We Like:

- Over 15 years of experience in the financial trading space

- Internationally registered broker

- Waives deposits and withdrawal fees

- Well-regulated broker

- Offers deep liquidity with no dealing desk intervention

- Low trading commissions

- Lightning-fast executions

- Invest in copy trading

- Lose only what you invested using negative balance protection

- Solid security of your funds through segregation

- Wide range of markets to trade as CFDs

- About 85 industrial awards attained

We Don’t Like:

- One-time $15 fee for account maintenance

- Monthly fee of $5 after six months of account inactivity

- Some payment options may charge fees for a transaction

- High minimum deposit of $1000 compared to other brokers

- Not available to USA residents

The Verdict:

FxPro Group Limited is a unified entity of an array of brokerage companies under the trademark FxPro located in different regions of the globe, serving both retail and institutional CFDs traders. The CFDs provider holds an international trade supplier license from the Invest in Great Britain and North Ireland body and regulation from the Securities Commission of Bahamas on a global scale giving it the momentum to expand worldwide.

The brokerage conglomerate pioneered in the financial trading space back in 2006, aiming to offer dealing-desk-free CFDs trading to retail and corporate traders with meager fixed and variable spreads and ultra-fast executions.

At this writing, FxPro claims to serve clients from over 170 countries speculating its CFDs marketplace holding 400+ trading instruments, with spreads starting from 0.6 pips and execution speeds of under 14 milliseconds.

Company Details

FxPro Group Ltd is an umbrella of CFDs liquidity providers under the trademark FxPro based in different locations around the globe, but the broker’s head office operates in London, England. The brokerage giant made its debut in 2006 before extending roots worldwide and visioned to offer CFDs to retail and institutional traders on a wide range of markets.

Currently, FxPro serves clients from 170+ countries with quality trading services such as providing direct access to deep liquidity, tight spreads starting from 0.6 pips, and speedy executions in under 14 milliseconds. The broker claims more than 2400 trades execute in under one second. Customers place these orders from the broker’s asset classes that hold more than 400 trading instruments.

FxPro asset classes include:

- Forex pairs

- Commodities

- Indices

- Futures

- Shares

- Cryptocurrencies

Clients speculate on these assets’ instruments as CFDs with no dealing desk intervention as FxPro claims to operate as a true NDD purely. Trading CFDs gives clients a chance to maximize their profits by going long and short, thus having the hedge even when the markets go down. It also presents an opportunity to diversify your portfolio by trading a spectrum of instruments without owning the underlying product.

And at FxPro, the CFDs products trade with a leverage of up to 1:500 backed by 24/5 expert customer support and low commissions. Most of the broker’s instruments only trade with fees due to the market spread. The mitigated commissions, among other advantages, fueled the company to achieve milestones, and at the time, FxPro is said to have won 90+ industrial awards.

Nonetheless, FxPro aims to help clients get more profits when exploring its markets by providing smart trading tools that give insights into the market trends and help calculate profit and risk margins. These tools integrate with the broker’s stream of trading platforms encompassing the MT4, MT5, among others.

FxPro’s integrated trading tools include:

- Economic and earning calendars

- Trading calculators

- Daily market review

- VPS

But traders fund their trading accounts to practically apply these tools and trading platforms with a set monetary size. The minimum deposit accepted by FxPro is capped at $1000 across all its real account types. However, the liquidity provider also provides a demo account that inexperienced traders access to boost their trading skills before diving into the financial markets.

FxPro offers a spectrum of real accounts tailored to serve different traders depending on their overall market ambitions. Some might choose to sign for the copy trading account as investors or signal providers, while others could go for the retail or corporate accounts. Meaning they will all fall under varying trading conditions. However, all customers access the following payment options when funding their accounts.

