Welcome back! We’ve prepared a review of the FX Rapid EA.

There are introduced two packages of the EA: Due (EUR/USD and NZD/USD) and Quattro (EUR/USD, AUD/USD, NZD/USD, and USD/JPY).

Is FX Rapid EA good for trend trading

Let’s sum up the most important intel about the EA and strategy it runs:

- FXRapidEA is designed for trend trading. Using special algorithms, the robot determines the trend’s direction and opens a trade following that direction.

- If it happens before the trend started, so there occurs a little rollback.

- The EA closes trades that go in the opposite way of the market trend.

- When the devs told about “rapidly,” they meant that the EA never keeps trades open more than several hours. “This is achieved by using medium Take Profit, and trading by the trend, profit goals are reached faster.” More than 80% of trades close for 1-2 days.

- The EA closes profit trades as well if they overrun by terms.

- It works with any broker and doesn’t require anything special.

- FXRapidEA has a money-management system that controls drawdowns. Everything we need is to choose what risks we want to trade. The rest will be calculated automatically.

- The EA is compatible with NFA regulated brokers and brokers that run under FIFO rules.

- The installation is simple, and no additional configuration is required.

- The minimum deposit requirement is up to $500 to trade with 0.01 Lot Size.

How to start trading with FX Rapid EA

As we can see from the main features, the EA is a highly profitable fully-automated trading solution. It trades “rapidly” (?) and doesn’t trade against the trend. It can be run on any brokers that support the MT4 and MT5 platform trading.

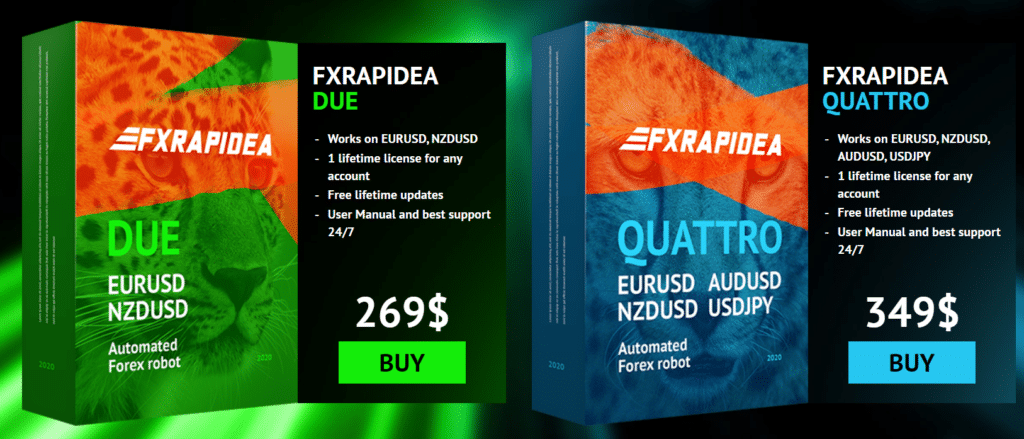

The Due package costs $270 and includes one life-time license for any (type?) account, free updates, user manual in PDF, and 24/7 support.

The Quattro costs $350 and unites the same services.

We can rely on the 30-day money-back guarantee.

