The global financial market has been on edge ever since the World Health Organization termed the spread of the coronavirus, a global pandemic. The forex market, as well as the broader stock market, has experienced levels of volatility never seen in years. Unusual volatility levels have made it impossible for traders to ascertain with accuracy, ideal entry, and exit points in the forex market. Likewise, the search for forex market equilibrium is bearing no fruits as forces of supply and demand continue to battle each other for control.

Understanding Market Equilibrium

Ideal market conditions where forces of supply and demand are well-balanced markets tend to trade in a range. Likewise, such conditions make it possible to detect various chart patterns ideal for trading different forex trading instruments. However, that has not been the case as volume levels have ballooned over the roof in recent weeks.

While some traders have made thousands of dollars in taking advantage of the increased volatility levels, so have some traders lost a huge chunk of returns accrued over the past few years. The losses have not only affected traders engaged in manual trading but also affected those leveraging Forex Expert advisors as part of automated FX trading plays.

Wild price swings remain the order of the day in the forex market with currency pairs registering higher highs and low lows with a frequency never seen in recent years. The big question now is when the dust will settle down, and the forex market seeks equilibrium?

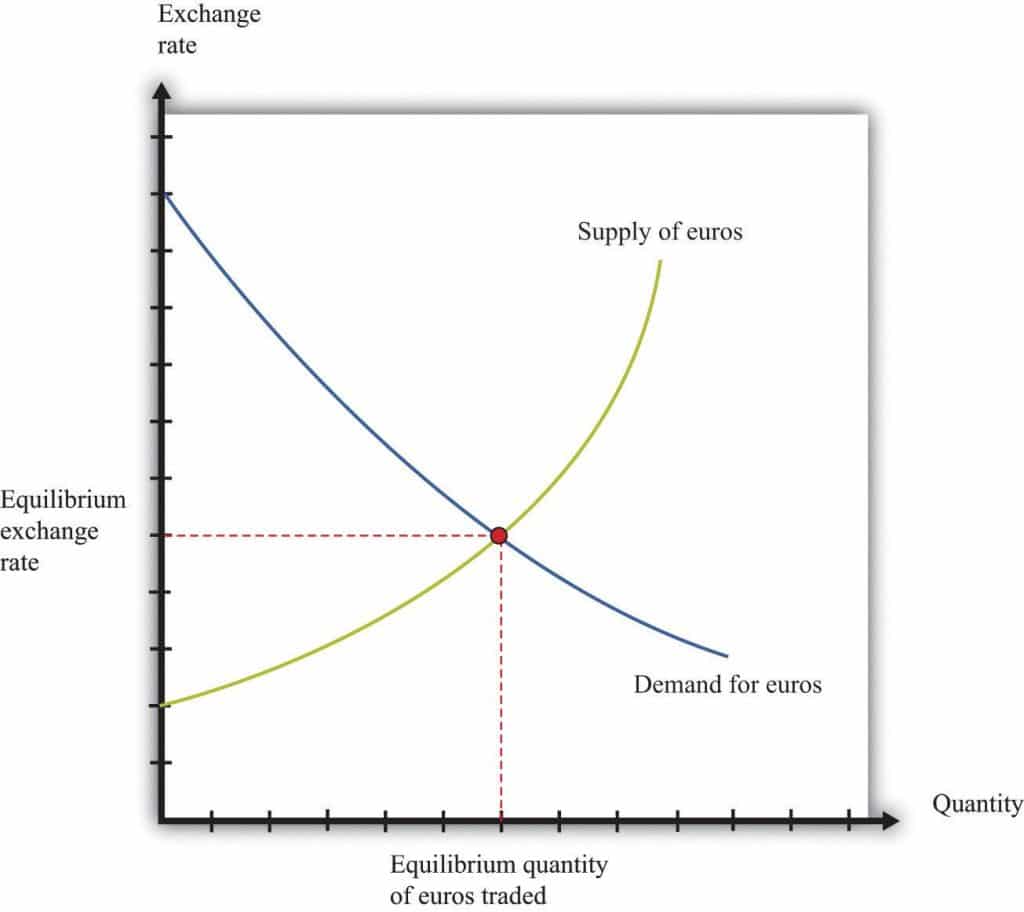

What is Market Equilibrium

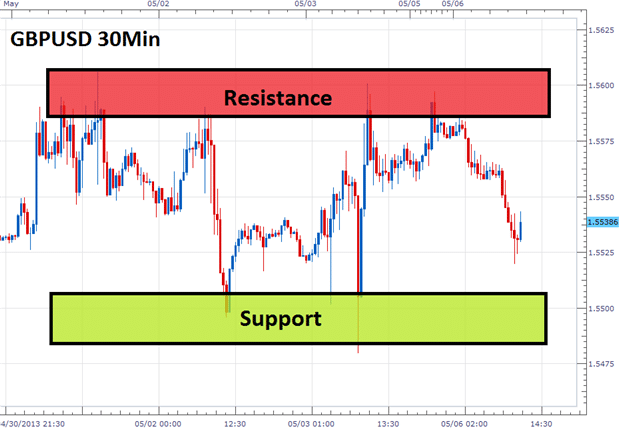

Equilibrium denotes a time or a price point when forces of supply and demand are balanced. An equilibrium chart of any security will, in this case, appear as a range with price oscillating between a clear support and resistance levels. Price movements, in this case, occur methodically without any wild swings. At equilibrium, markets are said to be trading in a range.

Similarly, whenever prices move off equilibrium, it might end up seeking a new level where buyers and sellers come together into balance. While trading an equilibrium market, be it manually or via a forex robot, what traders mostly do is trading a range of betting on the best directional move. Trading while the market is seeking equilibrium amounts to taking advantage of momentum, be it on the upside or downside.

Having an understanding of whether a market is in equilibrium or not is an important aspect when it comes to price action analysis.

