Hippo Trader Pro is said to have an ‘advantageous profit/drawdown ratio’. But the trading live results found on Myfxbook.com demonstrate the contrary. Our analysis of the data has confirmed what we suspected about the system’s capabilities. These findings are included in this review.

Is Hippo Trader Pro a feasible investment option?

The features of the robot are listed below:

- It runs on MT4/5 terminals.

- It mainly works on the EURUSD currency pair on the 1 minute time frame.

- The EA is FIFO compliant.

- It can work with all brokers as well.

- The minimum deposit required to start trading is $1000, but $3000 is recommended.

The EA’s strategy is described as follows:

- Follows the trend and trades majorly during Asian and European sessions.

- Searches for the main trend.

- Enters the market based on volatility.

However, the developer does not tell traders that grid and martingale strategies are part of this system. We will discuss this later in the ‘trading results’ section.

The seller of this EA is an Italian known as Michael Russo. He is affiliated with tradingforex.pro, a website he uses to market his services. Turtle Scalper Pro, Panther Trader Pro, and Spider Crazy Pro are the other EAs under his brand. This is as far as his profile goes. We have no knowledge about his experiences and achievements as a developer and Forex trader.

How to start trading with Hippo Trader Pro

You can buy Hippo Trader Pro at $299. On the other hand, you can rent it either for 1 month at $199 or for $269 quarterly. Obviously, you will end up paying more in the long run if you choose to go with the renting options.

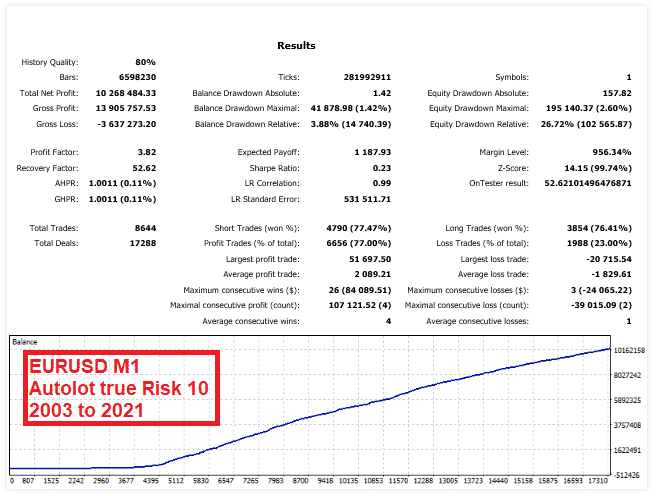

Hippo Trader Pro backtests

During its testing period, that is, between 2003 and 2021, the system carried out 8644 trades and generated millions of profits ($10, 268, 484.33). But this is nothing to boast about, considering that the drawdown was 26.72% and high. The short and long trades did not perform well, either, because they recorded 77.47% and 76.41% win rates respectively. The profit factor was 3.82.

Trading results

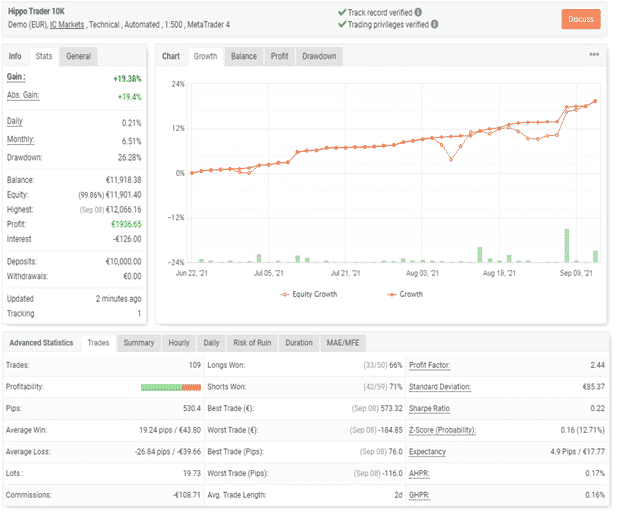

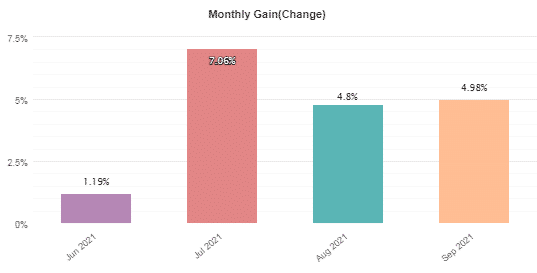

The inner workings of this system in the live market are being tested on a demo account rather than on a real one. The account was activated on June 22, 2021. A huge deposit amount of €10,000 was placed. In turn, the EA has grown it by 19.38% after making a profit of €1936.65. Nonetheless, the high drawdown of 26.28% warns us that the EA is trading recklessly.

