The certainty of losing streaks

Losing streaks in trading is an unavoidable part of the process. The majority of novice traders start their path in trading with unrealistic expectations. Their minds tell them – “It cannot be that easy, anyway even those veteran traders have a hard time profiting from time to time”, but the voice of their hearts is often louder – “I’m special! It will be different for me! I uniquely understand the markets, etc.”.

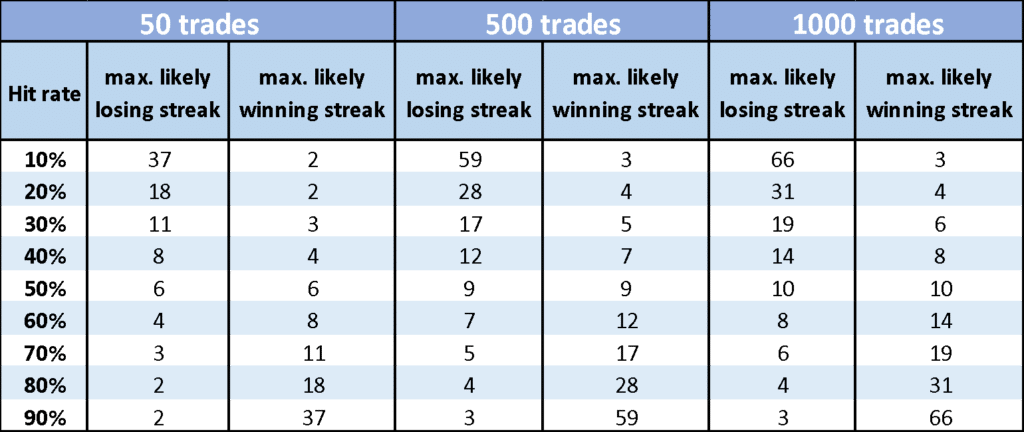

The truth lies in the nature of how the probability works in a large sample of events. It doesn’t matter what the events are – betting on the soccer team, your hands in poker, the likelihood of the rain or the direction of the market. Even the events with 50%-win rate can reach the streaks of the same event of up to 10 times in a row in a sample of 1000 attempts. That means, if you flip a coin 1000 times, the coin may land up to 10 times in a row on one side.

How many trading systems are there with a hit rate of over 50%? Add it up to the factor of a human error in the analysis or execution of a trading system. You get the idea.

The ways to get out from a losing streak

Let’s look into four ways to break losing streaks. Don’t see them as immediate remedies, like if you were a computer and it takes to replace a piece of hardware, and you’re good to go. But instead, consider it as a medicine (or a food supplement if you like) that you apply to cure yourself of sickness. We usually don’t immediately recover, but gradually come back to the healthy state. The same applies to your trading performance.

First, make sure you’re eligible for the treatment

For all four ways to work, you must have and consistently observe the following elements of your trading:

- You have a clearly defined trading system

- The performance of the system is proven statistically over the large sample of trades (at least 100)

- You employ a proper position sizing system in your trading (you follow the specific rules of how much you bet per trade, taking into account your account size, the size of likely drawdown, etc.)

- You execute your system correctly

1.Remember what got you there

It may feel like you lost your ability to trade profitably, and the markets are against you. That’s the time to stop and look back at the history of your trading performance.

Your trading journal and the trading statistics database will help you with that. I hope you do have at least one of those. If you don’t, I’d suggest to investigate your P&L statements and gather the basic data about your trading such as average profit, average loss, maximum consecutive losing streak, etc.

Look into the past periods of drawdowns. Are there any similarities in them? In the same way, check what kind of trades you took during your winning streaks. Find what works and what doesn’t and in what conditions (hint – consider different market conditions: trending and sideways).

If you have a trading journal with the deeper details about your trading, you can also discover the psychological factors that impacted your trading. Did emotions get in the way of your profitability? The trading journal reveals what happened behind your charts.

