Many investors don’t even bother with risk management or looking for a more reliable indicator, more definitive entry and exit signals, and automated Forex trading software that can help them succeed in the market.

Trading in Forex comes with its fair share of risks and every prudent trader has to do their bit to manage them, although it is not possible to eliminate them entirely. A seasoned investor, however, employs the best Forex risk management strategies in an attempt to minimize the risk. Here are five tips that will help you manage your risks better and stay away from common mistakes that often lead to losses.

1. Establish your risk tolerance

You should keep in mind that no risk should be taken without calculating the reward that you can attain through it. You don’t want your losses to exceed your profits in the long haul, in spite of losing out on a few trades. In order to find out whether a trade is worth the risk or not, your Forex trading plan should have its own risk to reward ratio.

The percentage of your account’s value you are willing to risk largely depends on your experience level. If you are new to the Forex market, you naturally want to take some time familiarizing yourself with the trading techniques, so the smaller risk levels appeal to you more.

In order to calculate the risk to reward ratio, you need to weigh up the money you are spending on a transaction with the potential profit. For instance, if the peak value of the loss is $300 and the maximum profit is $800, the ratio will come to 1:2.6.

2. Manage Your Timing

There is nothing more exasperating than not being able to grab an opportunity because of timing constraints. The Forex market operates 24*5 and so this problem can be commonly seen, especially when you are trading for the short-term. Of course, you can get yourself a Forex EA or robot, but such systems are not always reliable and require you to surrender some of the controls.

This essentially means that you need to be there to conduct the trades when the occasion presents itself. If you have a regular day job, a family, and an active social life, you need to manage your time well. In this case, you should consider trading the hourly or daily charts based on your lifestyle.

You can also set stop orders for risk management when you have other things to attend to. This allows you to keep making trades while the market is favorable and immediately stop the trade when the price shifts in another direction.

3. Avoid weekend gaps

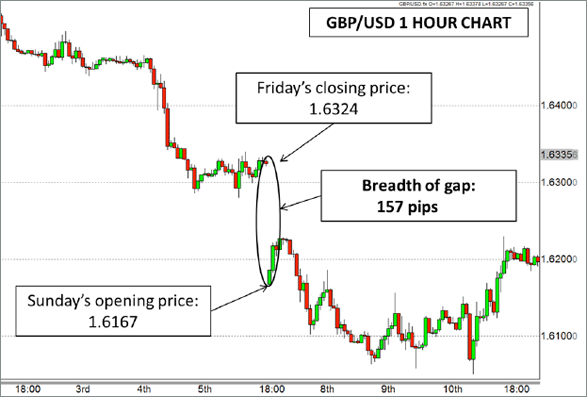

It is a great challenge for investors to hold the currency over the weekend and you shouldn’t do it until and unless it is a profitable position. In the Forex market, the pairs often tend to open at a different level from the closing price on Friday. This can happen due to an important event that alters the order flow that in turn causes the opening price to change.

In the event of a geopolitical crisis, you should be particularly wary of holding over the weekend. If a gap opens, it might rise beyond the stop loss you placed, so the loss you suffer could be much larger. That being said, there have been instances when the price gap has been favorable for investors.

But, as a best practice, you should exit the trade on Friday and reopen it later in order to avoid this phenomenon altogether. The figure below shows us how a large gap can exceed a stop, provided you placed it within the gap.

4. Formulate a strategy

Many players who are new to the Forex market trade solely based on instinct or some recent news development. If luck favors them, they could make profits from such trades, but this does not happen every time. For effective risk management, you need to formulate a strategy outlining the following:

- When to place a trade

- When to exit the trade

- The risk to reward ratio

After coming up with a plan, you need to follow it religiously. Having a solid plan will prevent you from making impulsive trading decisions and clearly define your rules for entry and exit, so you know exactly when you should take profits or сut losses. Additionally, having a good plan makes a more disciplined trader out of you, and as such, you can manage your risks with greater effectiveness.

Furthermore, you should be careful not to attach too much significance to the most recent profit or loss. Try not to go out of your way to gain profits from your current trade.

5. Keep things simple

Keep things simple and start trading with a demo account first to get an idea about the Forex market. This way you can gain some much-needed confidence without losing any actual money.

Responsible investors always advise against putting in more money as an investment than what can be afforded. You should remember that investing is not gambling and you shouldn’t risk all of your hard-earned money on a volatile market where the prices often change based on unpredictable dynamics.

When you trade with money you cannot afford to lose, it places you at a psychological disadvantage because you tend to make hasty decisions like taking your winnings too early or holding your losses longer than required.

Summing Up

These risk management practices will not only save you from suffering huge losses in the Forex market, but they will also help you know your way around the market in a shorter time. Of course, there are other factors at play that will determine your success, but risk management would certainly make long-term success more likely.