There is something that stops traders from exploiting the full potential of their trading skills. You can know the best trading techniques, have enough “screen time” behind your shoulders and even have a trading system with a positive expectancy but still profit much less than you’re supposed to, if profit at all! If you notice these symptoms in your trading, the chances are you’re affected by the self-sabotage.

You can do everything right up to the point of deciding whether to open a trade. And then you second-guess whether you should open it. Also, everything can go well until the moment you see your running position, and then you spontaneously wish to close it due to the fear of a loss – only to see it go in your direction not long after you’re out of the market. The annoyance or frustration because of the mistake opens the gates to the wide range of the destructive behaviors of a trader. That’s how we punish ourselves for the lack of discipline or sabotage ourselves.

There are usually some triggers to activate the self-sabotage. It’s like an emotional domino – we screw up our mental state by the lack of discipline, and then the damaged mental state will take care of any further judgment-related mistakes.

Next, let’s look at the three ways of how not to let self-sabotage get in your way in trading.

Stay confident!

If you’re confident when trading, it will sustain you in this business in the long run. It doesn’t mean, however, that once you feel confident, every trade will be a winner. It just means you’ll perform at your best. Your judgment about the market will work like a clock, executing your strategy correctly, hence truly exercising your system expectancy.

Stay confident! Well, easier said than done! You cannot just “upload” confidence onto your brain by reading books, watching videos, or simply positive thinking. It’s deeper than that. There are specific techniques of how you handle every single trade to stay confident. Here, let’s look at it in a broad sense.

Confidence must be earned!

You must know your strategy at an intimate level. Ideally, you should stop getting surprised about what the market does when you execute your strategy. The mindset should be, “Whatever happens, I know what to do. I’ll make money in the long run even if I take a loss now.”

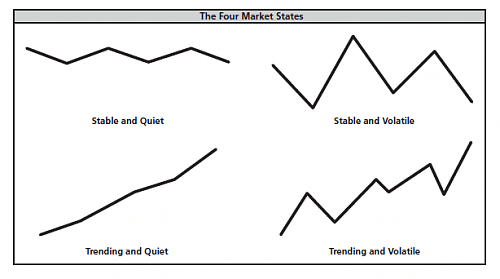

How do you get to know your system that deeply? You trade it! You invest your time to see how it behaves in all market conditions (see the cheat sheet on the left) and how you mentally respond to what the strategy does (How to do losing streaks, drawdowns, fast and slow gains make you feel?).

Test your strategy limits; test what you should and what you shouldn’t expect from the strategy. It takes time and dedication. There is no easy way if you want to keep earning consistently.

Another way to know your strategy closer is backtesting. It is not as effective as live trading, as you don’t learn to manage your mental state and your lifestyle. Backtesting can be helpful at the initial stage of finding the edge in the markets, mostly if the execution of the trades can be automated.

Mental discipline

Did you notice how harder it gets to stay focused after dealing with charts for 15-30 minutes? For many people nowadays, that’s an issue. People get caught up in a vicious circle of distractions on social media and other various internet content. The ability to stay focused is an incredibly valuable asset these days.

The decision making in the markets requires a strong mental discipline. For example, if you found an instrument that you expect to have a setup today, you must make sure you’ll grab the opportunity when it presents itself. There are tons of ways to make you distracted and miss an entry, so you must be aware of it and take your focus seriously.

The ability to maintain focus is more challenging when we get tired. You must build it! Just like other muscles, you can also train your focus muscle.

How to develop this muscle?

There are different relaxation techniques like breathing exercises, meditation, and their varieties. It doesn’t matter what particular method you use. The point is to develop your ability to focus on one thing. Incorporate relaxation exercises into your daily routine, especially before you do anything about trading. It should take around at least ten to fifteen minutes. You will be amazed at how easier your mind will process information and make decisions over time.

Trade a small size

There aren’t many things in trading that can be compared to the fear of loss by its destructive power. Whatever other techniques you use to protect your judgment, if you feel like in case you take the loss, it will hurt you, you’re hooked! When you’re fearful, you will miss good setups, and if you get in some of them, you’ll exit too quickly to avoid any loss, even if it’s a decrease in a “paper profit” of the running position.

Any profit or loss should neither make you nor break you. You can only achieve it if you risk a small size. I can assure you it will be quite hard to blow up your account (even if that was your purpose!) if you risk 0.5-1% per trade. The more bullets you have, the more chances there are to hit the target!

Summing up

Self-sabotage can overshadow any experience or potential you have as a trader. There are always specific triggers to start the vicious cycle of self-sabotage. To prevent the self-sabotage from affecting our trading, focus on developing confidence (by knowing your strategy), ability to focus, and maintaining a small position size.