Automic Trader is an FX robot that promises a steady and compounded return without any prior experience in trading. This FX EA assures a passive income with its fully automated system. Under a low-risk setting, the ATS assures up to 30% monthly profits and up to 100% in a high-risk setting. This FX EA trades six different currency pairs and claims to be a beginner-friendly system.

Is this a perfect trend system robot still good to go?

This FX EA is promoted by the LeapFX company. The company offers exclusive trading tools, VPS, brokers, and managed account services. We could not find company details like its founding year, the developer team, a location address, phone number, etc. The lack of info makes us suspect the reliability of the company.

As per the vendor info, this FX Robot has the following exclusive features that make it stand apart:

- An account protection system

- Fully automated software

- Beginner-friendly design

- Supports more than 6 currency pairs

- Provides up to 100% profit on high-risk trade settings

- Promises up to 30% monthly profit on low-risk settings

According to the vendor, this FX EA works independently trading multiple times a day. The currency pairs it works on are shown below:

The vendor claims that the above pairs trend well and hence they were chosen for this EA. After the system identifies the right price momentum and enters a trade, it uses automatic adapting trade management for successful results.

How to start trading with Automic Trader

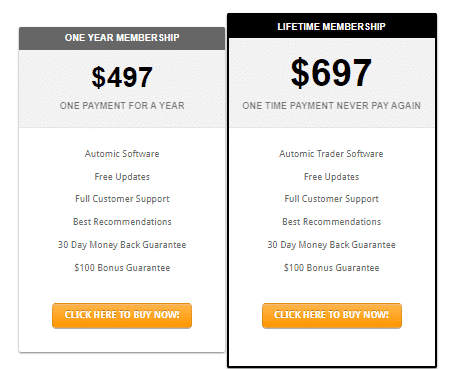

To purchase this FX EA, you need to choose from the two packages present. One is the annual membership plan that costs $497 per year and the other is the life membership package costing $697. The features available with the packages include the trading software, free updates, customer support, and best recommendations.

A 30-day money-back guarantee is present which you can use to get a refund if you are not satisfied with the product. An additional bonus guarantee of $100 is on offer if you find the system is not making a profit after 6 months of using it along with the original refund.

We could not find much info on the functionality, setting recommendation, and the required balance, leverage, etc. The lack of details makes us suspect this is not a dependable system.

Automic Trader backtests

No backtests are present for this FX EA on the official site. The strategy tester reports provide a better insight into the approach and the efficacy of the FX robot. Although they are based on historical data and cannot predict a similar performance in real trading, traders find them a valuable evaluation tool. The lack of backtests raises a red flag for this EA.

Trading results

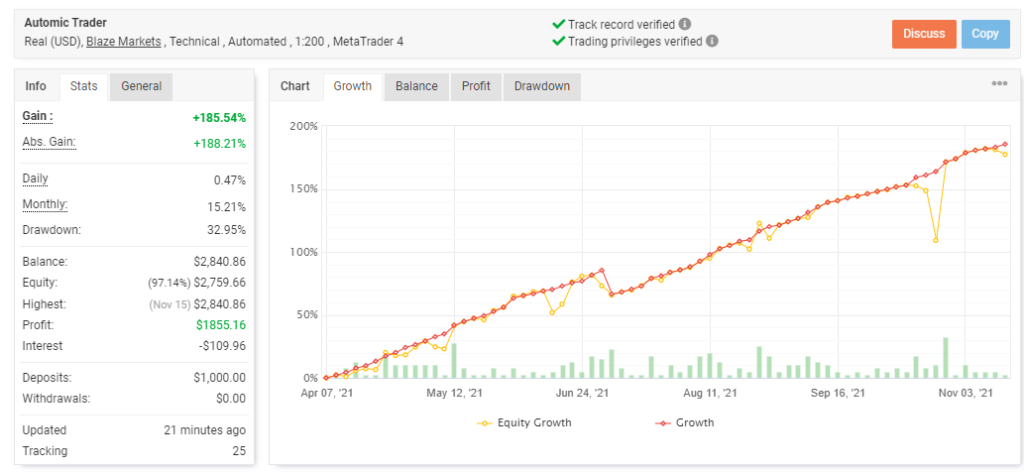

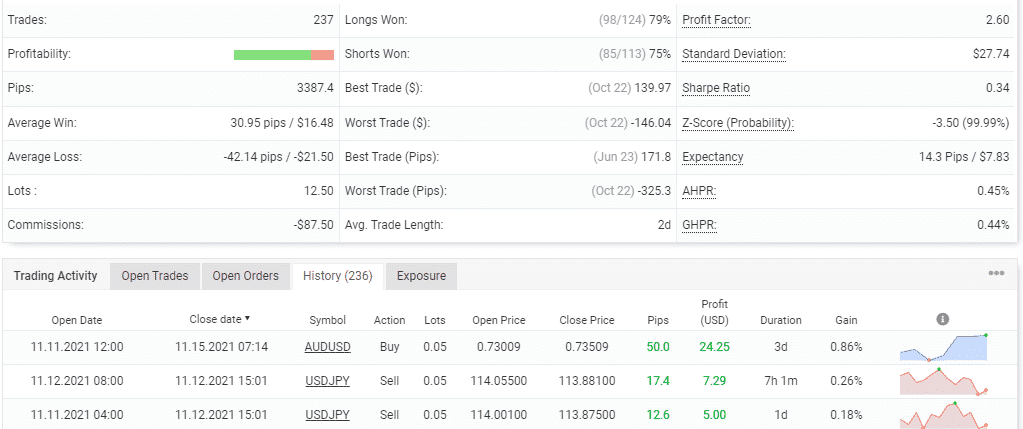

A real USD account using the Blaze Markets broker and the leverage of 1:200 on the MT4 platform is present on the official site. Here are a few screenshots of the trading results verified by the myfxbook site.

From the above report, we can see the system has generated a total profit of 185.54% and an absolute profit of 188.21%. A daily and monthly profit of 0.47% and 15.21% are present for the account. The drawdown for the account is 32.95%.

For the account that started in April 2021 with a deposit of $1000, a total of 237 trades have been executed with a profitability of 77% and a profit factor of 2.60. From the trading history, we can see the lot size used is 0.05. The high drawdown and big lot size indicate the approach used is dangerous and can put your capital at risk.

Customer support

An online contact form is present for customer support. We could not find a location address or phone number for contact. There is no live chat feature. The inadequate support makes us suspicious of the dependability of the company.

People feedback

We could not find user reviews for this FX EA on reputed third-party sites like Forexpeacearmy, Trustpilot, etc. The lack of feedback shows this is not a well-known system in the market.

Wrapping Up

Advantages

- Fully automated system

- Refund offer

Disadvantages

- No explanation is provided for the strategy

- High drawdown in trading results

- Expensive price

Automic Trader claims to provide high returns with its trend-based approach. Our evaluation of the EA reveals many shortcomings that make it an unreliable system. For starters, the vendor does not provide info on the trading approach. The real trading results show a high-risk approach and the vendor does not provide backtesting results. Further, the absence of user feedback, inadequate support, and the expensive cost are other downsides that confirm our assessment of the unreliability of this FX robot.