Available payment options

- Bank wire transfers

- Debit/credit cards

- Skrill

- Neteller

- UnionPay

Regulations

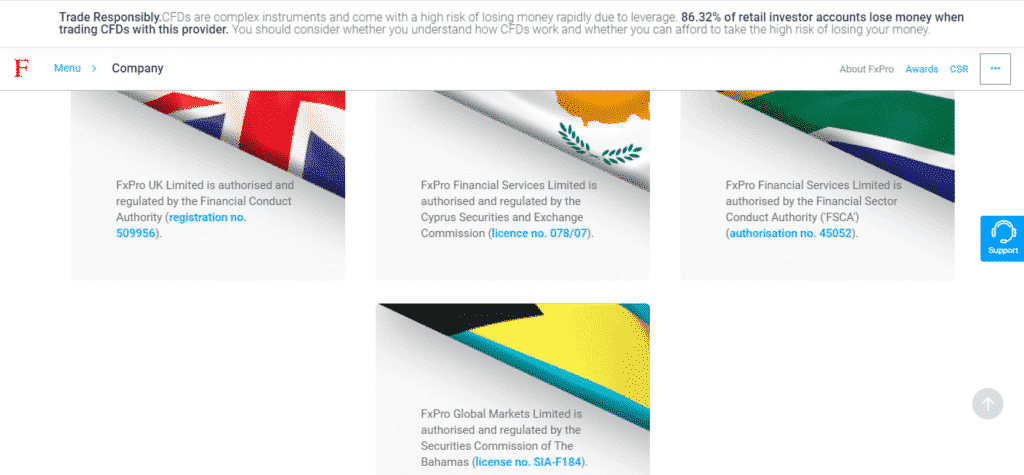

FxPro falls under a reputable regulation led by the FCA, a top-tier agency among other legitimate regulatory bodies such as the CySEC, FSCA, and more other credible registrations making the London-based CFDs provider a safe broker.

Its licenses and registrations:

- Regulated in the UK by the Financial Conduct Authority (FCA) — license No. 509956.

- Regulated by the Cyprus Securities and Exchange Commission (CySEC) — license No. 078/07.

- Also regulated by the Financial Sector Conduct Authority with the license No. 45052.

- FxPro Global Markets holds the license SIA-F184 from the Securities Commission (SCB) of the Bahamas.

Trading Platforms

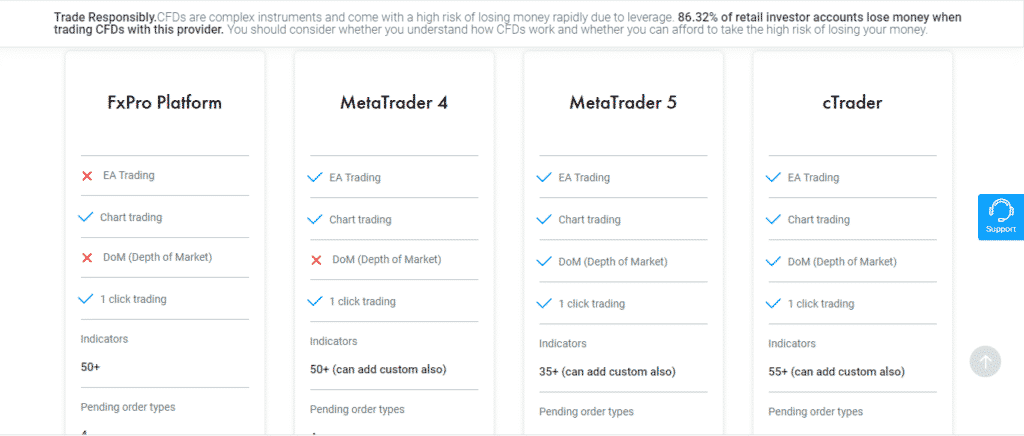

FxPro offers an array of trading platforms, including the world’s popular trading platforms, its proprietary trading platform dubbed FxPro Edge, and a copy trading platform — cTrader. The platform a trader selects decides the account applicable to him as most go for the MT4 and MT5 trading platforms.

