Overview

As a beginner, you don’t need to find MT4 daunting. As one of the most widely used trading platforms (particularly in forex), MT4 gained its large market share partly because of the user-friendliness and simplicity it provides.

Understanding some of the basic functions is particularly important in the context of other fundamental aspects of forex.

If people talk about market execution or pending orders, for example, this is one of the functions that one should efficiently perform on the software without hesitation. This article will break down certain sections of MT4 and what each process does.

Navigation tools

The picture above shows the top pane of the platform with different navigation tools. Each number corresponds below to an important function and what it does.

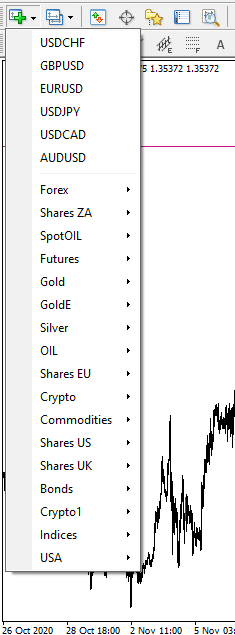

- Create a new chart: Using this option enables the user to see a selection of available instruments from their broker and open charts for them.

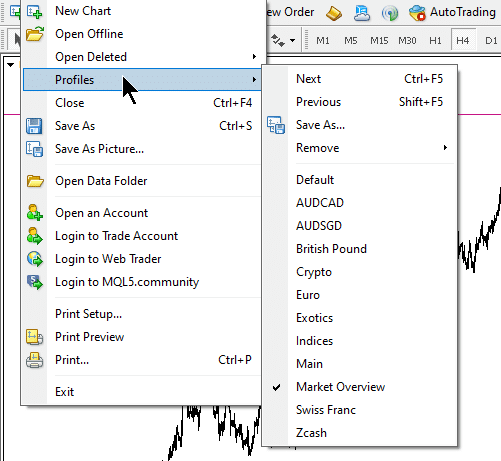

- Profiles: Profiles are one of the must-know functions of MT4 due to their time-saving capability. They will allow one to group selected instruments based on different groups. When the trader logs in again, by simply clicking on a profile, all charts that they saved here will show in order.

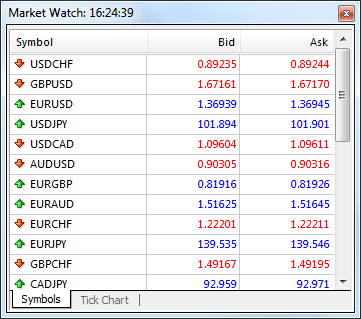

- Market Watch: We can see the bid and ask prices for all instruments provided by the broker. Furthermore, other uses of the Market Watch include seeing the real-time spreads, tick charts, swaps, and opening times of the chosen markets.

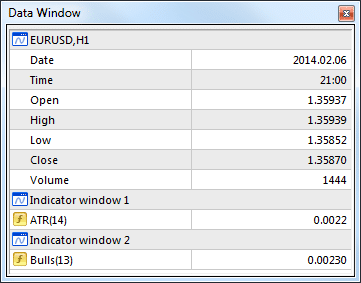

- Data window: Using this option, a trader can see the date, indicator values, and open, close, high & low prices of the markets they currently have open orders for.

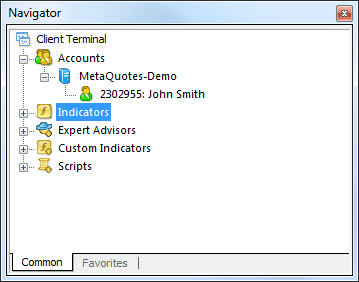

- Navigator: The Navigator displays all the accounts that one can log into directly from the same platform, along with any installed default indicators, custom indicators, expert advisors, and scripts for a particular market.

- Terminal: We will cover this part later as it’s one of the crucial components to understand.

- New order: This section opens up the order window where traders open orders and set the necessary parameters for them.

