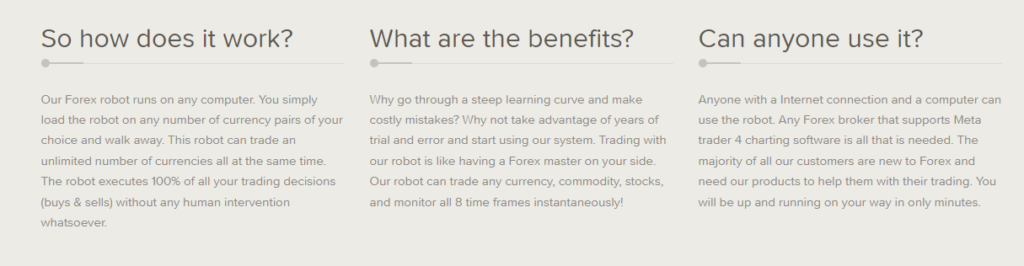

HAS Forex Robot is a trend-following system that uses multiple timeframes simultaneously for successful returns. As per the vendor, it has generated a profit of $63,875 in the past 30 days and $21,566 in 2022. It is a fully automated system that can work on multiple currency pairs effectively without your intervention. The vendor claims that you need a broker account that supports the MT4 system to start using this FX EA.

Is it a viable trend system robot?

Don Steinitz is the developer and promoter of this ATS. He is the founder of the Forex Robot Trader company. Other products of the company include Falcor, Vader, Odin, and Reaper. He and his team of developers created the EA using the HeikenAshi Smoothed indicator. The developer team consists of many quality programmers skilled in the MQL code used for creating FX robots. We could not find info on the founding year, the experience of team members, location address, phone number, etc.

For the strategy, the developer explains that the ATS uses the HAS indicator to know the trend direction. The indicator helps to identify the strong and weak price movements. It also indicates the volatility ensuring accurate and profitable trade entries and exits are made. As per the developer, this system works on all currency pairs, stocks, and commodities.

How to start trading with HAS Forex Robot

You can buy this FX robot for $49. A 75% discount has been applied to the original price of $199. There are no details found on the features included with the package. There is no money-back guarantee present. When compared to the market price, the pricing of this FX robot is very affordable. However, the lack of a refund offer makes us suspect the reliability of the system.

For the recommended balance, the developer mentions that any size balance can be used as the amount is mostly decided by the broker you use. There are no recommendations on the leverage and other settings needed for using the MT4 tool.

Other than explaining the HAS indicator, the developer does not divulge much info on the working method, strategy, and recommendations.

HAS Forex Robot backtests

No backtesting results are present for the FX robot. Testing historical data helps to assess the strategy and its potency. Although the results cannot predict future performance, traders look for backtesting results to evaluate an FX tool. The absence of strategy tester reports raises doubts regarding the reliability of the system.

Trading results

No verified trading results are present for this FX robot. But the developer provides monthly performance reports. Here is the report showing the performance in January 2022.

A net profit of 21,565 is generated by the FX EA for a total of 181 trades. Profitability is 100% and no drawdown is present. The growth curve shows consistent profits for the account. While the results show good performance, they are not verified by reputed sites like Myfxbook, FXBlue, FXStat, etc.

Customer support

For support, the vendor provides an FAQ section and an online contact form. An online support center is also present that provides info and useful guides for traders.

People feedback

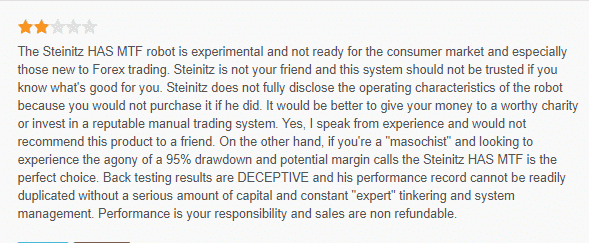

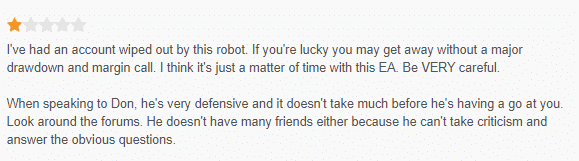

We found 270 reviews for the Forex Robot Trader company on the FPA site. A rating of 2.262/5 is present for the products of the company. Here are a few of the reviews:

From the above feedback, we can see that the FX EA is not reliable as it caused a drawdown of 95%. Another user complains of similar losses with the robot. Another factor to note with the reviews is that they date back to 2009 and there are no recent reviews for the products of the company.

Wrapping up

Advantages

- It is a fully automated software

- Price is affordable

Disadvantages

- The strategy explanation is vague

- No verified performance proof present

HAS Forex Robot assures high profits with its trend trading system. On evaluating the FX robot, we find that the product is cheap when compared to the market average. The developer provides an explanation of the trading logic used in the robot and monthly performance reports. Unfortunately, the performance reports are not verified by reputed third-party sites like myfxbook, FXBlue, etc. Without a verified track record, it is difficult to assess the system. Other downsides you should be aware of include the lack of backtesting results, vague strategy explanation, lack of a refund policy, and negative user feedback.