Overview

- Prices of gold and copper have rebounded after plummeting to multi-year lows at the beginning of the year.

- Weakening dollar prices have led to an increase in commodity prices, with copper gaining more than gold.

- Increased industrial activity and heightened demand from China are expected to push copper prices.

Copper futures were up on 23rd December 2020. This trendline is indicative of the increased industrial activity and weakening dollar. Vaccine development has eased pressure on traders regarding the new coronavirus variant that has hit the UK market. The metal traded at $3.5220 on 23rd December 2020, 2.90% below this year’s high of 3.6275. Gold futures are also gaining ground, rising to $1,864.85. Prices may rise to $1870 by 31st December 2020.

Weak Dollar

The falling dollar index is one reason behind strong commodity prices. Global products such as copper are priced in dollars and have an inverse relationship with the currency. The dollar index was up by 0.3% to 90.546, showing the dollar had not recovered from multi-year lows. The index is headed toward 89.811 – a two-year low by the end of the week.

The delayed approval of the COVID-19 stimulus package by the US President may strengthen the dollar. The Trump administration called for increased checks to the American public, a situation that will increase the value of the dollar against other currencies. However, this effect may be minimal, considering the expected commodity rally of precious metals. The stimulus package will boost risk-taking among traders. This move will further reduce the dollar index.

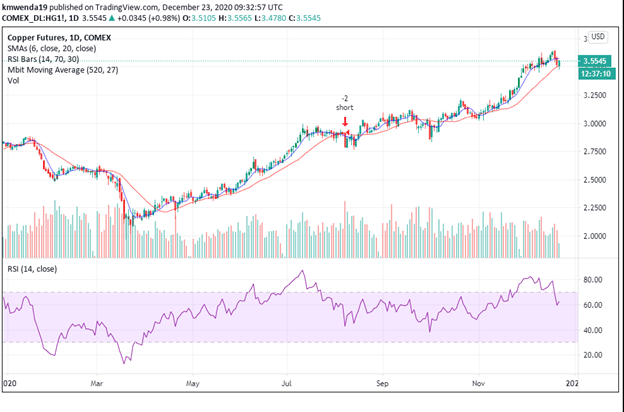

Copper’s rise has been steady and significant over the past eight months, while gold has struggled to gain an advantage (See Chart 1). The failure of gold to rally substantially in the wake of a falling dollar index indicates that investors are warming up to rising bond yields. There is a strong recovery of the global economy shown by the increase in order flows. Vaccine-related developments and the ease in economic restrictions have tilted copper prices to multi-year highs.

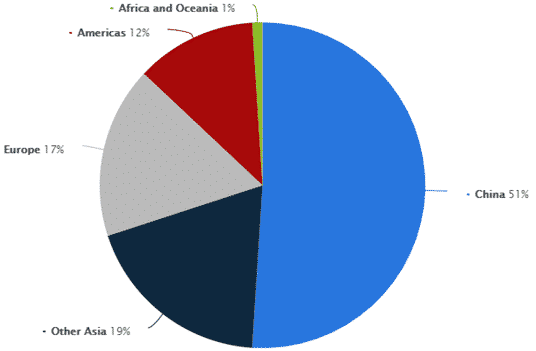

There is increased demand from China, especially in the construction of freezers for food storage. Countries affected by COVID-19 lockdowns have increased demand for copper due to the fear of possible food shortages towards the year-end. Price per ton has risen from $4,500 in March to $ $8,000 in December 2020. China is currently the highest consumer of commodities, notably refined copper at 51% (See Chart 2).

Underinvestment in new mines is causing a tight supply situation. The expected gain in construction activity and household appliance manufacturing will add pressure to the metal’s price. Copper production is expected to contract from the 20 million metric tons recorded in 2019. Reduced mining activity caused by lockdowns and industrial restrictions will mean lower copper production against heightened demand.

The progress of green industries such as electric car manufacturers and renewable energy producers is piling pressure on the copper price. The current forecast is that copper may soon enter into a super-cycle with no signs of slowing down.

As the global economic barometer, a positive trend in the metal’s prices indicates that the worldwide demand will maintain consistency.

Technical View

The 6-day Simple Moving Average indicates that copper price found support at 3.5740 while the 20-day SMA stood at 3.5133. This uptrend shows that copper prices will increase in the short term.

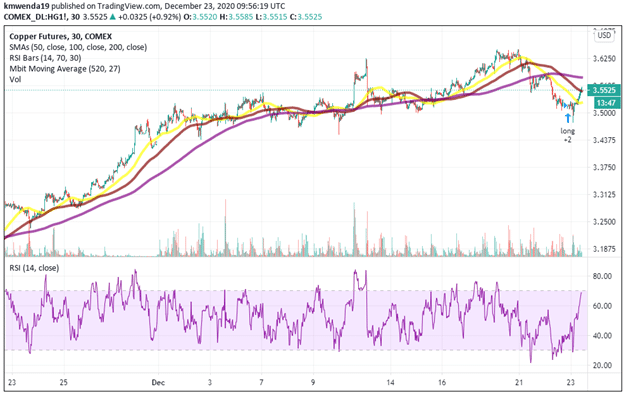

The impulse movement has tilted upwards, indicating a constant uptrend in the short-term (See Chart 3).

In the 200-day SMA, copper futures are expected to find resistance at the 3.5809 level.

The relative strength index (RSI) of the copper future in a one-month analysis is 70.11. This index shows that there were increased buying activities among investors during the month of November-December. The RSI is also moving in a consistent uptrend, indicating a positive momentum of the commodity.

Trader sentiment is positive towards copper. The net-long position of gold indicates that prices may fall.