Everyone should know about technical and fundamental analysis in forex, though what is sentiment analysis? Although a rarely used trading approach, the sentiment is highly beneficial for observing crowd psychology, providing insights about where trends are likely to go in the future.

What is sentiment analysis?

Sentiment analysis refers to a trading approach attempting to gauge how a large group of market participants feel (hence ‘sentiment’) about the direction of a market. Through crowd psychology, for example, if a noticeable majority of traders are going long, this indicates a bullish sentiment.

The interesting question then becomes how do we know what the majority is doing? Currently, the only known and proven method of sentiment analysis is by using a sentiment indicator.

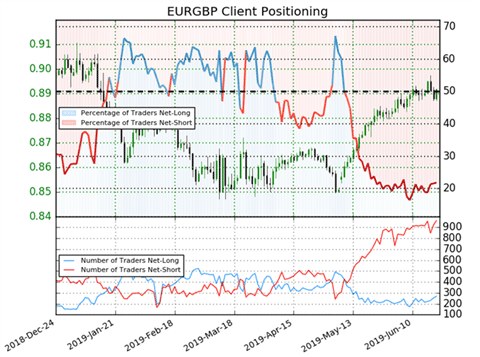

This tool is typically numerical and graphical, provided only by a handful of forex brokers and exchanges. It reflects client positioning data for specific markets where we can see, in percentages, how many people are going long (buying) or going short (selling).

Using this information is a subtly powerful method to understanding exactly how traders feel as it reflects in the positions they’ve executed.

Why are most sentiment tools contrarian indicators?

The most important thing about nearly all sentiment tools is their contrarian nature. One of the crucial aspects of any market is the trend.

Retail traders trading against the trend

A trend is necessary for moving prices up and down, and trading on its right side (‘the trend is your friend’) is ‘trading 101’. Sentiment data has conclusively proven traders, specifically retail, very often trade against the trend by continually looking for reversals.

This camp boasts tiny volume to have any impact on movements even when a reversal might seem potentially lucrative. On the other hand, institutional traders (also colloquially referred to as ‘smart money’) have power in numbers and are the catalysts for all big moves.

Sentiment data has consistently reinforced the belief that ‘smart money’ will go against ‘dumb money’ (retail traders). So, for example, if the data reflects 80% of traders are long in a downtrend, this should be taken as a bearish signal instead (and fairly often results in a downtrend) since ‘smart money’ simply moves the price to further lows.

Retail traders buying at tops or selling at bottoms

The phenomena of retail traders buying when the price has already gone high or selling when it has already gone low is something else ‘smart money’ exploits and where we might also take a contrarian view.

Nonetheless, we can only take advantage of this idea when we study the underlying market structure, even in the example of retail traders going against the dominant trend.

How is sentiment analysis different from the technical and fundamental analysis?

We could simply conclude that technical analysis ‘sets the prices to enter,’ while fundamental analysis moves those prices. But what does sentiment analysis do? Such a question can be quite tricky to answer confidently given the highly chaotic nature of the markets.

Sentiment may be the factor attempting to reflect a mismatch between technical and fundamental analysis. Let us illustrate with an example.

Sentiment analysis example

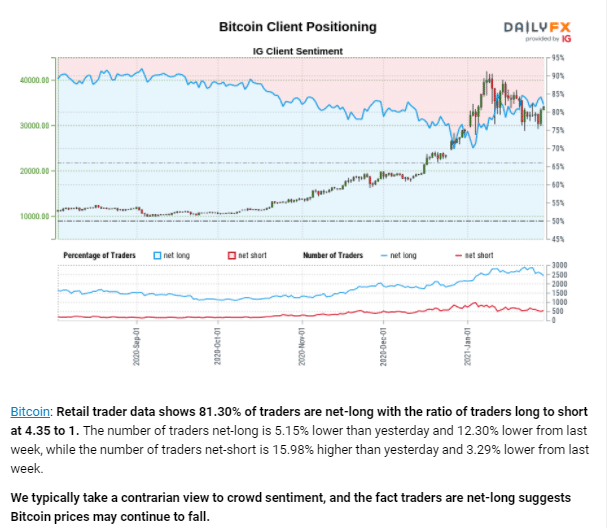

The image above is the IG Client Sentiment report for Bitcoin or BTC/USD. While not an exclusive forex pair, the main price of Bitcoin is against the US dollar, and we can use this as a good case study.

The technical analysis clearly shows a strong bull market; the fundamentals suggest a weak dollar and more substantial Bitcoin adoption than ever before. Using these three attributes alone, the immediate bias anyone would hold is for going long.

However, there is a mismatch between these facts and what the sentiment data suggests. An overwhelming number of clients are net long or have buy orders (81.30%), and this would naturally entail prices should continue rising.

As we’ve established that sentiment is often a contrarian indicator, IG suggests prices may fall instead. The mismatch is, although the technical and fundamental analysis generally agree with each other by pointing at a bullish bias, ultimately, market participants feel differently.

This idea reinforces the previous concept of retail traders buying at very high prices in an uptrend. Although this article is not leaning towards any suggestion, this is how traders can combine sentiment with other fundamental and technical factors.

The catch with sentiment analysis

Some may argue sentiment is more important than technical or fundamental analysis because an indicator like the IG Client Sentiment report gives us the real feelings of market participants.

The reasons for them holding the positions they have may have little to do with some economic report or resistance level. Thus, technical and fundamental analysis might seem insignificant if we can see how the market is feeling.

