FXParabol uses indicators as its chief strategy. The ATS boasts more than 18 months of live trading and historical testing was done from 2015. As per the vendor, you can generate an average win rate of 70% with this system. Its effectiveness is confirmed through verified stats on real money accounts. This ATS works mainly on 2 currency pairs namely the USDJPY and USDCHF.

Is this a viable trend system robot?

According to the vendor info, this FX EA uses math to identify accurate trades. The mathematical algorithm helps it to recover losses accrued from losing trades. It uses the Parabolic SAR and the Bollinger Bands indicators for placing successful orders. It detects a trend and determines the entry point in the direction of the trend.

On the official site, we find mention of the FX EA being powered by Forex Store. The domain copyright is for 2022. There are no other details on the company, its year of establishment, location, developer team, etc. For support, an online contact form is present. We could not find other support methods like FAQ, live chat, phone number, etc. The absence of info indicates a lack of vendor transparency.

How to start trading with FXParabol

You can buy this FX robot for $289. You get two program versions for the MT4 and MT5 terminals and you can manage the license online from a personal section. A single software license, a user guide,24/7 technical support, and free updates are other features you get with the package. The vendor provides a 30-day refund offer. After you download and activate the license, the robot will start scrutinizing the market looking for profitable entries.

In addition to the two indicators and the mathematical process, it uses a special system for reducing drawdowns. As per the vendor, the ATS works on any broker and does not have limits on the account types you can use. There is no info on the recommended deposit, broker, leverage, etc.

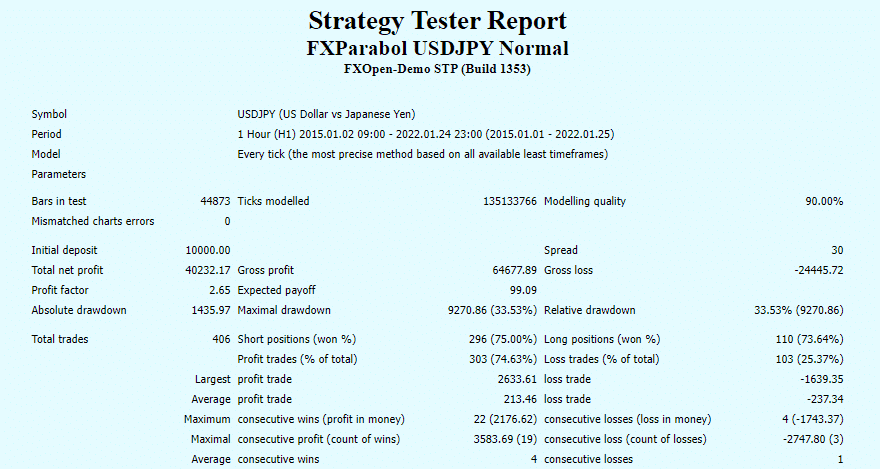

FXParabol backtests

Backtesting done with the normal and aggressive trading styles is posted on the official site. Here is a backtesting report using the normal mode on the USDJPY pair.

From the above report, we can see the testing was done from 2015 to 2022 using the H1 timeframe. For an initial deposit of $10000, a total net profit of $40232 was generated. A total of 406 trades were executed with profitability of 74.63% and a profit factor of 2.65. The maximum drawdown was 33.52%. From the results, we find the drawdown is high and profits are low indicating a risky and ineffective approach.

