Automated forex trading refers to the trading in which computer software is employed. It is also called a forex robot or algorithmic trading. In this trading type, the automated system utilizes repetitive technical analysis and a group of parameters in order to establish if certain currency pairs should be purchased or sold during the day. A forex robot has its own benefits, which can make forex trading lucrative for you in the long run. Let us take a look at the different types of forex robots and how you can devise your own automated trading plan.

Types of automation

There are two chief types of forex trading robots or automation.

They are:

Semi-automated

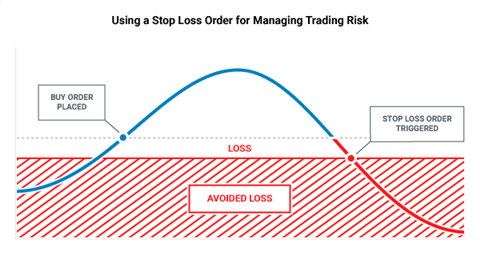

This type of automation involves a computer program that scans the forex market in order to find trading opportunities as per a set strategy. The program then delivers the trading signals to the user. This includes entry prices, profit targets, stop-loss orders, etc.

Semi-automated systems leave the end decision with the traders, whether they want to enter a trade manually. This means that the trader has more command on their trading account than fully automated systems. They can decide whether they would like to make a trade on the basis of their expertise, experience, and skills.

Fully automated

This kind of trading system automatically generates its own signals. It uses these signals to carry out trades electronically on the user’s behalf on the basis of some set rules. It examines the forex market to seek trading opportunities.

The system lets you intervene via several settings in order to manage the trading risk, like lot size stop losses, take profits, etc. Its signal generators establish the trading signals through technical analysis. These signals include details about trailing stops, timings, stop-loss and take-profit orders, profit targets, entry and exit prices, and much more.

How to create an automated trading strategy

Now, let us see how you can build your own automated strategy for forex trading. Follow these points in order to do so.

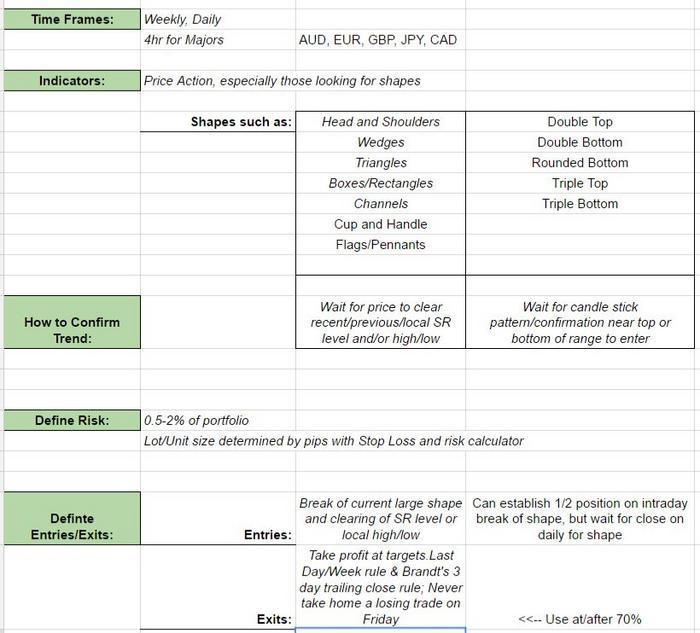

Define your trading rules

The first thing You need to have your own technical trading rules in order to create your automated trading system. Plus, you can tell your rules to your developer if you are taking their help to get your trading system coded. Make sure you cover all the vital trading rules, such as the trading time, indicators, entry and exit points, lot size, money management, and others.

Select your risk settings

You must inform the automated system as to what kind of risk management tools you would like to utilize, such as maximum drawdown, maximum leverage, stop losses, etc. Your risk management setup will also come in handy when you want to sell your automated trading system as it is one of the primary things that purchasers consider more than the profits it generates.

Verify your trading plan

You need to make a trading plan that will state your trading method and goals. For this, you need to trade live on your own for a few months. This will tell you if your plan really works or not.

