Avia is an account management service run by LetfTurn. The company trades using an expert advisor and uses manual intervention to intervene in positions that contribute to aggressive drawdown. Our article will cover all the ups and downs of the programs offered by LefTurn and provide the answer on whether you should invest with them or not.

Is Avia still profitable?

Multiple live trading records provide us information on the output of the system. While it may give out a satisfactory return, the risks are too high.

Vendor transparency

The company is not willing to share the details of the programmers and traders behind the program. We don’t know anything about their experiences with the designated personals. The website’s address details are as follows.

Strategy

The developer states that they use a semi-automated trading strategy. While most of the trading is done by the robots, there will be manual intervention when the EA reaches a high drawdown. There are several programs available that differ based on average monthly returns and the drawdown. They require a hedging account with high leverage of 1:500.

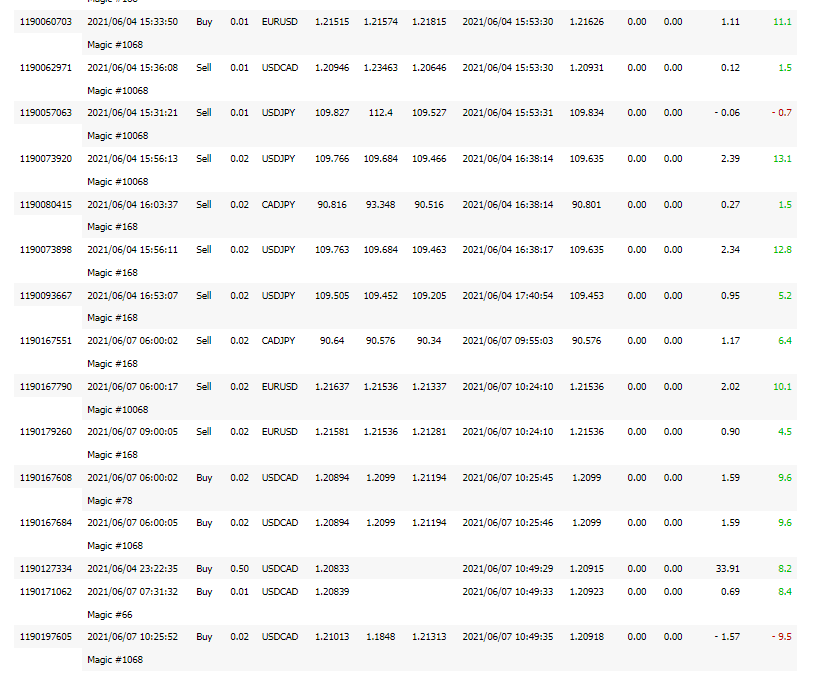

Looking at the trading history on FXBlue for a moderate account, we can see that they are using grid and martingale strategies. The company is not transparent on using such a risky game plan which is a poor approach.

How to start trading with Avia?

To start trading, traders will have to open an account with the broker of their or company’s choice and send over the login details. The company will then start to copy trades based on the risk plan that traders choose.

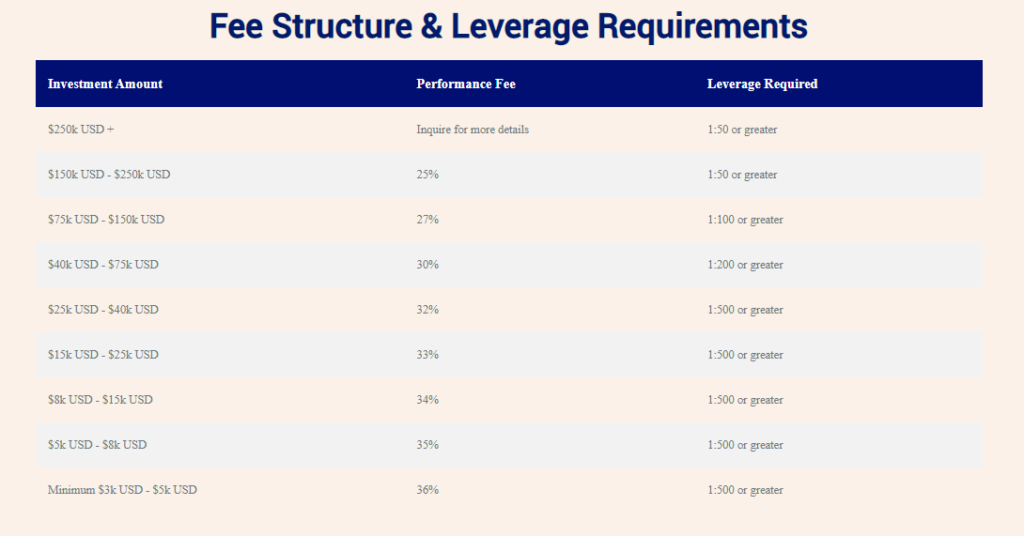

They require a minimum leverage of 1:500 for accounts less than $40k in size. There should be hedging allowed and an unlimited number of positions.

Price

The company makes a profit by charging a performance fee on the monthly gains. The charges decrease as the account equity increases in size. There is a 30-day risk-free trial that is available for those who want to test out the service. The trial is only available for a demo account.

Avia backtests

The company fails to share its backtesting records of the algorithm, which is a poor activity. The algorithm may likely have failed the backtests as it uses a martingale and grid strategy that does not work when the market trends in one direction.

Trading results

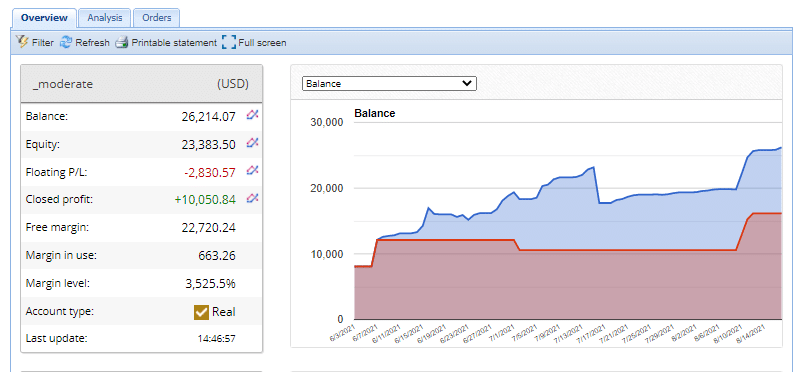

Verified trading records on Myfxbook show performance from March 06, 2021, till the current date for the moderate risk portfolio. The system made an average monthly gain of 27.2% during the period, with a drawdown of 23.4%. The winning rate stood at 74.1%, with a profit factor of 1.76. The best trade was $466.56, while the worst was -$1330. There were a total of 1764 trades. There were $8077 in deposits.

People feedback

There are no customer reviews available on Forex Peace Army and TrustPilot. This may mean that the account management service has recently started, and traders are afraid to give it a try. Also, there are martingale and grid strategies on the portfolio that are risky and can make the investors cautious.

Update 2021

When we decided to analyze the trading performance of Avia system, we saw that it was renamed to Alphi. The trading account as well as four programs offered on the website were removed. What is the reason? Without explanations, trading with this Forex system is risky.

Summary

Advantages

- Three different programs differ on the basis of risk, which traders can choose

Disadvantages

- They are not open about the use of grid and martingale strategies

- There is no transparency on who is the real developer

- There are no backtesting records available that can guide us on the historical data

Avia is not a suitable account management service as the providers are not transparent on many things. They use a risky martingale strategy that can blow your account at any instant.