Euro Hedge is an FX EA that uses a combination of trading approaches to enable quick entries and exits without being affected by changes in the market. This FX robot works on the EURUSD, GBPUSD, and the XAUUSD currency pair. As per the developer, the system uses both Martingale and anti-Martingale approaches to ensure the returns are high and the drawdown low.

Is this a profitable FX Robot you can trust to invest in?

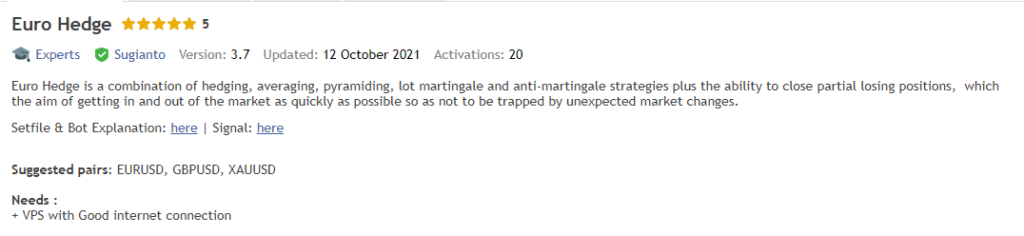

Sugianto is the developer of this FX robot. The developer is based in Indonesia and has more than 6 years of experience. He has created 37 products and 19 signals. Go Trendline, Simple Trade Panel, and Dunia Maya are some of his expert advisors. The Euro Hedge was published on the MQL5 site in March 2021. We could not find further info about the developer. There is no location address or phone number for contact. For support, the telegram channel link provided and the messaging board on the MQL5 site are the methods present.

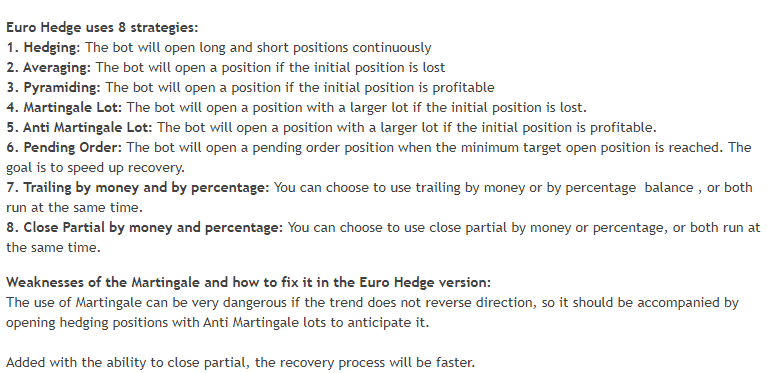

As per the developer, this EA was initially designed to work on the EURUSD pair. Now it is suitable for the XAUUSD and the GBPUSD pairs. The strategies used by the EA include hedging, averaging, pyramiding, pending order, anti-Martingale and Martingale lot, trailing stop, and close partial.

In general, the Martingale approach is considered a dangerous approach, and traders steer away from it to avoid heavy drawdowns or blowing of the entire account. But the vendor mentions that the use of hedging positions and the anti-Martingale lots help to compensate for the losses brought on by the Martingale approach.

How to start trading with Euro Hedge

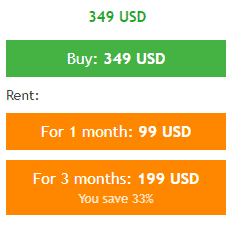

This FX EA is available for $349. You have rental options to choose from. The one-month rental costs $99 and the three-month rental costs $199. There are no details related to the features provided with the package. We could not find a refund offer which makes us suspect this is not a reliable EA.

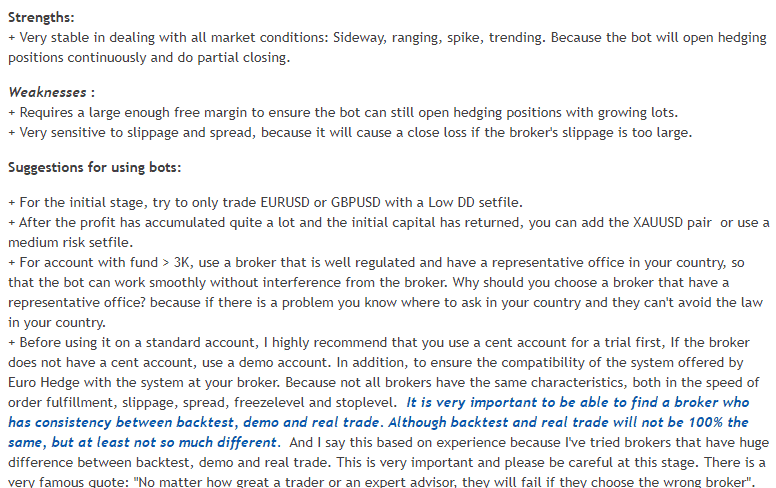

As per the developer, the EA should be used to trade the EURUSD or the GPBUSD pair using a low drawdown set file to avoid heavy losses. He suggests starting with a cent account instead of the standard account or to use a demo account. Several parameters are provided by the developer on the site for managing the open positions, pending orders, lots, and more.

