Robinhood FX EA uses virtual stop loss for hiding the exit points from the broker. The robot works on multiple account types such as ECN and standard. The developers make many claims on the performance of the algorithm that has convinced us to write a review for the system. Let us analyze the backtesting and live results to see if it is good for investment.

Is Robinhood FX EA still profitable?

Robinhood FX EA uses a risky strategy known as the grid, which the developers do not disclose on their website. This type of game plan leads to a severe drawdown in certain market conditions. The algorithm will lose terribly shortly.

Vendor transparency

The developers are not transparent in providing their experience and whereabout information. They can be contacted via call or email. Lack of necessary knowledge is not good for the outlook of the system.

Strategy

There is no comfortable information on the strategy. The robot works with a minimum account size of $200 and trades rarely. To get a better outlook, we see the FXBlue history. From there, we can witness that the algorithm uses a grid strategy and uses a predetermined take profit. It may close out the trade before it hits the target.

The average trade length is 18.1 hours which means that the algorithm uses a day trading methodology.

How to start trading with Robinhood FX EA?

To start trading, traders have to follow the following steps:

- Purchase the system from the developers’ website and provide the account number.

- The developer will then send the designated ex4 file.

- Place it in the experts’ directory of the MT 4.

- Enable auto trading and attach the EA to the charts.

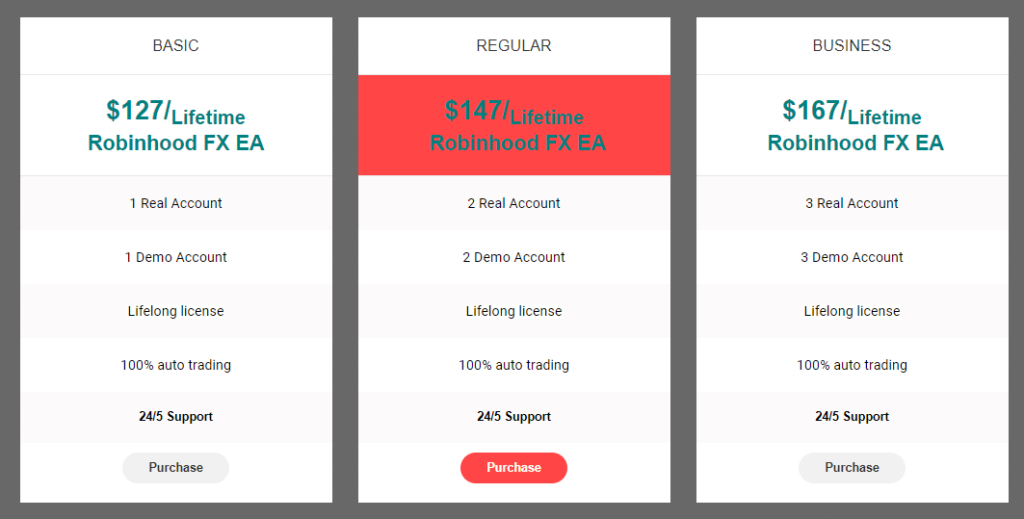

Price

The robot comes at a price tag of $127, which provides a license for one live and demo account. Traders can also give $147 and $167 for two accounts, respectively.

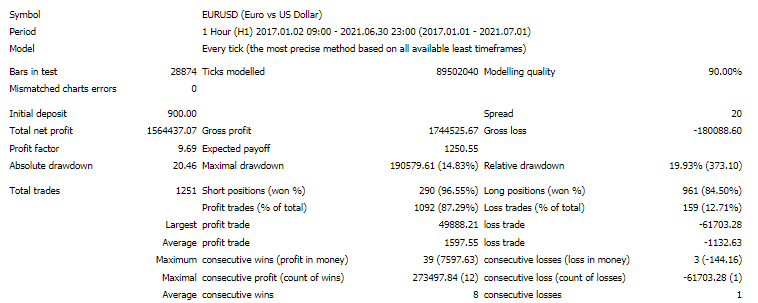

Robinhood FX EA backtests

Backtesting results are available for EURUSD. For the pair, the relative drawdown was around 14.83%. The winning rate was 87.29%, with a profit factor of about 9.69. The test was performed on the hourly chart with a starting balance of $900. The robot tanked an average profit of $1564437.07 during this period. There were 1251 trades in total. The best trade was $49888.21, while the worst one was -$61703.28. The duration of the test is 2017.01.01 – 2021.07.07.

