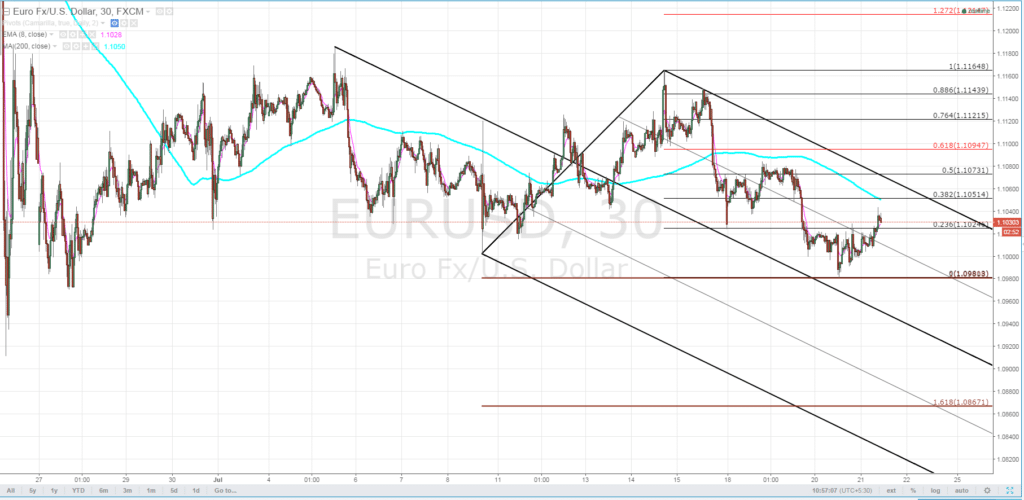

EURUSD :

Euro rebounded off confluence Fibonacci support at 1.0975/80 & heading into the release I’ll be watching this near-term formation with the risk weighted to the downside while below the weekly open / 38.2% Retrenchment at 1.1050/51.

A break lower targets subsequent objectives at 1.0941,1.0909 & the 2016 open at 1.0872. A breach above the monthly open at 1.1106 is needed to shift the broader focus higher.

As far as trading the release, today is ECB Day: so if ECB do nothing today then it might provide squeeze to the EUR crosses: in such case long EURNZD & EURJPY might be good option and both NZD & JPY are performing weak at this moment.

If they introduce any new measure then EUR can sharply fall back in such case EURUSD short would offer nice levels as USD is stronger and may remain stronger across the majors.

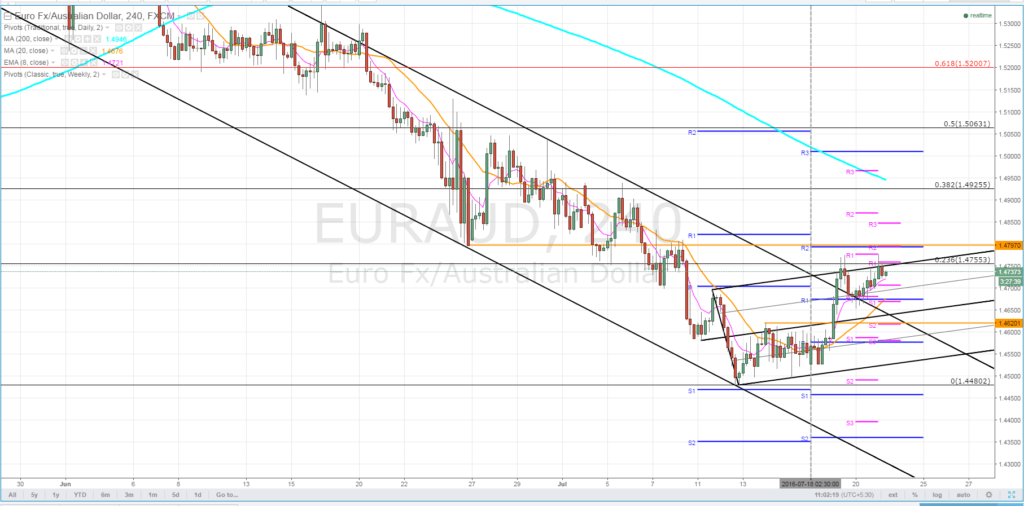

EURAUD:

EURAUD is facing Major resistance at 4770 & 4850 area on D close Basis; 4620 remain strong support (former range resistance); Daily close < 4620 shift focus on 4575 & 4519; ultimately I want to buy this anywhere near 4620 with tight stop < 4575 and will target above 4770. (ECB ahead)

USDJPY:

Finally takeout the Brexit high; now looking for close < 160.80 On D basis and then short with stop above the high.

Any move < 105.80 is needed to support the bearish view and reach us to initial target near 104.35

Read more about our recommended forex broker HotForex https://forexezy.com/hotforex-review