The foreign exchange market is an ideal place to make high profits. However, with great profits, the market is also filled with risks and dangers. It is important to educate yourself right, so you are not misled by false information and misconceptions.

The first misconception is that the forex market can offer an immediate profit of brilliant proportions to you, when in fact, almost eight to nine traders out of ten end up with losses. Secondly, many people just jump into the market without preparing themselves mentally or without doing thorough comprehensive research of the market. However, you can only make a profit from trading by acquiring deep knowledge about the market and different kinds of trading.

One such misconception of many traders is that you must trade with high leverage to fully benefit from the forex market. To understand why this is a misconception and what you should do, you need to understand the basic concept of leverage and margin in trading.

How Does Leverage Apply in Forex?

Leverage is the ability that allows you to use whatever funds you have and increase the amount you can borrow from an external body. The capital brought to the table is referred to as margin. Assume that you are purchasing a house but cannot afford to pay the full amount upfront. In this case, the bank sees if you are financially capable to pay monthly installments by checking your salary statements. If you are capable, then the bank allows you to leverage your salary. At the same time, you are given the money as a loan to purchase the house. Leverage and margin in forex trading are very similar to this scenario.

The high leverage of forex trading is one of its best advantages. During trading, you can open positions worth hundreds of thousands of dollars even with a capital of only a few hundred dollars. It attracts a lot of traders to the forex market. However, after spending a few minutes studying the concept, you can understand that leverage also is one of the biggest forex dangers.

Forex Leverage in Trading

Forex leverage trading can be compared to driving a car where leverage is equivalent to high speed. If you drive at a low speed and the wheel is turned slightly accidentally, the car will shift very slightly, and you can correct your mistake. However, if you drive at a very high speed, the consequences of the same mistake will turn out deadly and you will have no time to fix the situation. It is the same with leverage in the forex market.

The higher leverage you go for, the faster you drive. Hence, your account can be damaged by even the smallest change in the market. However, if you trade with low leverage, you may have to be content with smaller profits, but you will be able to avoid a complete closure of your trading account by only one trade. No matter what the outcomes of trade are, you can fix it with another trade. So, judge the trading condition carefully before you choose whether to go with high or low leverage.

How to Calculate True Leverage?

Recently, the term true leverage is used to differentiate it from the maximum leverage used by brokers in marketing efforts. The word leverage was enough a few years ago, but the traditional use of the word has been changed by the retail forex marketing lingo. As mentioned earlier, leverage in the financial markets refers to the ratio of debt to equity, so, we need to calculate the value of these two.

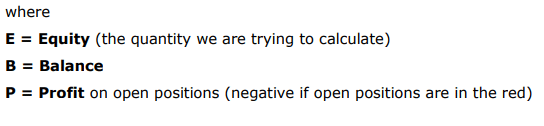

You can calculate equity very easily with this formula: E = B + P.

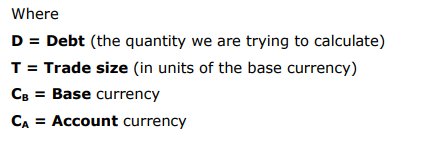

The formula of debt is a bit complicated: D = T x Cb / Ca.

Keep in mind that this formula does not use true mathematical notation. Instead, forex notation is used here. EUR/USD is displayed as USD/EUR in mathematical notation as it denotes a ratio of dollars per euro. Currency pairs must be inverted if the mathematical notation is used.

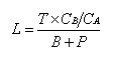

So, to calculate leverage, L, you have to use this formula:

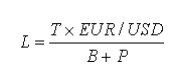

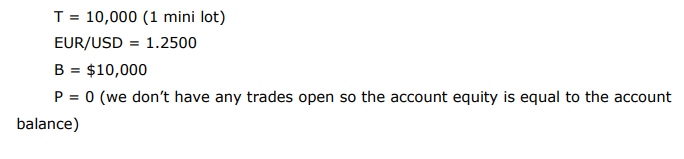

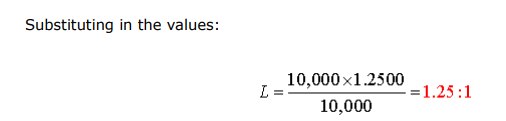

For example, assume you have a USD-denominated account with $10,000 and you want to trade 1 mini lot of EUR/USD at 1.2500.

Then the leverage will be:

The calculations ignore the spread that affects P. By including the pip value, the equations become more complicated. The leverage equation in this example is simple, but it would be more complex for pairs where the account currency is not the same as the quote currency. The omission becomes significant where P has large values compared to B, but it does not usually take place in a properly managed forex account.

Keep in mind that this formula is great for pairs not involving the account currency, but it is essential to be cautious so you can make the right substitution with the required additional information. For instance, if you are using the same $10,000 account to trade 1 mini lot of GBP/JPY = 200.00 and GBP/USD = 2.0000, then leverage is as follows:

To trade such pairs, we must know the current rate of the base currency against the account currency. The rate for the actual currency traded is not required:

You also need to note that the actual leverage you use continues to vary during the period of any open trade. As currency rates move, the leverage equation, as well as P, are affected by them whether the move is in your favour or against you. The currency moves also affect Cb / Ca.

Conclusion

If you want to master in forex trading, you need to properly learn to calculate your leverage. You can secure your deposit with the correct lot size corresponding to the leverage. It is the key to profitable trades. However, as mentioned earlier, keep in mind that leverage helps you make you more profit if the trade goes right, but you will also have to face a huge losses if you do not win the trade. You need to be careful about this risk associated with leverage during trading.