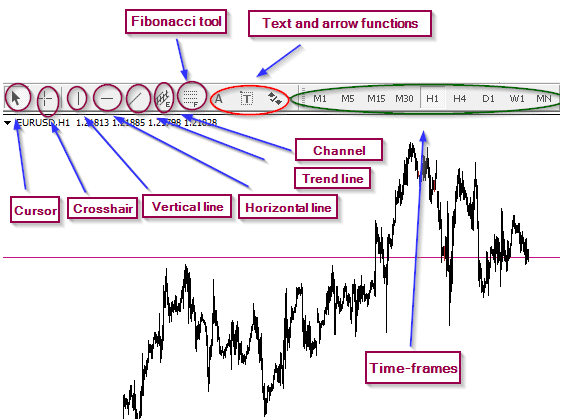

- Charts: MT4 supports three different types of charts, namely the bar chart, Japanese candlesticks, and line chart. The Japanese candlesticks are the most widely used amongst traders for their visual aesthetic and ability to reflect price action.

- Overlapping tiles: With this option, users can have the platform to show multiple charts at once, depending on the current profile.

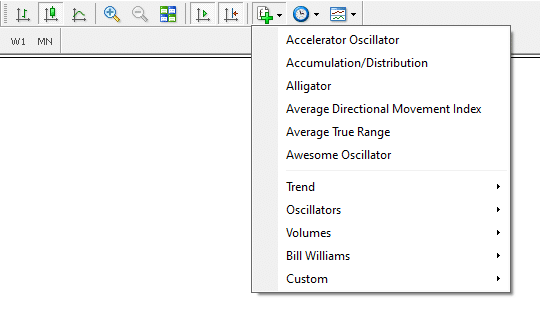

- Indicators list: This section allows users to access most of the built-in indicators, including custom ones.

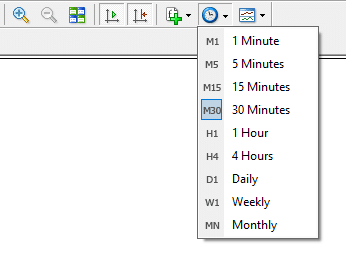

- Periods list: The periods list is another way to access all available time-frames of a chosen instrument.

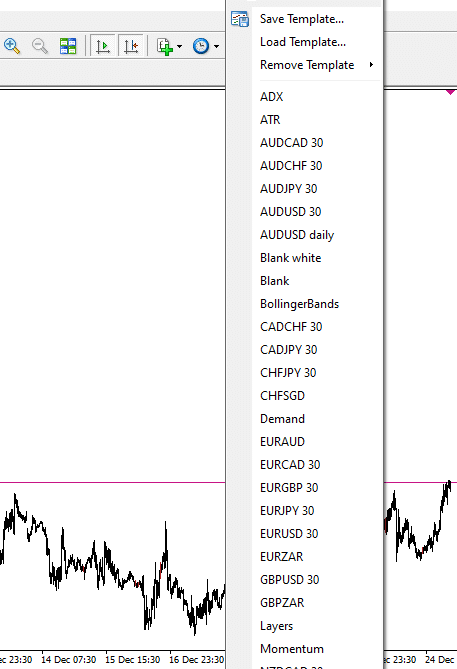

- Templates: Creating templates is a handy tool allowing traders to save different settings and charting work for specific markets. For example, a user may save a template on the GBP/USD pair with a custom indicator and some channels drawn onto it.

Another template can include EUR/USD with an RSI, MACD, and a couple of trendlines. Templates are an organizational tool for traders.

Drawing tools and time-frames

MT4 offers one of the simplest interfaces for technical analysis charting. The platform has nine built-in time-frames, namely the 1 minute, 5 minutes, 15 minutes, 30 minutes, 1 hour, 4 hours, daily, weekly, and monthly.

