FX Classic Trader is an expert advisor that was designed to become the best business solution. The presentation doesn’t look quite professional.

Is FX Classic Trader a good system to rely on?

The devs introduced EA’s features in these blocks. What’s the reason to write everywhere FX Classic Trader? We don’t know. There are no other EA introduced, right? So, let’s take a closer look at this EA:

- The robot trades fully automatically only on MT4.

- It performs a Swing trading strategy between Support and Resistance levels, analyzing indicators every day.

- It doesn’t use Martingale in trading.

- It includes smart money-management.

- It follows FIFO and NFA trading rules.

- The robot can be run on any broker.

- There’s lifetime support, updates, and upgrades.

- The minimum leverage should be 1:50.

- The recommended leverage started from 1:100 and ended at 1:500.

How to start trading with FX Classic Trader

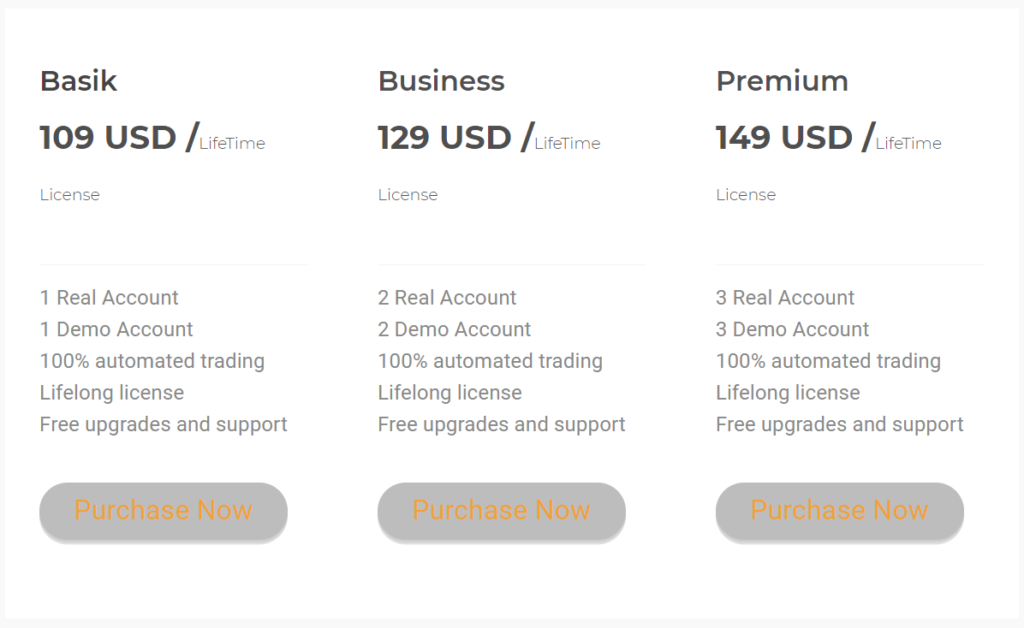

The EA was introduced in three packages: Basic, Business, and Premium. We don’t know who taught them marketing because the Orange on the Grey background looks awful. The Basic pack costs $109 and includes one real and one demo license, free updates, and upgrades. The Business pack costs $129 and includes two real and two demo licenses. The Premium one costs $149. We’ll get three demo and real licenses.

- The robot works only with 5-digits brokers.

- The minimum balance should be from $200.

- VPS server is recommended for stable execution.

- The Lot Size should be 0.01 for each $200 of the account balance.