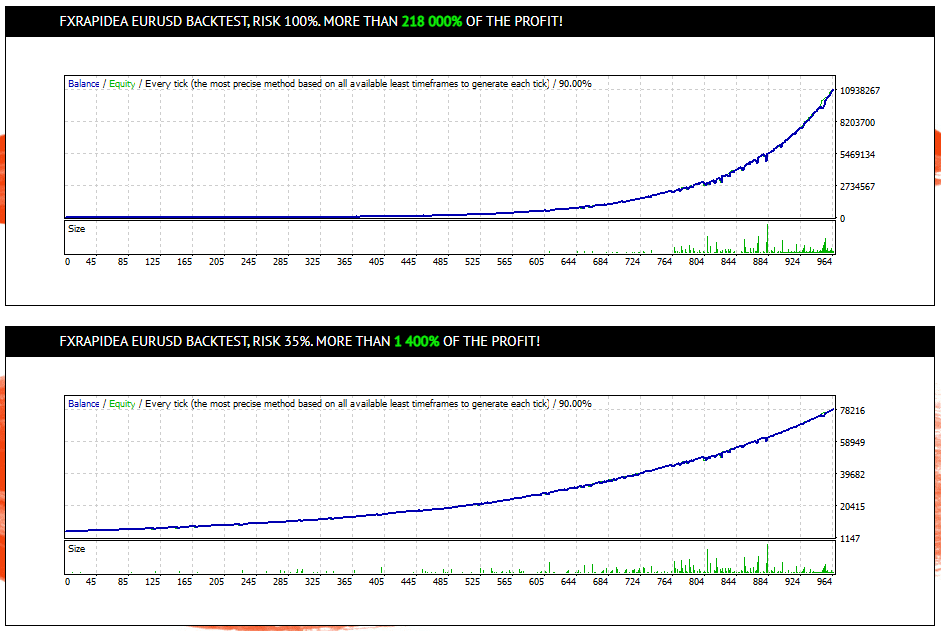

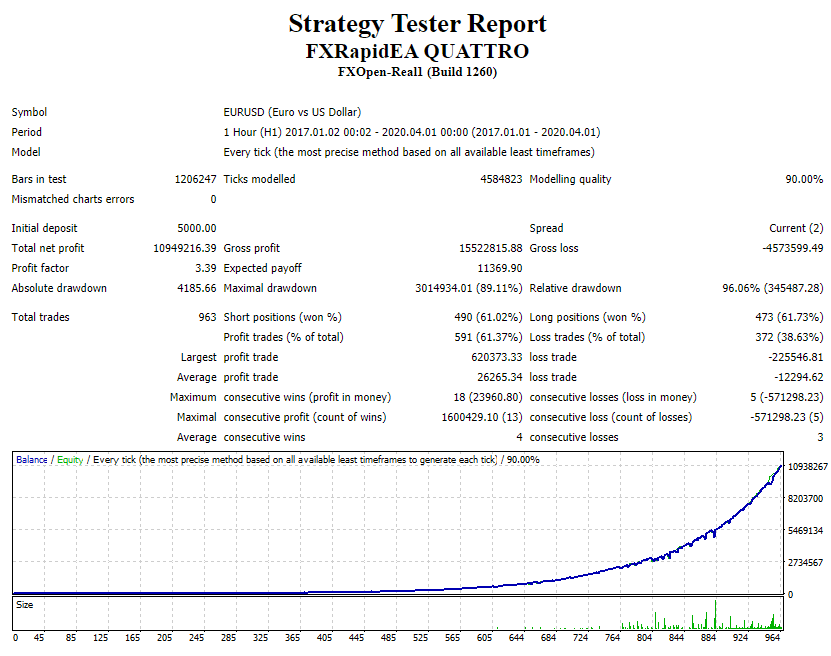

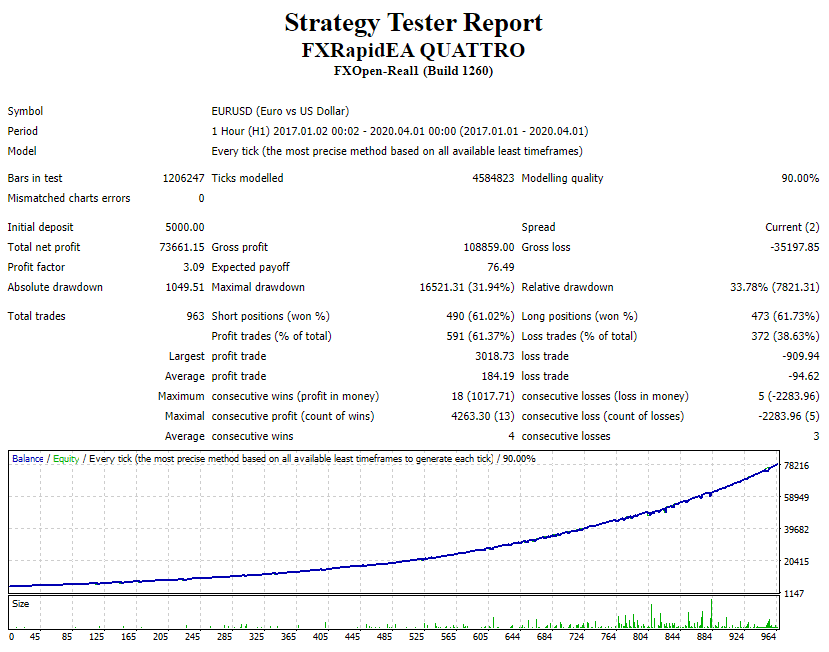

FX Rapid EA Backtests

The developers tested every symbol with two risk levels: 35% and 100%. Let’s take a closer look at them.

