We Like:

- A reliable broker always withdraws funds without any problems and does not block client accounts.

- There is an opportunity to receive exclusive materials from the broker’s analysts, and they are provided completely free of charge.

We Don’t Like:

- Just two methods are available for feedback: international phone and email.

- Quite a few training materials will become a clear obstacle for novice traders who will have to engage in self-education at the expense of other sources of information.

The Verdict:

CMC Markets is a broker with a wide range of trading instruments and high-end trading platforms with easy-to-use features, most of which are unavailable on other brokers’ or competitors’ trading platforms. CMC Markets is intensely regulated across multiple established platforms speaks more about its authenticity.

Company details

The Currency Management Corporation (CMC) is a United Kingdom-based financial derivatives dealer. The CMC organization provides online trading such as Contracts for Difference (CFDs), spread rates, and FX globally.

In 1989, Peter Cruddas founded the Currency Management Corporation (CMC) as the foreign exchange market. It is listed on the London Stock Exchange. The broker was licensed in the United Kingdom by the Financial Services Authority (FSA) in 1992.

The company opened a live FX trading platform in 1996 and made its first trade in the foreign exchange market over the internet. Later, in September 2005, the name was changed to CMC Markets.

The broker was one of the financial companies providing online trading. The company has had a good track record since 1989. The MarketMaker software platform was used to pioneer CMC Market e-commerce technology.

Regulations

The broker has been working on the market for almost 30 years. Today its offices operate not only in the UK but also in other countries:

- Germany

- France

- Canada

- New Zealand

- Australia

- Singapore

- Spain

- Austria

Several leading regulators control the activity:

- ASIC

- OSC

- NFA

- BAFIN

These financial institutions check the broker’s work and accept claims from traders. Regulatory decisions are binding on all parties. Therefore, traders can ensure that any of their requests will not go unanswered.

Trading platforms

To conduct trading operations and analyze the current market situation, the broker offers its clients to use of the classic MT4 terminal, which is available in three versions:

- The program on a computer or laptop.

- Web-version, which does not require installation of the program, available through a browser window.

- Mobile apps for Android and Apple devices.

MT4

CMC Markets also offers MT4 a substitute for its leading trading platform. The broker submits the MT4 platform as most traders prefer its proprietary platform.

MT4 features include:

- Instant trade executions

- Tight spreads

- Automated trading

- Live chat

- One-click through trading

- Customer support

- Over 10,000 instruments

- Interactive features

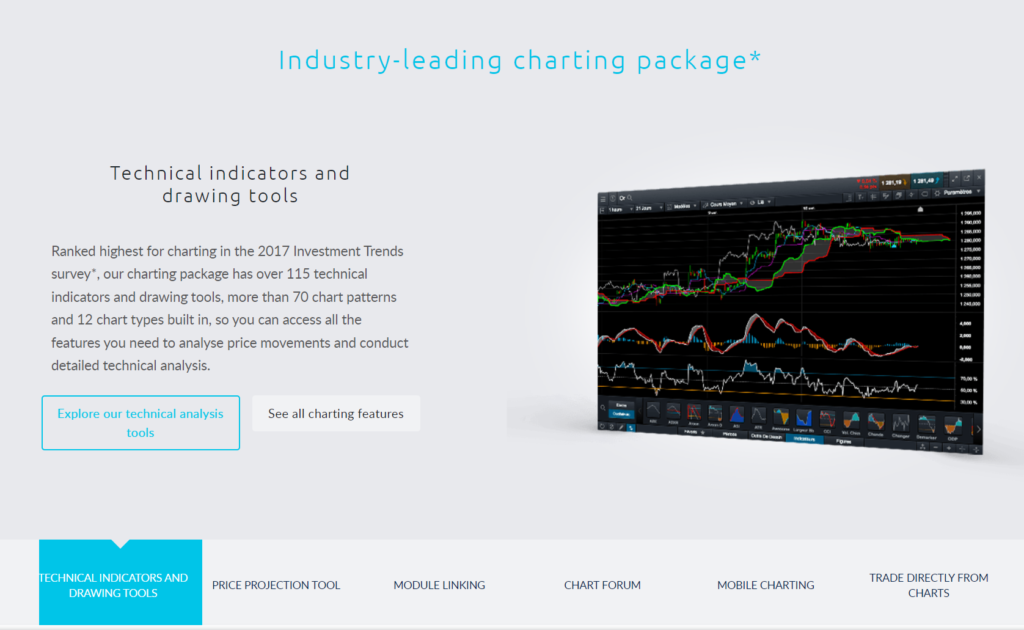

Next-generation platform

This platform serves the broker’s clients on all its accounts. It’s available on the web, desktop, and mobile phones giving clients the ability to trade from anywhere.

Its features include:

- Market watch indicators provide clients with new and market insights

- Fast order execution and easy to use

- Advanced features including boundary orders, SL, TP orders, etc.

