Mr.Martin is a cost averaging trading advisor that works with high risks on a demo account. The presentation is short and not trustworthy.

Is this robot a viable option?

We don’t think so. The presentation looks horrible and not informative. Trading results showed that the system isn’t stable and can easily lose a whole grid of orders with Martingale lot sizes.

How to start trading with Mr.Martin

The robot has some details provided. It’s not enough but at least something that can help us with making a decision.

- The system works automatically on a terminal for us. No extra deeds should be performed.

- The current version of the system is 2.24.

- The platform is MT4. However, the vendor also offers a MT5 version of the system.

- It’s “designed for quiet, investment trading over a long period of time. The Expert Advisor uses in its strategy the principles of averaging unprofitable positions, but due to the unique input system, several filters, and the deposit protection system, expressed in the SL_percent_balans parameter, is completely safe for your deposit.”

- So, there’s a scary strategy called cost averaging behind the system.

- The default settings are optimized.

- Trading is allowed on EURUSD.

- The time frame should be M1.

- GMT offset is +2 only.

- The balance should include $1000, or so.

- “There are also more conservative and more aggressive settings, to get them, contact me.”

- “The Expert Advisor opens and closes trades on a “closed bar.”

- It can work with any broker and spreads.

- The hedge account is a must option.

- If spreads are over 10 pips, it’s not well-profitable.

The price is sky-high. We can purchase a copy of a product for $560. There are no rental options available. The system is available for demo usage for free. Alas, the offer isn’t supported by a refund policy.

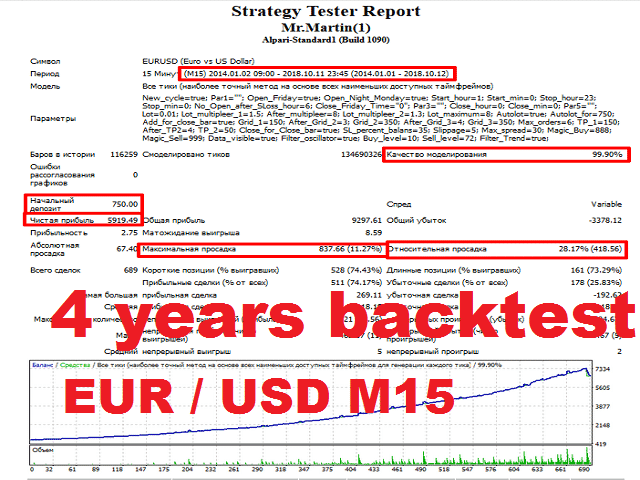

Mr.Martin backtests

The robot has a backtest report on EURUSD on M15 based on four years of tick data received from Alpari. The modeling quality was 99.90% with variable spreads. An initial deposit was $750 that has become $5919.49 of the total net profit. The profit factor was 3.75. The maximum drawdown was 11.27%. There were 689 orders executed with the win rate of 73-74%.

