Scalping trading strategy is mostly designed for professional traders. Usually, the experts open the trade in a lower period and quickly book the profit. But becoming a pro scalper is a very tough task and many traders often blow up the trading account. You must have a perfect scalping strategy or else you are going to lose money like 96% of the retail traders.

This article is going to act like a step by step guide to learn scalping strategy. After reading this article, you can expect to scalp the market by using 100 period SMA just like the pro traders.

What is a 100 period SMA?

SMA stands for the simple moving average. When you set the period to 100, it becomes 100 period SMA. The 100 period SMA acts like an excellent support and resistance level and gives unique profit-taking opportunity. But executing the trades in the 100 period SMA is not that simple as it seems. You need to set pending limit orders to get the best possible price.

Setting up the orders

Setting up the pending orders is fairly simple. If you know the scalping method, you can expect to make big profits by taking advantage of the rejection. Let’s see a real-life trade setup so that you can get a better picture of this strategy.

Figure: Shorting the GBPUSD pair, 4-hour chart analysis

Just setting pending orders at the 100 periods SMA is not going to work. The 100 period SMA works more like the trend line. To find a valid support or resistance zone, you need at least two rejections. If you look at the above chart, you see multiple rejections 100 periods SMA. The scalpers need to set the pending orders at the third rejection point. The market rectangular region is the perfect place to place the pending sell limit. Though this strategy offers a quick profit-taking opportunity, you can notice how sharply the price fell after rejecting the 100 period SMA for the third time. By using this simple concept you can scalp any major pairs like the pro traders.

But executing the trades is not enough. You need to analyze the risk to reward ratio. You might have the best scalping strategy in the world but if it comes with low risk to reward ratio, you are going to have a tough time recovering the loss. Let’s learn about the recovery factors of this strategy.

Recovery factors

Before you start scalping the real market using the 100 period SMA, you need to know about the recovery factor. Those who are executing orders with 1:1 risk to reward ratio must win most of the trades and they have a very poor recovery factor. The elite traders prefer to use the 1:3+ risk to reward ratio when scalping with this strategy. It allows them to recover 3 losing trades with just one winning order. But the recovery factors greatly depends on your potential stop loss. Unless you know the perfect way to set the stops, you have to use some fixed numbers.

Determining the stops

There are two methods to determine the stops while using the 100-period scalping strategy. The amateurs can set fixed 15 stops and 30 pips take profit without thinking about other parameters. But using the fixed stop loss often tends to disasters. You need to determine the stops based on price action signals as gives perfect scalping opportunity. Let’s give you a simple example.

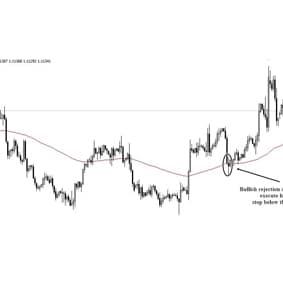

Figure: Using the price action signals

If you notice the above chart, you can see the bullish pin bar is used to set the stop loss. Those who prefer to use fixed 15 pips stop at the dynamic 100 periods SMA often gets stopped by such false spike. But if you use the simple candlestick pattern, you can scalp the market more conservatively. The placement of the stops will be much more accurate.

Those who can pay attention to the details might have noticed the long orders have been executed in the first rejection. We have already told you that the trade should be placed in the third rejection point. But there is a small twist to this scalping strategy. If the price breaks the dynamic SMA and indicates a change in trend, you can execute the orders in the first rejection point. But for that, you must use the price action confirmation signals.

Attention to the major news

By now, you know the perfect way to scalp the 100 periods SMA. But you must stay in the sideline on the eve of the major news release. Most of the time, price tends to break the dynamic support and resistance level on high volatility. So, learn about the scheduled news and avoid scalping the market to reduce the risk exposure in trading. Last but not least, try to scalp the 4 hours or 1 hour period only.