Money flows to high interest rates because investors will receive a higher return for their investment of cash. Money, on the other hand, flows as a result of how individuals spend their money. The value of a currency is affected by the demand for commodities such as gold and oil. Why? If you wanted to buy gold, you would do it in the producer’s native currency. As a result, you would sell your money to purchase the local currency, which you would then swap for gold.

This holds true for all goods. If you wanted to purchase a stock on the German stock exchange, you’d have to first acquire EUR. When commodity prices rise and fall, though, it’s critical to know what to buy and sell.

Crude oil

Crude oil, often known as petroleum, is a key economic force across the world. It’s most known for manufacturing gasoline, which is used in the majority of automobiles (by volume). Oil is also used to make the natural gas that warms your house, the asphalt you drive on, all plastics, and food-protecting insecticides, which are all less well-known to many people.

Growing economies normally need a lot of oil since it is utilized in so many different ways. The rise of China and India as economic heavyweights has altered the global oil demand equation substantially. The Far East has become a rising sponge for oil as new industries have emerged and flourished in those nations, and increasing percentages of their inhabitants have achieved financial wealth. Fortunately, you may profit from the fluctuation in oil prices as a forex trader by trading the Canadian dollar and Norwegian krone.

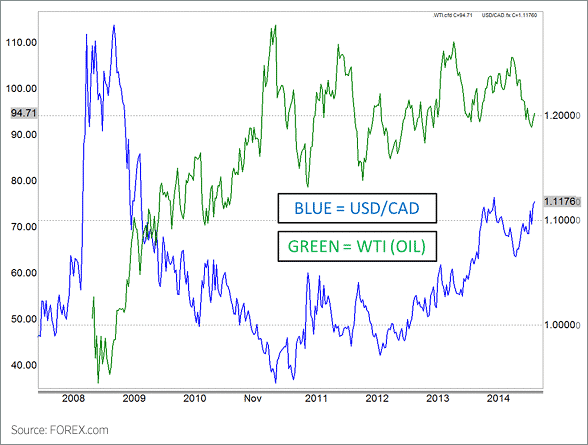

USDCAD

The major type of oil sold in North America is West Texas Intermediate or WTI, and it has a huge impact on the Canadian economy. It’s no secret that the United States is the world’s largest oil user (at almost 19 million barrels per day (bpd), far ahead of second-place China’s approximately 11 million bpd), yet many people are unaware of how that oil is obtained. Many people believe that Saudi Arabia is the source of the bulk of its oil imports. However, Canada accounts for a third of all oil imports, with Saudi Arabia accounting for just over 17%. Surprisingly, 10 million bpd of the 19 million bpd the US consumes is generated domestically, but since Canada sends so much oil to its bigger neighbors to the south, their currency is inextricably linked to the black gold’s worth.

When oil prices fall, the USDCAD tends to rise (see the chart above). In a statistical sense, oil price fluctuations account for about 84 percent of the USDCAD price volatility. Note that this does not imply that changes in the exchange rate of the US and Canadian currencies are only due to variations in oil prices; rather, the two variables move in lockstep.

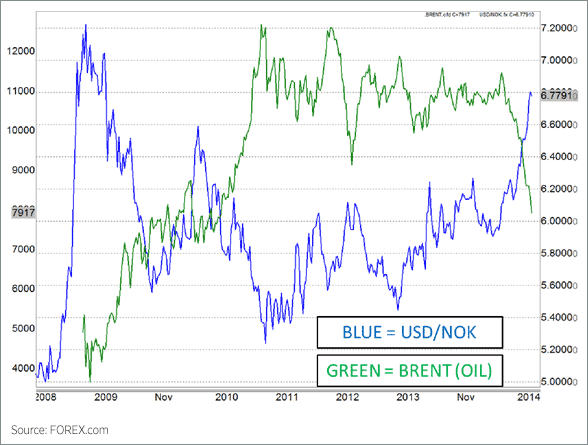

USDNOK

Brent crude oil is a type of oil that is derived from the North Sea, and it is mostly traded in Europe. The oil in the North Sea is accessible to a number of countries, although it is believed that the Norwegian sector has roughly 54 percent of the sea’s oil reserves. Therefore it is heavily impacted by pricing.

