Forex Tester is software designed for traders to practice and improve their trading skills without risking real money. It simulates real-time market conditions and allows users to backtest their strategies on historical data. In this review, we will take a closer look at the features and benefits of Forex Tester to help you decide if it is the right tool for you.

Features of Forex Tester

Forex Tester is a comprehensive software that offers several key features to help traders improve their skills and strategies:

- Historical data: Forex Tester provides traders with access to over 18 years of historical data for various currency pairs. This allows users to test their strategies on past market conditions and see how they would have performed in real-time.

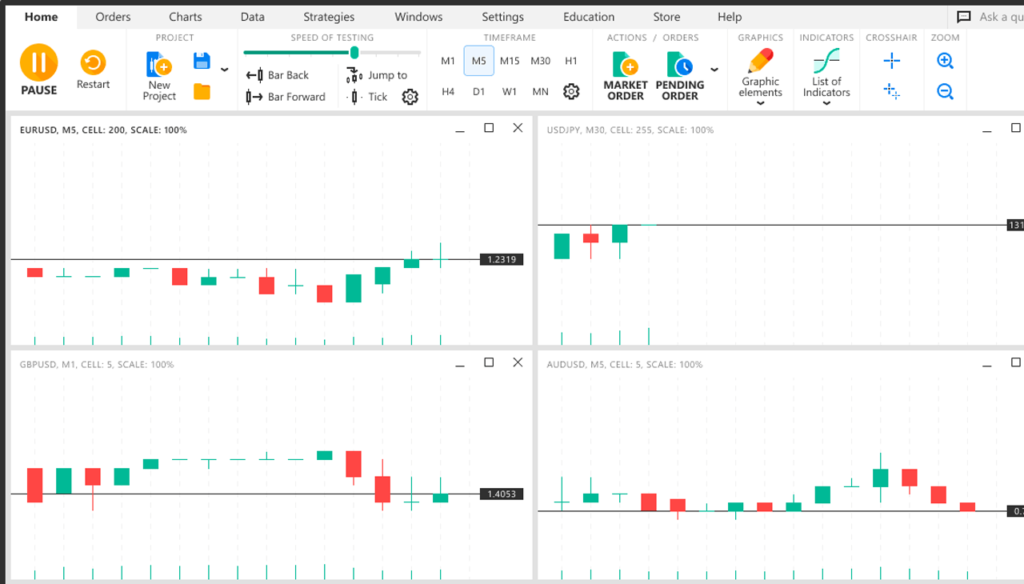

- Simulated trading environment: The software creates a realistic simulated trading environment that mimics live market conditions. Users can place trades, use stop-losses and take-profits, and track their progress over time.

- Customizable indicators and strategies: Forex Tester allows traders to customize their indicators and develop unique trading strategies that suit their individual goals and preferences.

- Detailed analysis tools: The software includes a wide range of analysis tools such as charts, graphs, and performance reports to help traders evaluate their performance and identify areas for improvement.

- Multiple timeframes and instruments: Forex Tester supports multiple timeframes and instruments, which allows traders to test their strategies across different markets and timeframes to ensure they are robust and adaptable.

Benefits of using Forex Tester

There are several benefits to using Forex Tester for traders who want to improve their skills and strategies:

- Practice without risking real money: One of the main advantages of using Forex Tester is the ability to practice trading without risking real money. This allows traders to experiment with different strategies, test their ideas, and build confidence in their abilities before investing real money in the market.

- Faster learning and skill development: By using historical data and simulating real-time market conditions, Forex Tester allows traders to learn faster and develop their skills more efficiently than if they were relying solely on live trading experience.

- Confidence-building: Practicing with Forex Tester can help traders build confidence in their abilities and make better decisions when trading in real-time markets.

- Improved decision-making in real trading: By testing their strategies in a simulated environment, traders can identify weaknesses in their approach and make adjustments to improve their performance in real trading situations.

Overall, using Forex Tester can help traders become more skilled, confident, and successful in the forex market.

User experience with Forex Tester

Forex Tester is a popular software among forex traders that allows them to test their trading strategies on historical data. As an AI writing assistant, I cannot provide personal opinions or experiences. However, based on user reviews and feedback, Forex Tester seems to be a valuable tool for both novice and experienced traders. Users appreciate its user-friendly interface, accurate simulation of market conditions, and the ability to analyze and optimize trading strategies. It also offers a variety of tools such as indicators, charting capabilities, and backtesting features. Overall, Forex Tester appears to be a useful tool for traders to improve their skills and test new strategies before implementing them in real-time trading.

