The timeframe you choose to trade should be the one that can easily fit into your busy schedule and lifestyle choice.

What is the best timeframe to trade from? What is a timeframe anyway? The video above goes over this and more.

What is a Timeframe?

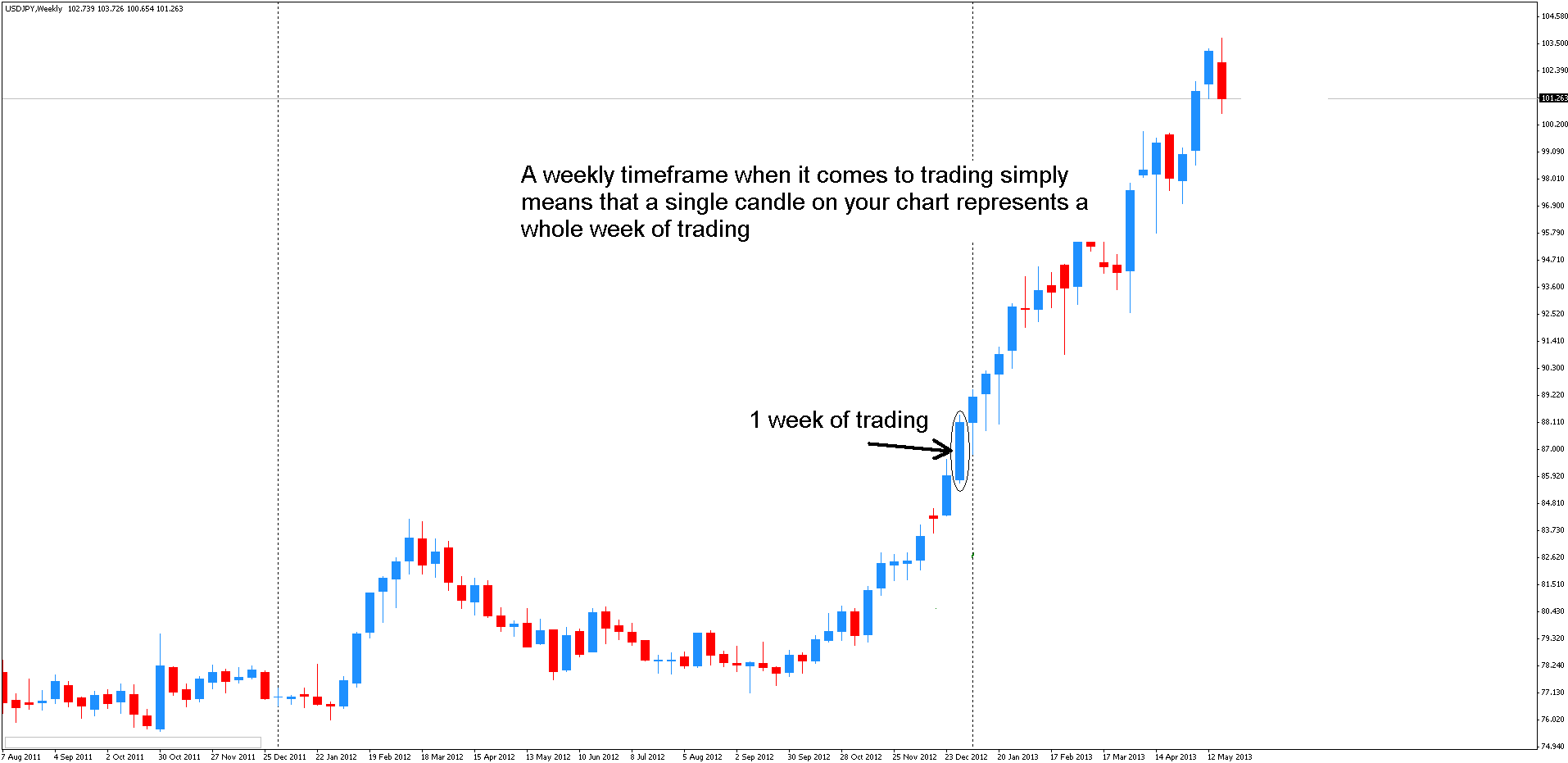

The chart below is a weekly chart of the USD/JPY currency pair. A weekly timeframe when it comes to trading simply means that a single candle on your chart represents a whole week of trading.