Norway is the world’s fifth-largest oil exporter and third-largest gas exporter, with both industries accounting for more than 20% of the country’s GDP. The chart above shows the correlation between NOK and oil prices.

Gold

Gold production has not kept up with demand on the global market. In recent years, gold producers have not invested in the discovery of new mines. However, demand for both jewelry and investments is rising, particularly as many nations’ economies improve, allowing consumers to accumulate more discretionary cash.

Because of its high electrical conductivity, malleability, and corrosion resistance, gold is used to make components for a broad range of electronic devices and equipment, including computers, telephones, cellular phones, and household appliances.

Gold is obviously in great demand in the jewelry market, but it is also in high demand in the dental profession. Apart from that, there is still a widespread belief in the market that gold is a safe haven investment, which adds to the yellow metal’s attraction.

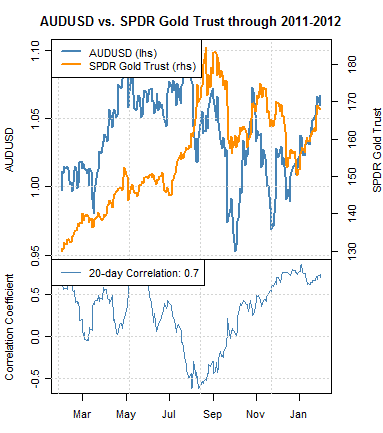

Australia, as the world’s third-largest gold producer, expects to gain from higher gold prices. AUDUSD is highly affected by Gold prices, as seen in the chart above.

Silver

Silver has been a precious commodity for hundreds of years, and despite the fact that its uses have varied through time, it has never lost its market value. Silver has been able to adapt to changing times, in part owing to its intrinsic malleability, and its value has remained high even now.

Silver is suitable for use in jewelry, decorations, and silverware due to its relative rarity, appealing look, and malleability. Many civilizations have benefited from it, including the ancient Greeks, Romans, Chinese Tang Dynasty, medieval Saxons, Spanish and Portuguese in the 16th century.

As a consequence of the discovery and exploitation of Mount Isa, Hilton-George Fisher, Cannington, and McArthur River lead-zinc-silver deposits, Australia now owns the biggest proportion of the world’s economic silver resources.

It’s no secret that mining is important to Australia’s economy, but few people know how big it is: it employs over 2% of the workforce, accounts for over 5% of GDP, and roughly 35% of the country’s exports.

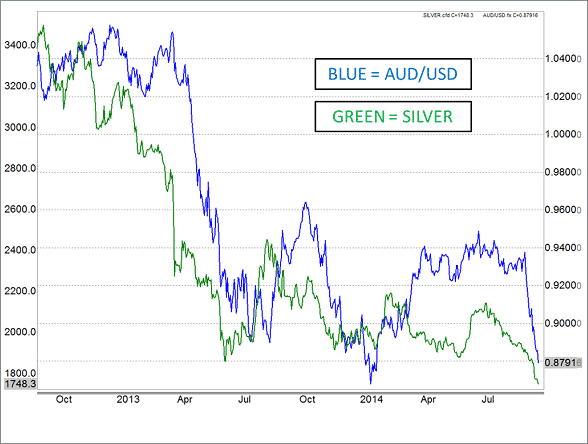

As a result, metal market changes have a significant influence on the AUDUSD’s outlook (see the chart above).

Conclusion

You are not required to monitor the commodities market minute by minute, but you may do so if you so choose. In general, if gold prices are increasing, the AUDUSD is likely to rise as well. If the price of West Texas Intermediate Crude Oil rises, the Canadian dollar may rise as well. If silver prices rise, the Australian dollar will also grow. If the Brent Crude Oil surges, the NOK will follow suit. These commodities account for a significant portion of each economy’s GDP.

Please keep in mind that these are fundamentals and do not alter the currency’s value in real-time. You’re on the lookout for current events. All you have to do is read the economic updates and keep up with the price of oil and gold.