Cosmonaut is a fully automated forex trading bot designed by Cashmaker. It is compatible with the MT4 and MT5 terminals. The vendor states that the robot does not employ harmful techniques like a martingale. The EA combines order protection and money management features to minimize drawdown while increasing profits.

Is a Cosmonaut robot still good to go?

Cosmonaut FX EA’s presentation lacks a comprehensive understanding of the strategic logic and a thorough explanation of the concept. The company behind it, Cashmakers, is supposedly based in Europe. However, we were unable to find any other information on the company, such as its founding year, staff members, license, etc. We found no evidence of live trading results or user reviews on third-party websites. This clearly shows that the vendor lacks transparency.

The robot trades whenever the instruments deviate from the center of a price channel. It can trade more than ten currency pairs at the same time. This guarantees that your asset portfolio is well-diversified.

How to start trading with Cosmonaut

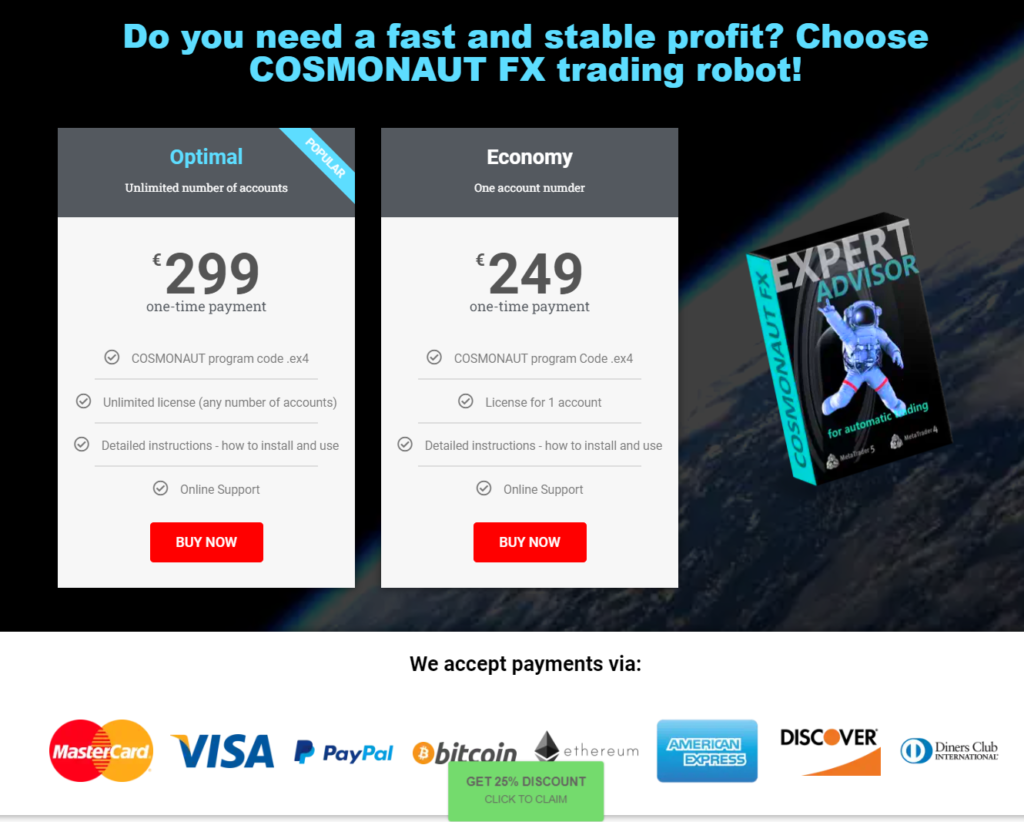

Cosmonaut EA offers two subscription options: The Optimal package, which costs 299 Euros, and the Economy package, which costs $249 Euros. The Optimal package offers an unlimited number of account licenses, while the Economy package has only one license. There is a 14-day money-back guarantee, regardless of which subscription you choose.

How it works

The bot has two systems: Mars and Jupiter. It uses them to accurately identify accurate and profitable trades. However, no further information about the systems is offered. It also employs elements such as order protection and money management to minimize the drawdown while increasing profits. The vendor does not offer any installation or settings recommendations.