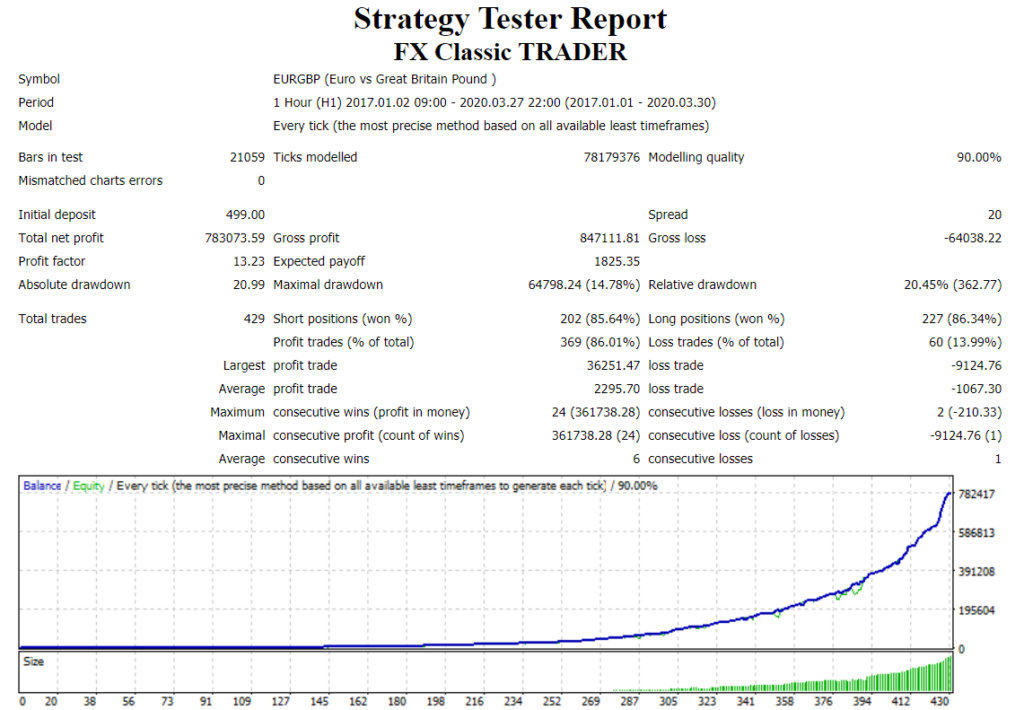

FX Classic Trader backtests

There’s a single backtest of EUR/GBP on the H1 time frame. The modeling quality was 90.00%, and the spreads were 20. An initial deposit was $499. It became $783k of the total net profit. The Profit Factor was high (13.23). The maximum drawdown was little (14.78%). The robot, for over three years, has closed 429 deals with 85%-86% of the win-rate. The win-streak was six deals.

Trading results

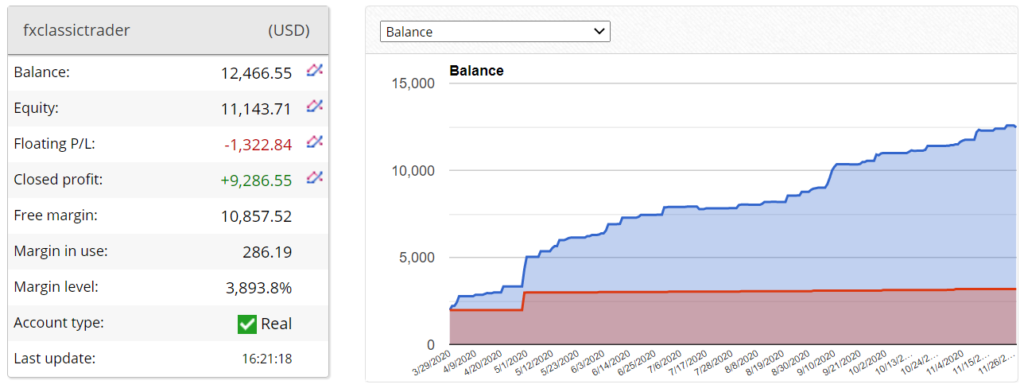

It’s a real USD account that was created on March 29, 2020, and deposited twice up to $3009. There is much free margin, so the margin level is 3893%.