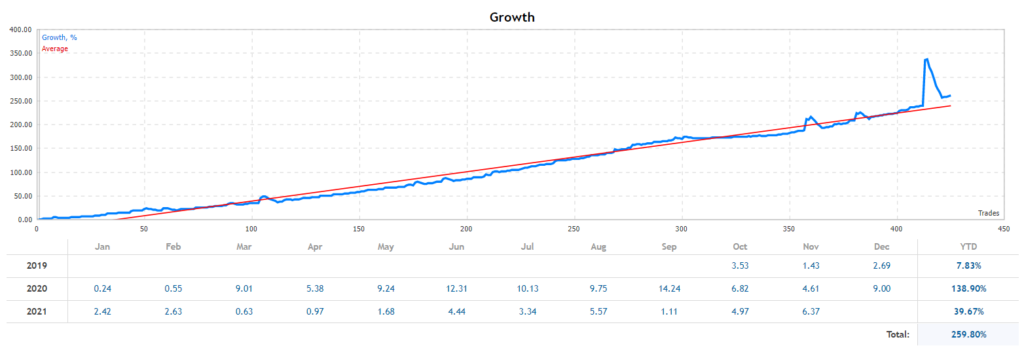

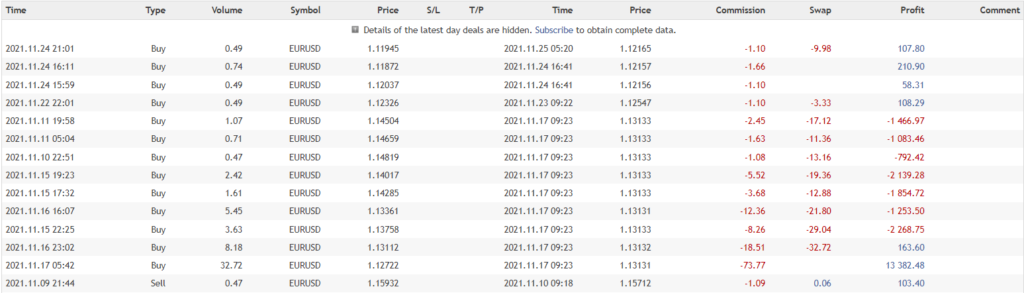

Trading results

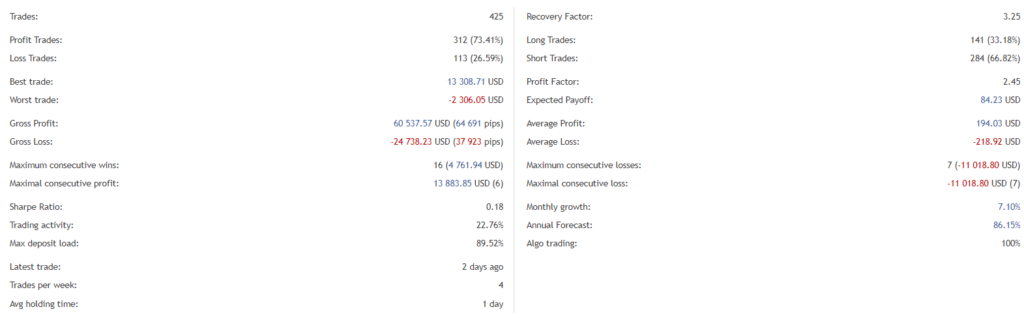

The robot has been running a demo account on RoboForex with 1:300 leverage. The maximum drawdown is 46.1%. The maximum deposit load is sky-high – 89.5%. The accuracy is 73.4%.

An average trade frequency is four deals weekly. The holding time is one day.

The system has closed all months with profit.

We may note that the robot has closed a Grid of orders with some Martingale lot sizes with losses. It’s noticeable that the system performs high risk trading.

The robot has executed 425 orders. The best trade was $13,308 when the worst trade was -$2,306. The recovery factor is 3.25 when the profit factor is 2.45. An annual forecast is 86.15%.

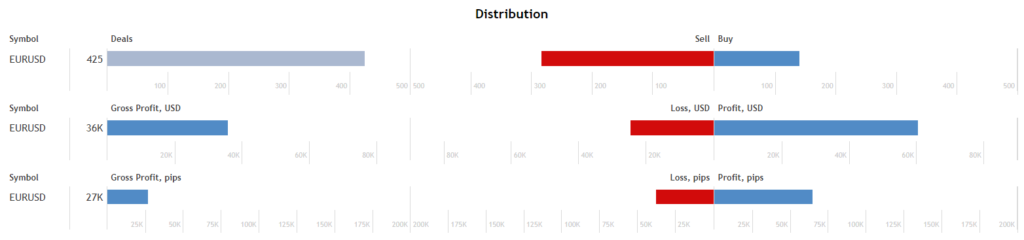

It works with EURUSD only. The Sell direction is traded more frequently than the Buy direction.

Other notes

Vasiliy Kolesov is a dev from Russia with a low personal rate, 3413 points. There are 11 products in the portfolio. His products have a 5 star rate based on 10 reviews.

People feedback

The client mentioned that the system is not okay. Other reviews are positive ones but we cannot trust them as they could easily be manipulated by the vendor.

Wrapping up

Advantages

- Backtest reports provided

- Trading results shown

Disadvantages

- No risk advice given

- No settings explanations provided

- Horrible and high risk trading results

- The pricing is high

- No rental options provided

Mr.Martin is a trading advisor that uses cost averaging with high-risk Martingale on a demo account. If something goes wrong, and this is pretty possible, we can easily lose our balance. So, the robot is simply dangerous and overpriced.