After looking back, you might find that your current losing streak is relatively typical compared to your past streaks. In this case, it can be just a matter of time before you get back to profits again. Alternatively, if you do everything as before, but your drawdown exceeds all your historical lows significantly, something is wrong, and you must make adjustments to your system.

2. Don’t take it personally

Often the most challenging part about a losing streak is not even the pain caused by an accumulated financial loss, but rather the feeling of being incapable of doing this business at all. It feels like you’re failing to exercise your potential, in severe cases even like you’re losing your identity!

First, there is nobody after you. The markets don’t know who you are. In essence, they go where they go not because they aim to rip off specific individuals.

Second, although you may feel like a failure, the feeling itself is not You. You are You, and this feeling is just your reaction to specific events.

Think of it this way, if you’ve been running for a while and you got exhausted, at the moment you cannot picture yourself running anymore. Does it mean you cannot run at all? Of course not! It just means you need to take a break or work on your running and breathing technique.

3.Neutralize the damage to your self-confidence

There is a point for every trader when the number of losing trades starts to affect self-esteem. Although losses are the part of the game, nobody likes the feeling when something isn’t working out. To know and to feel it through are different things. Often, it’s the feeling that has a more significant impact on our judgement, not knowledge.

If the problem is in the damaged self-esteem and the negative emotional state, we must do something to get back into the territory of confidence and optimism.

Here is the kicker – trading doesn’t even have to be the source of your regained optimism and self-esteem. The source doesn’t matter. Find something that you’re good at outside of trading and enjoy the process. Do things that bring you joy and personal satisfaction: spend time with family and friends, help people that are less fortunate than you, do some hobbies, sports, etc.

Once you refill your mental state with more joy and optimism while being detached from trading, when you’ll look at the charts again after a while, you’ll feel peace about your trading.

4.Change your environment

The first three points deal with your emotions and help you to get out from the emotional state that keeps you in the losing streak. Now, let’s talk about the ways to start being profitable again.

The success in any endeavour consists of the set of specific habits. Trading is not an exception. Humans have a tremendous ability to adapt. We develop habits to be more efficient according to the environment we are in. Did you notice how differently you act at home, in the office or outdoor?

When you do daily routines, the brain doesn’t need to focus much. Therefore, less mental capacity is used for the tasks of less importance. Instead, more focus can be directed to more complex tasks, making the overall judgement more efficient. Habits and routines are powerful tools. There are times, however, when habits become obsolete and make us stumble without us being aware of the cause.

To break your losing streak, make sure there are no unhelpful habits. You can do that in several ways:

- Add something before you start your trading day – do something that inspires you, brings the sense of peace, joy and confidence. Once you start your trading day, the mental impact of the activities you had done before will improve your judgement.

- Try trading from a different location – the environment can make a lot of difference. The things like light, noises, the order on your desk and around you, the comfort of your chair, etc. can stimulate or restrain the quality of your judgement in trading.

- Consider different views of the market – get exposed to the opinions of traders that think of the market in drastically different ways than you do. It will allow you to be more flexible in your thinking, and look at your strategy from a different angle.

- Look at the markets differently – after you got exposed to some new ideas of how to trade, try to use different trading tools (or don’t use the tools that you used) or trading concepts. Backtest them on the price history or try them out with a tiny size. The goal here is to make you receptive to any necessary adjustments you need to make to your trading approach, not necessarily jump into a completely different trading system.

- Take a strategic break from trading – schedule the specific times during the year to stay away from trading. Humans have a limited ability to process information. We’re all susceptible to burnouts from time to time. Go on vacation, meet up with your friends and relatives, take the time to contemplate your life, whatever works best for you.

We cannot avoid losing streaks, mathematically, it’s just the nature of things. Before executing any technique described above, make sure you take trading as a serious business, meaning you have a statistically profitable trading plan. First, you must fix the mental state that drags you deeper into the drawdown and second, work on your various habits that impact your trading.