FxPro Edge

- EA trading — no

- Chart trading — yes

- Depth of market — no

- One-click trading — yes

- Indicators — 50+

- Pending order types — four

- Trailing stop — no

- Price alerts — sound

- Chart types — line, bar, candlesticks, Heiken, Ashi, HLC & dots

- Chart time frames — 15

- Trading central integration — no

- Sentiment — only for majors

- Languages available — one

- Coding language — N/A

- Integrated economic calendar — yes

- Detachable charts — yes

MetaTrader 5

- EA trading — yes

- Chart trading — yes

- Depth of market — yes

- One-click trading — yes

- Indicators — 35+ (can add custom also)

- Pending order types — six

- Trailing stop — yes

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks

- Chart time frames — 21

- Trading central integration — yes, with a plugin

- Sentiment — no

- Languages available — 49

- Coding language — MQL5

- Integrated economic calendar — yes

- Detachable charts — yes

MetaTrader 4

- EA trading — yes

- Chart trading — yes

- Depth of market — no

- One-click trading — yes

- Indicators — 50+ (can add custom also)

- Pending order types — four

- Trailing stop — yes

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks

- Chart time frames — nine

- Trading central integration — yes, with a plugin

- Sentiment — no

- Languages available — 37

- Coding language — MQL4

- Integrated economic calendar — no

- Detachable charts — no

cTrader platform

- EA trading — yes

- Chart trading — yes

- Depth of market — yes

- One-click trading — yes

- Indicators — 55+ (can add custom also)

- Pending order types — six

- Trailing stop — yes + advanced take profit and breakeven stop loss

- Price alerts — sound, email, notification

- Chart types — line, bar, candlesticks, and dots

- Chart time frames — 26+ tick, range, and Renko

- Trading central integration — yes via chart targets

- Sentiment — yes

- Languages available — 22

- Coding language — C#

- Integrated economic calendar — yes

- Detachable charts — yes

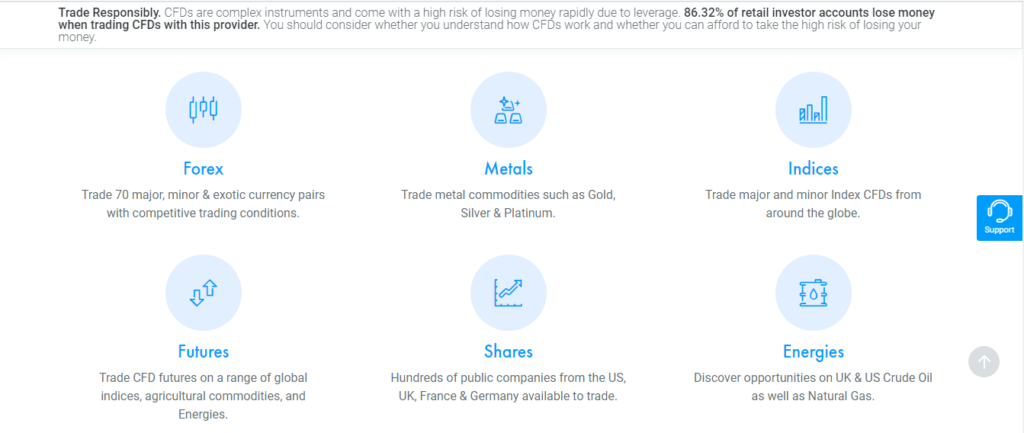

Range of markets

FxPro offers a range of markets holding more than 400 instruments that traders speculate as CFDs with meager floating and fixed spreads starting from 0.6 pips, low commissions, and sharp executions. The broker claims clients trade these products also with deep liquidity and no market maker interventions.

As reiterated in this review, the asset bracket encloses products such as 70+ FX pairs, metals, energies, shares, indices, and futures, allowing traders to diversify their portfolios further and benefit even when markets plunge by going short.

