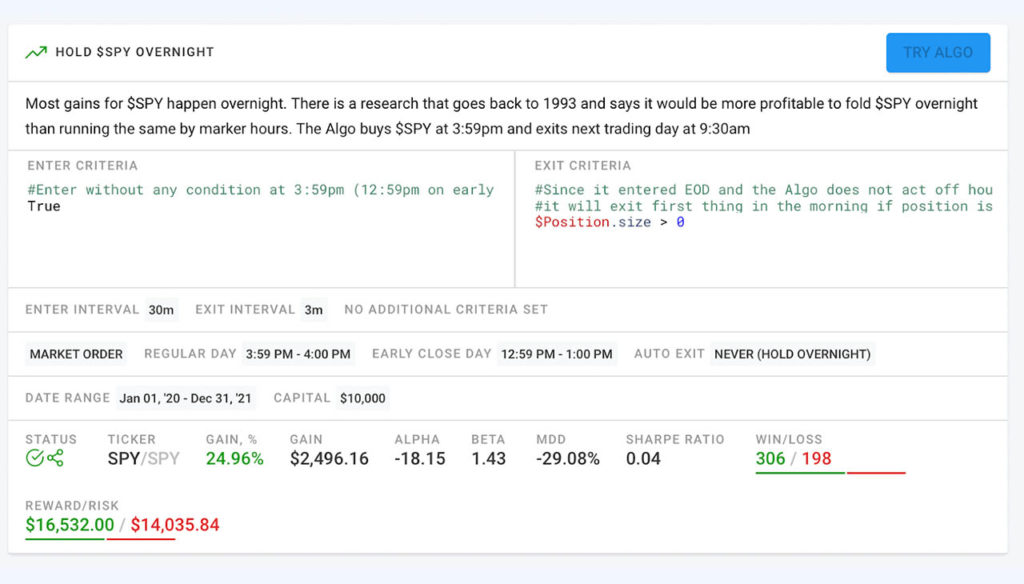

- Monitor Technical Indicators: Use technical analysis tools to monitor the stock’s price movements and identify trends and patterns. Look for technical indicators such as moving averages, relative strength index (RSI), and volume to help determine the best entry and exit points.

- Monitor Market Conditions: Keep an eye on macroeconomic factors such as interest rates, inflation, and geopolitical events that can impact the stock market. Be cautious during market downturns and look for opportunities to buy undervalued stocks when the market is down.

- Set Entry and Exit Targets: Based on your analysis, set entry and exit targets for the stock. Set a target price for entry and exit based on your valuation and technical analysis. Be disciplined and stick to your targets to avoid emotional decisions.

Common mistakes made by amateur investors when assessing stocks

Here are some common mistakes made by amateur investors when assessing stocks:

- Focusing on Short-Term Gains: Many amateur investors focus on short-term gains and try to time the market to make a quick profit. This can lead to impulsive decisions and high trading fees, which can erode returns over the long term.

- Ignoring Fundamentals: Some investors focus solely on stock price movements and ignore the underlying fundamentals of the company, such as earnings, revenue, and debt levels. This can result in investing in companies with poor fundamentals that may not be able to sustain long-term growth.

- Overemphasizing Recent Performance: Amateur investors may overemphasize recent performance and assume that past success will continue. This can lead to investing in companies that have already peaked and may not be able to sustain their growth.

- Lack of Diversification: Amateur investors may concentrate their investments on a few stocks or industries, leading to a lack of diversification. This can increase risk and volatility in their portfolio.

- Letting Emotions Drive Investment Decisions: When emotions drive investment decisions, amateur investors may make impulsive decisions that are not based on sound analysis or research. For example, they may panic during a market downturn and sell their stocks at a loss.

- Following the Crowd: Finally, amateur investors may follow the crowd and invest in popular stocks or industries without conducting their research or analysis. This can result in investing in overvalued stocks or industries with limited growth potential.

Ways to measure a company’s growth and performance over time

There are several ways to measure a company’s growth and performance over time. Here are some common methods:

- Revenue Growth: Revenue growth is the increase in a company’s sales over time. It is a key indicator of a company’s ability to generate income and expand its operations. You can measure revenue growth by comparing a company’s current revenue to its revenue from previous years.

