Overview

Did you know that you could become a funded trader with FTMO as quickly as 20 days? Using a clearly-defined two-step evaluation course, FTMO offers an incredible opportunity best suited for intraday traders to trade an account prop-funded up to $100,000 depending on the joining fee paid in the initial stage.

FTMO has maintained an excellent reputation in the forex industry, making them a worthy candidate for a comprehensive review of their offering and ultimately whether traders should consider joining them.

What is FTMO?

So, who are the FTMO? Headquartered in Prague, Czech Republic, the fund was established in 2015 on the now-defunct website, Ziskejucet.cz. The idea, however, was conceived a year prior by a bunch of young day traders in the ‘City of a Hundred Spires,’ although the official co-founders are Otakar Suffner (CEO) and Marek Vasicek (CTO).

The FTMO was built on the principles that teamwork, professionalism, and strong self-discipline are essential to successful trading. Furthermore, by leveraging their resources of large prop firm funding, they believe that if their traders are profitable, so will they, thereby helping others in the process meaningfully.

What does FTMO have to offer?

For a one-time joining fee, FTMO affords the luxury for traders to trade several highly-speculated markets, namely forex, commodities, indices, and cryptocurrencies, through their proprietary firm on MetaTrader 4, MetaTrader 5, and cTrader.

After a trader successfully meets all trading objectives, the company claims to reimburse this fee with the first live profit split. Their program consists of two simply-defined stages aiming to prove a trader’s skills in managing risk and meeting particular milestones.

The main two phases (Challenge and Verification) occur on a demo account, with the final (FTMO Trader) being the ultimate stage on a live account where traders will have officially passed the program and venture into the point of earning real money.

For those unsure about their confidence in meeting the FTMO’s goals, there is a ‘free trial’ intended to test whether traders are capable of trading in the real challenge inevitably.

