Are you considering Forexero as your next Forex broker? In this review, we’ll take a closer look at the platform’s features, fees, and reliability to help you make an informed decision. Whether you’re a seasoned trader or just starting, it’s important to choose a broker that meets your needs and fits your trading style. So, without further ado, let’s dive into our Forexero review.

Features and Tools

Forexero offers a variety of features and tools to help traders make informed decisions and execute successful trades. Here are some of the key features and tools available on the platform:

- Trading platforms: Forexero supports popular trading platforms such as MetaTrader 4 and MetaTrader 5. These platforms provide advanced charting tools, technical indicators, and the ability to use automated trading strategies.

- Account types and features: Forexero offers different account types to suit traders of all levels and needs. Some of the account features include leverage, minimum deposit requirements, and access to trading instruments.

- Educational resources: The platform provides various educational resources, including video tutorials, ebooks, webinars, and trading courses. These resources aim to improve traders’ knowledge and skills in forex trading.

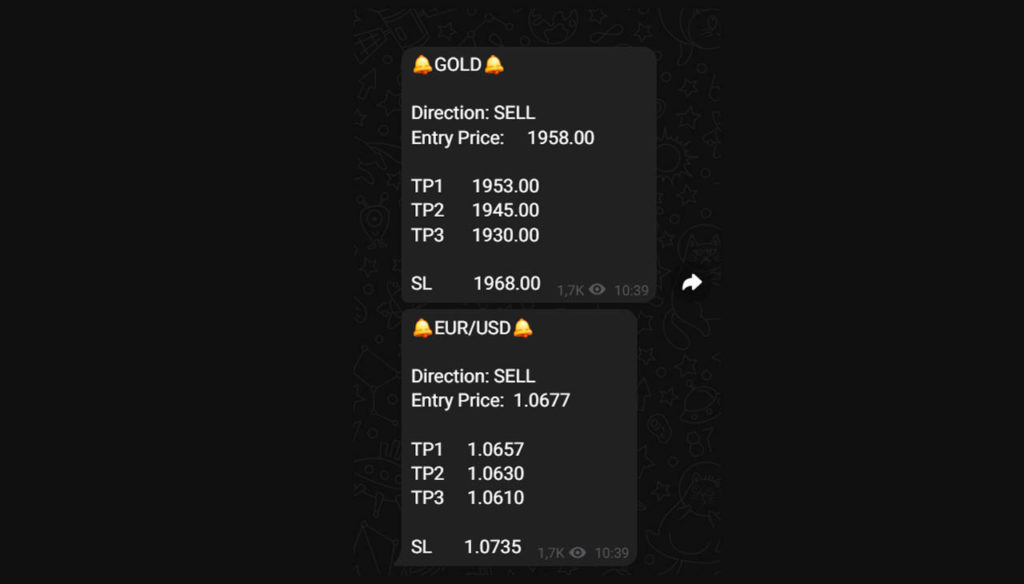

- Market analysis and research tools: Forexero provides live market news updates, economic calendars, and trading signals. They also offer daily and weekly technical and fundamental analysis reports to help traders make informed trading decisions based on market trends and news.

Overall, Forexero offers a comprehensive set of features and tools that cater to both beginner and advanced traders looking to trade forex markets.

Fees and Commissions

Forexero charges competitive fees and commissions based on the account type and trading instrument. Here’s an overview of their fees:

- Spreads and commissions on trades: Forexero offers variable spreads on its trading instruments, which means that spreads can vary depending on market conditions. Commissions are charged on some account types and trading instruments, and the commission rates also vary.

- Deposit and withdrawal fees: Forexero doesn’t charge any deposit fees, but they do charge withdrawal fees. The withdrawal fees vary depending on the withdrawal method chosen by the trader.

- Inactivity fees: Forexero charges an inactivity fee of $10 per month if a trader doesn’t log in to their account for more than 90 days.

It’s important to note that fees and commissions vary depending on the account type and trading instrument. Traders should carefully review the fee schedule before opening an account with Forexero. It’s also worth noting that while Forexero’s fees are competitive, there may be cheaper options available for traders who prioritize low fees.

Customer Support and Reliability

Forexero offers a range of customer support options to help traders with their questions and concerns. Here’s an overview of their customer support and reliability:

- Customer support options: Forexero provides 24/5 customer support via live chat, email, and phone. Their customer support team is known for being knowledgeable, responsive, and helpful.

