Leverage is an important concept in forex and stocks trading. It refers to the amount of money that a broker extends to a trader in order to help them maximize their profitability. The concept is usually related to that of margin. In this article, we will explain how these concepts work and some of the most popular free leverage calculators to use.

How leverage works

The concept of leverage is best explained using an example. Assume that a stock is trading at $10 and you believe that it will rise to $13. If you have $10,000, you can buy 1000 shares. If the stock rises to its target, you will have a profit of $3,000.

Assume that you decide to take a $10,000 loan and buy the stock. In this case, you will have 2,000 shares. As a result, your total profit will be $6,000. This means that leverage has helped you double your profit.

While leverage is a good thing, it is also highly risky since it exposes a trader to a possibility of making a negative balance. This happens since leverage is a loan that a trader needs to pay back.

Margin refers to the amount of money that one needs to open and maintain an account. In other words, a trader uses margin to maintain a leveraged position. A margin call, which is a feared situation, is when a trader is requeste to add cash in order to maintain his position.

Benefits of using leverage

There are several benefits of trading with a leverage. First, it allows you to buy assets that you would not necessarily afford without it. For example, if you have $1,000 in your account, it will not be extremely profitable to trade gold, which trades at about $1,900.

Second, leverage is a good feature for diversification. Again, if you have just $1,000 in your account, it might be difficult to hold multiple stocks at the same time.

Third, leverage can help you increase your profitability. As shown in the example above, if things go your way, your trade will be more profitable.

What is a leverage calculator?

A leverage calculator is also known as a margin calculator, is a free tool that helps a trader to determine whether on should reduce their lot sizes or adjust their leverage. The calculator helps to simplify a relatively long and complicated challenge. It simplifies the following formula:

Required margin = Trade size / leverage x account currency

For example, assume that you are trading 4 lots of the GBPUSD pair using a 1:100 leverage. In this example, we assume that the account is denominated in USD and that the pair is trading at 1.1200. As a result, the required margin is

200,000/100 x1.1200 = $2,240.

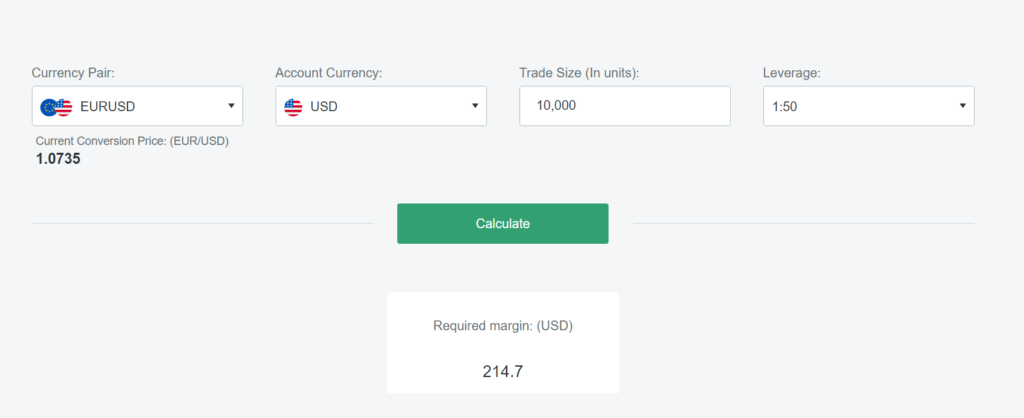

FxPro leverage calculator

FxPro is one of the biggest companies in the forex trading industry. It has more than 1.8 million customers from around the world. The company has achieved this success partly because of the multiple features it offers.

One of these features that the company offers is a free leverage calculator. This tool is provided to both customers and non-customers.

To use it, you just need to select the currency pair you are trading, the base currency, trade size in lots, and leverage.

In the example below, we have selected the EURTRY pair whose currency account is in USD. We have also added trade units at 10,000 and a leverage of 1:50. In this case, the required margin is $214 as shown below.

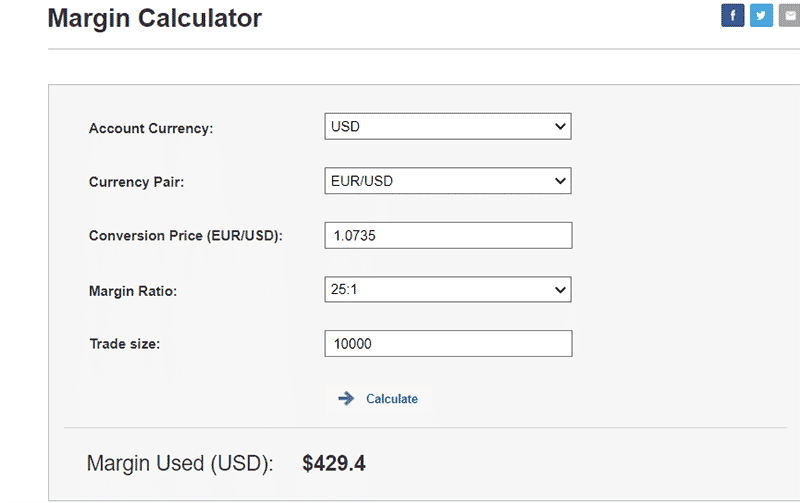

Investing.com margin calculator

Investing.com is one of the biggest financial media companies around. According to SimilarWeb, the website has over 142 million monthly visitors. The site provides some of the most useful tools in the forex industry. For example, it is widely used for the economic calendar, which provide a schedule of economic events.

Investing.com has a simple leverage calculator. To use it, the platform requires you to enter several parameters like account currency, currency pair, conversion ratio, margin ratio, and trade size. A good example of this is shown in the chart below.

