- Bank of Japan retains interest rates at -0.1%.

- US Treasury yields are still rising, thus helping cushion the dollar.

- Rising oil prices could exert pressure on the dollar.

The USDJPY pair inched up further on Tuesday, gaining 0.26% in 24 hours to trade at 114.909. This came as the market largely ignored the monetary policy announcement by the Bank of Japan (BoJ).

Rising Treasury yields shield the dollar

Rising US Treasury yields are helping cushion the dollar against major losses. On Tuesday, 2-year Treasury yields edged up above the 1% mark for the first time since February 2020 as 5-year yields added three basis points. The yields have been on the rise for most of January and may have cushioned the dollar from worse losses.

The US economy is currently struggling to stave off rising unemployment and high inflation. These have left the US dollar without solid ground as the market awaits the Federal Reserve’s interest rates hike. So far, indications are that interest rate hikes are at least two months away. Therefore, investors will be keenly monitoring employment data and consumer inflation for cues on possible traction by the greenback.

The possible impact of rising oil prices

Rising oil prices are likely to exert more downward pressure on the dollar. On Monday, WTI hit $84, while Brent contracts hit $86, the highest in over three years. Historically, the greenback has an inverse relationship with oil prices. Since crude oil is quoted in dollars, rising prices are likely to reduce the demand for dollars.

BoJ retains interest rates

The Bank of Japan maintained its monetary policy, keeping short-term interest rates at -0.1%. However, the bank revised up its economic growth projection for 2022 by 0.9% to 3.8%. The bank is keen on guiding the country through deflation, as the 2% inflation target remains elusive.

The BoJ forecasts that inflation will rise to 1.1% this year. The November CPI rose to 0.5%, creating a positive outlook of the inflation target. Notably, the decision to retain the easy monetary policy was informed by the uncertainty caused by surging Covid-19 figures.

What could tilt the market?

The market seems to have absorbed the BoJ’s decision, with investors seemingly unmoved by the action. In the absence of significant macroeconomic data coming out today, traders are likely to favor the dollar. However, things could change following Wednesday’s release of US housing sector statistics, including Building Permits data for December.

Technical analysis

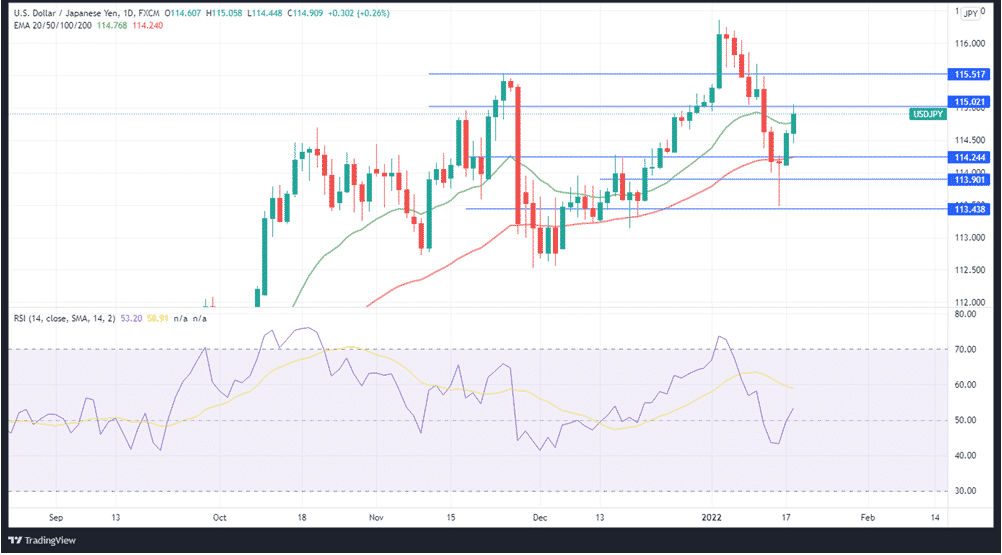

The RSI for USDJPY is currently at 52, which signals mild strength. In addition, the RSI is below the 14-SMA. This tallies with the 4H chart, where the 50-EMA is above the 20-EMA. The momentum indicators are, therefore, signaling a potential weakening of bullishness. If the bears regain some control, they could pull the price down to find support at 114.244, corresponding to the 50-EMA. A break below that point will set the next support under 114. An upward movement looks more likely, with the first resistance likely to come at 115.021. If the momentum strengthens further, the next resistance will likely be at 115.517.