Adaptive EA is a trainable system that can be modified to trade any currency pair of your choice. To learn how the robot works, the vendor advises you to run it in a tester. At the initial pass of the tester, the neural network will carry out random transactions. The trading stats can then be seen utilizing your trained neural network during the second pass.

Is Adaptive EA a reliable system?

Svetlana Visnepolschi is the person behind this EA. He is a developer based in the United States. Sadly, his profile doesn’t reveal anything more about him. So, his trading experience, achievements, or qualifications in Forex remain a mystery.

The system is featured by the following parameters:

- Take profit, stop loss, and trailing stop size in pips

- A restriction for buy and sell orders

- Process adaptation on history bars

- Ignore pattern errors on the chart while working

- Process adaptation every time that overwrites the neural network in any case

- Monday trade session to Sunday trade session

- Marginal level minimum, upon which the order is closed, making it impossible to open new orders

- Comments for orders opened

- Maximum slippage level

- Show info panel that demonstrates an informational dashboard

- Adaptation folder

- Lot size and risk for orders

How to start trading with Adaptive EA

The vendor is currently selling Adaptive EA at $111. There are no renting options or a money-back guarantee offer.

The specific strategy used by this EA is not revealed. Anyway, the vendor tells us that the robot can trade all currency pairs, oil, metals, or cryptos.

Adaptive EA backtests

The robot lacks backtest results. Therefore, it is not clear if the developer tested the workability of the strategy before releasing it to the market. We thus remain in the dark with regards to the strategy’s profitability potential, trading risks, win rates, etc.

Trading results

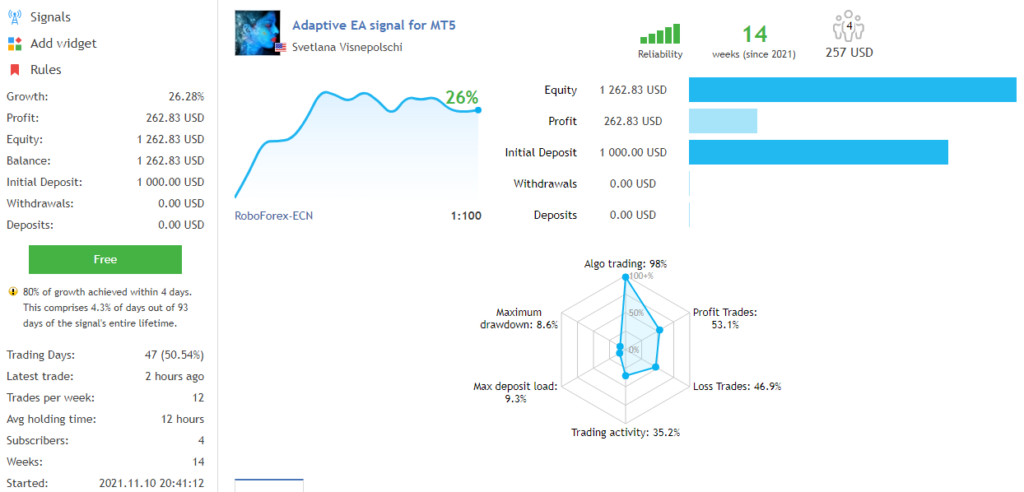

As you can see, we are provided with the results of the dev’s personal account instead of a verified account on Myfxbook.

The data above indicates that the account was deposited with $1000 when it was deployed over a month ago, November 11, 2021. To date, the EA has made a profit of $262.83, thus causing the account to grow by 26.28%. So, the balance currently stands at $1262.83. About 12 trades are completed weekly. The account has a drawdown of 8.6%. This amount is small and shows that the strategy used isn’t risky.

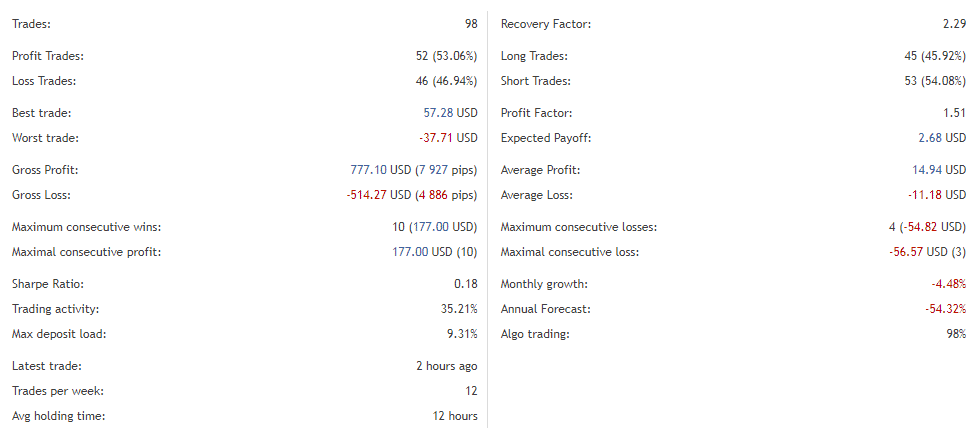

The EA has implemented 98 trades, and a monthly growth rate of -4.48% tells us that they are hardly lucrative. In this regard, only 53.06% of the orders have brought in profits. The gains must have been small given the profit factor is 1.51. The worst trade has cost this account -$37.71, while the best one has contributed to a profit of $57.28.

People feedback

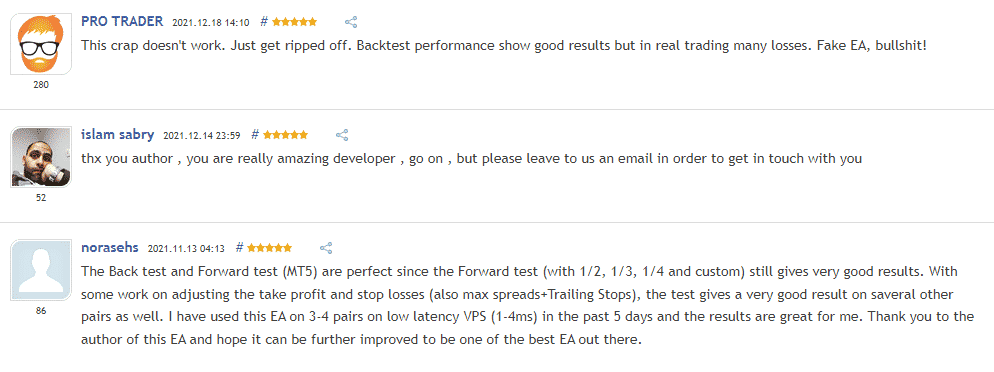

There are three reviews for this robot on mql5, and only one is negative. One of the traders is angry for losing money while using the EA. He says that Adaptive is crap and doesn’t work. The other two thank the developer for the robot and assert that it generates good results in backtest and forward tests.

Summary

Advantages

- Features a stop loss and a trailing stop loss

- Can trade any currency pair

- Fair pricing

Disadvantages

- No backtest report

- Live trading stats are unverified

- Vendor transparency is not satisfactory

- No strategy insight

The robot has a stop loss and a trailing stop loss, which ensures that it doesn’t make unnecessary losses. And the adaptable nature of the EA enables you to trade any pair. Unfortunately, the vendor doesn’t explain how it works and fails to provide a backtest report that can help you assess the long-term efficiency of the strategy. With no verified trading data, you won’t know for sure how the EA performs in the live market until you test it, a move that can be risky.