Whenever a market is in equilibrium, FX Expert Advisors would often end up buying at the lower end of the range, which acts as a support level and sells at the higher end of the range, which acts as a resistance level.

Changes in the forces that influence supply and demand in the currency market often end up affecting the equilibrium level. It is at this time that the equilibrium level would end up shifting either to the upside or downside, depending on who is in control between buyers and sellers. Once the equilibrium shifts, so do prices tend to adjust itself.

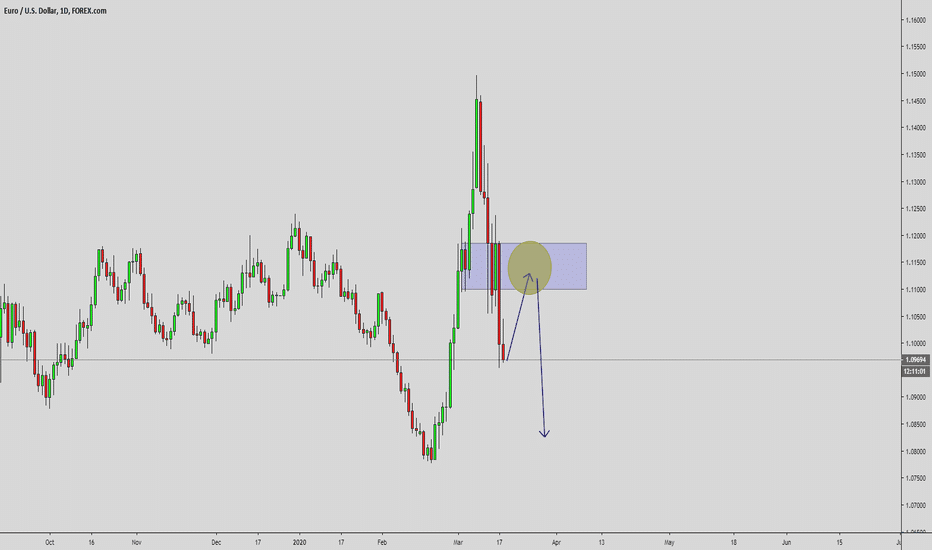

The fact that marketers are always in search of new levels of equilibrium also gives rise to increased levels of momentum from time to time. Conversely, whenever a forex market is moving from one equilibrium level to another, wild swings might be experienced as the price adjusts from one price range to another.

Search For Equilibrium Amidst COVID-19 Spread

The elusive search for equilibrium looks set to persist as currency pairs in the forex market are on edge amidst growing concerns that the global economy is slowly plunging into recession. Wild swings remain the order of the day as buyers and sellers struggle to come to a balance amidst the uncertainty in the global markets triggered by the coronavirus pandemic.

Policymakers moving with speed to try and try to arrest the repercussion of the coronavirus pandemic has all but exacerbated concerns in the market, making it difficult for FX EA to generate consistent returns given the wild swings in play. Even with the use of the best forex indicators in Automated Trading, it is becoming increasingly impossible to predict with precision the direction the market is likely to move.

Traders used to advance tools in algorithmic FX trading have not been spared either as wild swings triggered by unprecedented volatility levels continue to pummel various currency pairs. The dollar, for instance, has defied all forces of supply and demand rallying in the process to three-year highs.

The lack of equilibrium in the forex market has seen most markets crumble as investors continue to liquidate everything for cash. The U.S dollar considered the most liquid currency continues to strengthen in value as its demand around the world continues to surge. Other major currencies of the like of Euro, British Pound as well as Japanese Yen have continued to lose ground against the U.S dollar as the search for equilibrium persists.