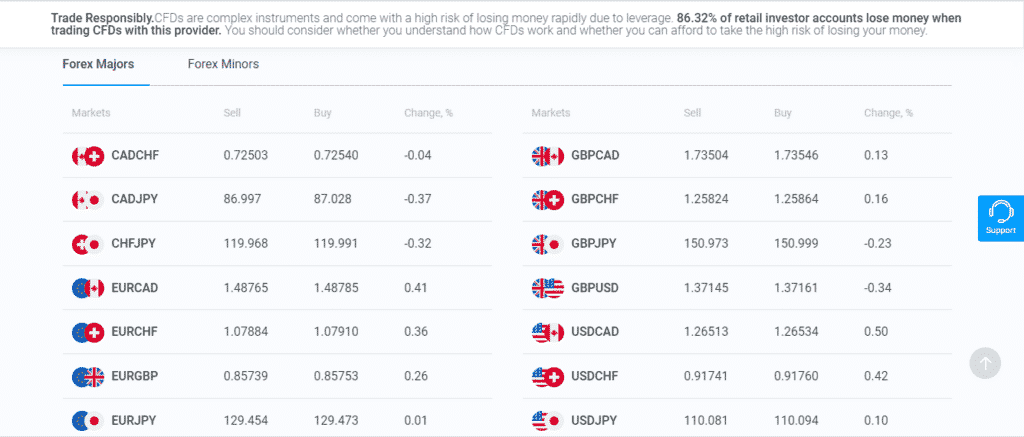

Forex

The foreign exchange market at FxPro trades through weekdays aided by 24/5 expert support. It holds 70+ currency pairs encompassing majors, minors, and exotics trading against eight base currencies. The minimum spread is capped at 0.6 pips and fluctuates to average around one pip across the pairs, but leverage goes up to 1:500. FxPro customers experienced deep liquidity when trading FX pairs, and price quotes depended on the market entry time.

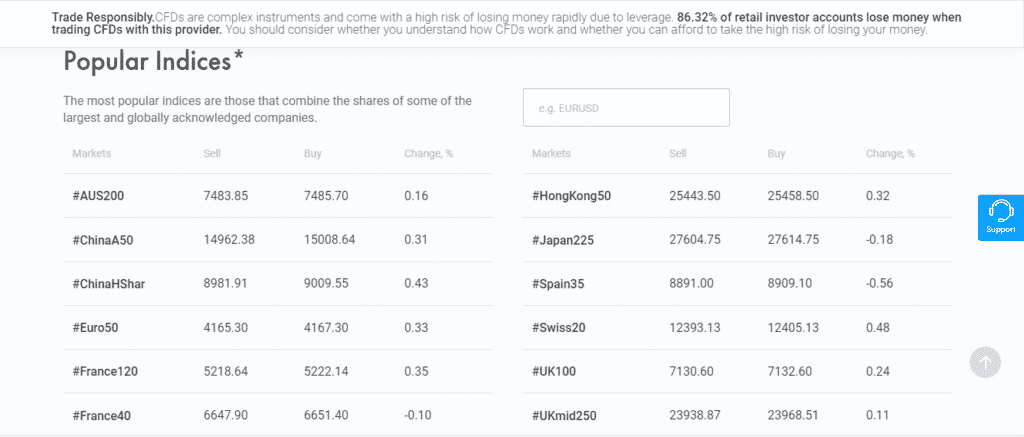

Indices

Indices allow traders to speculate the prices of a group of shares on a global exchange without owning the underlying instrument. FxPro offers multiple indices with tight spread and lightning-fast executions from Monday through Friday backed by real-time expert support. Some of the indices traded on the broker include AUS200, China250, Euro50, and many more.

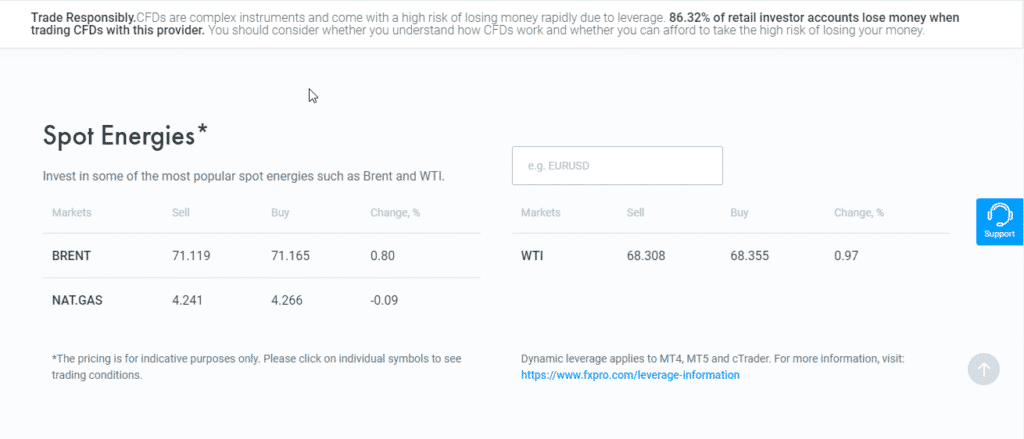

Commodities

The commodities marketplace at FxPro supports a spectrum of hard commodities such as precious metals and energies. These assets trade all through weekdays with competitive spreads and leverage and ultra-fast executions.