The terminal

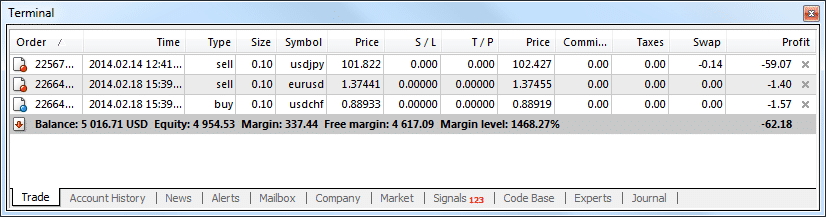

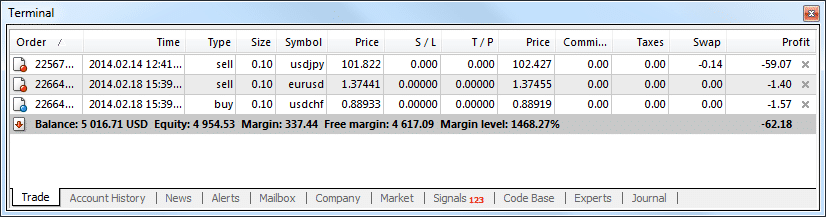

MT4’s terminal is a detailed representation of a trader’s account. Fortunately, you can make this function disappear to allow more space at the bottom of your screen, providing a more minimalist look. Before a position, this section will only show Balance, Equity, and Free margin.

There are no open trades during this stage; hence all three will show the exact amount (essentially the account balance). However, equity and free margin become more relevant with new open positions.

When a trade is live, further parts become visible on the terminal. The equity represents the fluctuating account balance in real-time.

The margin represents how much a position is worth in relation to the position size and leverage used. Free margin is the amount that is still tradeable after the used margin. The margin level is a percentage of the total margin utilized.

With the exception of the margin and balance, all other elements vary according to the price until a position is closed. The margin level percentage is significant for preventing margin calls. Different brokers will employ various stop out levels, usually between 25% and 50% margin level.

If one’s margin reaches these levels, the grey bar will turn red, signaling all positions are at increased risk of being automatically liquidated by the platform. Therefore, traders always need to ensure sufficient margin by risking only a small portion of their account per trade and making proper calculations beforehand.

Order functions

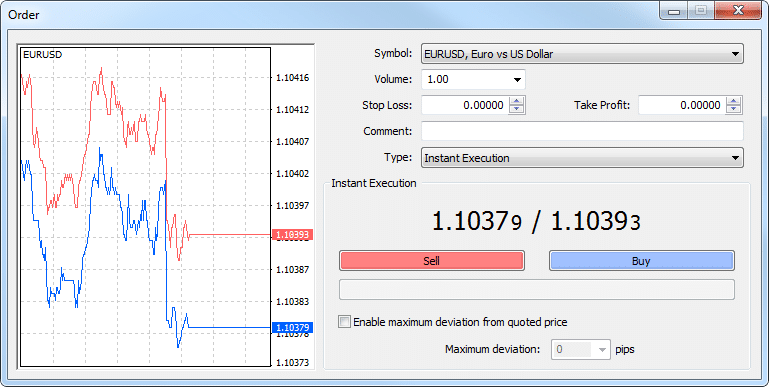

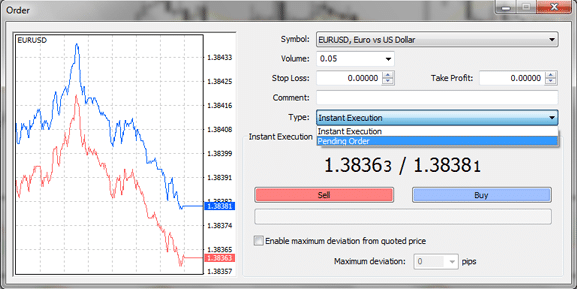

MT4 supports two order execution types, market execution, and pending order.

Market execution is an immediate order using the current price. A pending order pertains to when a trader sets an order at a price the market may or may not reach in the future. One also can choose to have an expiry date on such orders that the software automatically cancels if not filled.

Regardless of the execution type, it’s imperative to set stop loss levels before the order triggers. Depending on the market’s volatility, not setting these levels beforehand may cause price to go against you suddenly and severely.

Conclusion

All the features above are necessary for new traders to familiarise themselves with MT4. Of course, we have only scratched the surface of this platform, although mastery of these tools will enable a better user experience and ultimately enhanced understanding of trading.