- Live chat and feedback

- Over 10,000 instruments

- 115 technical indicators

- Drawing tools

- 70 chart patterns

- 12 chart types

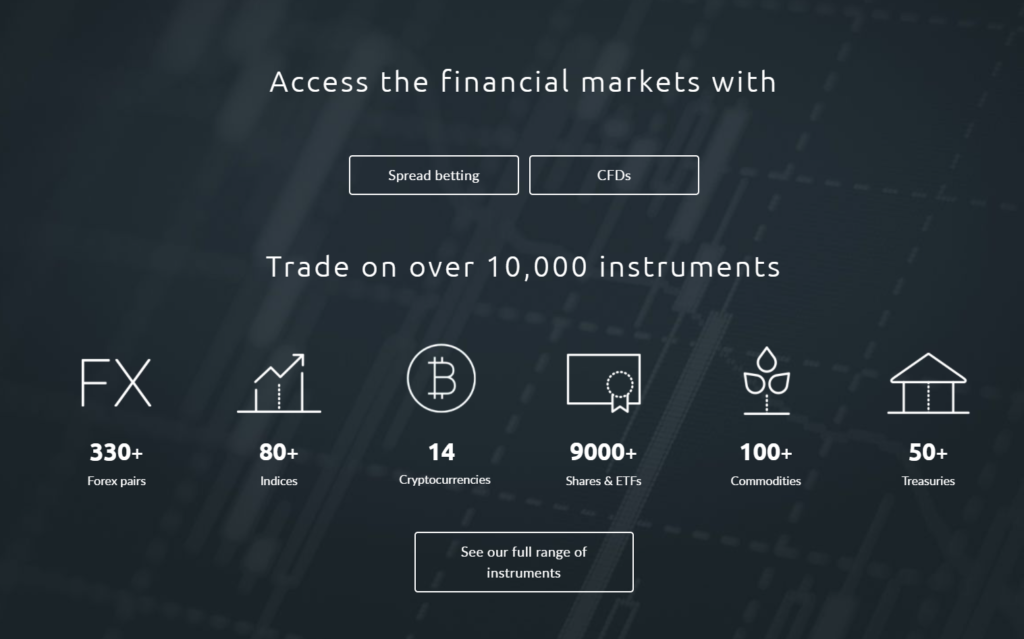

Range of markets

The broker claims to provide clients access to diverse liquidity markets in the financial arena. It asserts to offer more than 10,000 instruments with competitive spreads and margins.

Forex

At CMC Markets, the FX market trades 24/5 on the broker’s platforms. It offers clients over 350 currency pairs made up of both significant pairs and exotics. These assets trade with spreads starting from 0.7 pips, instant executions at 0.0045 seconds, and with no dealer intervention — clients have a 99.7% fill rate.

Indices

Over 80 indices trade on the broker based on the FTSE 100 and other regional indices. The indices basket holds both popular indices like the UK 100, US 30, among others, at a 24/5 trading schedule. The broker offers accurate bid/ask prices on these assets with no dealer intervention.

Cryptocurrencies

The broker sites offer about 14 crypto assets for market participants. The assets trade with instant execution and a 99.9% fill rate. Clients experience limited partial and zero manual dealer interventions. The min. spreads start from as low as 1.9 points and change relative to the asset.

Commodities

The broker offers an array of commodities to traders. Clients trade over 100 commodity assets, including popular instruments such as Brent and West Texas oil and lesser-traded products. Some of these assets trade at a min. spread of 0.3 points and a margin rate of 5%. Some commodities include natural gas, gold, silver, and others.

Shares

CMC Markets claims to offer over 9000 instruments on shares. The asset class holds about 250 biggest UK shares and the most popular US shares. They trade with instant execution and automation and 24/5 customer support. The spreads start from as low as 0.1 points but fluctuate depending on the instrument.

Treasuries

The broker also diversifies its markets into treasuries such as bonds and global rates. Clients trade over 50 treasuries with full automation, fast executions, and without any dealer intervention. The broker also offers access to 24/5 expert customer support to clients trading these instruments and others, such as the US T-Bond trade up to 23 hours a day.

Main features

Trading tools

- Expert advisors on news and insights

- Trading calculator

- Charting tools

- Advanced order options like 1-click trading, price ladders, among others

Analytical tools

- Market watch information tools

- Economic calendar

- Technical analysis tools

- Indicators

- Signals

Broker bonuses

From time to time, the broker offers welcome bonuses in the form of crediting a small amount (up to $ 250) when opening an actual deposit. These funds can not be withdrawn immediately, but only if a certain number of bets have been made to achieve the level of profitability.

Therefore, it is better for traders to correctly assess their strengths in advance to cope with such a task. This is especially true for beginners, who often take bonuses with pleasure, but subsequently cannot “work out” them.

Types of trading accounts

The broker provides both a demo account and a live account. The demo accounts act as a learning tool, especially for beginners, while the live account serves both intermediate and professional traders. However, the broker also allows newbies to create a live account directly as it offers social trading.