Make sure you create an easy and comprehensive plan, which will make it easier for you to program your forex robot. The plan can consist of important things, like the reward-to-risk ratio and the trading time. Your automated trading system can then assist you in accomplishing your trading goals.

Code your system

Coding is done to program the forex robot as per your requirements and trading style. When your trading system is ready, you can start coding it on your computer. Make sure you check out the coding language that your selected trading platform uses since different platforms use different coding languages. You can either do the coding yourself if you know it or you can take the services of a professional coder. If you choose the second option, ensure that you clearly explicate your trading plan to them.

Backtest

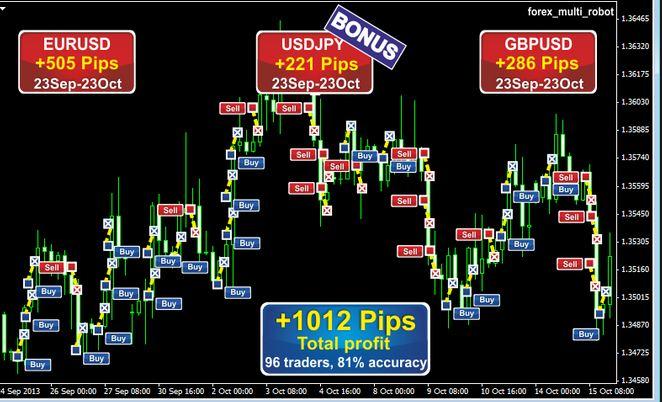

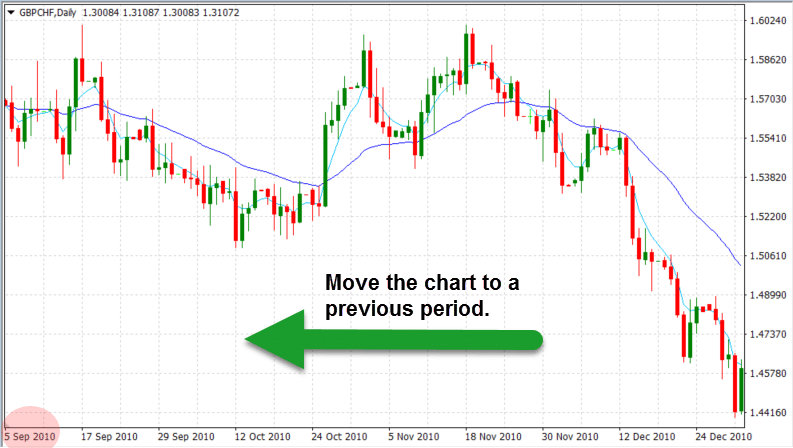

You should backtest your trading rules as well as several currency pairs in various market conditions. Backtesting refers to using the trading rules on historical market data so that you can know if they work and how well they perform. It can demonstrate how your trading strategy works in diverse market conditions, like significant news, events, and announcements and low and high volatility.

Moreover, backtesting can help with seeing possible reward-to-risk ratios, maximum drawdown, wins, and losses. You can then make any tweaks to your trading plan to improve it. There are several free programs for backtesting on the internet, which you can use.

Forward test

Along with backtesting, forward testing is also vital since backtesting does not cover everything when it comes to live trading. Forward testing will further confirm the effectiveness of your system before you start trading with real cash. You should test your trading rules on the live market using a demo trading account or if you can put in some money, you can also use a real trading account.

Analyze

After you are done with creating and testing your automatic trading system, your job is not done. Even though the forex robot will take care of everything for you, you still need to examine it occasionally so you can make any adjustments to it as per the shifting market conditions. This will help you avoid any unexpected issues and improve your automated trading system.

The bottom line

Automating forex trading can really be beneficial for all expertise levels, no matter if you are a novice, experienced, or veteran trader. Since an automated system cannot deduce any approaches on its own and is quite limited in its capabilities, you must tell it what it needs to do. This way you can take full advantage of it and succeed in forex trading. However, you must keep in mind that forex robots can merely minimize the mechanical workload and it is only the trader, that is you, who can devise a winning trading plan.