We Like:

- Strong regulation

- Multiple trading platforms

- Multiple account types

- Provides ECN trading environment

We Don’t Like:

- The min. deposit requirement is AUD 200

- Does not provide services for clientc from US

The Verdict:

It is an Australian FX and CFDs broker based in Melbourne. It started the business operation in Australia and then expanded worldwide.

The platform offer trading in multiple currencies, stocks, metals, CFDs, and crypto. Besides, the broker offers MT4, MT5, and cTrader platforms with copy trading functions for all traders from beginners to advance. However, it does not provide services for US clients.

Company details

The main aim of Pepperstone is to provide FX and CFDs trading opportunities with multiple trading platforms. Moreover, the company offers investment opportunities through its social trading platform.

The average daily trading volume for the broker is US $12.55 bn, making it one of the largest FX brokers. The platform have more than 70,000 active market participants who are continuously trading with the platform under ASIC and FCA regulations.

The trading cost in Pepperstone is high compared to other brokers that might be a discouraging fact for the company. However, based on the availability of funds with more increased regulation, investors can easily rely on this platform.

Regulations

The broker is authorized and regulated by four high yield regulators. In addition, the company has professional indemnity insurance through Lloyd’s of London.

Pepperstone is regulated by the following:

- Financial Conduct Authority (FCA)

- Australian Securities Investment Commission (ASIC)

- Dubai Financial Services Authority (DFSA)

- Securities Commission of the Bahamas (SCB)

Trading platforms

The broker provides trading services through MT 4&5 and cTrader platforms, where traders can operate their web, mobile, and desktop platforms.

MT4

It is the world’s most used trading platform, famous among most retail traders. Market participants can see real-time charts, live quotes, market analytics, etc.

Some other features:

- Twenty-eight trading indicators and available expert advisors.

- Provides autochartist to find high probability trades.

- Opportunity to hedge tradings.

- All trading instruments are available on the platform.

MT5

It is the upgraded function of the MT4 platform, where both of these platforms are user-friendly by traders. The platform provides faster processing times, advanced orders, and hedging opportunities.

Other features:

- In the MQL5 language, traders can build automated trading tools.

- Many inbuilt indicators and faster processing.

- Advanced customization of the trading style.

cTrader

It is an advanced platform developed by Spotware that offers sophisticated charting and trading features. The platform provides an institutional trading environment where traders can fill their orders with a progressive environment.

Other features:

- Control features.

- Access FIX API.

- Provides automated trading functionality with C++ platform.

Comparison of trading platforms

| Platform | CTrader | MT4 | MT5 |

| Desktop versions | Windows, Mac OS | Windows | Windows, Mac OS |

| Browser version | Yes | Yes | Yes |

| Android / iOS | Yes | Yes | Yes |

| 150 trading instruments | Yes | Yes | Yes |

| Algo trading | Yes | Yes | Yes |

| Backtesting strategies | Yes | Yes | Yes |

| Customizable charts and indicators | Yes | Yes | Yes |

| Adjustable session times | Yes | No | No |

| Market depth research | Yes | No | Yes |

| Extended take profit / SL levels | Yes | No | No |

| Historical data access | Yes | No | No |

| Detachable graphics for multiple monitors | Yes | No | No |

| Social trading / copy trades | Yes | Yes | Yes |

| Profiles, templates and passwords hosted in the cloud | Yes | No | No |

| Trading CFDs on stocks | No | No | Yes |

Range of markets

Broker traders who have opted for the MT5 trading platform can trade stock CFDs. More than 60 stocks can be selected to trade CFDs with low commissions from $0.02 per share. Market participants can open long or short positions on these CFDs. The downside is that the commission for the crypto is not specified, which is disappointing given the high volatility of this category and relatively wide spreads.

Forex

FX is the most liquid market globally, where the broker allows trading in major, minors, and exotic pairs with the leverage of up to 500:1. It will enable more than 40 exotic pairs, nine minor pairs, and six major currency pairs with a spread of 0.0 pips.