Furthermore, he mentions that the system needs a large free margin for using the hedging approach and that it is sensitive to spread and slippage. These factors indicate the high risk involved in using the system.

Euro Hedge backtests

We could not find backtesting results for this EA. Although the developer displays a backtesting report on the MQL5 site, there is no detailed strategy tester report. The absence of backtesting results makes us suspect the reliability of this FX EA.

Trading results

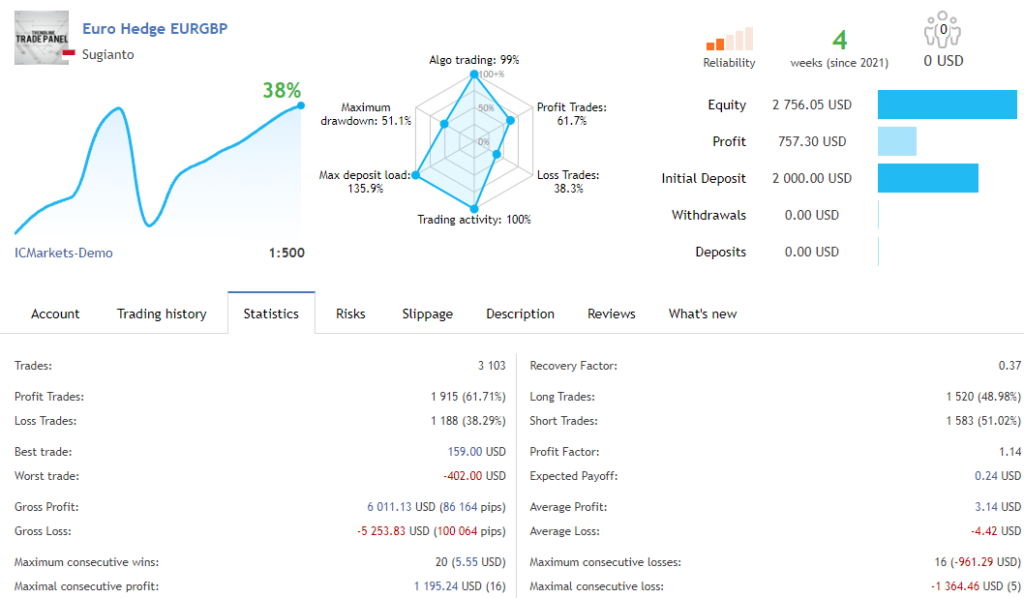

A demo account trading result is present on the MQL5 site for this FX EA. Here is a screenshot of the result.

From the above screenshot, we can see that the account has completed 4 weeks of trading and shows a growth of 37.87%. For an initial deposit of $2000, the account reveals a profit of $757.30 and profitability of 61.7%. The maximum drawdown is 51.1% and the profit factor is 1.14. From the high drawdown and low profitability, our suspicion that the approach used is risky is confirmed.

People feedback

We could not find user reviews for this FX EA on trusted third-party sites like Forexpeacearmy, Trustpilot, etc. Although the MQL5 site has a couple of reviews, since the site promotes the product, the reviews cannot be relied upon. We prefer sites like Forex Peace Army as they provide an unbiased view of the results, support, and other aspects of the trading tool. The lack of user feedback reveals that this is not a popular system.

Summary

Advantages

- Fully automated expert advisor

- Uses multiple trading approaches

Disadvantages

- The use of the Martingale method makes it a risky EA

- High drawdown in the demo account

- Expensive price

Our evaluation of Euro Hedge reveals this is an unreliable expert advisor. While the MT4 tool uses many strategies, the presence of the Martingale approach makes it a high-risk product. Further, our assessment is confirmed by the high drawdown seen in the demo account. The failure of the developer to reveal a detailed backtesting report, inadequate support, and the absence of user reviews are other downsides that confirm our assessment that this is not a reliable FX EA.