Precious metals

These valuable goods at FxPro include instruments like Gold, Silver, Platinum, among others, and help traders diversify their portfolio by trading on their prices.

Energies

Energy products available at FxPro include instruments like natural gas, Brent crude oil, among others.

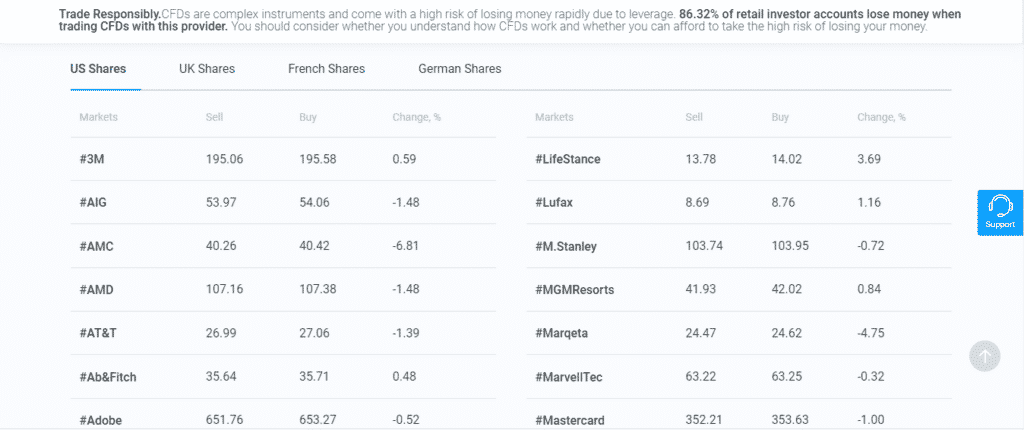

Shares

Share CFDs allow traders to speculate prices of shares from giant companies without owning the asset itself. At FxPro, these products trade from Monday to Friday backed 24/5 multilingual customer support with fast executions and low spreads. Some of the shares are from firms such as AMD, AMC, and a lot more.

Futures

Future instruments allow clients to buy and sell various assets at an agreed price and a specified time in the future. These assets can be any financial traded instrument, but the contract is set at a predetermined price and at a specific time to come.

At FxPro, the futures marketplace holds soft commodities, energies, indices, among other instruments, and opens from Monday to Friday trading with competitive spreads and leverage.

Main features

FxPro prides itself as the world’s number one CFDs provider with over 15 years of experience offering CFDs on a wide range of markets. But, what are the main features that the online brokerage platform offers ahead of contesting for the CFDs market share?

- No dealing desk intervention — FxPro claims to operate as a true NDD linking clients to deep liquidity and best market prices.

- Competitive spreads — the broker also cites offering fixed and floating spreads depending on the account type starting from 0.6 pips with no hidden commissions.

- Ultra-fast execution — FxPro notes that its orders execute at speeds of under 14 milliseconds

- An array of trading platforms — it also offers four trading platforms integrated with powerful tools.

- Several payment options — clients access a variety of payment options for deposits and withdrawals at zero costs.

- Rich educational resources — FxPro also offers a well-furnished educational platform with materials to boost a trader’s market skills.

Types of trading accounts

As mentioned, FxPro provides a demo account and a spectrum of live accounts. But the live platform depends on the trading platform selected by the client.