Cryptocurrencies

Some essential features of the broker’s crypto trading are mentioned below:

- Weekend trading in BTC, ETH, etc.

- The opportunity of trading cryptos without any digital wallet.

- Ability to hedge on a single account.

- Available leverage of BTC CFD is up to 5:1.

Share CFDs

The broker provides service in Share CFD from AU Shares, US Shares, and German Shares. The min. margin rate for these instruments is 5%.

| The commissions per trade for Share CFDs | |||

| Share denomination | Commission (per trade) | Min. charge | Margin rate |

| AU | 0.07% | AUD 5 | 5%-20% |

| US | USD 0.02 per share | – | 5% |

| Germany | 0.10% | EUR10 | 5%-20% |

Index CFDs

The broker allows trading in 14 major stock markets with no commission. Here investors can trade with the leverage of up to 1:200.

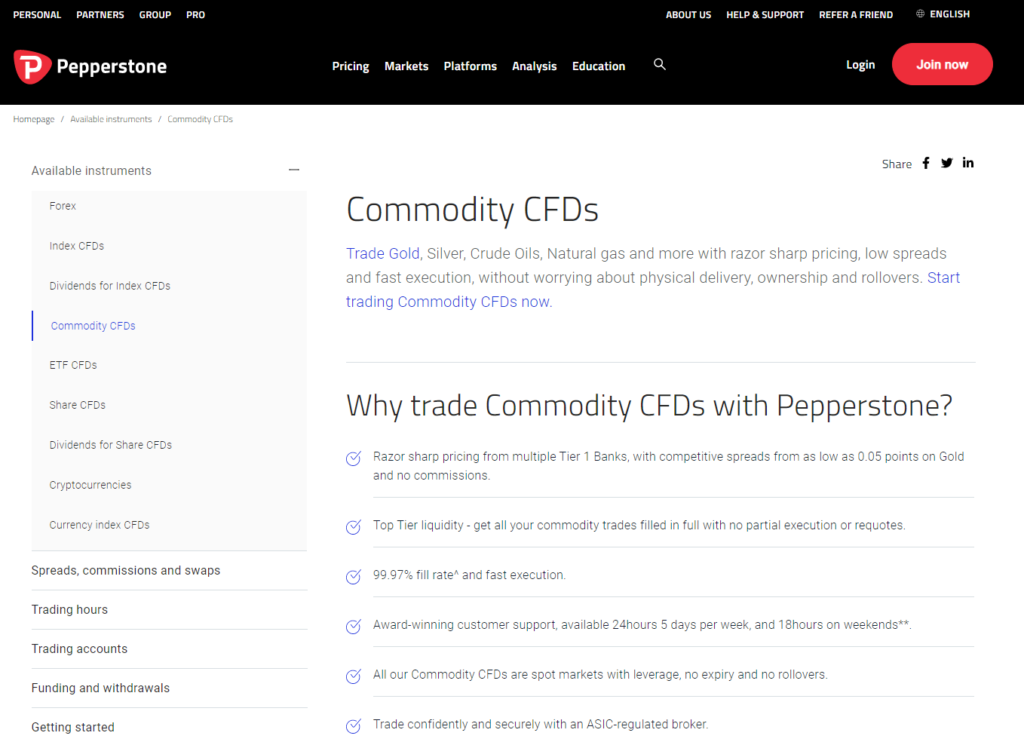

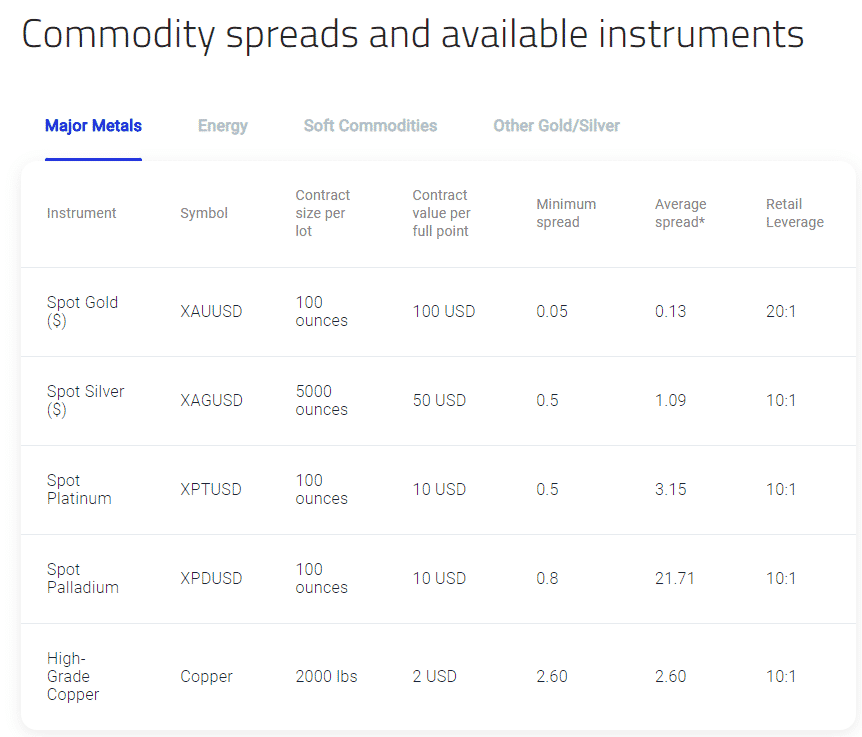