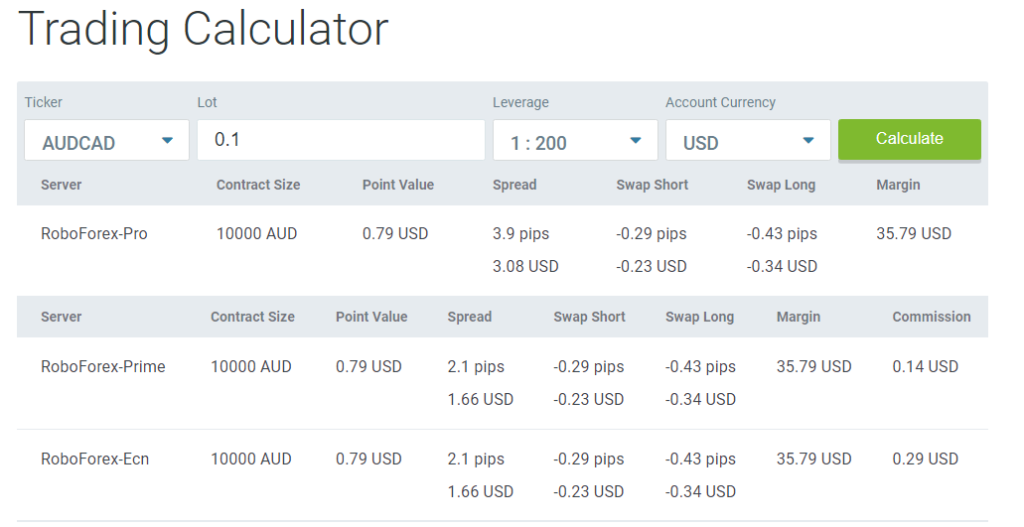

RoboForex margin calculator

RoboForex is another top forex and CFD broker that provides solutions to thousands of people from around the world. Like FxPro, the platform provides more tools such as a calculator that has more features than the other two.

All you need to do is provide a ticker, the lot size used, leverage ratio used and the account currency. The chart below shows the results that the calculator produces, including the typical spread and swap short and swap long.

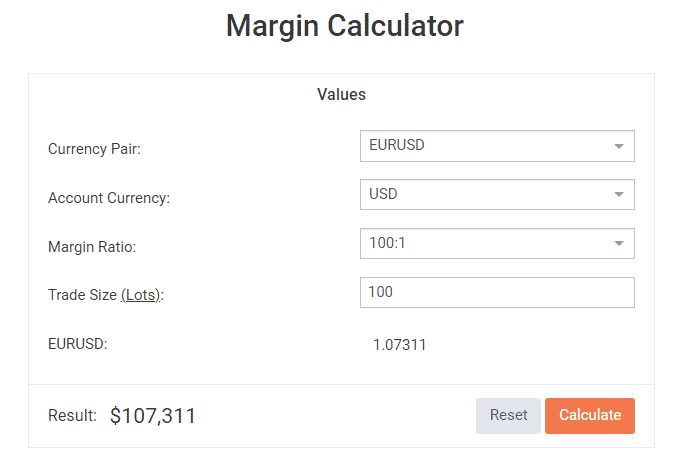

MyFxBook

The other most popular leverage calculator is provided by a company known as MyFxBook. This is a company that is widely-known for providing automated bots reviews. As a result, it is used to monitor the performance of robots in the market.

Because of the importance of leverage and margin, the company also provides a free calculator that one can use to find the data. This calculator is similar to that provided by Investing,com. All you need to enter is the currency pair, account currency, margin ratio, trade size, and the currency pair.

XM Margin Calculator

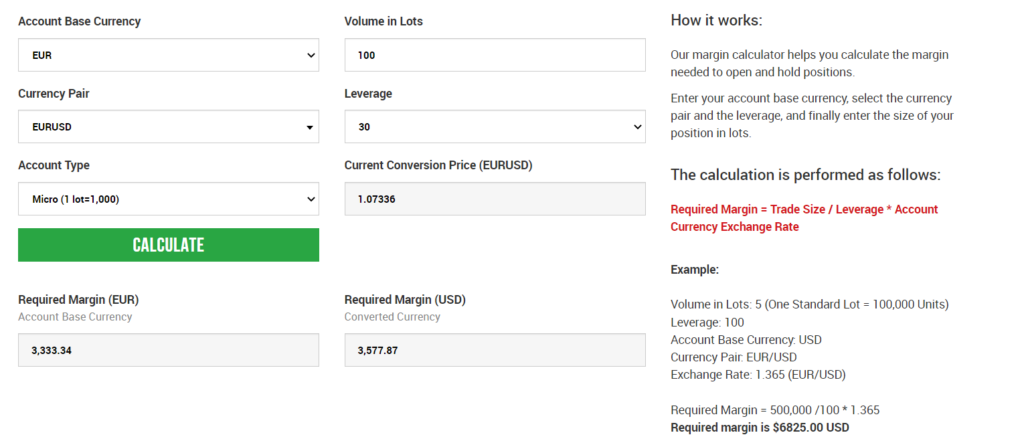

XM is one of the biggest companies in the forex and CFD industry. The company offers its services to thousands of people from around the world. The calculator works just like the others. All you need to select is the account base currency, currency pair, accoun type, volume in lots, leverage, and the conversion price. In the account type, the three offered ones are micro, standard, and XM Zero.

Summary

Leverage and margins are some of the most important concepts in the forex and CFD markets. In this article, we have explained how margin works and highlighted some of the most important margin calculators in the market today.