- Earnings Per Share (EPS): Earnings per share is the amount of earnings attributed to each outstanding share of stock. It is a key metric for measuring a company’s profitability and financial health. You can measure EPS by dividing a company’s net income by its outstanding shares.

- Return on Equity (ROE): Return on equity is a measure of a company’s profitability relative to shareholder equity. It indicates how much profit a company generates with the money invested by shareholders. You can measure ROE by dividing a company’s net income by its shareholder equity.

- Price-to-Earnings (P/E) Ratio: The price-to-earnings ratio is a valuation metric that compares a company’s stock price to its earnings per share. It is used to assess whether a stock is undervalued or overvalued relative to its earnings potential. You can calculate the P/E ratio by dividing a company’s stock price by its earnings per share.

- Debt-to-Equity Ratio: The debt-to-equity ratio is a measure of a company’s leverage, or the amount of debt it has relative to shareholder equity. It indicates the level of risk associated with a company’s financing structure. You can measure the debt-to-equity ratio by dividing a company’s total debt by its shareholder equity.

- Market Share: Market share is a measure of a company’s sales relative to its competitors in a particular market. It indicates how well a company is competing in its industry. You can measure market share by dividing a company’s sales by the total sales in its industry.

By using these methods, investors can evaluate a company’s growth and performance over time and make informed investment decisions based on objective criteria. It is important to use multiple metrics when evaluating a company to get a comprehensive picture of its financial health and potential.

Strategies for mitigating risks associated with equity investments

Equity investments come with a certain level of risk. However, there are several strategies that investors can use to mitigate these risks. Here are some common strategies for mitigating risks associated with equity investments:

- Diversification: Diversification is the practice of spreading your investments across different asset classes, sectors, and regions. This helps reduce the impact of market volatility on your portfolio because it reduces exposure to any one particular investment. By diversifying your portfolio, you can potentially reduce overall risk without sacrificing returns.

- Research and Analysis: Conduct thorough research and analysis before investing in a company. This involves analyzing the company’s financial metrics, management team, competitive position, and industry trends. It is important to understand the company’s growth potential, risks, and prospects for long-term success before making an investment decision.

- Long-Term Investing: Equity investments should be viewed as long-term investments because short-term fluctuations in the market can be unpredictable. By investing for the long term, you can potentially reduce the impact of short-term market volatility on your portfolio.

- Risk Management Tools: Use risk management tools such as stop-loss orders and limit orders to minimize losses and protect gains. Stop-loss orders automatically sell a stock if it falls below a certain price, while limit orders allow you to set a maximum purchase or sale price for a stock.

- Dollar Cost Averaging: Dollar-cost averaging is the practice of investing a fixed amount of money at regular intervals over time. By investing regularly, you can potentially reduce the impact of market volatility and take advantage of dollar-cost averaging to potentially achieve better overall returns.

- Regular Monitoring: Regularly monitor your portfolio performance and make adjustments as needed. Keep an eye on market conditions, industry trends, and changes in the company’s financial metrics to ensure that your investments continue to align with your investment goals and risk tolerance.

The Review

Summary

Equity investing involves buying shares in a company and is an important part of any investor's portfolio. To make informed investment decisions, investors should review a company's financial metrics such as the P/E ratio, debt-to-equity ratio, and market share. Several strategies can be used to mitigate the risks associated with equity investments, including diversification, research and analysis, long-term investing, risk management tools, dollar cost averaging, and regular monitoring. By utilizing these strategies properly, investors can potentially reduce their risk while increasing their returns.

PROS

- Diversification can help reduce the impact of market volatility on your portfolio

- Research and analysis is important for making informed investment decisions

- Long-term investing can potentially reduce the impact of short-term market volatility

- Risk management tools can help minimize losses and protect gains

- Dollar-cost averaging can potentially achieve better overall returns

CONS

- Equity investing involves a certain level of risk, which cannot be eliminated

- It is important to understand all the risks associated with equity investments before making an investment decision

- Regular monitoring is essential to make necessary adjustments as needed and ensure that your investments are aligned with your goals and risk tolerance

Review Breakdown

-

Risk Level

-

Potential return

-

Ease of Use

-

Cost/Expense

-

Liquidity