Divo EA works by identifying and exploiting market vulnerabilities. It is a fully automated system that boasts a multi-currency and flexible system. As per the author, Anton Kondratev, the ATS does not use dangerous methods like martingale or grid. The vendor claims that this trading tool is a long-term trading setup making use of the quiet market periods.

Is Divo EA a viable trading tool?

Anton Kondratev, the author of this FX EA is based in Russia. He is a professional developer with expertise in C#, C++, Java, Delphi, and more. He has one year of experience in creating FX trading tools and has developed 4 products and 5 signals. For contact, the developer provides a Telegram channel link, a blog, and the messaging feature on the MQL5 site.

Some of the main features and the strategy used by the system are listed below:

- It works on the GBPUSD, EURGBP, and EURUSD pairs with the default settings optimized for the GBPUSD pair.

- A timeframe of M15 is used for the FX EA.

- The author provides additional settings for AUDCAD, GBPCAD, USDCAD, and EURCAD pairs.

- Pending limit orders in the FX robot helps to increase the profitable slippages.

- Pending orders are placed on the Broker’s server beforehand to reduce delay.

- Every order has a fixed SL .

- Protection from large spreads and slippage is present for all the trades.

- Big News protection system is also present.

- The FX EA can self-diagnose and adapt to broker conditions.

How to start trading with Divo EA

To purchase this FX EA, you need to pay $545. A free demo account is present. The author does not provide details on the features available with the package. There is no money-back guarantee present which makes us doubt the reliability of the system. When compared to the average market price, we find the pricing of this FX robot is expensive.

As per the developer, the ATS is an open system that provides full access to its parameters. You can optimize it with your unique configuration. It uses a three-stage hybrid process of tracking profitable positions and comes with a news filter, a big spread filter, and more.

Recommendations for using the the robot include: a hedging account, use of a broker with low spread and slippage, a minimum deposit of $100, and the leverage starting from 1:100.

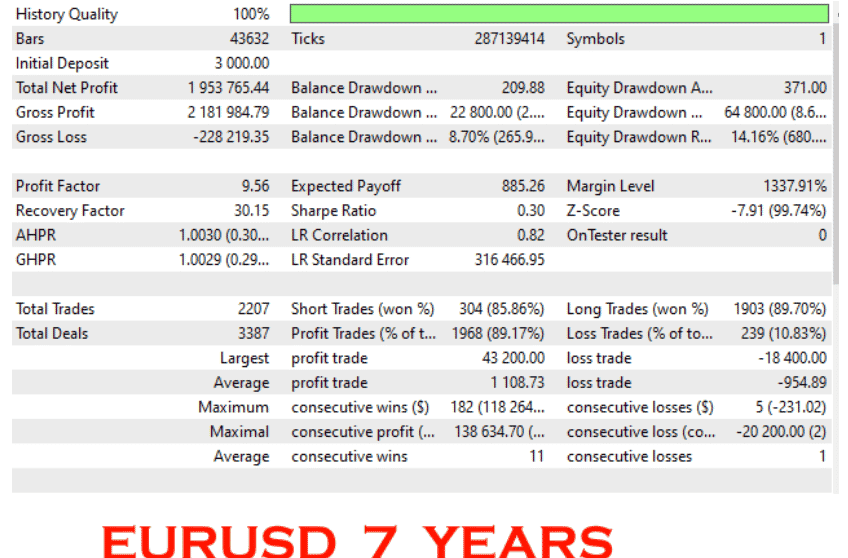

Divo EA backtests

A few backtests are present for this FX EA on the MQL5 site. Shown above is one of the backtests done on the EURUSD pair for 7 years. An initial deposit of $3000 was used for the backtest which generated a total net profit of 1,953,765.44 for a total of 2207 trades. Profitability of 89.17% and a profit factor of 9.56 were present. The drawdown for the account was 8.70%. From the results, it is clear that the system uses a low-risk approach and effective money management as seen by the low drawdown and high profits.

Trading results

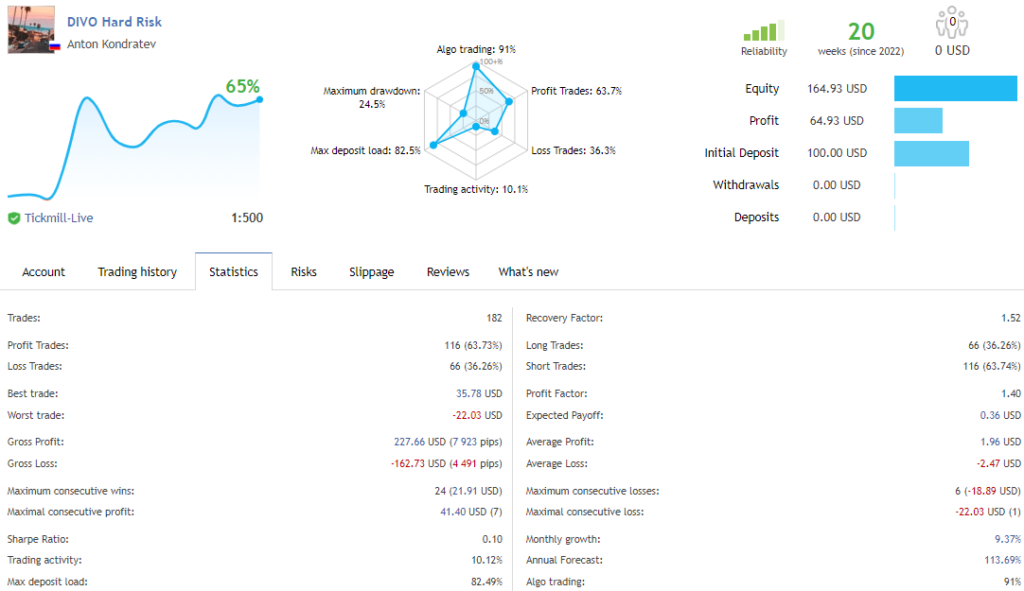

The author provides live signals for the FX EA on the MQL5 site. Here is a real USD account using the Tickmill broker and the leverage of 1:500.

From the above stats, we can see that the account that has completed 20 weeks since 2022 shows 64.93% growth for an initial deposit of $100. A total of 182 trades were completed with profitability of 63.73% and a profit factor of 1.40. The drawdown for the account is 24.5%. From the growth curve, we can see the account has several ups and downs indicating risky money management. Further, the profits are not high and the drawdown is a bit high both of which indicate an ineffective approach. When compared to the backtests, the drawdown is higher and the profits are lower in real trading.

People feedback

We found 10 reviews for the FX EA on the MQL5 site with a rating of 4.5/5 for the MT5 version and only 2 reviews with a 5/5 rating for the MT4 version. However, there are no reviews for the FX robot on trusted third-party sites like Forex Peace Army, Trustpilot, etc. that could back up the positive reviews. Since the MQL5 site promotes the product, the chances of the feedback being manipulated are high.

The Review

Divo EA works on multiple currency pairs and uses filters, and other protective settings to ensure big returns. Our analysis reveals that the money management method used is not effective. Other shortcomings we identified in the system include the expensive pricing and lack of a refund policy.

PROS

- It is 100% automated

- Backtesting and real trading results present

CONS

- Real trading results indicated a risky approach

- Pricing is expensive

- No money-back guarantee