What Is a Forex Broker?: An Introduction

A forex broker or an exchange provides the means for traders to carry out their buy/sell trades through a trading platform. The amount of currency exchanges in the financial industry is substantial, making the novices and amateurs confused. These brokerages differ in terms of spread, regulations, instruments, platforms, deposit/withdrawal methods, education, customer service, etc.

IC Markets: How Does It Fare Compared With Other Brokers?

IC market is one of the most noted brokerages that have low spreads, not just on the EUR/USD but on all other forex pairs. This versatility makes it a unique choice for traders that trade multiple pairs and demand low fees. Not only this, the exchange is preferred for automated trading by most robot users due to its fast execution speeds. Let us dive into the details of the best forex brokers in the market.

Regulation

The broker maintains its trustworthy status as three top tier authorities regulate it. Australian Securities and Investments Commission (ASIC), Financial Services Authority (FSA), and Cyprus Securities and Exchange Commission (CySEC) are responsible for making sure the exchange complies with the standards and keeps its services free of fraud.

Other than regulation, IC markets keep their client’s funds in a segregated bank account. The broker also holds to anti-money laundering schemes.

Spreads and Fees

Spreads and fees are most looked after prospects by traders when they look out for reliable brokerage. As mentioned before, IC markets has kept it’s head above in the industry by providing the lowest possible spread on major/minor pairs, including metals.

Image 1: The spreads offered by IC markets can be seen. The image was taken at night during the London/Tokyo session interchange when the spreads are usually high. Even at that hour, the broker maintains its low rates.

Other than spreads, deposits and withdrawals will cost nothing. Some fees may incur during bank transfers by the institutions themselves. There is also no account inactivity fees.

Opening an Account

Anyone looking to get their hands in the forex at a moment’s notice should try opening an account with IC Markets. The whole process will only require a few minutes. A demo account is free, but a minimum deposit of 200 USD is required to trade a live account.

Deposit and Withdrawal Methods

Fifteen different funding options are available at IC markets to deposit in 10 base currencies: USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD. Credit/debit cars, PayPal, e-wallet, UnionPay, and bank/ wire transfer can be used to put money in your trading account. Depositing cash in IC markets with the same currency as your bank will ensure no conversion fees occur.

Withdrawal methods are also the same as deposits and should be done in an account under your name to prevent fraudulent activity.

Trading Platform

Having your own choice of the trading platform can help in executing your buy/sell executions smoothly. IC markets has support for a wide range of such programs, including MetaTrader4/5, MT WebTrader, MT iPhone/iPad, MT Android, MT Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader Android, and cTrader cAlgo. The company does not have its own trading software; however, the above-mentioned third-party platforms are good enough to cater to your needs.

Trading Instruments

The range of instruments available at the brokerage is broad. IC markets allow its customers to trade on forex, commodities, indices, bonds, digital currencies, stocks, and futures. Primarily being a forex broker, the company allows you to trade on 65 currency pairs where the total number of tradable assets is 232.

Account Types

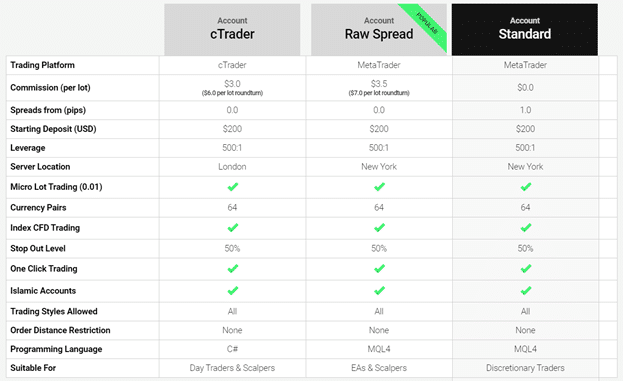

The exchange has three different types of accounts under the following names:

- Standard

- Raw spread

- Raw spread (cTrader)

Raw spread accounts are most favored by traders and are the recommended choice by the broker itself. With commissions starting from 0 pips, raw spread offers blazing fast executions having only a 7 USD charge per lot round-turn. Minimum deposits start from 200 USD, and leverage of 500:1 is available on all. Day traders, scalpers, and expert advisors can get the most out of the different account types at IC markets.

Image 2: Different account types and their respective characteristics can be seen.

Research and Education

IC Markets has trading ideas in its clients’ sections, some charting tools, and a market news feed to keep you updated on all the latest from the financial world. The broker provides MAM/PAMM, VPS, trading servers, and MT4 advanced trading tools.

The education section includes basic stuff necessary for any novice trader to read. It covers an overview of trading alongside helpful video tutorials on using MetaTrader 4/5. Webinars and quality articles give valuable information on risk management and technical analysis.

Customer Support

Clicking on the 24/7 customer service will take one to the FAQ page, answering most of the questions. Still, if you have more questions, you can reach out to their support by clicking on the live chat option available 24/7. Phone and email are also accessible as the means to contact the broker. The overall service is fast with quick response times.

Bottom Line

The services offered by the IC markets indeed make it one of the top choices amongst the traders. Lower spreads, fast execution, superior technology, ultimate trading conditions, advanced trading tools, platforms, and regulation add to the broker’s plus points. With no requotes, restrictions, price manipulation, trust, and transparency IC Markets take its place as one of the best forex brokers.