Trading is a continuous journey. Although professionalism requires consistency in the trading approach, solid routines, and habits, we can never declare, “I’m done learning. It’s time to follow what I know and reap the rewards forever.” Even if you have a winning trading system, and you know how to execute it well, the markets evolve, and the windows of opportunities open and close in a cyclical manner. That’s why we need to have the mindset to be natural learners and focus on getting better in our craft consistently.

Know what you’re already good at

Initially, focus on your strengths, not your weaknesses. It’s easier to develop what you already do well than fix something that you’re bad at. It’s counterintuitive though, most of us want to work on our weaknesses first.

How do you know your strengths? Use a trading journal! Every time you see or feel that you’re doing something well, note it in your journal and highlight it with a specific color (for example, green).

Working on your weaknesses

Most people will unconsciously shade their weaknesses by their strengths and will never objectively see what their weaknesses are. Your weaknesses signal you where you slack in your trading and what you need to improve.

A good example of it is when we have a break-even day. There are several winners and some losers. Often, such a day (week, month, a quarter in case of less intensive trading styles) is an excellent example of how your strengths conceal your weaknesses. Rather than only moving on and seeing this day as merely a “zero-day,” the breakeven day is an excellent opportunity to address your weaknesses.

It takes a strong dedication and discipline to keep monitoring your weaknesses even when your P&L stays positive. But that’s what separates good traders from the best traders.

Document it!

So, starting from today, focus on being mindful of your behavior when you trade. Note in detail what you did that wasn’t according to your trading plan (even if the trade turned out to be winning) or anything that affected your results negatively. Highlight it with a specific color (let’s say, red).

Document what trades you made, the reasons behind them, any useful observations from the market, and what you felt. Over time you’ll discover the specific ways that fit you personally to maintain the journal. If you actively day trade, you can add to it the screen recording so you can literally replay what was going on in real-time. It’s especially useful to see the Time and Sales (T&S) and the action in Depth of The Market (DOM) in stock markets.

So, the logical goal here is to reinforce strengths and to do fewer weaknesses. How do we do that in practice?

The journal helps you to replay the situation in the market and what was going on in your mind. It can never be too much stuff in your journal.

Daily reviews

How to make the best use of the journal? You must review it! It’s easier said than done, though. In reality, at the end of the day, when we’re tired, that’s the last thing we’d want to do. Here is a trick of how to deal with it in two simple steps:

- Highlight your strengths and weaknesses. Spend five minutes reading your journal at the end of the day.

- Write a quick summary of your notes. You don’t need to think deeply about it. The function of this summary is to reinforce what you’ve learned.

- Keep it in your memory to help you with your weekly review.

