There is a common notion in every career that you need to work hard to get good results. Since our early years, educational institutions teach us that we will get that if we do this. If we do this much homework, we will have that high grade. If we collect that many good grades, we will have a scholarship and so on. Pretty straightforward, isn’t it? People who understand these rules play the game well: they excel at school and are often successful on a career ladder.

When such people come to trading, they tend to bring their expectations and understanding of how success works from their previous life experiences. Get me right; there is nothing wrong with expecting to work hard in trading. In fact, putting in the time to master this craft is essential for long-term success.

The trap of self-deception

The problems start when people study the markets extensively to get the feeling of control over the markets. Also, it’s a dangerous expectation that the amount of work and the time you spent studying the markets is somehow correlated with the immediate profits as if you’re paid hourly for your time.

What happens next is the new traders start their trading day, after vast preparations, often to the point of exhaustion. They may feel that the market owes them something. Even if the market does something as they plan (and most of the time it does!), they may end up forcing trades, eventually making bad trading decisions. It happens because of being misled by this thought, “I worked and studied hard, so I deserve to make money today!”. While markets don’t know us, they don’t care what we think; they were long before us and will likely be there after us.

Such people may suffer from this kind of behavior. However, they have a distinct advantage – they’re instinctively ready to put in the work. They need to learn to manage their focus and direct their efforts into the right things. Also, it’s important to understand that just like in any business, often we will have to do the work without any guarantee of immediate results. It takes faith and self-control.

The road to Mastery

Do you really think that you need to know everything about the market to be a good trader? If you look at the best traders in the world, most of the time, they are focused on some specific market or a setup.

Jesse Livermore was collecting the specific patterns of the price action in his notebook while working as a runner on a trading floor.

Paul Tudor Jones studied the markets intensively, focusing his attention on one single event – an upcoming stock market crash, which he successfully predicted and took advantage of in 1987. Richard Dennis (a co-creator of the Turtle trading experiment) specialized in trading commodities.

Can you see the pattern here? The best traders in the world became successful in trading specific things, kinds of market, pattern, event, etc.

Develop your edge

To be a good trader, you just need to be good in a few select situations.

Focus on preparing for 3-5 specific trading situations, so you don’t have to learn everything about the market and be endangered by control bias. You need to know what you’re looking for. Get obsessed about a specific situation (fake breakout, specific candlestick pattern, etc.).

Get anxious about expecting those specific opportunities before they happen. Learn how to structure the risk and manage the trade properly in your top setups.

When you find your first specific situation (setup), you will have a reason to be patient and wait for it each week (month, quarter). And every new setup that you find and scrutinize gets you “promoted” as you open a new income stream in your trading business.

As you master more of those scenarios, you’ll find yourself at a higher level of patience and confidence. It will be a lot easier to trade and handle your emotions. You will be patient waiting for them and confident in taking them. It will make you a great career as a trader!

Link your mind with the market

The mind is a super powerful tool to overcome any challenge. There are many things in life that were very challenging to us in the past, but we don’t even think about them anymore as they became part of us. Take walking, for example. We were not born with the skill of walking. It took us the deliberate effort of trial and error until the skill became ingrained in our subconscious mind, so we don’t even think about it anymore; we just do it. The same goes for many other essential skills in life: driving a car, handwriting, typing, and even, heck, eating with chopsticks!

How about developing the skill of executing your favorite setups at the same level of ease? To achieve that, you need to replay your target market situations hundreds or even thousands of times, practicing your execution tactics in each of them.

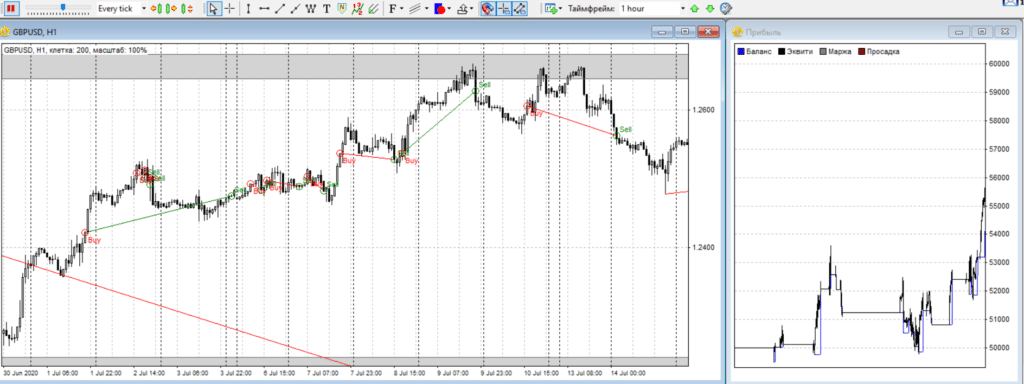

There are different kinds of market replay software available (see the screenshot of the Forex Tester 4 interface below).

Among them are Forex Tester, built-in market replay in TradingView, and many others. Choose your favorite market instrument and replay it candle by the candle in the market replay software. Once you see your setup, trade it, as you would when you’re live trading, practice your trade management and position sizing. The key here is to do it responsibly without any sorts of cheating, which won’t help you to prepare to act in the environment of the uncertainty of live markets.

Visualize it!

Many professional athletes practise their craft in mind before the actual performance. It increases confidence, focus, and quality when the showtime comes. In the same way, traders can apply this technique in their craft too.

With your eyes closed, practice visualizing your trading setup and how you’d manage the trade once you opened the position. Do your best in imagining every little detail of it and how you’d feel and act in that situation. Practicing visualizations before trading day dramatically increases your chances to win even before the battle begins.