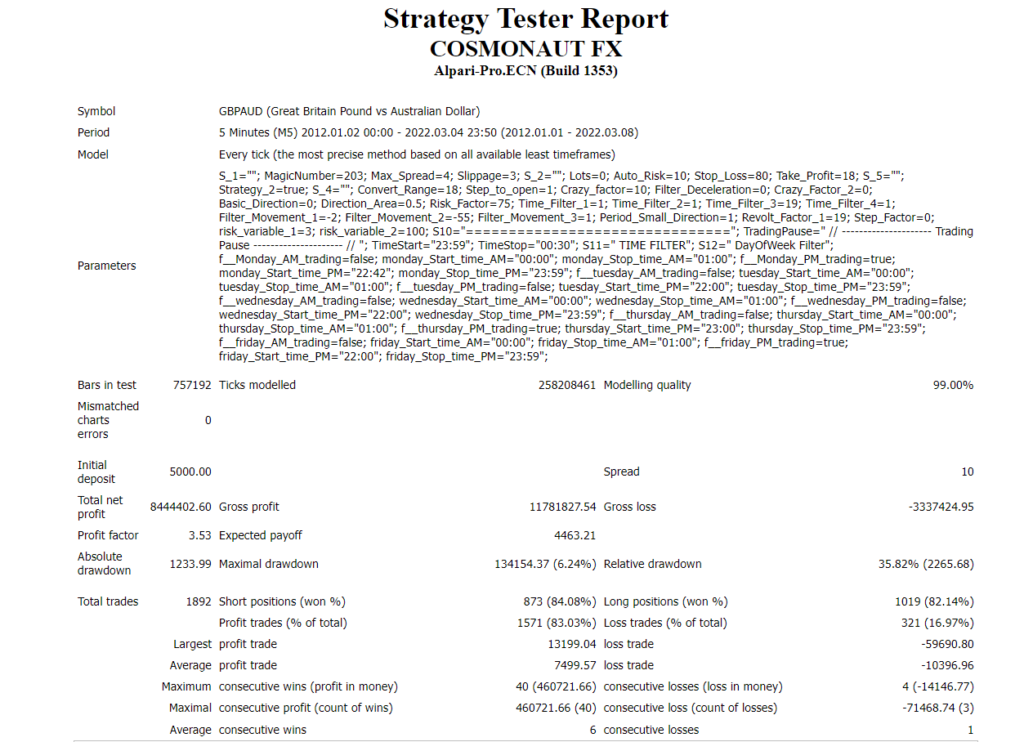

Cosmonaut backtests

Backtesting records have been shared as downloadable zipped files on the website. We cannot verify them because we could not find the results on third-party platforms. This raises concerns about the legitimacy of the data.

There are four tests of different pairs available on the zipped files. We will explore the GBPAUD one.

During the GBPAUD tests, the bot made a total of 1791 trades from 2nd January 2012 to 4th March 2022. From an initial deposit of 5000, the bot yielded a net profit of 8444402.60. Of 1791 trades, 873 were long trades, 84.08% of which culminated in gains. The other 1571 were short trades, and 83.03% of them closed with the funds earned. The maximum drawdown was 6.24%. The profit factor, on the other hand, was 3.53.

Trading results

We could not find any live results on third-party websites like Myfxbook, FxStat, or FxBlue. As a result, we can’t guarantee the bot’s reliability. On the bot website, however, there are screenshots of what appears to be the results we’re looking for. We will analyze one of them.

From December 21, 2020, until November 22, 2021, the Cosmonaut bot executed 1345 trades. From a $59,220,000.00 initial deposit, which resulted in a net of $247, 098,227.53. This was a monthly gain of 27.95%, translating to a daily gain of 0.68%. The maximum drawdown was 4.41%.

Comparing the live and backtest results is hard because the latter are inconclusive. We can only compare the drawdown data. That of live tests was 4.41%, while that of backtests was 6.24%. Optimally an account should experience drawdowns of 5-30% frequently. The backtest drawdown was ideal, while that of the live test was less than 5%; thus, it reduced the capital gains unnecessarily.

On broader research, we discovered that the performance reports of all the software products by Cashmaker looked nearly identical. In our opinion, that points to the faked results.

People feedback

There is no user feedback on third-party platforms like TrustPilot. However, there are numerous, only positive, results on the website. They seem to be schemed or handpicked, and we cannot verify that they are legitimate.

The Review

Cosmonaut EA promises stability and profitability. It's reasonably priced and comes with a 14-day money-back guarantee. However, its presentation lacks a comprehensive understanding of how it works and the strategy they apply. Backtesting records are available on the website, but we are unable to validate them. There are no live trading results on third-party websites, and the ones on the platform are inconclusive and look completely fake to us. The vendor is not transparent, which is a red flag.

PROS

- Money-back guarantee

- Full automation

CONS

- No customer feed to prove the refunds are really granted

- No clear explanation on the strategy

- The vendor is not transparent

- The performance tests look fabricated