Commodities

The broker allows trading in gold, silver, coffee, cotton, orange juice, sugar, silver, gas, oil, etc. Moreover, it allows six gold crosses and three silver crosses against the dollar and the euro.

Main features

Besides some general features, the broker provides some services that may encourage traders to consider it as a trustworthy broker.

Premium trading tools

Here is the list of some premium trading tools.

Innovative Trader Tools for MT4 and MT5

It includes an alarm manager, excel RTD, mini terminal, and many more.

cTrader Automate

It provides an automated trading functionality with the C# language.

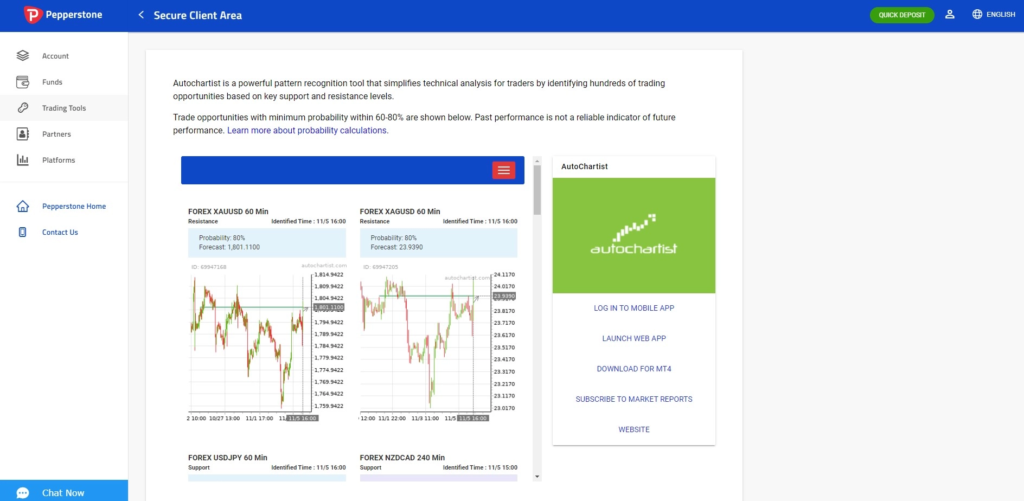

Autochartist

It is a powerful pattern recognition tool that simplifies technical analysis for traders by identifying hundreds of trading opportunities based on key support and resistance levels.