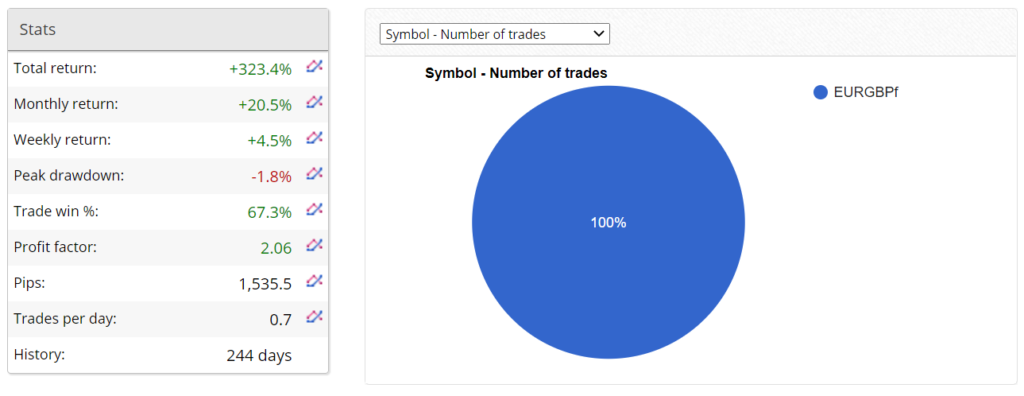

The total return is +323.4%. An average monthly gain is +20.5%. The maximum drawdown is only -1.8%. The average win-rate is 67.3%. The Profit Factor is much less than on the backtest (2.06). An average trade frequency is up to five trades weekly. The EA is online for 244 days.

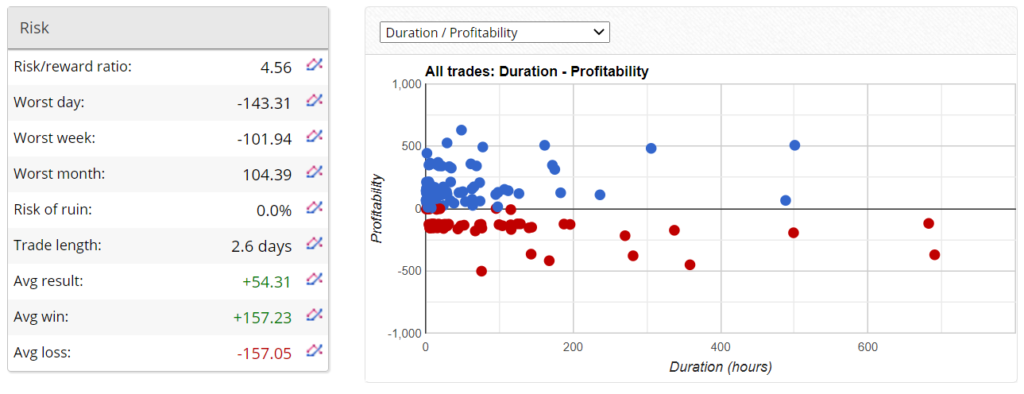

The average trade length is 2.6 days. An average trade win is +$157.23. An average trade loss is -$157.05.

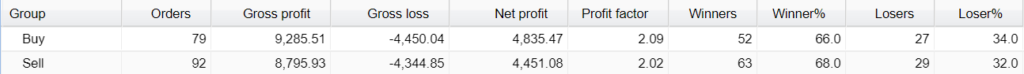

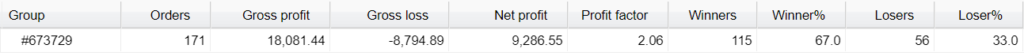

The robot trades both directions equally by Net Profit, Profit Factor, and Win-Rate.

The system has only one strategy behind it.

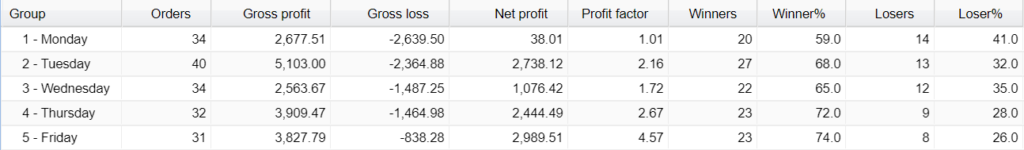

A weekly sheet shows that the EA trades all days with the same frequency. The most profitable ones were Friday, Thursday, and Tuesday. The least profitable was Monday.

