Control Forex is a fund management service for companies, hedge funds, and individual investors. It claims to have an experienced team that has delivered 14102% profits across all its accounts. The vendor claims it is an unrivaled system for trading that is profitable and reliable. Compatible with MT4 brokers, this service boasts live and verified trading results since 2015.

Is It a Viable Service to Invest In?

The vendor claims this service to be a complex and intelligent system using three servers to ensure a reliable and precise operation. Monitoring of over 25 currency pairs as well as analysis of the pairs using different strategies is done here. On finding the best strategy, the system initiates the trading. The vendor claims all its approaches are unique and deliver an impressive profit to risk ratio.

How to Start Trading With Control Forex

To use the service, you need to use any reputed MT4 broker and start an account and fund it with the minimum required amount. After you give access to the service to trade on your account the service will execute the trades which you can monitor in real-time. The vendor does not mention info on the trading approach it uses or the recommendation on currency pairs, timeframe, and more.

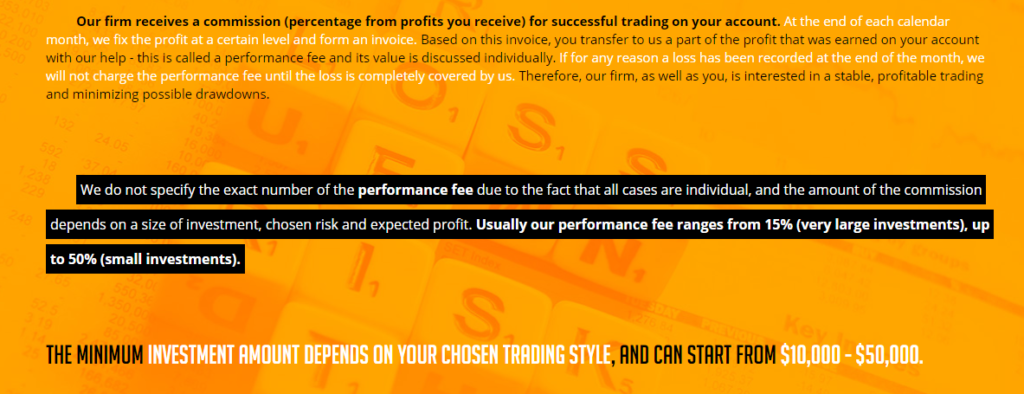

Pricing is based on commission fees. The company charges a percentage of the profits received from trading. Monthly invoices are raised based on the profits reached that particular month. In the case of a loss, the company does not charge fees until the amount is recovered. The fee that the firm charges ranges from 15% for small investments and can increase to 50% for smaller investments. Recommended balance starts from $10,000 up to $50,000.

Control Forex Backtests

No backtests are present on the official site. The lack of backtesting reports along with the absence of explanation on the trading approach raises a red flag. Since backtests are useful in knowing about the strategy used and its efficacy, the absence makes us suspect the reliability of the service.

Trading Results

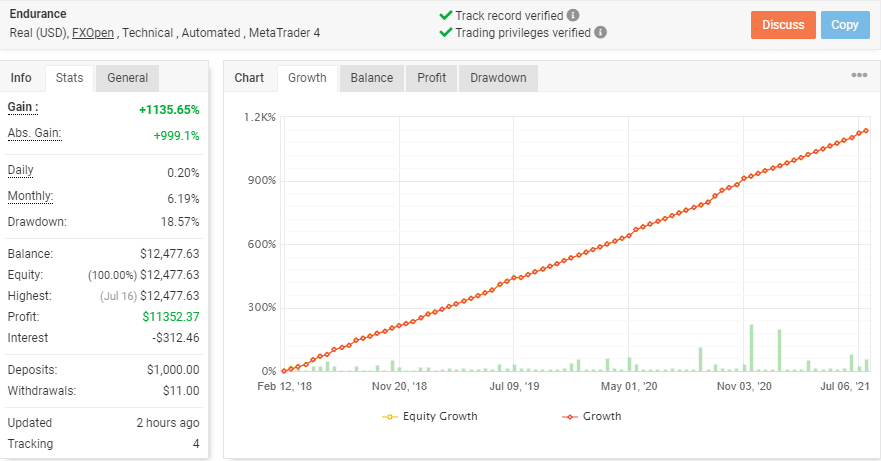

Many real account results verified by the myfxbook site are present under the Performance section of the site. Here is a live real account of the firm using the FXOpen broker and the MT4 platform and using a technical and automated trading approach.