Different timeframes can have different trends

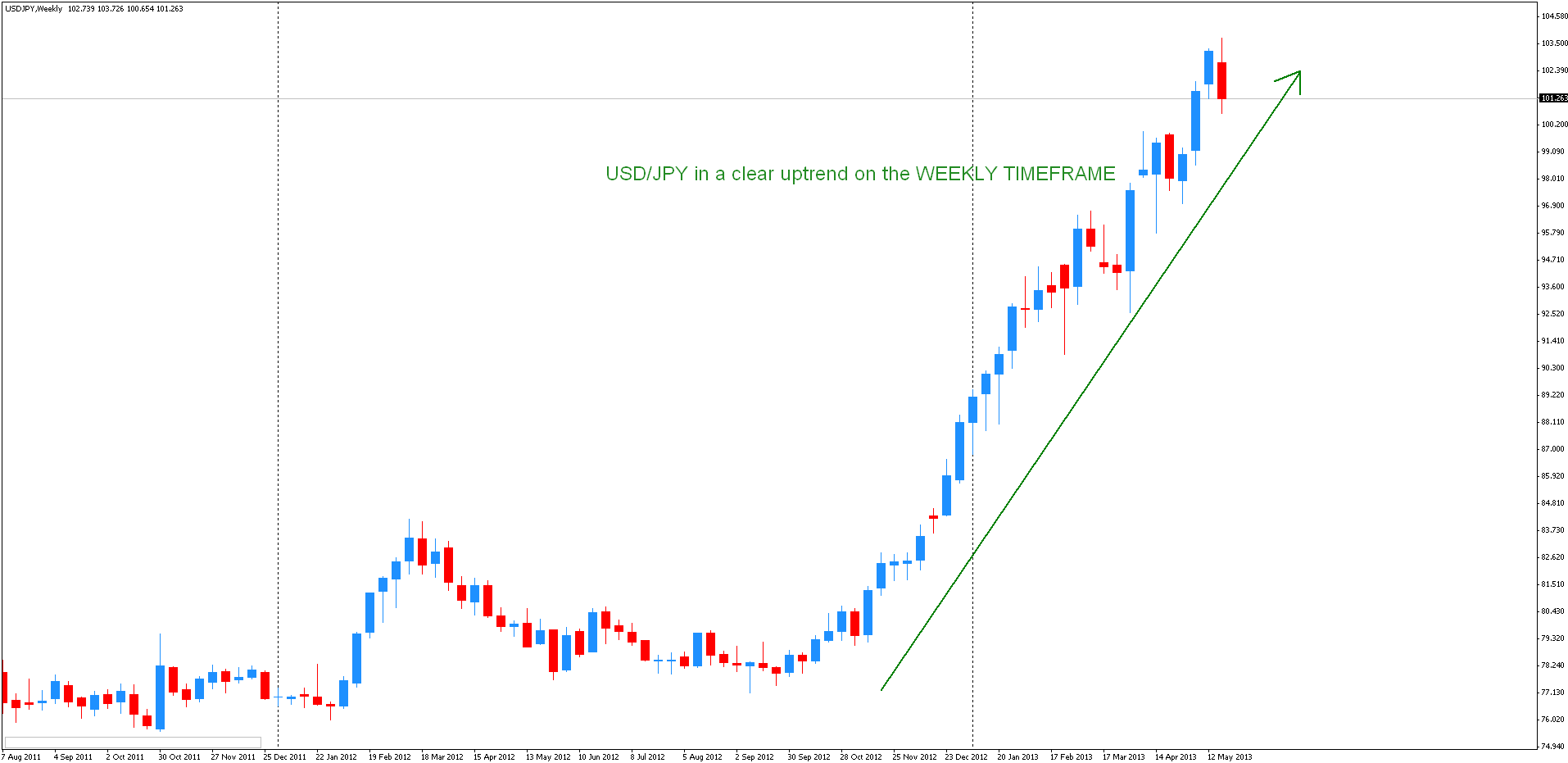

The Weekly chart of the USD/JPY shows a clear uptrend since November of 2012 when the Bank of Japan embarked on its massive new money printing effort.

But look at the hourly chart below taken on the same day, May 23, 2013. The hourly chart shows a downtrend. Different timeframes can show different trends and different ways to look at the market.

Larger Timeframes are Lot Cleaner

As you can see from the 2 charts above, larger timeframe charts tend to look a lot cleaner and they are thus easier to trade. They are recommended for new traders.

The lower you go down in timeframes, the more messy price action becomes. The lowest timeframes like the minute or second charts contain the most “noise”, or random unpredictable market movements.

Look at Larger Timeframes For Direction, Lower Timeframes For Entry

You should always look at the larger time frame charts like the Daily and the Weekly chart to give you a general direction.of where price is heading. You then move to the lower timeframe charts like the 15 minute or 1 hour to time your entries.

This way of trading will allow you to “beat” the larger timeframe traders. You could get in a lot sooner and also get out a lot sooner then someone trading off a weekly chart.

What Timeframe is the Right One for You?

Do you work full time? Have a family to look after? Then trading the minute charts is out of the question for you. Stick to larger timeframes.

The timeframe you choose to trade should be the one that can easily fit into your busy schedule.