It’s a backtest with 100% risks of the EUR/USD symbol on the H1 timeframe. The modeling quality was 90.00% with 1,2M bars in the test. The initial deposit was $5k. The total net profit became $10.9M for over three years. The Profit Factor was quite high and equaled at 3.39. At the same time, the maximum drawdown was insane (89.11%). If it happened on the real account with 1:200 leverage or higher it’d be triggered Stop Out. The win-rate across shorts and longs was equal and amounted to 61%.

This backtest has the same parameters, but it’s run with 35% risks to the account balance. The initial deposit of $5k became $73.6k of the total net profit. The maximum drawdown was noticeably low (31.94%).

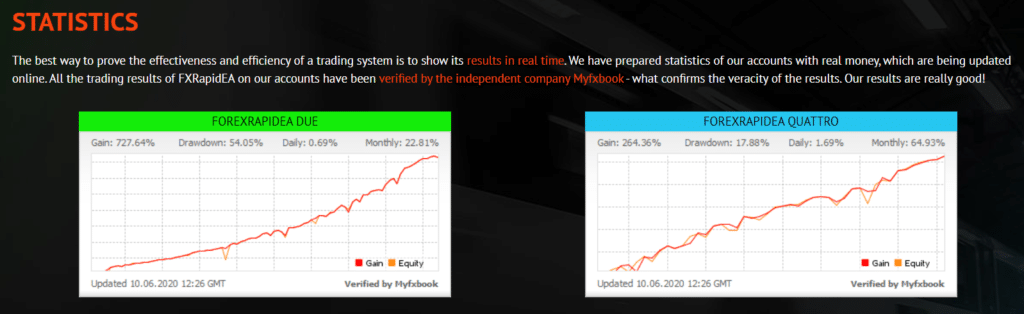

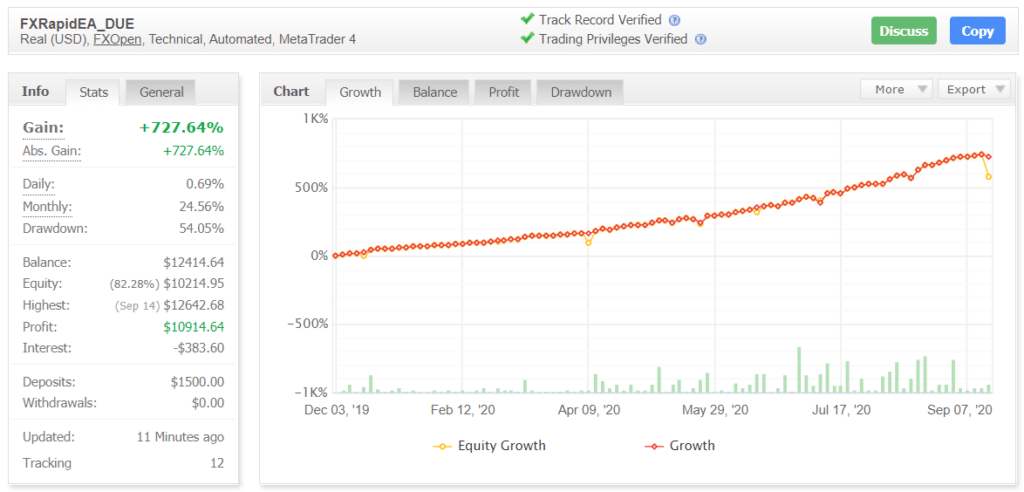

Trading Results

The devs provided Myfxbook’s widgets with statistics.

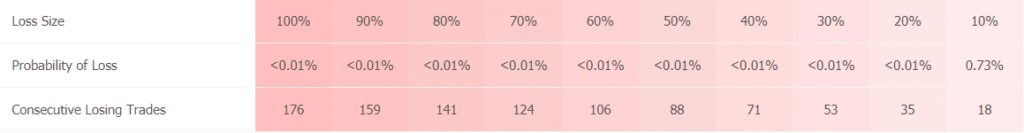

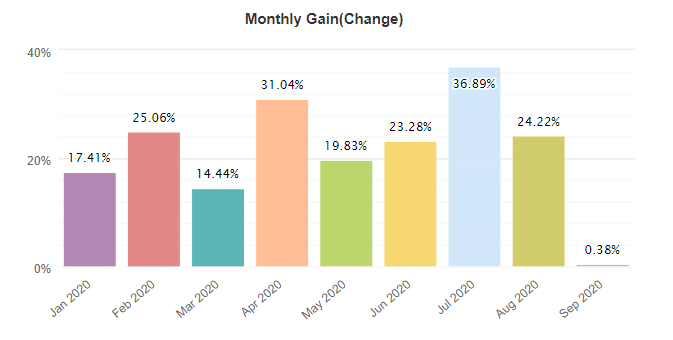

It’s a real USD account on FXOpen (it’s a good broker house). The EA trades without leverage on the MetaTrader 4 platform. The initial deposit was $1500. The total gain amounts to +727.64%. The monthly gain is huge and equals 24.56%. The robot has got a maximum drawdown of 54.05%. The account was deployed over ten months ago.