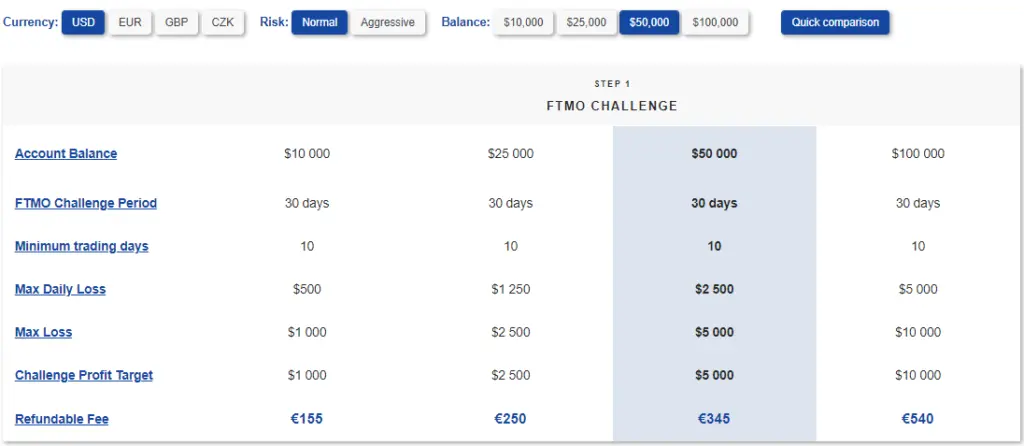

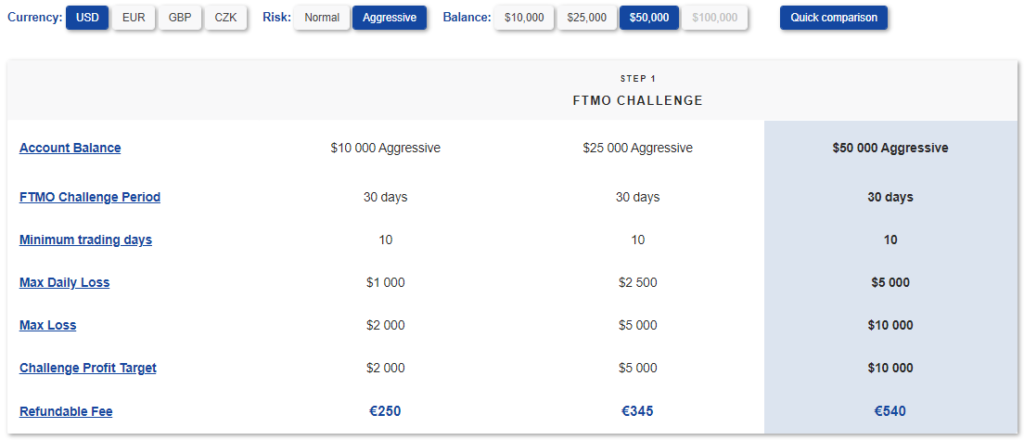

There are four main accounts, further broken down into Normal and Aggressive. The Aggressive package allows for a higher maximum daily loss, maximum overall loss, although the profit mark is higher.

The chosen equity at the demo stage is the same that will appear on the live account. The cheapest option on a $10,000-funded account is €155, and the most expensive is €540 on a $100,000-funded account.

Main objectives

- The maximum trading period on the Challenge stage is 30 days and 60 days on Verification.

- The daily maximum loss limit is 5% of the total equity.

- The maximum drawdown overall is 10%.

- The profit target in the first step is 10% of the account (half the percentage on the second step).

Pros and cons

As with any firm, we should note what may be some of the benefits and drawbacks.

Pros

- Unlike many other firms, FTMO allows clients to trade on not just the MetaTrader 4 platform but also MetaTrader 5 and cTrader.

- Traders receive a 70% profit split.

- Furthermore, unlike numerous companies, FTMO permits traders to trade several markets, namely forex, commodities, indices, and cryptocurrencies, which provides wider options.

- The firm enables all kinds of trading styles or strategies (discretionary, hedging, scalping, expert advisors), although there are some restrictions for trading news on their website.

- FTMO claims to reimburse the joining fee after one has passed all the stages and has made their first withdrawal.

- Flexible leverage: you can get (up to 1:100) and a 10% maximum drawdown.

- Among the other benefits, you can receive help from dedicated customer support, access to in-house trading applications, and a performance coach.

- There is a scaling plan to increase a trader’s funded account gradually over time above $100,000.

- If a trader, unfortunately, fails to meet the trading targets but ensures the account is net positive at the end of the trading duration, FTMO promises to provide a new FTMO challenge for free. This exception is fair in light of the fact that when one fails at a prop firm, there is no reimbursement.

Cons

- Like any funding program, the risk of failure without compensation exists. Thus, joining such a firm must always be a carefully-considered decision.

- The maximum trading period for the first stage is only 30 days, which is highly unlikely to suit more long-term traders who need more time for completion. FTMO appears to better suit scalpers and day traders.

- In addition to the previous point, traders are not allowed to hold positions overnight or over the weekend on the live FTMO account (they can do in the first two stages), an attribute that is paramount for those holding orders over several days or weeks.

Conclusion

Prop firms are still frowned upon by many in the trading community because of the joining fee. There also appears to be a low success rate of traders passing these programmes due to the strict risk management rules and profit targets.

FTMO also employs strictness in their evaluation. Along with the joining fee, a trader is taking a calculated risk they will not fail the program, even if they believe to be consistently profitable long-term.

We can easily conclude that FTMO’s objectives are better geared towards scalpers and intraday traders rather than swing or position traders (referring to short-term maximum trades and not being allowed to hold positions overnight or over the weekend on the live FTMO account).

Otherwise, the conditions presented by them are reasonable if we objectively assess the pros in line with many of their competitors. Assuming a trader has gained enough confidence and is aware of the risk of not meeting the objectives, FTMO is a highly recommended prop firm.