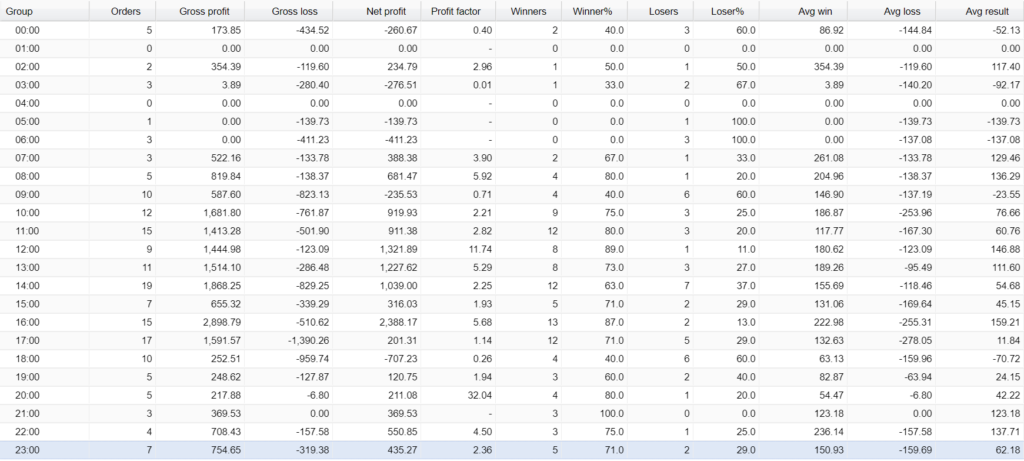

The robot focuses mostly on trading a European trading session.

The robot provided little profits for the last two months, having increased the account balance at 4% and 8.4%.

About the company

The presentation’s bottom is unprofessional too. There’s a Gmail address instead of a professional one that bases on the site name. There’s a map that should be removed if they don’t want to spot their location.

People feedback

There are some statements based on feedback that we can’t check. There are 2114 happy clients from 2190. The devs counted eight times more profitable days than the robot trades on the account.

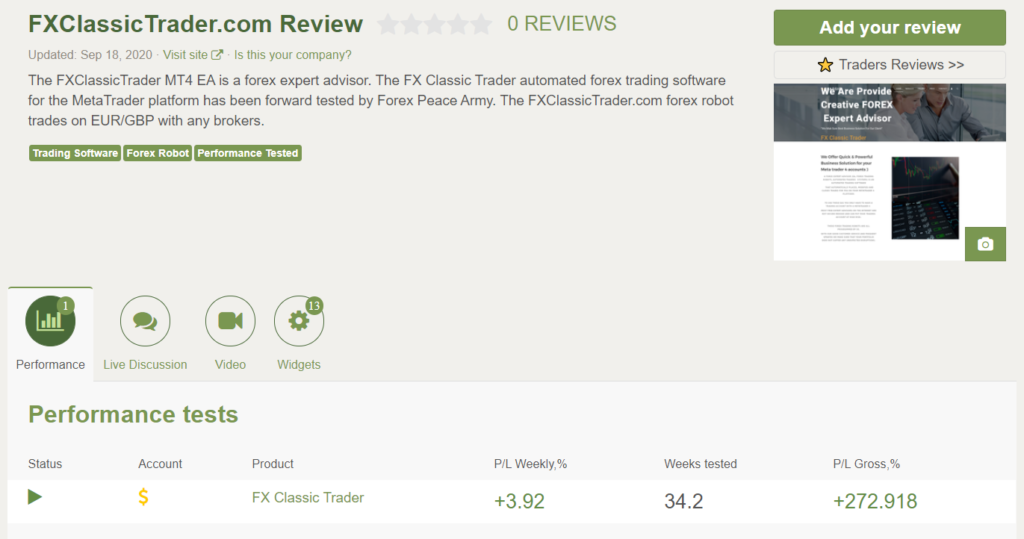

There’s a page on Forex Peace Army with a connected account, but no one from all these happy clients wanted to provide a testimonial here.

Wrapping up

Advantages

- Real account trading results

Disadvantages

- No team revealed

- No settings explanations provided

- Only one symbol to trade

- Low trading frequency

- There are many manipulations in the presentation

- No money-back guarantee

- No people’s feedback provided

Summary

FX Classic Trader is a robot that performs swing trading on the H1 time frame, trading EUR/GBP. Trading results show that the EA can trade on the real account and be profitable. At the same time, the EA is too young to say something for sure about how it’ll be able to handle various market conditions and huge drawdowns that are so typical for swing trading.