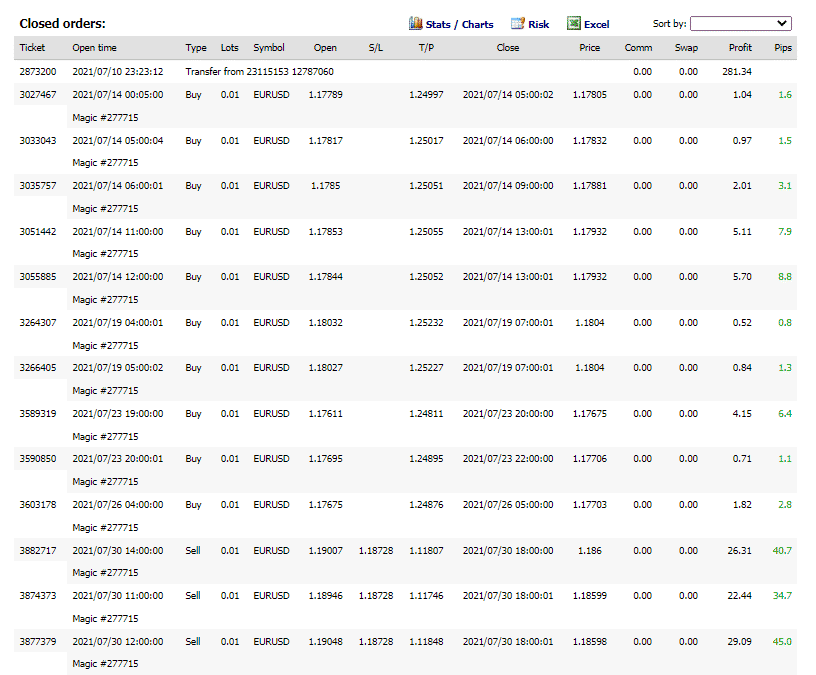

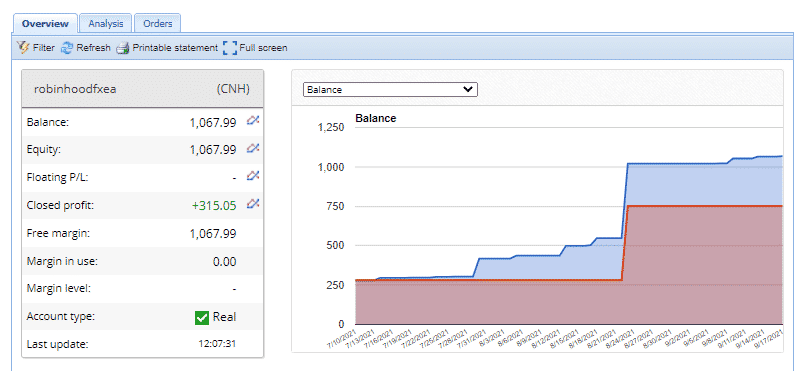

Trading results

Verified trading records on FXBlue show performance from July 10, 2021, till the current date. The system made an average monthly gain of 36.6%, with an unknown drawdown value. The winning rate stood at 80.4%, with a profit factor of 6.71. The best trade was 44.69 CNH, while the worst was -33.28 CNH. There were a total of 56 trades. There were 752.94 CNH in deposits.

People feedback

There is only one review available at the Forex Peace Army, which can not provide us information on the general viewpoint of traders. Emil Abdullah from Turkey states that he found the robot as profitable, but he also points out that he has only tested the EA for two weeks. Such a small duration of testing is not enough for concluding.

Summary

Advantages

- It provides live records on FXBlue

Disadvantages

- No money-back guarantee

- No transparency on developer

- Backtesting results are for a short duration

Robinhood FX EA is not a profitable system in the long run as it uses a grid trading approach. The algorithm will result in a margin call soon as the market trends heavily on EURUSD.