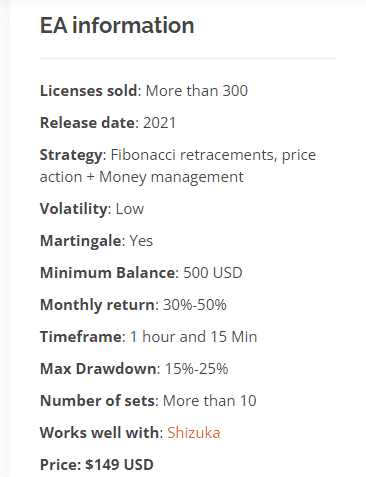

Big Poppa EA is an FX robot released in 2021 by BenderFX. As per the vendor, the EA is highly profitable with its effective strategy. It is a low volatility system that uses the Martingale approach as part of its strategy. Since its launch, the company has sold over 300 licenses of this EA. As per the vendor, this system can provide a monthly profit of 30% to 50% and a drawdown ranging from 15% up to 25%.

Is this a reliable robot still good to go?

BenderFX is a South American company formed by a team of young traders specializing in automated strategies. The About Us section of the official site reveals that the team members are knowledgeable in data analytics, development, machine learning, and genetic algorithms. The vendor mentions that the system has used different strategies, risk management, and money management for ensuring high profits and minimal risk. There is no mention of the currency pairs the EA can work with.

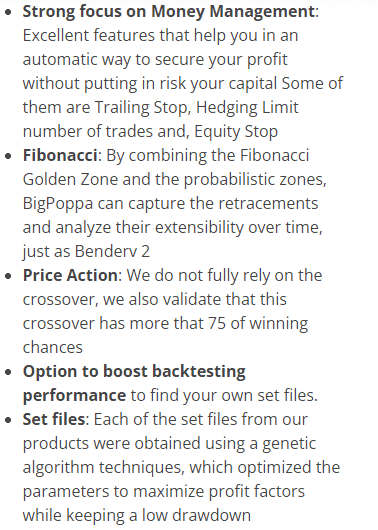

According to the vendor, the EA uses Fibonacci retracements, capital protection, price action, and money management for ensuring effective results. By linking the probabilistic zones with the Fibonacci Golden region, the ATS can snag the retracements and assess their reliability. For price action, the vendor explains that the MT4 tool does not rely on crossover alone but confirms it properly before using it.

How to start trading with Big Poppa EA

This FX robot will cost you $149. As per the info present on the official site, the system focuses strongly on money management. It has features like trailing stop, equity stop, hedging limit, and more that help it to increase returns without endangering your capital.

Some of the recommendations for this ATS include a minimum balance of $500 and a timeframe of one hour and 15 minutes. The vendor offers an option to enhance backtesting performance to help identify your set files. According to the vendor, genetic algorithmic methods are used for creating the set files that are optimized with parameters that ensure maximum returns with a low drawdown.

Big Poppa EA backtests

No backtesting reports are present for this FX EA. The lack of strategy tester reports raises suspicion concerning the reliability of the system. Backtesting is an integral part of trading as it helps in giving you a deeper insight into the EA and its efficacy. Although the tests use historical data, they are useful tools that traders look for. The absence raises a red flag for this EA.