The live accounts include:

- FxPro MT4 instant account

- FxPro MT4 account

- FxPro MT5 account

- cTrader account

- FxPro Edge account

It’s worth noting that the trading conditions for the MT4 Instant and MT4 accounts are the same. However, the FxPro MT4 Instant account cannot trade cryptos, and fixed spreads apply to 7 major currencies. In contrast, there are no fixed spreads for the FxPro MT4 account.

FxPro MT4 account

- CFD traded instruments — all

- MT4 platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and 1 for shares only

- Trading costs — spread only (no commissions)

- Swaps and rollovers — yes (on overnight trading)

- Min stop levels — 1 pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

FxPro cTrader account

- CFD traded instruments — FX, metals, indices, energies

- CTrader platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and no cryptos and shares.

- Trading costs — FX & metals (reduced spreads plus $45 per one million traded)

Indices & Energies (spread only and no commissions) - Swaps and rollovers — yes (on overnight trading)

- Min stop levels — no minimum

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5

- Execution model — no dealing desk

- Stop out — 50% (all entities)

FxPro MT5 account

- CFD traded instruments — all

- MT5 platform offered — on the web, desktop, Android, and IOS

- Trade sizes — from 0.01 micro-lots and no shares.

- Trading costs — spread only (no commissions)

- Swaps and rollovers — yes (on overnight trading)

- Min Stop Levels — one pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — netting (hedging available on requests)

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

FxPro Edge account

- CFD traded instruments — all

- FxPro Edge platform offered — on the web, desktop, Android, and IOS. Also MT4 platform ranges

- Trade sizes — from 0.01 and one for shares only

- Trading costs — spread only (no commissions)

- Swapps and rollovers — yes (on overnight trading)

- Min stop levels — one pip (depending on market entry price) for significant assets

- Execution type — tiered liquidity (VWAP)

- Netting/hedging by default — hedging

- Trading times — FX trading 24/5, crypto trading 24/7

- Execution model — no dealing desk

- Stop out — 50% (all entities)

Opening an account at FxPro

Step 1: Log into their website and click the register account button.

Step 2: Fill the registration form they provide.

Step 3: Verify your account through email.

Step 4: Log into your trading account using the provided credentials.

Step 5: Select the account type.

Step 6: Make the required deposit or more.

Step 7: Start trading.

Commissions and spreads

FxPro waives all commissions for traders except the clients registered with the cTrader account. They incur a $45 commission on a one million volume of trades but trade with slightly meager spreads compared to other account traders. FxPro only adds commission on the market spread, and it depends on the type of asset and market entry. Some assets trade with lower spreads than others.

Also, traders might incur some overnight fees on swaps and rollovers and an inactivity fee of $5 per month after six months of account dormancy. In addition, FxPro charges a one-time account management fee of $15 to all clients. Moreover, some payment options may include transaction fees.

Customer service

Effective trading must be backed by expert support to help traders solve the yielding problems and answer their queries, making them confident when exploring the markets. FxPro cares for the well-being of its clientele in the financial arena and provides platforms where customers can interact with the support team.

Such platforms include a Help Centre that hosts real-time customer support content in articles and glossaries, a live chat, and a call button that directly links clients with the support team. The customer support team is available 24/5 in multiple languages to cater to all sorts of traders around the globe.

The Review

FxPro

FxPro proves to be a legit online CFDs brokerage company as it operates under a reputable regulated firm bolstered by the FCA and holds an international company license. The broker boasts as the number one Fx and CFDs provider broker offering direct access to deep liquidity and no dealing desk intervention with competitive spreads and fast executions. However, although it asserts to operate as a true NDD, some of its assets trade with high spreads, and FxPro looks to capitalize on commission on the market spread. The broker also charges account management fees and inactivity fees, costing traders when joining FxPro and depriving them of the freedom to trade at their own time.

PROS

- Easy to open an account

- Well regulated broker

- Offers copy-trading

- Market entry price quotes

- Experience deep liquidity with no market makers involved

- Several trading platforms and accounts

- Fast order executions

- No hidden commission

- Negative balance protection

- Segregation of clients’ funds

CONS

- Does not offer CFDs services to residents of the USA

- High minimum deposit compared to other brokers

- High spreads on some instruments

- Commission for copy traders

- Inactivity fees

- Account management fees