The foreign exchange market is the largest financial market in the world, where many have amassed fortunes just by playing their cards right. Whether you trade part-time or full time, success in this market depends solely on the trading practices and preferences of the individual in question. Forex trading can be learned, but the experiences cannot be transmitted. Every individual has to attain success through a personal effort of understanding as well as sheer hard work.

One of the most common and effective styles of trading foreign exchange is day trading. Day trading refers to the action of purchasing and selling any security within the same day. In other words, one cannot hold any positions overnight. Some of these strategies will be the focus of this article. Your price target might change, depending on the style you choose.

Strategy for Momentum Traders

20-100 Short-term Strategy

The 20-100 short-term strategy is ideal for momentum traders in the forex market and can be used independently or in conjunction with other strategies to find a better entry price for the long term. Here, your main aim is to go short or long only when momentum is on your side.

To use this strategy, you need three different indicators: The moving convergence/divergence, the 20-day Exponential moving average, and the 100-day simple moving average. The 20 days EMA is the trigger for this trading strategy. You should take the trade only when the MACD turns within 5 candles. This is because we have to enter the trade when the momentum is just blossoming, and not when it has already matured.

How to Implement the strategy?

There are separate rules for using this strategy when entering Long trades and Short trades.

In case of short trades, find a currency pair trading above both the 20day EMA and 100 day SMA. Wait for the price to cross above both the MAs by 15 pips. The MACD has to turn negative no longer than 5 candles before. Sell at the market and place your stop at the high of the candle that broke the MAs. When the currency pair moves in your favor, buy back half of the position. Move your stop on the remaining position if you want to breakeven. Finally, trail the stop on the rest of your position as calculated: 20day EMA + 15 pips.

In the case of long trades, use a 5-minute chart. Find a currency pair that is trading below your 100 days SMA and 20 days EMA. Wait for the prices to move above both of them by at least 15 pips. You should make sure that the MACD has turned positive only 5 candles ago. Place your stop at the ow of the candle that breaks the moving averages. Sell half of the position when the currency pair moves in your favor by the risked amount. To break even, move your stop on the remaining position. Finally, you should trail the stop on the remaining position as calculated: 20 days EMA – 15 pips.

Strategies for Day Traders

Fading Trading

In the world of forex trading, fading basically means trading against the trend. Traders who follow a fading strategy expect the price to drop when the trend goes up, and thus they sell. Similarly, they buy when the price rises. It is contrarian in nature as it is used to trade against the trend, differing from other types of trading where the aim is to follow the prevailing trend.

There are three assumptions that you have to make when employing a fading trading strategy: The early buyers become ready to take in gains, the current buyers appear as if they are in danger and the security appears overbought.

How to Implement Fading Trading?

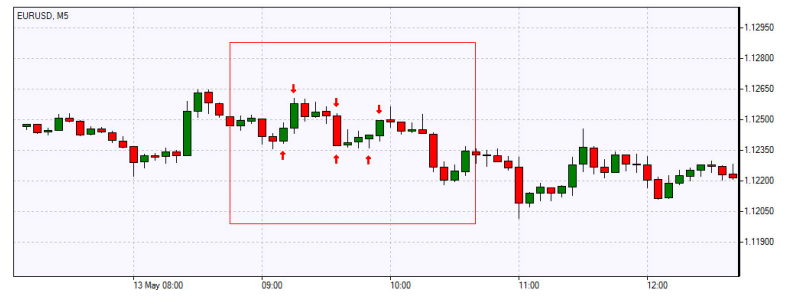

The above is a chart for the EUR/USD currency pair. To implement this strategy, simply place two limit orders at specified prices. Set the sell limit order above the current price and set a buy limit order below the current price.

Remember that fading trading carries a degree of risk because the trader is essentially trading against the trend at any time. But since almost all currencies are expected to show reversals after a sharp rise or decline, it presents opportunities to profit. Thus, make sure you have proper risk management rules in place when getting out of each trade to ensure that you have profit at the end of it.

Scalping

Another effective day trading strategy is scalping, which is based on short and quick transactions which can result in profits on minor price changes. Scalpers have a tendency to implement up to 200 trades daily as according to them, minor price movements can be followed more effectively than big price movements.

The above is a 5-minute chart for EUR/USD. Here, liquidity, time frame, volatility, and risk management are essential elements. Liquidity has a huge bearing on how you perform the scalping. To quickly move in and out of large positions, choose more liquid markets. To get larger bid-ask spreads, trade in a less liquid market. Your time frame will have to be significantly shorter and your aim would be to profit from small market moves which other traders will find difficult to see on a 1-minute chart.

Strategy for Swing Traders

Trading Ranging Markets

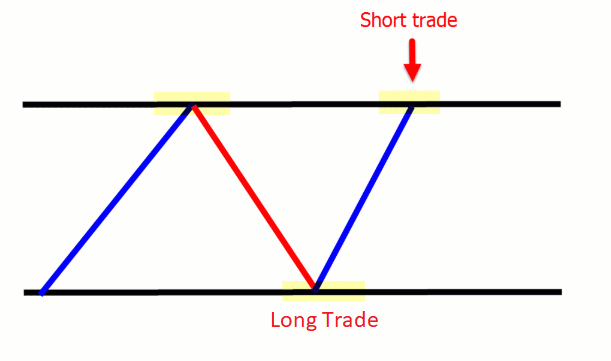

For swing traders who want to trade ranging markets, he/she is aiming to generate profits from the swings the range is making both lower and higher. You will have to enter short trades at the higher and resistance of the range. You will also have to buy long trades at the low and support of the range.

Always look for ranges that have a clearly defined low/ support and high/ resistance. Avoid the middle and only stick to trading from the clear range highs and lows. You can use the pin bar, or engulfing bar or similar price action triggers for trade confirmation. Always be on the lookout for false breaks. To minimize losses, use the correct position sizing.

Final Thoughts

The above strategies are just some used by swing traders, position traders and day traders while trading forex. Following a single trading style, all the time isn’t enough for being successful and thus traders should try to combine different methods and styles only after thoroughly understanding them.