Trading results

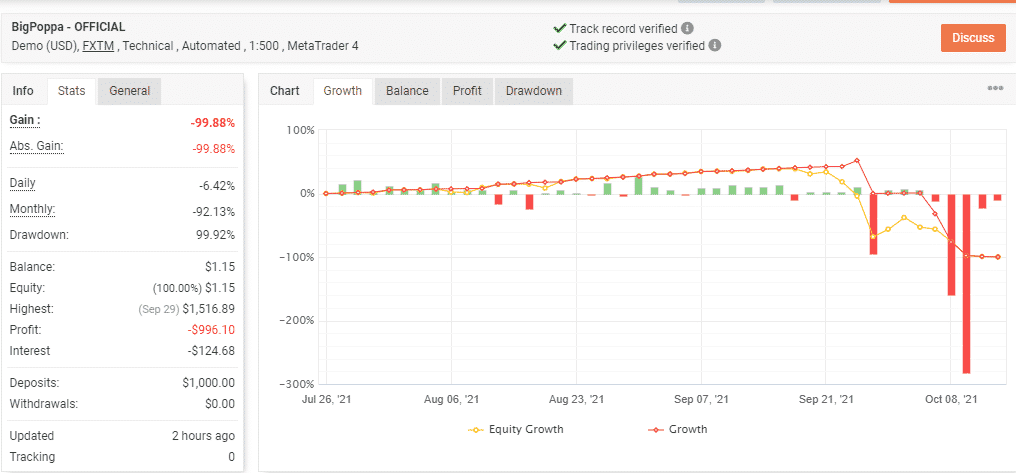

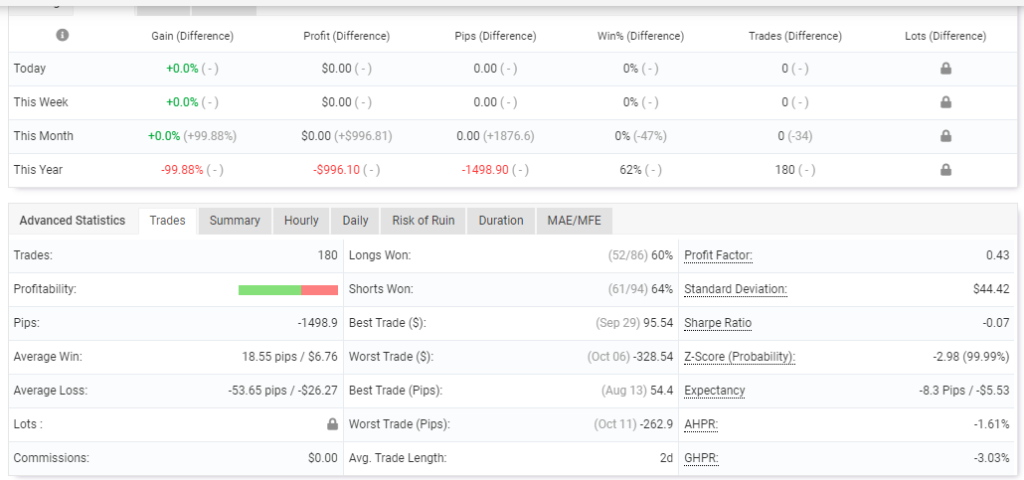

A demo USD account using FXTM broker and automated trading style with the leverage of 1:500 on the MT4 platform is shown here:

From the above stats, we can see the system is under a heavy loss. A total loss of 99.88% and daily and monthly losses of 6.42% and 92.13% are present for the account. The drawdown is 99.92%. For a deposit of $1000, the account that started in July 2021 has completed 180 trades with a profitability of 63%. The profit factor value is 0.43. We could not find info on the lot size as the vendor has hidden all details related to the lots used. The high drawdown and hidden data raise a red flag for this EA. They indicate a high-risk approach.

Customer support

A Telegram channel link is the only support method the vendor offers for this EA. While the vendor mentions the company is based in South America, there is no location address or phone number present for contact. The insufficient support makes us suspect this is not a reliable product.

People feedback

We could not find user reviews for this FX EA on reputed third-party sites like Forexpeacearmy, Trustpilot, etc. The lack of feedback indicates this is not a popular system among traders.

Summary

Advantages

- Fully automated system

- Verified trading result

Disadvantages

- The high-risk Martingale approach is used

- Big drawdown and loss in demo account indicating a risky and ineffective approach

- No money-back assurance

Big Poppa EA assures a drawdown of 15% to 25% and high profits. From the demo account results, we find that the claims are false as the results reveal a near-total loss of capital. The use of the Martingale system which is considered a dangerous approach is another indicator that this is not a reliable FX EA. Further, there are other downsides like lack of backtesting results, absence of user reviews, insufficient support, and inadequate info about the system. With so many downsides, we find this is not a trustworthy expert advisor we can recommend.