However, as with anything, sentiment can change at the drop of a hat as millions of traders change from buying and selling (and vice versa) for unknown reasons. How market participants are feeling right now is no indication of how they’ll feel in the near future.

Unfortunately, forex is a decentralized market, meaning that very few, if anyone, have access to the orders of every single of the millions of traders, let alone a vast majority of them. For example, IG claims to have at least 240,000 clients, which is microcosmic compared to the broader market.

List of popular sentiment indicators

There are very few viable forex sentiment indicators. As already established, forex is an over-the-counter market where an ordinary person would not have access to the real volume of traders for a particular pair. Essentially, there is no one central ‘forex order book.’

However, there are a few sentiment indicators that have caught the interest of traders worldwide for years.

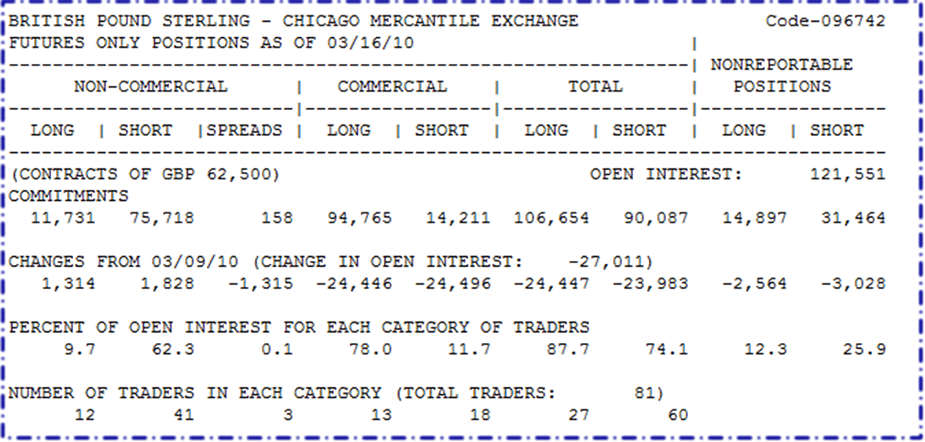

- Commitment of Traders (CoT) report: The CoT is the ‘granddaddy’ of forex sentiment indicators as it’s the closest thing to finding out the positions of ‘smart money’ or the ‘big boys’.

The Commodity Futures Trading Commission (CFTC) publishes the CoT every Friday to report the positions of currency futures markets traders (a significant portion of which consists of institutional traders) on the Chicago Mercantile Exchange, the largest futures exchange globally.

The forex futures markets move in tandem with the spot forex markets we are accustomed to, making the CoT a precious tool for long-term trends in the latter.

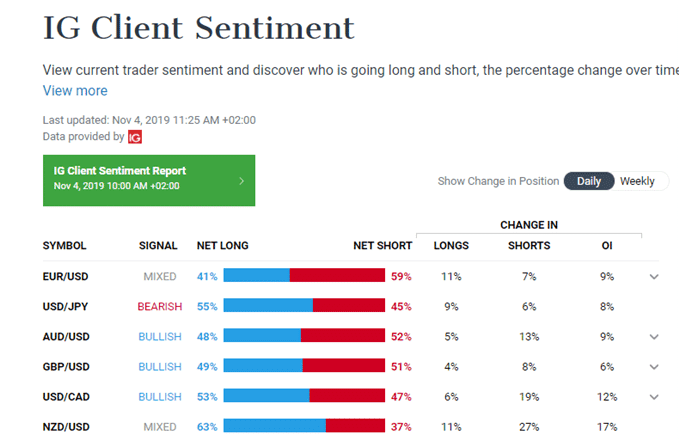

- IG Client Sentiment Indicator: This sentiment indicator is also well-known and a lot easier to navigate than the CoT report. This indicator reflects the client positioning (at least 240 000 clients) of IG, a long-standing, publicly-listed, and London-based derivatives broker.

What separates this indicator from others is aside from providing the information on the percentage of long and short positions, it also provides the directional bias (bullish, bearish, or mixed) traders should consider.

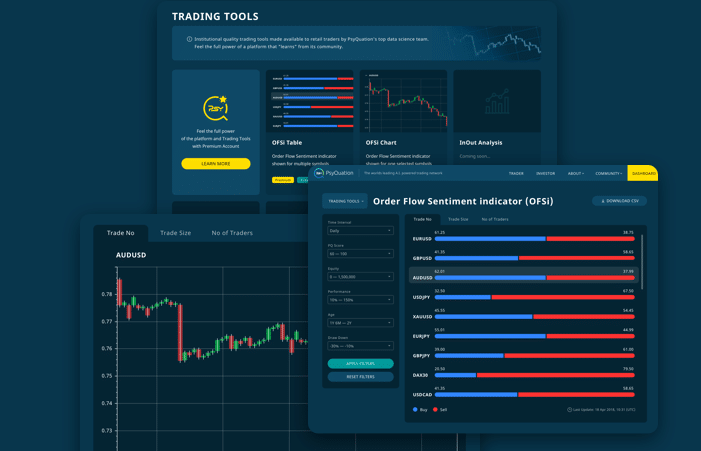

- Axi Order Flow Sentiment Indicator: Similar to IG’s tool, this sentiment indicator reflects the order flow of at least 23,000 clients trading on Axi (Australian-based broker), though in more detail.

Conclusion

Fortunately, rather than relying on polls for how traders feel about an individual instrument, sentiment indicators are much more accurate since they truly reveal where clients are buying or selling. When used strategically, sentiment analysis can be one of the most potent analysis forms.