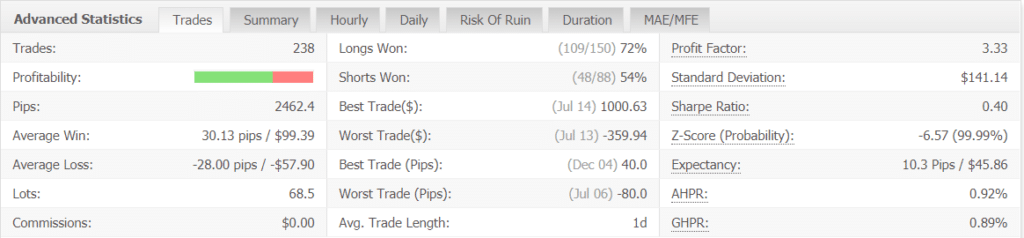

There have been performed 238 deals with a solid number of pips (+2462). The average trade (30.13 pips) equals the average loss (-28.00 pips). The average win-rate for longs is 72%, and it’s much higher than for shorts (54%). The average trade length is one day. The Profit Factor is brilliant and equals to 3.33.

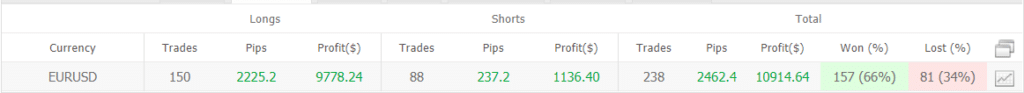

We have proven results only for a EUR/USD currency pair.

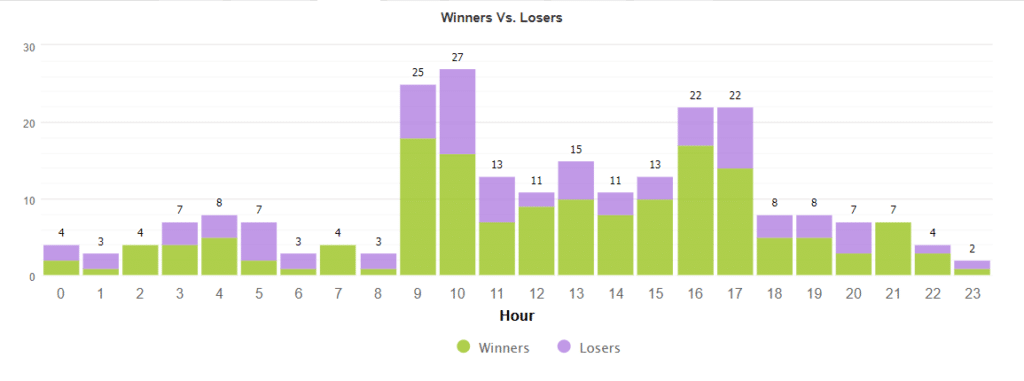

The EA prefers to trade during European and a little bit during the end of American sessions.

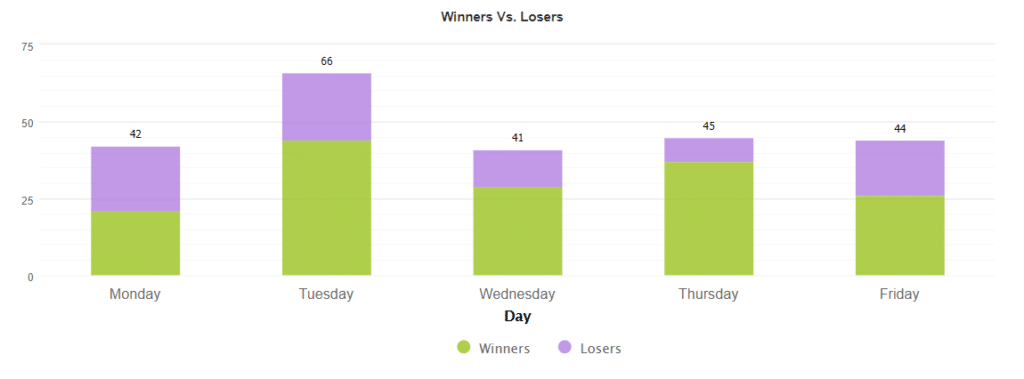

It performs equally every day.