The live accounts include:

- A spread betting account

- CFDs trading account

- Corporate account

Spread Betting account

- The minimum deposit is 0

- Access to a demo account

- No trading commissions

- Negative balance protection — yes

- Only two base currencies — GBP, EUR

- Market data fees — no

- Inactivity fees — yes (after one year)

- Fast execution

- Access to over 10,000 instruments

- Free deposits and free withdrawals

- 24/5 expert support

- Access to free education, online trading courses, and content

- Access to real-time market trends and advanced trading tools

- Low spreads starting from 0.7 pips

- Leverages of up to 30:1 for forex

CFD account

- The minimum deposit is 0

- Access to a demo account

- A $10 trading commission on shares only

- Negative balance protection — yes

- Ten base currencies

- Market data fees — yes

- Inactivity fees — yes (after one year)

- Trade with points low points starting from as low as 0.3 points

- Leverages of up to 20:1 for stock index CFDs and 5:1 for stock CFDs

- Instant execution

- Access to over 10,000 markets

- Free deposits and withdrawals

- 24/5 expert customer support

- Access to real-time market trends

- Access to free education, online trading courses, and content

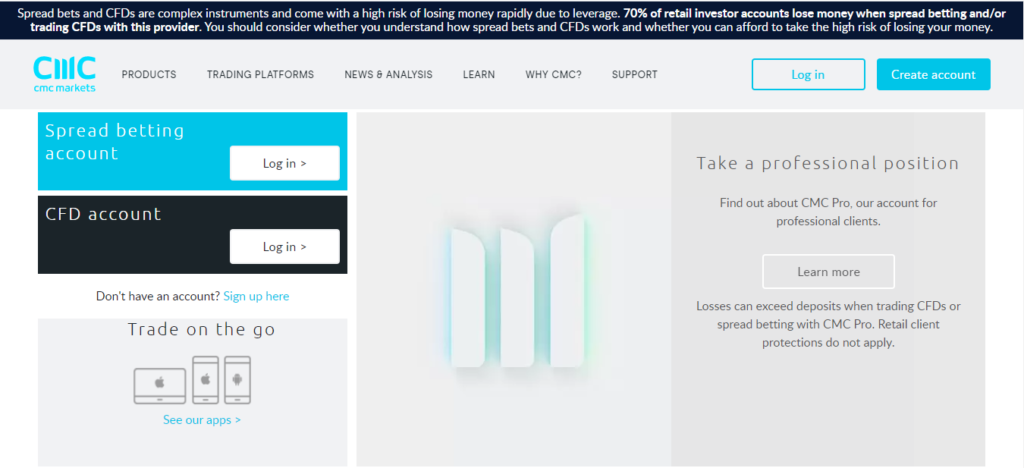

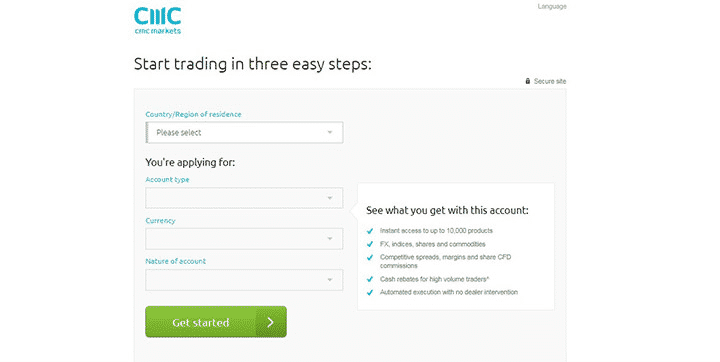

Opening an account at CMC Markets

To register, the user enters the main page, clicks on the “Create account” button in the upper right corner, selects the type of account (real or demo), and fills in the following fields:

- Country of residence

- Account currency

- Account type (individual, corporate, or general)

Next, indicate the surname, name, email, and phone number. After that, you can transfer funds and start trading. To withdraw money, you must go through the standard verification procedure.

To do this, the user provides a scan or photo of his passport (main page and page with the address) and a payment document (receipt for payment of utilities) for the last three months.

Commissions and spreads

We have analyzed the trading conditions of CMC Markets for explicit and implicit fees. There are no hidden fees. The company only charges spreads. Their minimum value is the same for all account types.

| Account type | Spread/commission | Withdrawal commission |

| Spread betting account | from 7$ | No |

Customer service

- Phone, live chat, email support 24/5

- Professional staff

- Webinars, videos, analysis, tutorials for free

- A huge educational center for beginners and advanced traders

CMC Markets Review

What we liked

- Authorized over 10,000 markets to host opportunities from forex to gold to BTC

- No restrictions on the amount of the deposit

- Free and fully structured demo account for testing trading without time limits

- Providing a social trading platform where different users can share their ideas and offer help to each other

- Access to personalize user dashboard on both desktop and mobile

- The platform is regulated by major international financial bodies

What we disliked

- High CFD fees

- Overnight trading fees

- Spreads vary across different instruments

- Not available to US clients

The bottom line

Customer reviews of CMC Markets are mostly positive. Users point to the exceptional honesty and reliability of the company: the broker always fulfills financial obligations, clearly withdraws funds, and does not block accounts.

On the other hand, there are some complaints about the work of the support service. Also, sometimes you can come across statements that incorrect quotes are received, and the spreads are standard, i.e., not low enough.