- Security measures and regulations: Forexero takes security measures seriously and uses cutting-edge technology to secure its platform and protect traders’ funds. They’re also regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK.

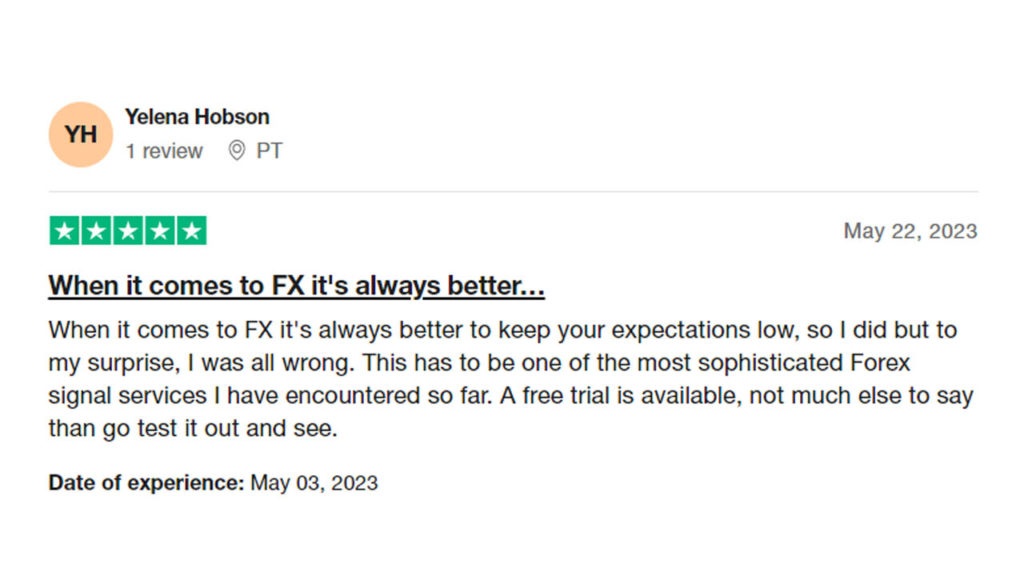

- User reviews and ratings: Forexero has generally positive user reviews and ratings online. Traders appreciate the platform’s competitive fees, a wide range of trading instruments, and user-friendly trading platforms. However, some traders have reported issues with account verification and withdrawal processes.

Overall, Forexero appears to be a reliable forex broker with good customer support, competitive fees, and strong security measures. However, traders should always do their own research and due diligence before opening an account with any broker. It’s important to consider factors such as fees, regulations, and customer support when choosing a forex broker that meets your needs.

Account types and features

Forexero offers several account types to suit traders of different levels and needs. Here’s an overview of the main account types and features:

- Standard Account: The standard account is designed for beginners and novice traders. It requires a minimum deposit of $100 and offers trading on more than 70 currency pairs, metals, and commodities. Spreads start from 1.2 pips, and there are no commissions on trades.

- Gold Account: The gold account is designed for intermediate traders. It requires a minimum deposit of $5,000 and offers trading on more than 70 currency pairs, metals, and commodities. Spreads start from 0.9 pips, and there is a commission of $7 per lot traded.

- Platinum Account: The platinum account is designed for advanced traders. It requires a minimum deposit of $25,000 and offers trading on more than 70 currency pairs, metals, and commodities. Spreads start from 0.6 pips, and there is a commission of $5 per lot traded.

All account types come with access to Forexero’s trading platforms (MT4 and MT5), educational resources, market analysis, and customer support. They also offer leverage of up to 1:500, negative balance protection, and Islamic accounts for traders who follow Sharia law.

Traders can choose the account type that best suits their needs based on their trading experience, budget, and preferred trading style.

The Review

Summary

Forexero is a reliable and secure forex broker that offers competitive fees and commissions, a wide range of trading instruments, user-friendly trading platforms, educational resources, market analysis tools, and customer support. They offer different account types to suit traders of all levels and needs. Overall, Forexero appears to be a good choice for traders looking for a reliable Forex broker. However, traders should always do their own research and due diligence before choosing any broker. It's important to consider factors such as fees, regulations, customer support, and trading tools when selecting an appropriate forex broker.

PROS

- Competitive fees and commissions

- Comprehensive range of trading instruments

- User-friendly trading platforms

- Educational resources and market analysis tools

- Reliable customer support

CONS

- Low maximum leverage (1:500)

- Withdrawals may be slow in some cases

- Limited payment methods accepted