Autochartist in your Pepperstone account

All kinds of trading calculators are also available to the trader in the cabinet.

- Pips calculator — provides the value of one pip based on the trade volume entered for a specific asset.

- Margin calculator — shows the margin required to enter a position on an asset, taking into account the leverage of the account, volume, and the asset being traded.

- Profit calculator — shows the trading profit for an asset, taking into account the transaction volume, the difference in the opening and closing prices, and the traded asset.

The Daily Fix

It provides trading functionality in details of FX, stocks, equities, etc.

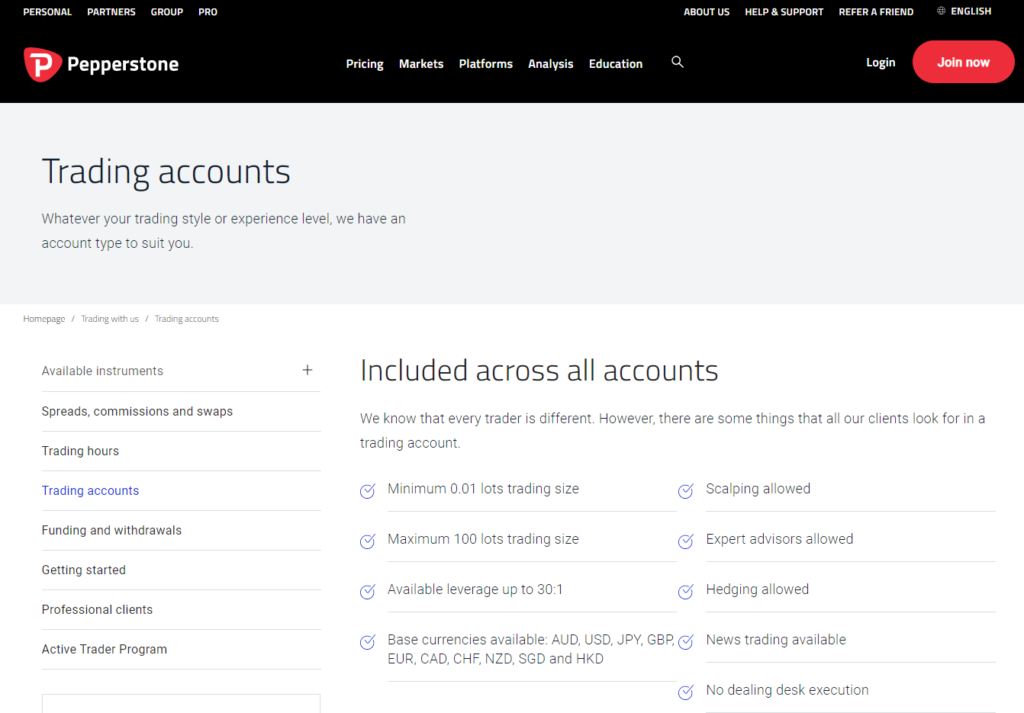

Types of trading accounts

The broker focused on clients’ requirements by providing two pricing models in their account types. The first is the commission-based razor account, and the second is the standard account. Therefore, traders may experience a change in trading costs among these account types.

Razor account

It is an ideal choice for the company’s clients with little trading experience.

- To have such an account, you need $200 or more savings.

- The size of a trade order is from 0.01 lot.

- An account can be created in dollars.

- You will be charged a $ 3.5 commission.

- Spread value from 0.1 pips.

- Holders of such an account can use almost any EA.

Standard account

It is ideal for clients of the organization who have no trading experience.

- To have such an account, you need savings of $200 or more.

- The possible size of a trade order is from 0.01 lot.

- The account can be opened in dollars.

- You will not be charged any commission fees.

- Spread value from 0.1 pips.

- Holders of such an account can use almost any EA and trading method.

Copy-trading

Besides personal trading, the broker offers copy trading through its MirrorTrader and RoboX platform. Moreover, they provide social trading through the ZuluTrade, MQL4, and Myfxbook platforms.

