Confidence in trading is the driving force that keeps the quality of a trader’s judgement at the highest level and keeps traders “in the zone”. There is a common misconception among traders that we gain self-confidence by merely positive thinking.

One of the most powerful sources of self-confidence is knowing that you can handle the worst scenarios in your trading career and come back stronger than before. In other words, self-confidence is accumulated when you manage to survive the tough times.

The great way to gain self-confidence from losing periods is to observe how you trade and take any possible lessons from your losses.

Next, let’s talk about specific ways to gain confidence after losses.

1.Following your rules as you place a trade

You should have a set of specific rules that you follow when placing a trade. What should the price do for you to take a position? At what time, in what instruments, etc. Your trading plan must contain the precise answers to these and many other questions about your trading.

If you trade according to your plan, you’ll always be able to look back with clarity at past trades and make necessary adjustments to your system. It gives you more confidence because you see every next trade as an opportunity to improve your trading.

2.Keeping losses small

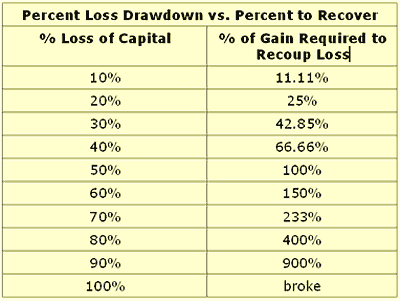

Build your trade management rules in the way to ensure that you can always have another chance to trade and over time, hit back your losses. That means, if you take a loss, it isn’t too large to the point that it’s hardly recoverable. The lack of confidence isn’t a surprise if you keep taking large losses and you have no idea if you will ever be able to recover from them.

If you know the essential statistical data of your trading system, like the average win rate and the average loss, you can project what kind of losses you’d have over time.

For example, say you have a system with a 60% average win rate. According to the law of large numbers of this system, you will have up to 8 losses in a row throughout 1000 trades. Plan your position size in the way, that in case you experience those eight losses in a row, it won’t take you too long to hit back the losses always using same position size.

Knowing what to expect in the worst-case scenario, either related to a single trade (fixed loss) or to the performance of your system as a whole (expected drawdown) will give you tremendous mental freedom and confident outlook on your trading.

3.Patience and avoiding revenge trading

What happens to our psychology when we take a loss? Once we take a loss, our instincts manifest themselves, making us crave to get back as fast as possible to where we were before in terms of the account balance.

Next, in a rush, we get into anything that at least remotely looks like a setup. Often this kind of setups is low quality, or we don’t manage the position correctly. Further losses intensify the same instincts spinning the vicious cycle of the revenge trading.

Your job as a trader is to restrain this urge and protect the quality of your judgement. After a loss, focus on staying patient, and preventing the cycle of an emotional meltdown.

4.Dealing with consecutive losses

After you’ve managed to stay cool after a loss, place the next trade following the same rules as you did in the No.1.

What if you take another loss? If you’re a short-term trader, you will have to make more efforts to cope with the emotional pressures than position traders. Losses may occur more frequently within a short time as you place more trades in general. Your judgement will be more susceptible to the distortions due to magnified emotional pressure.

That’s why you must have a tactic of limiting your daily, weekly and monthly losses. You may do seemingly everything right but still, experience losses. The reasons could be numerous: hidden psychological issues, change of the market environment or the losing streak due to the law of large numbers. Whatever the reason is, the fact of consecutive losses affects the psychology of any trader. Therefore, traders must take specific precautions.

Such precaution rules may be:

- Two losses in a row – take a break for 20 minutes.

- Three losses in a row – stop trading until tomorrow.

5.Proper trade management

Finally, you placed your new trade after several consecutive losses. You strictly followed the entry rules, so you’re confidently holding the position.

As you’re in the trade, do your best to focus on what the market does now, instead of recalling the previous losses. The biggest danger at this point is to be tempted to think that you must cover all your losses with the current trade. Such thinking will push you into setting your profit target too far away. Stay conservative with your trades. It’s the consistency of executing your strategy (assuming it has a statistical edge) that will get you back on track, not home runs.

Final words

So far, we’ve gone through simple, yet powerful ways to build up your self-confidence as a trader.

All of the mentioned ways aim to protect your judgement at all costs and encourage you to focus on the consistent execution of your strategy.

If you overcame deep drawdowns in the past, cling to this fact, it’s already an achievement and a powerful source of self-confidence. You did it before, and you can do it again!