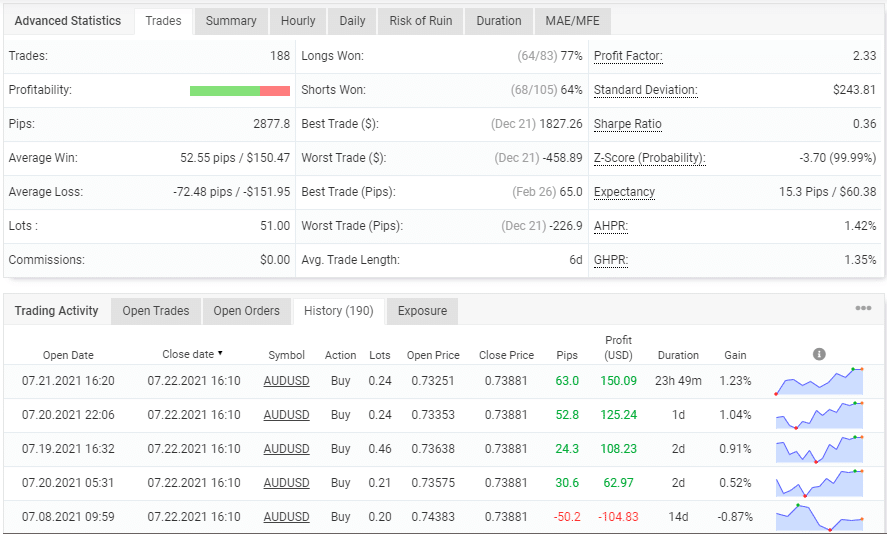

From the trading stats, we can see the total profit is 1135.65% and the absolute profit is 999.1%. The difference between the two values indicates a discrepancy in the performance. A daily profit of 0.20% and a monthly profit of 6.19% are shown for the account. The drawdown is 18.57%. For the account that started trading in February 2018, a total of 188 trades have been executed with a profitability of 70% and a profit factor of 2.33.

From the trading history, we can see the lot sizes are very high and range from 0.20 up to 0.85. The big lot sizes and low profitability along with the discrepancy in the total and absolute profit values indicate the approach used is not an effective one and can be of a high-risk category.

Customer Support

Other than the presence of an online contact form, the company does not provide other means of contacting the support service. This lack of support options makes us suspect the dependability of the service. Since users expect an immediate response to their queries, concerns, and doubts, the absence of support options like live chat, phone contact, etc. indicates the unreliability of the service.

People Feedback

We are unable to find user feedback for this firm on trusted FX sites like Forexpeacearmy, myfxbook, Trustpilot, etc. The absence of reviews indicates the system is not popular among traders. With the firm being in service for several years the lack of user reviews raises a red flag. We look for reviews from such sites as they offer unbiased insight into the performance, support, and other pertinent aspects of the service.

Summary

Advantages

- Verified trading results

- Experienced team

Disadvantages

- No explanation is provided on the strategy used

- Big lot sizes used in trading indicate a high-risk approach

- Lack of vendor transparency

Control Forex claims to have generated profits of more than 14102% from over 10 accounts maintained by the service. Our analysis of the features, performance, support and feedback from clients reveals that this is not a dependable system. While the firm provides verified results, the performance stats indicate a high-risk approach and low-profit potential. The absence of vendor transparency, lack of backtesting reports, and failure of the vendor to explain the strategy used all indicate this is not a trustworthy service.