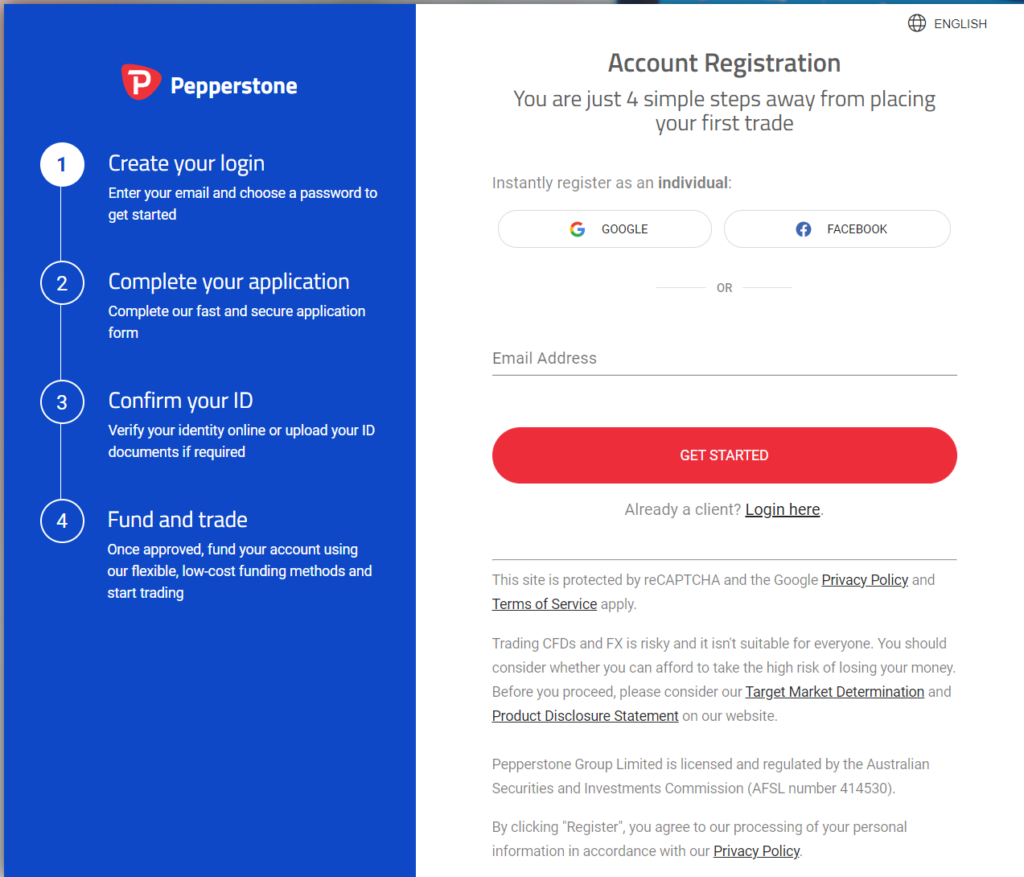

Opening an account at Pepperstone

Step 1. Create the login.

Step 2. Complete the app.

Step 3. Confirm the ID.

Step 4. Fund the money.

Step 5. Start trading.

Verification

It would be best to verify; otherwise, you won’t be able to open a trading account. Only a demo account is available without verification.

To get started, you need to fill out all the necessary forms:

- Personal data, residential address.

- Trading preferences – terminal, leverage, account type, account currency.

- Employment, income, trading experience.

- Compliance test for CFD and FX trading.

- Regulator requirement.

- Declaration.

Here you need to read and confirm that you understand and agree with the broker’s terms and conditions. Only reliable data should be provided, as further confirmation will be required. As a final step, the user is asked to provide photographs or scanned images of a passport or other document to verify identity and a bank statement or utility bill to verify the residence address.