It runs with several percent of risks to the account balance.

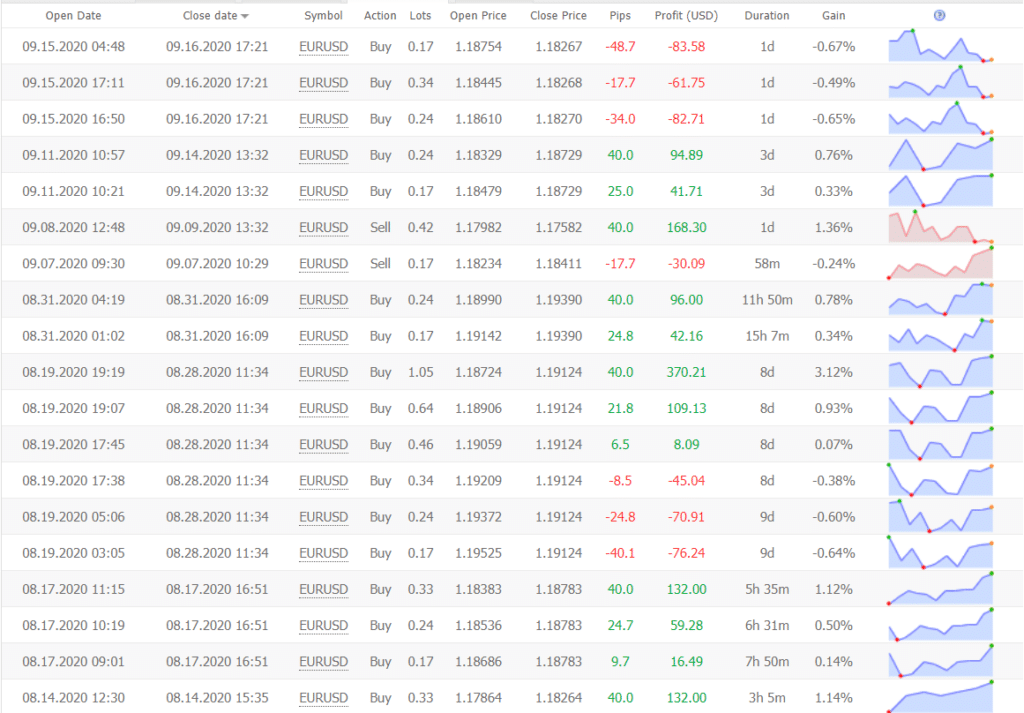

The devs told us that the robot doesn’t keep trades for several days, but the results show the opposite. Many trades have been closed after 3, 8, and even nine days.

It looks like the EA is broken. The September 2020 results look like a joke comparing to the previous months. In the first week of October 2020, there’s any deal closed as well.

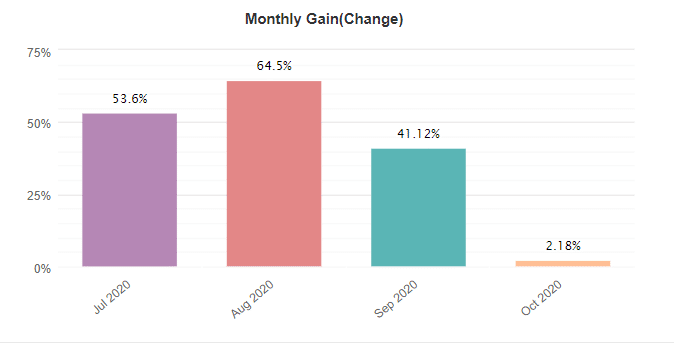

They’re Quatro’s results. It’s such a big difference.

People Feedback

The site has no reviews, but both accounts are watched by 14 people. It’s not so much, but it shows that traders are interested in this EA.

Conclusion

Pros

- Strategy explanations provided

- Money-management and settings explanations provided

- Real account trading results

- Outstanding Profit Factor

- Quattro has good profits from month to month.

- Not so high price compared to the shown results

- The 30-day money-back guarantee provided

Cons

- No team revealed

- High the maximum drawdown on the Due account

- Mediocre trading results on the Due account

- No people feedback provided

- Trades can be kept open for a week or even more

As we can see, the results vary depending on the package. Due has a high maximum drawdown and 40 days of mediocre trading results when Quattro provided a solid profit. If you have thoughts to buy any of the packages, we’d like you to contact their support to ask what happened with Due’s results.