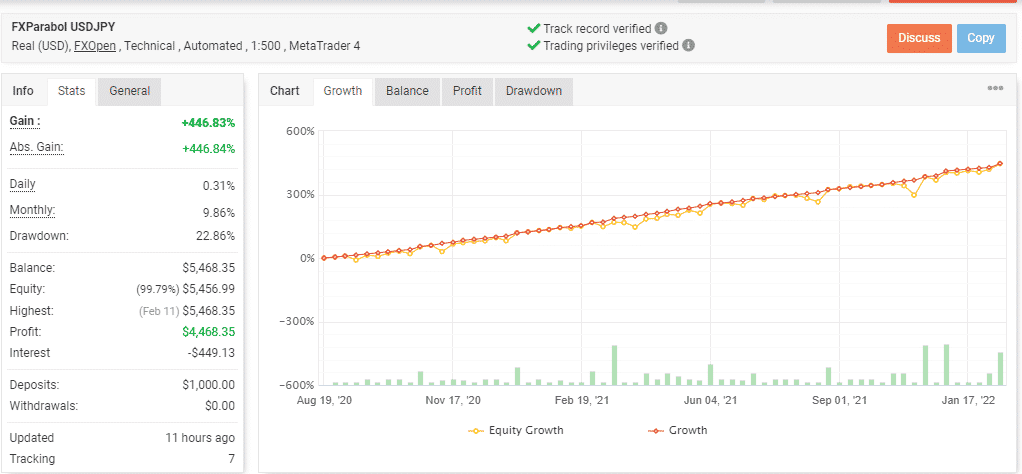

Trading results

A real live USD account verified by the myfxbook site is present for this FX EA. Here are screenshots of the results:

From the above stats, we can see the system uses the FXOpen broker and the leverage of 1:500 on the MT4 platform. For an initial deposit of $1000, the account that started in August 2020 shows a total profit of 446.83% and an absolute profit of a similar value. The daily and monthly profits are 0.31% and 9.86% which shows a decent profit. The drawdown for the account is 22.86%. A value that is above 20% is considered risky by most traders and we suspect it is the case with this FX EA account too.

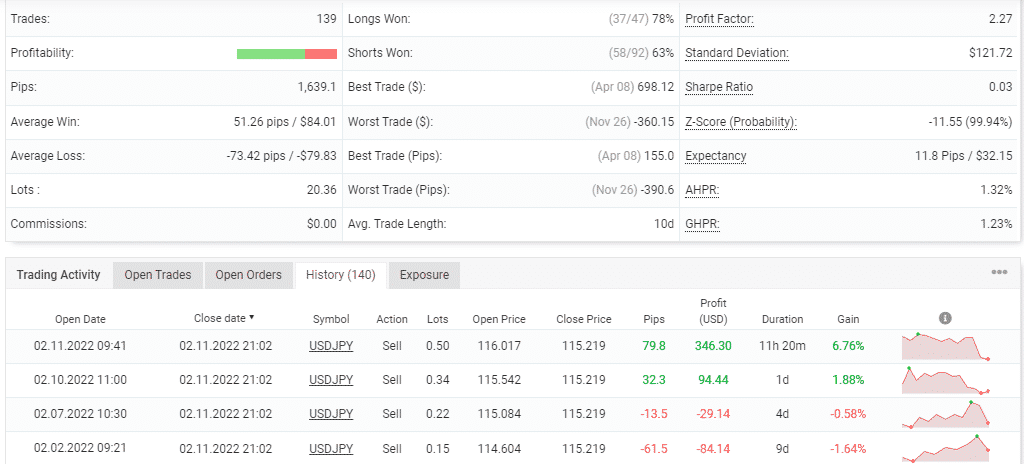

A total of 139 trades have been completed with 68% profitability and a profit factor of 2.27. From the history, we can see that varying lot sizes are used ranging from 0.10 to 0.50. The big lot size and high drawdown show a risky approach is used. Further, when compared to the backtesting results, the profits are low indicating the performance is not good in real trading. The high drawdown in the two results confirms the fact that the strategy used is of the high-risk category.

People feedback

Unfortunately, we could not find user reviews for this FX EA on reputed third-party review sites like Forexpeacearmy, Trustpilot, etc.

Summary

Advantages

- A fully automated software

- Live verified trading results

- Refund offer

Disadvantages

- Strategy explanation is vague

- Live trading results show a risky approach

- Pricing is expensive

FXParabol assures a winning rate of 70%. The vendor provides live verified data and backtesting reports to prove the efficacy of the FX EA. Our evaluation of the info indicates the FX robot uses a risky approach as is evident from the high drawdown. Further, the lack of vendor transparency, expensive pricing, and absence of feedback are other shortcomings that you need to consider before deciding to use this FX EA.