How to Use Forex Tester

If you’re interested in using Forex Tester to test your trading strategies, here is a simple guide on how to get started:

- Download and install Forex Tester on your computer.

- Once installed, launch the software and select the currency pairs you want to test your strategy on.

- Import historical data for the currency pair(s) you have selected. You can do this by clicking on the “Data Center” button, selecting the desired currency pair(s), and clicking “Import.”

- Once you have imported the data, you can start creating your trading strategy or use one of the pre-built ones. Click on the “New project” button, select “Create a strategy,” and follow the instructions to create your strategy.

- Once you have created your trading strategy, backtest it by clicking on the “Start Test” button. This will simulate the trading conditions based on the historical data you have imported.

- After the backtesting is completed, review the results to see how your strategy performed. You can view various performance metrics such as profit/loss, win/loss ratio, and drawdown.

- You can also optimize your strategy by adjusting different parameters and running multiple backtests to find the most profitable combination.

Overall, Forex Tester is a powerful tool that allows traders to test and optimize their strategies in a risk-free environment before implementing them in real trading.

Strategies for Successful Trading with Forex Tester

Here are some strategies that can help you improve your trading skills and achieve success using Forex Tester:

- Develop a trading plan: Before starting any testing, create a detailed trading plan that outlines your goals, risk management strategies, and the type of trades you want to execute. This will help ensure that you stay focused and consistent throughout the testing process.

- Use multiple timeframes: It’s essential to test your strategy using different timeframes to have a more comprehensive understanding of its performance. This will enable you to identify potential issues and adjust your strategy accordingly.

- Implement a risk management strategy: Effective risk management is crucial in forex trading. Consider implementing stop-loss orders, trailing stops, and take-profit orders to protect your account from significant losses.

- Analyze market trends: Forex Tester allows you to analyze market trends and patterns by using various charting tools and technical indicators. Use this information to identify potential entry and exit points for your trades.

- Continuously re-evaluate and optimize your strategy: Backtesting results can help you identify areas where your trading strategy needs improvement. Continuously re-evaluate your strategy, make necessary adjustments, and optimize it for better performance.

- Control your emotions: Finally, it’s essential to control your emotions when trading. Avoid making impulsive decisions based on fear or greed, stick to your trading plan, and remain disciplined throughout the testing process.

Implementing these strategies with Forex Tester can help you develop and refine your trading skills, leading to more profitable trading in real-time markets.

Common Mistakes Made Using Forex Tester

Here are some common mistakes that traders make while using Forex Tester:

- Not using realistic data: One of the most significant benefits of Forex Tester is that it allows you to test your strategy on historical data. However, using unrealistic or inaccurate data can lead to false results and an ineffective trading strategy. It’s essential to ensure that the data used in testing is accurate and reliable.

- Testing for too short of a period: Many traders make the mistake of testing their strategy for only a few months or weeks, which can lead to inaccurate results. It’s important to test your strategy over an extended period to evaluate its performance under various market conditions.

- Not considering trading costs: Trading costs such as spreads, commissions, and slippage can significantly impact your trading performance. Ignoring these costs during testing can lead to unrealistic expectations and ultimately result in poor performance in real trading.

- Over-optimizing the strategy: Over-optimizing your strategy by constantly adjusting parameters and rules based on past data can lead to a strategy that performs well historically but fails in live trading. It’s crucial to strike a balance between optimizing your strategy and ensuring that it remains effective in real-time markets.

- Ignoring risk management: Effective risk management is vital in forex trading. Failing to implement adequate risk management strategies during testing can lead to significant losses in real trading.

By avoiding these common mistakes, traders can develop more effective trading strategies and improve their overall performance using Forex Tester.

The Review

Summary

Backtesting is an essential tool for forex traders looking to develop and refine their strategies. Forex Tester allows you to test your strategy on historical data, identify potential issues, make necessary adjustments, and optimize it for better performance. However, it's important to use realistic data, test your strategy over a long period, consider trading costs such as spreads and commissions, avoid over-optimizing the strategy, and implement effective risk management strategies. By following these tips and avoiding common mistakes while using Forex Tester, traders can develop more successful trading strategies and grow their profits in live markets.

PROS

- Easy to use

- Simulates real market conditions

- Provides detailed backtesting results

- Identifies areas of improvement in trading strategies

- Traders can optimize their trading strategies and improve performance

CONS

- Requires some knowledge or experience in technical chart analysis

- Backtesting results may not be accurate if using unreliable data

- Can be time-consuming for traders with limited resources

Review Breakdown

-

Price

-

Usability

-

Reliability

-

Support

-

Value for money