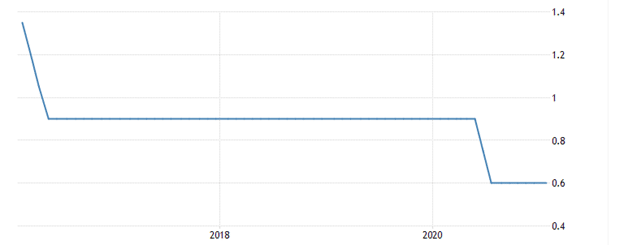

- Maintenance of a constant interest rate by the Hungarian National Bank at 0.6% may add impetus to supporting growth in 2021.

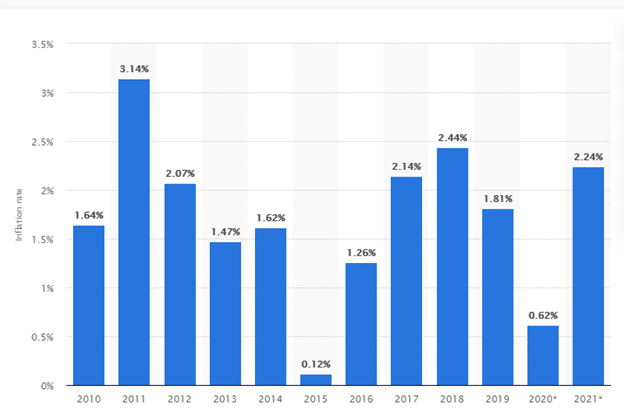

- An increase in the inflation rate to 2.24% in 2021 may boost positive investor sentiment in Hungary.

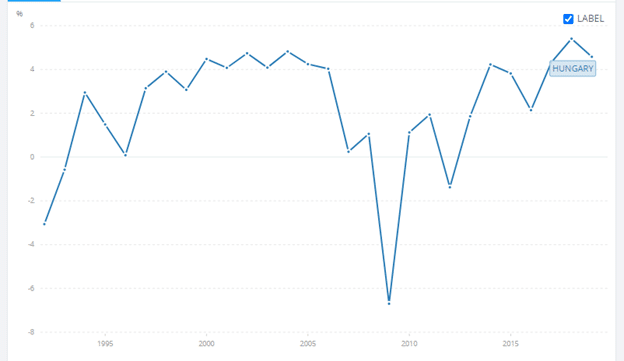

- Further decline in the GDP growth rate may affect recovery in Hungary post-COVID-19.

The Hungarian forint weakened near its December 2020 lows to hit 296.68 against the US dollar on January 29, 2021. The forint had strengthened from highs of 338.08 on April 3, 2020, to stand at 290.93 at the beginning of January 2021. The Hungarian National Bank (MNB) maintained the interest rate at 0.6% and the overnight rate of deposits at -0.05%. The inflation rate had slowed in September 2020 to 2.7% (about 0.3%), below the medium target rate of 3% into 2021. Decreasing inflation rates have contributed to an appreciation of the forint due to the currency transition to a market economy.

The appreciation of the Hungarian forint results from the decrease in both the interest and inflation rates. Hungary saw its inflation rise from 2.35% in 2017 to 3.34% in 2019 (+42.13%). Investors from the US feared an increase in inflation into the FY 2020-2021 after it soared from 2.14% (in 2017) to 2.44% (in 2018). The rate is expected to appreciate from 0.62% in 2020 to 2.24% in 2021.

Labor statistics in December 2020 showed that unemployment edged up 4.3%, with the annual jobless rate mounting at 1.2% percentage points. The labor force declined by 0.36% (from 4,720,620 in 2019 to 4,703,549) in 2020. This decrease presents a bad scenario for the HUF considering that it may accelerate the trade deficit between Hungary and the US.

US-Hungary trade relations

In 2020, exports from the US to Hungary increased from $1.9142 billion in 2019 to $1.9465 billion in 2020 (+1.69%). Imports from Hungary declined from $5.3101 billion in 2019 to $4.7552 billion (-10.45%). This decrease made the trade balance decelerate by $587 million in 2020 in favor of the US.

To help support government bonds’ purchase (below ten years): the Hungarian federal system will reallocate liquidity to fund the quantitative easing (QE) initiative. However, the QE program will need to be stepped up to recover a dwindling economy that has had limited growth since 2019.

The picture below represents Hungary’s annual GDP growth rate from 1995-2019.

The GDP growth rate declined from 5.405% in 2018 to 4.578% in 2019. This rate is expected to decrease from 5.0% in 2020 to 4.5% in 2021. A higher consumer price index (CPI) in 2021 is expected to turn things around for the forint. The inflation rate stood at 3.7% in 2020, up from 3.4% in 2019. In terms of the ease of doing business, Hungary was ranked 52 in the global list of countries. However, a perpetual drop in the GDP will erase economic gains made during the pandemic.

Technical analysis

In the short-term, fundamentals indicate that the Hungarian forint will gain against the dollar. The 14-day RSI supports a sell position of 37.596. The stochastic RSI is, however, looking at the buy possibility at 61.368. The 5-day moving average (simple) gives the new trendline at 294.47, while the exponential indicator points to the new support at 294.70. The 200-day SMA is at 295.17, while the EMA provides the latest support at 295.67.

In the short-term, the trading pair may violate the support at 294 and head lower. In the long-term, we expect the US dollar to regain advantage due to Biden’s administration’s implementation of the stimulus plan.