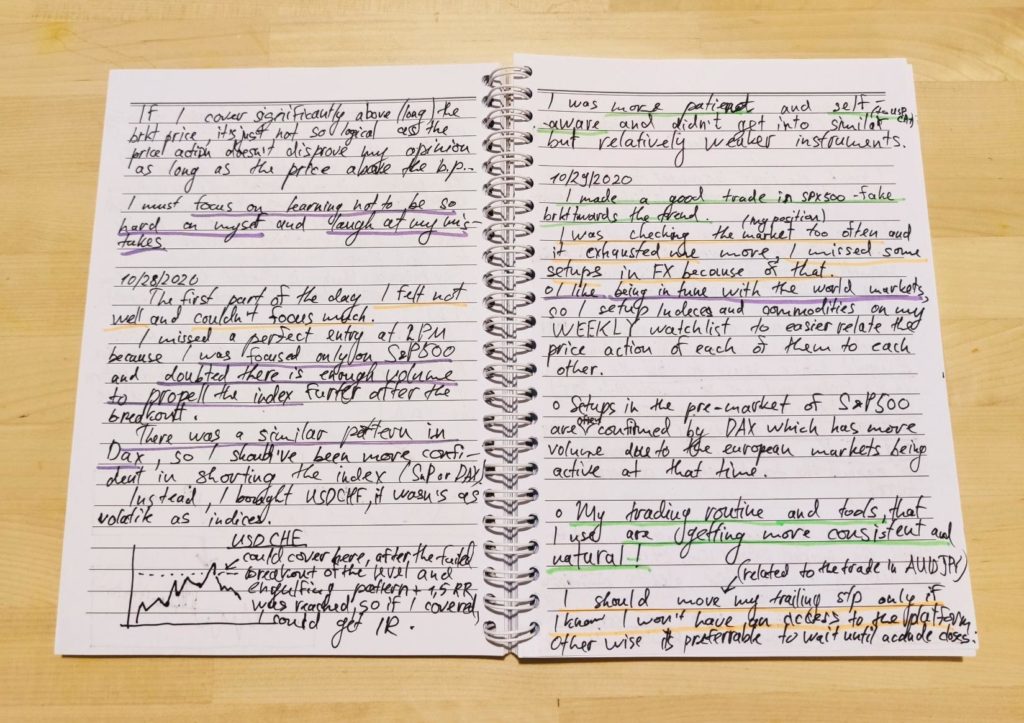

Below, you can see my trading journal and how I use the highlighting technique.

Also, it’s a great idea to highlight any particularly interesting observations in a different color. Personally, I use purple.

Weekly reviews

At the end of the week, read your journal in detail. It might sound daunting at first, especially when you’re exhausted from work. The key here is to find the time when you’re in a good mental and physical state and to schedule the review to do it consistently. Saturday or Sunday morning might be a good option. Get your favorite drink or snack, use some music, get inspired, and squeeze everything possible from that journal to learn from it. Just like you need to be at your best when making trading decisions, in the same way, you need your clear judgment to analyze your journal.

The secret weapon – index cards!

Here is a special tool to speed up your learning process. Take 3×5 size index cards. It must be physical, not digital. You’ll most likely forget about it if it’s on your computer or phone.

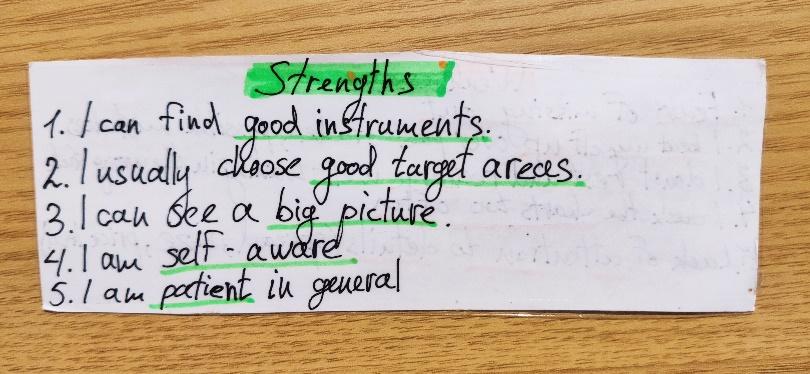

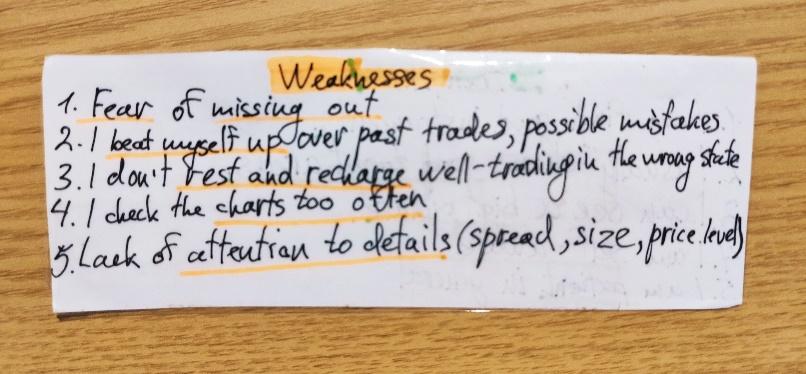

After reading your journal, you’ll know your strengths and weaknesses. On the front of the index card, write down three to five strengths that you’ll work on next week. In the same way, on the back of the card, write down three to five weaknesses that you’ll address next week.

Here is my index card (front and backside).

Why do we need an index card for it? Well, your journal will be packed with stuff. If the brain gets overwhelmed with information and tasks, it will simply refuse to digest anything! The index card is a neat way to get the lessons to soak into your mind. As you cannot fit too much on that card, you’ll write down only the most significant things you need to work on. Take that card everywhere: put it in your wallet, notebook, or just keep it always in front of you on your working desk! Just make sure you have reasons to review it.

The point is to constantly remind yourself of what you need to solve. The index cards are a classic tool that works in many other areas of life, so no wonder it works in trading as well. Too many issues in life are left unresolved simply because we forget about them over time.