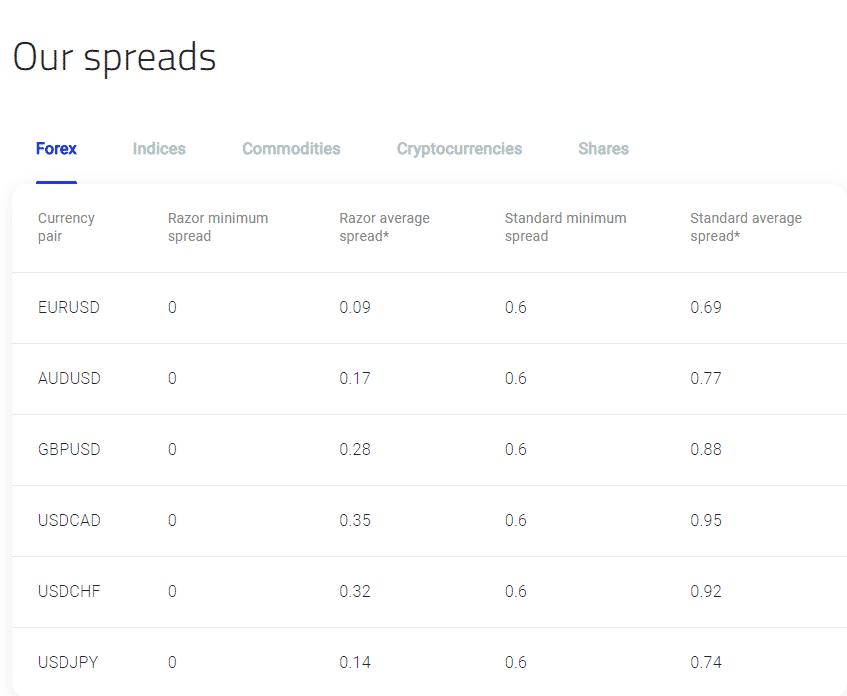

Commissions and spreads

- The broker takes commission per 0.1 lots on the MT5 razor account.

- The commission value is $0.04 per 1000 base currency and USD 3.50 for 100000 base currency.

- For the MT4 Razor account, the cost is $3.76 per 100000 base currency.

- In cTrader, the 7 unit charge per lot refers to the first currency displayed in the traded pair.

The broker is flexible in non-trading fees. There are no inactivity fees for trade, but it charges a withdrawal fee that is a drawback of the platform compared to other brokers. Specifically, it takes $20 as a fee while withdrawing through banks.

The average spread for Razor accounts starts from 0.0 to 0.9 in EUR/USD. Moreover, in minor currency pairs, the lowest average spread is 0.3 in the AUD/CAD pair. Overall, based on our review, spreads are relatively higher than the other brokers, but the lowest spreads are found in AUD-related pairs under the ASIC regulation.

Customer service

Broker’s website is available in five languages. Its support page has some popular FAQs, but the number of questions was not sufficient compared to another broker. Furthermore, trading hours and account security-related information are available on the support page. The most convenient way to contact the broker is the live chat open 24/7.

Pepperstone Review

What we liked

- One of the lowest commissions for replenishing the trade balance and withdrawing the received profit.

- It provides more advanced capabilities for financial reporting.

- The company’s clients can track all the actions with their accounts.

- The broker offers its clients the opportunity to place advertising materials for free and each month credits bonus funds to users of the MT4 terminal.

What we disliked

- Non-standard website maintenance.

- Limited account protection for non-UK / EU clients.

- No guaranteed stop-loss.

The bottom line

Since the broker entered the financial market arena, it has become crowded on the pedestal of the flagships of the FX industry. It is an Australian company providing advanced technologies for online trading in the FX market in an ECN environment since 2010.

The broker provides the whole range of services under the control of the national Australian ASIC regulator. In addition, the entire financial liability of the broker is insured by the Lloyds of London concern, which will provide compensation to clients in the event of bankruptcy.

The financial assets of its market participants are classically kept in segregated accounts separate from the company’s assets at the National Bank of Australia, as well as other AA-rated banks such as HSBC, which also adds a plus to this broker’s reliability rating.