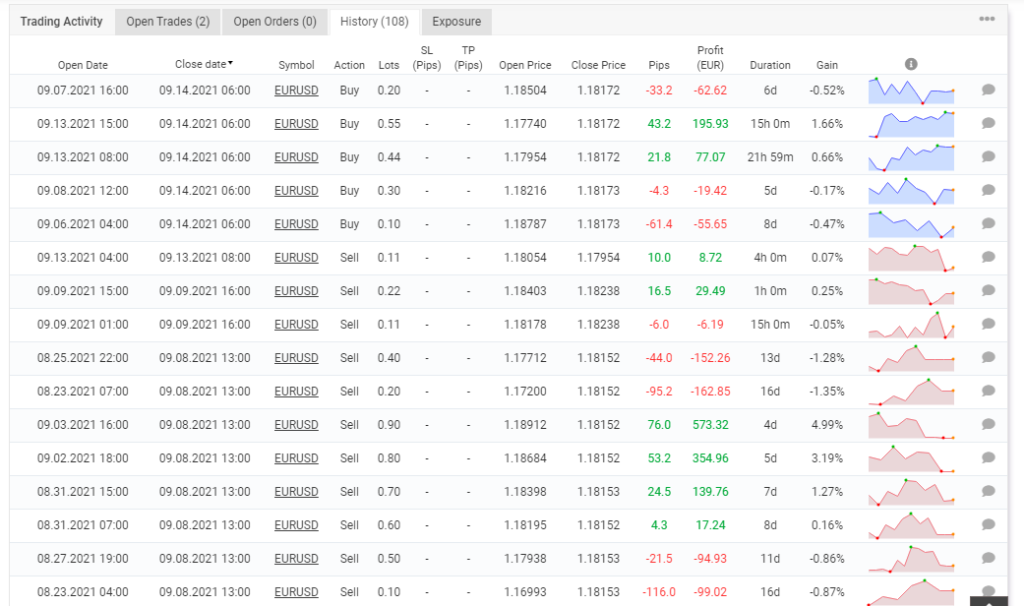

Based on the advanced statistics data, a total of 109 trades have been carried out, and the average trade length is 2 days. The profit factor (2.44) is lower than the one in the backtest statement. The average loss is -26.84 pips, while the average win is 19.24 pips. So, the system ends up with losses frequently. The accuracy rate is 66% for long trades and 71% for short ones. These results are poorer than the ones achieved in the EA’s past testing period.

The profits made were average and not impressive.

The EA placed a grid of orders. Martingale was used as well. We see that although the bot tried to recover losses, it didn’t succeed as it made more losses instead.

This trading instrument mainly won short trading positions (€1252.75), which were 2 times higher than the long trading positions (€683.90).

Other notes

The vendor states that the system has been subjected to stress tests for close to 2 decades and has passed them each year. Therefore, clients are welcome to test the efficacy of the EA themselves. A complete guide is available to help you run a backtest correctly.

Customer feedback

The EA’s sales pitch on mql5 has included several reviews from customers, and all are positive. We are not surprised. Vendors hardly display negative customer feedback as this could damage the reputation of their product. In this case, we prefer responses from third-party sites like Quora, FPA or Trustpilot because they are more credible.

Summary

Advantages

- Live trading results provided are verified

Disadvantages

- Martingale and grid method are in use

- Lack of clear strategy insight

- Vendor transparency is insufficient

- High drawdown

Despite the backtesting data showing that the EA could potentially generate millions in profits in the long-run, the live trading results show us otherwise. We have established that the profits made are small, and it would take forever to achieve similar results. The grid and martingale methods in play make the situation even worse. If the robot is caught on the wrong side of the market, then your account’s risk of ruin will be heightened.